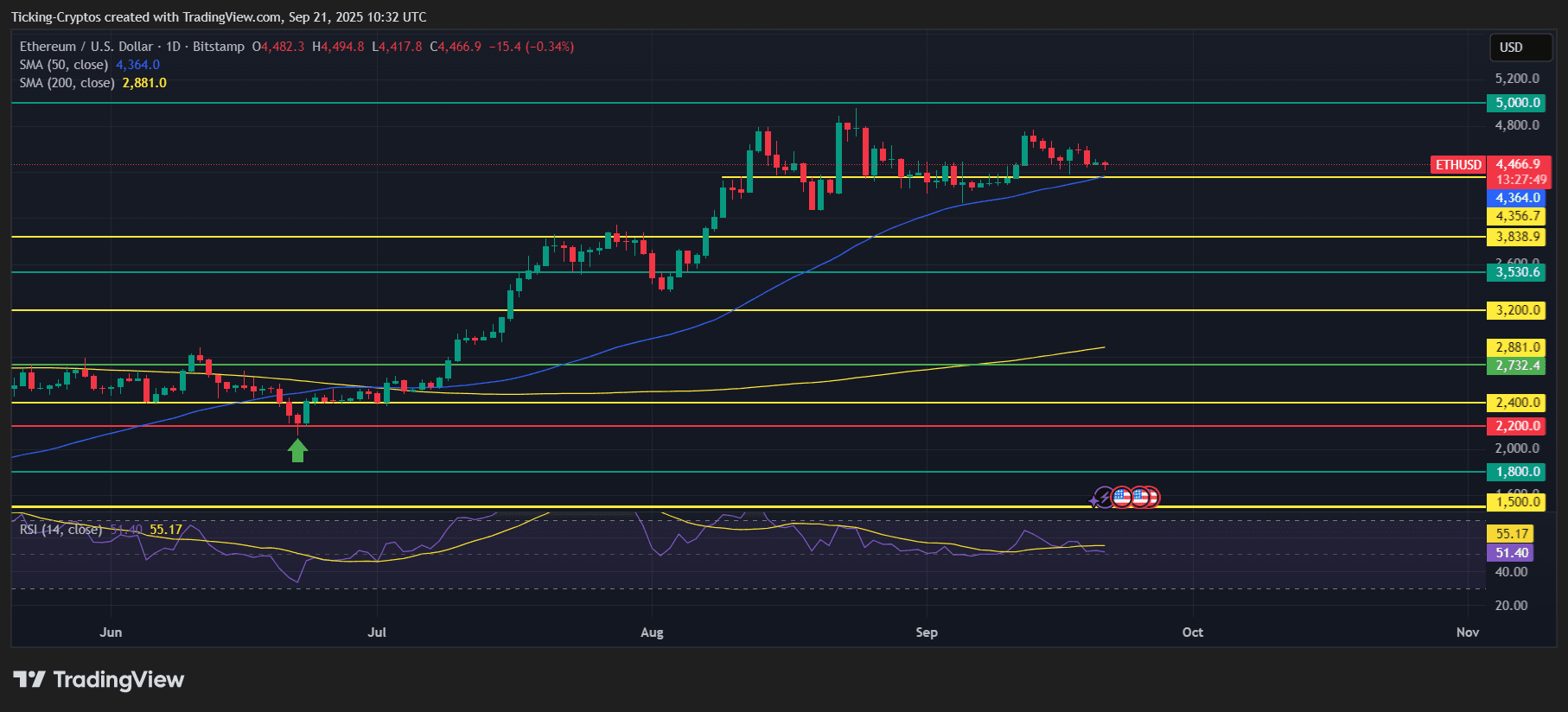

Ethereum Price Holds Support Near $4,364

Ethereum ($ETH) is currently trading at $4,466, holding above the critical 50-day SMA at $4,364. This level has acted as a solid support in recent weeks, with bulls preventing a deeper correction after the strong rally that peaked near $4,800.

ETH/USD 1- day chart - TradingView

The chart also shows ETH comfortably above its 200-day SMA at $2,881, reflecting a sustained bullish structure. Momentum remains neutral with the RSI hovering around 55, suggesting Ethereum is consolidating before its next move.

- Key resistance levels: $4,800 and the psychological $5,000 barrier.

- Support levels: $4,364, $3,838, and stronger support at $3,200.

Ethereum Quarterly Returns Show Q4 Strength

A look at Ethereum’s historical quarterly performance (Coinglass data) highlights an important pattern: Q4 has often delivered strong gains.

- Average Q4 return: +23.85%

- Median Q4 return: +22.59%

- In standout years like 2020 (+104.15%) and 2017 (+142.81%), Q4 propelled Ethereum into major rallies.

By contrast, Q1 tends to be highly volatile (+77.40% average but often negative in bear phases). The seasonal data suggests Q4 2025 could be another period of strong upside momentum if macro conditions align.

Institutional Interest: Bitmine Digital Buying ETH in Bulk

On-chain data reveals that Bitmine Digital has been aggressively accumulating Ethereum in recent days:

- Transfers of 21.5K ETH (~$99M each) were recorded multiple times.

- Galaxy Digital also moved large ETH batches to Bitmine, with individual transactions ranging from 3.2K to 4.4K ETH (~$14M–$20M each)

This level of institutional-scale purchasing signals growing confidence in Ethereum’s mid-term outlook. Heavy inflows from OTC desks to major entities typically indicate long-term positioning rather than short-term speculation.

Ethereum Price Prediction: Can ETH Hit $5,000?

Taking technicals, seasonality, and institutional accumulation into account, here are possible scenarios:

- Bullish Case: If ETH holds above $4,364 and breaks past $4,800, Q4 seasonality plus institutional demand could push $Ethereum toward $5,000–$5,200.

- Base Case: ETH consolidates between $4,200–$4,800 before attempting another breakout later in the quarter.

- Bearish Case: Failure to hold $4,364 could trigger a retest of $3,838–$3,200 support, delaying the move toward new highs.