(NOTE: You can read the full report on valisresearch.xyz)

The start of something new

It’s been around five months since my last post and a lot has changed since then. If you don’t follow me on X, you’ve probably had no idea what I’ve been up to in the meantime.

A couple months ago I decided to get serious about starting my own crypto research firm, and today it’s finally launching. I’d like to introduce everyone to Valis Research.

This report was cowritten with a good friend, Mosi, and I think everyone will really enjoy it regardless of your prior knowledge of prediction markets. Realistically it should have come out sooner, but starting something new is tough and I wanted everything to be perfect at launch. This is a long report, but a worthwhile one.

Subscribing to Valis costs $45/month and gives you access to two reports monthly, delivered on a bi-weekly basis. I think this is a fair price and hope to deliver much more than $45 of value, and it would really mean a lot to me if any of you decide to subscribe. This isn’t to say I won’t do the occasional free post on Valis or on Substack, but it’s the start of a new venture for me.

I wrote a bit of a manifesto describing why I’m doing this, what it means for the future, and the type of content I’ll be writing there.

Here it is, and as always thank you for reading:

“Valis is a science fiction novel written by Phillip K. Dick and published in 1981, almost fifty years ago. I first read Valis in 9th grade and it stuck with me as one of the most interesting stories ever put to paper, but more importantly a story that revitalized my love for reading and writing, somehow bringing me to where I am today.

I began publishing crypto posts on Substack back in 2021, almost four years ago today. My writing style has changed significantly since then, eventually morphing into what it is now: very digestible research that tends to be a bit longer than it should, but overall a body of work that's informative and generally well-received by over 7,000 free subscribers on Substack.

Crypto research has always been considered a meme by those that read it and those that spend their time writing it. Compared to traditional sellside research covering equities, commodities, and other asset classes, the task of analyzing the average cryptocurrency asset has always fallen short of the reality that great returns most often come from holding major assets for extended timeframes or rotating in and out of altcoins throughout cycles.

The research side has always been supplementary: useful to analysts working within the industry, the more technically inclined, and those of us left that still enjoy reading in their spare time. Crypto research can be useful to get your name out there online, or to show your LPs that the money they've provided to you is being directed to quality sectors and being spent in a very professional way.

It’s still yet to be viewed as an essential part of every crypto investor’s toolkit. It's yet to be treated as something that exists to benefit the industry.

Valis wants to change this.

As I’ve slowly introduced the idea of Valis Research to a few dozen close friends across the industry, I’ve realized that crypto isn't lacking mass adoption, but a higher degree of credibility. Technologies like artificial intelligence, virtual reality, and even social media applications have their fair share of skeptics, but none of these industries have faced nearly as much backlash as crypto manages to on a daily basis.

The industry isn’t treated equally and is often used as a scapegoat or catch-all for things like financial crime, scamming, and other unsavory behaviors that just happened to be conducted on blockchain rails.

But as I’m sure you all know, crypto is so much more than that.

I decided to take the leap and create Valis Research because I believe the coverage of our industry can be better than it's been in the past, and anyone who spends their time here deserves to have a publication that’s just as sound as the blockchain technology we’ve all come to appreciate.

There's an opportunity here to really elevate the job title of crypto analyst or crypto researcher, hopefully leading to a world where one day this will be viewed with the same level of respect as credit research analyst or macro strategist.

Crypto exists thanks to the efforts of highly dedicated researchers, computer scientists, and economists that truly believed in the work they do. As the industry has grown and matured, the bar for research has definitely grown, but the impact of it has stagnated.

Valis Research will be a breath of fresh air after an uncomfortable period spent drowning in a sea of noise.

We will not have sponsors. We will not write commissioned reports. We will not play favorites. We will not write slop. We will make our money through monthly (and eventually annual) subscriptions and initially publish two reports a month before picking up the pace a bit.

This is the only method of monetization that makes sense to me, and it won't be an outrageous price - just $45 a month. When it comes to the value provided, I believe there is nothing better than a well researched, passionate piece of writing that comes from someone who cares deeply about the subject.

This is what Valis will be - excellent research meant to inform, entertain, and keep you aware of what's happening and what's on the horizon for crypto.

It’s impossible for anyone to write without some level of bias, though Valis will be as close as it gets to pure research written for the singular purpose of informing readers and keeping them knowledgeable on a growing industry. Valis Research will start out very small, written and managed as a one-person team, but it won’t be like this forever. I'd like to collaborate with other writers as much as possible and help elevate the voices of those that I respect the most.

Valis is not just another blog. It's a completely separate thing and exists outside of any bubble I may have found myself in before. Substack's customization always felt limiting, and I knew that this would never make sense as a business venture if it wasn't created with the standards and vision I'd held in my mind. I wanted to create my own website and brand that feels just as vibrant as the content offering itself, and this was the only path that felt right to me.

The ideal end state for something like Valis Research is a publication you can recommend to friends or family, one that analysts at a family office can share to their boss, or one that a firefighter or semi driver might read on their day off to catch up on the industry.

I fully believe there is an opportunity here to reinvent what research looks like and who it's marketed to, especially the idea that this research has to be something that only people who are interested in crypto will read. Many of the later reports on Valis will cover a wider range of industries and subject matter that isn't limited to the world of digital assets.

It’s written for everyone, regardless of your technical expertise, created by someone that cares deeply about every single word that appears on your screen.

Valis should be live in a month and a half or less as there's a lot more work to be done. I'm looking forward to bringing this to life and can’t wait for everyone to see what’s in store.”

- Knower

What prediction markets are and aren’t

Prediction markets are everywhere. After the conclusion of the 2024 US Presidential Election, it was expected that Polymarket and Kalshi’s respective volumes would fall off a cliff as they’d done in years past. But that hasn’t happened, and our goal for today is unpacking why they’ve remained relevant and what can be expected if these volumes continue inching higher over the next 2-3 years.

For reference, Kalshi and Polymarket have processed over $35 billion of volume (according to @dunedata) since inception, and a combined $17.5 billion of volume in 2025 so far.

This warrants a deeper analysis, considering this is no longer a niche form of speculation for hobbyists or data nerds, but a readily available option for anyone with an internet connection. But even this already measurable success is just the beginning, and depending on who you ask, a drop in the bucket when considering what’s to come.

To quote @semajieth:

“Prediction markets have variously and recently been described as: the wisdom of the crowds in financial form, the most democratic financial market made yet, and simply the future of speculation.”

There’s been an endless stream of surface level content flooding X every day for the past month, giving you lengthy analysis on anything you’d ever want to know about prediction markets and explaining how anyone can make money trading event outcomes with ease.

Rather than feeding you trade ideas or filling your brain with wishful thinking, we’ll give you a complete overview of the top prediction market platforms and how they’ve managed to get to where they are today, analyzing more niche areas of interest like market maker dynamics, distribution of volume and open interest across markets, historical accuracy across multiple venues, and many other foundational topics that will contribute to your better understanding.

At its most basic, a prediction market is a type of financial instrument that allows people to trade contracts tied to the outcomes of real world events, letting traders win if they’re right, or lose if incorrect.

That’s a very surface level explanation, and maybe you’re asking why this is any different from other types of investments, or what the innovation really is here.

People enjoy trading prediction market contracts not solely because of the payouts, but because of what they let you trade. Prior to the introduction of consumer-friendly prediction market interfaces, if you wanted to put your money on an event, an opaque OTC desk or random internet counterparty was the only avenue for placing this bet. Today, it’s easier than ever to read a headline, scoff at the journalist’s opinions, and throw $100 on the exact opposite outcome of whatever you just read.

In Camilo’s words, “they distill the complexities of investing into a single equation of risk, return, and probability” which is a great way of saying that prediction markets make it so previously difficult-to-execute trades (that require complex financial instruments) are almost immediately accessible to the average user.

Robin Hanson is considered by many to be the father of prediction markets, largely due to his robust body of work covering futarchy, idea futures, decision markets, and other related topics. Much of his work can be found here. Despite these illuminating pieces of writing existing, many of which date back to the early 1990s, prediction markets were confined to a small corner of academics and nerds, existing as more of a pipe dream than a feasible financial instrument.

It took years but some unlikely names laid the groundwork for Polymarket, Kalshi, and every other company alive today. To name a few notable experiments (courtesy of Adjacent Research):

Terrorism Futures were created by the Pentagon back in 2005

Google ran their own internal prediction markets

The CIA published a report analyzing prediction markets’ ability to enhance US intelligence (PDF)

It’s 2025, and prediction markets are a runaway success not because of what they are, but what they’ve been able to enable, and of course what could mean for global market structure.

What you can learn

Most of what you’ve heard about prediction markets is true, but there hasn’t been an honest attempt at mapping out the most important functions crucial to the continued success of these platforms. This report will answer the following and more:

How do market makers and liquidity providers operate across Polymarket and Kalshi?

What are these exchanges’ reward/incentive structures like?

How much of a concern is market manipulation and what’s being done to mitigate this risk?

Which markets are more likely to receive a higher distribution of incentives?

Why haven’t parlays or leverage seen more traction?

Can prediction markets predict the future more accurately than the best experts?

What aspects of dispute resolution need to be fixed?

How important is the CFTC and is a regulatory-first approach the path to mass adoption?

Is it feasible to compete directly with sportsbooks on sports-related event markets?

Why have dozens of crypto-native prediction market startups spawned, seemingly out of nowhere?

We’re taking a data-driven approach and pulling together dozens of hours of research to bring you the most comprehensive report on prediction markets to-date.

Before going any further, we must clarify some things.

This report primarily looks at usage across Polymarket and Kalshi as they are the most widely used venues. This is not to say that incumbents can’t be overtaken in the future, but rather their combined usage sums up the vast majority of prediction market activity (>99% of notional volume & open interest), and analyzing their differences will shine the most light on the future of the space.

We aren’t here to tell you that prediction markets are or aren’t the next big thing. We’ll make use of dozens of sources across numerous independent publications and reports, use quotes liberally, and present the information to you while refusing to take a side.

It’s important for research to be unbiased and walk a tightrope between obvious favoritism and the objective truth. The truth?All of the above questions are a lot harder to answer and can’t be found just by looking at the data.

Are prediction markets the next frontier for finance?

Are prediction markets just a more obfuscated form of gambling?

Are prediction markets only a side effect of humanity’s growing desire to speculate in new ways?

“Prediction markets give us a way to harness the wisdom of crowds, and turn it into useful forecasts for decision-making. But I know from past conversations that you’re probably not convinced by this; indeed, you probably shouldn’t be, just yet.”

How prediction markets fit into a culture of speculation

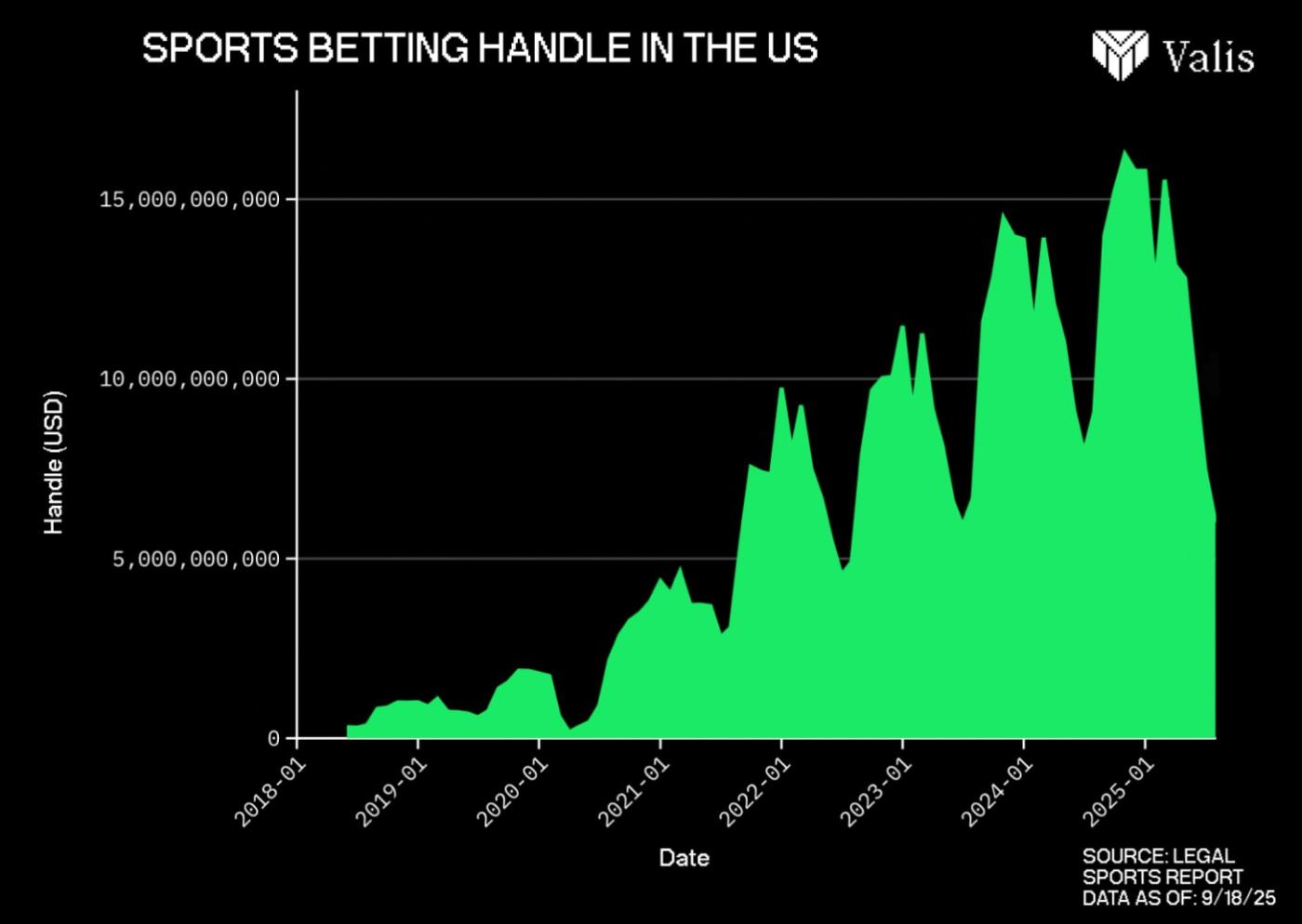

Everyone likes to gamble. Whether it’s sports, scratch-off tickets, or slot machines, the global gambling market is massive and has continued to grow despite the reality that the house always wins. Since the legalization of sports betting in the United States in 2018, over $500 billion of volume has been done (according to Legal Sports Report), generating tens of billions of dollars in revenue for states in the process.

You can’t watch a professional sports game without being shown moneylines, player prop bets, or betting-related predictions from TV analysts. Commercials frequently bombard you with propaganda distributed by these sportsbooks (namely FanDuel and DraftKings) directly, masking the toxic reality of gambling with endorsements from household names like LeBron James.

New York and New Jersey alone have made over $11 billion in tax revenue and the annual sum has grown exponentially in just seven short years. It’s unlikely sports betting is criminalized again given how lucrative it is to these states that allow it, though the negative externalities of widespread betting have not been considered.

We can make an assumption that gambling has more or less become an everyday occurrence for tens of millions of Americans (over 30 million in 2023), presenting us with a world where gambling isn’t just allowed, but normalized.

Sports betting is the best comparison we have for prediction markets, and while it isn’t perfect, it will be used to present how and why prediction markets have become more popular. While prediction markets are structured with payouts resembling binary options, and sports betting is odds-based, the venn diagram of users converges and the thought process behind taking either of these bets can be viewed quite similarly.

People don’t want to learn how to make money, they just want to make money.

If a devout Republican had read a headline in October 2020 that Donald Trump’s probability of winning the election sat at 40%, they may have previously scoffed and complained that mainstream media is out of touch with their personal worldview.

At this time - just five years ago - the average American was more than likely unaware of prediction markets and wouldn’t have known they could stake their money on something as important as the US Presidential Election, but we live in a different world today.

In late 2024, this same individual could have placed $100 on Donald Trump shares at $0.40 and hoped to return 2.5x their money assuming a successful win in the election, or watched their money evaporate as Kamala Harris shares settled to $1.00, but the outcome isn’t the point.

The core innovation of prediction markets is their ability to turn human beliefs into bets, letting anyone put real dollars on an opinion they believe is correct. This is human nature and it’s one of the reasons sports betting has risen to notoriety so quickly. Sports is a major part of many Americans’ lives, especially young men, which by and large are making up a larger share of sports betting volumes every year.

Quick aside, I can name dozens of friends and fraternity brothers from college that discuss sports betting constantly and place bets every day of the week that doesn’t end in a Y. This doesn’t come as a means of shaming anyone, but an observation from a 23 year old noticing a trend amongst peers.

Young men live and breathe sports, and it isn’t a stretch to say professional sports is quite high up on these individuals’ lists of hobbies or pastimes. If you spend countless hours outside of work tracking pro sports developments, watching games, and arguing with friends over the outcomes, it’s just as likely for you to then feel the need to make money off of this.

This same individual that feels strongly about the Philadelphia Eagles might feel equally as strong on whether Jerome Powell will cut rates, but lack the knowledge or a simple outlet to precisely bet on this via other financial instruments. The average dude would never message a sports group chat asking what everyone thought about the jobs report, but this same guy might actively chat it up on Polymarket’s in-market chat rooms.

The logic of making money from something you feel you have an edge in can be extended from sports to prediction markets, except for one small detail: the TAM is nearly infinite.

Whether it’s politics, global events, or pop culture, there is a market for something on Polymarket, and there’s a market for every type of person.

Leading avenues for speculation

Crypto hasn’t been discussed yet, so let’s get into that, as it’s a pretty popular technology and quite notorious in discussions related to speculation.

Buying crypto is easier now than it’s ever been. For years you could have purchased Bitcoin (and other major assets) directly from Venmo, Robinhood, or even in the form of an ETF through your brokerage account, and while getting crypto on-chain is still a bit messy, it’s within reach in probably under ten clicks for someone that knows what they’re doing. This has led to significant growth of digital assets trading, proliferation of stablecoins, and the obvious eye-watering performance of assets like BTC and ETH over the last decade.

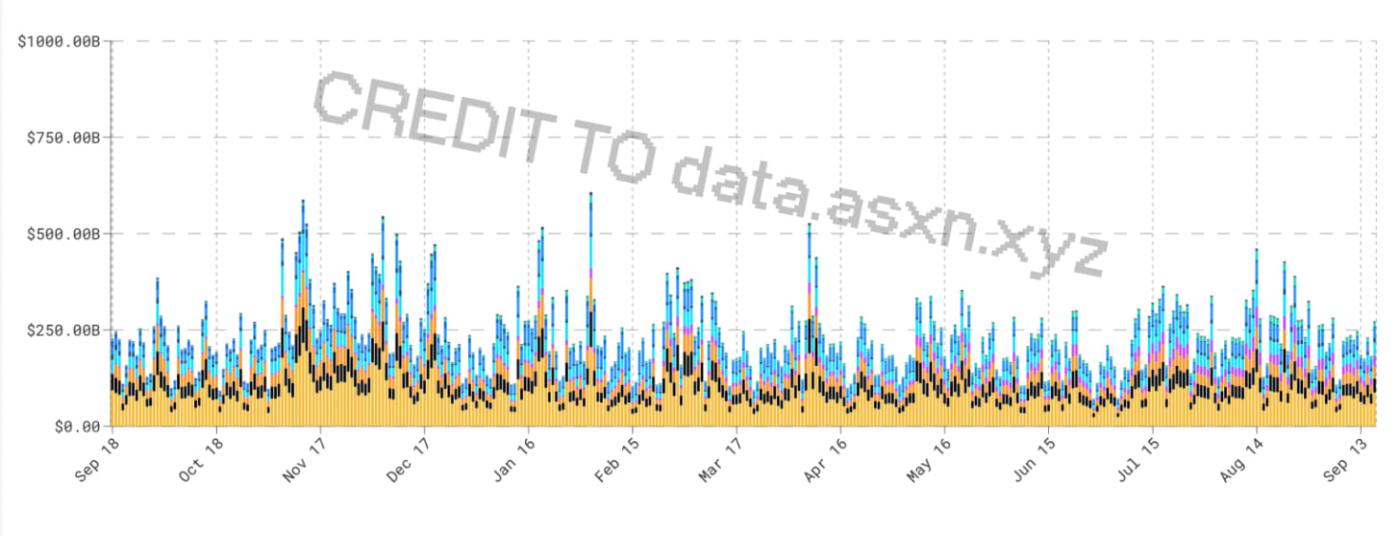

Across crypto’s largest exchanges, trillions of dollars of volume is done each month across a number of centralized and decentralized venues. The market for digital assets continues to resemble more sophisticated markets like equities or commodities, while the pool of traders and blockchain users only grows. We can make an argument that buying crypto, investing in crypto, or trading crypto on a shorter time frame is relatively easy and within reach for anyone with an internet connection, and that despite the utility accompanying many crypto assets, this is still an outlet for/form of speculation.

Going back to the point that prediction markets will become the next major avenue of speculation - similar to sports betting, 0DTE options, or memecoins - it’s easiest to compare the numerous frictions of retail user participation.

(The rest of this report can be read by subscribing to valisresearch.xyz)