This article was co-authored by K1 Research and Klein Labs

Key points:

Monad is a Layer 1 public chain focused on "high performance + full EVM compatibility" . It has raised over US$240 million in total funding, and mainnet is expected to be launched by the end of 2025. It is expected to become a game-changer in the public chain's "performance and compatibility cannot be achieved at the same time" problem. Its optimistic parallel EVM design is its core technological breakthrough direction.

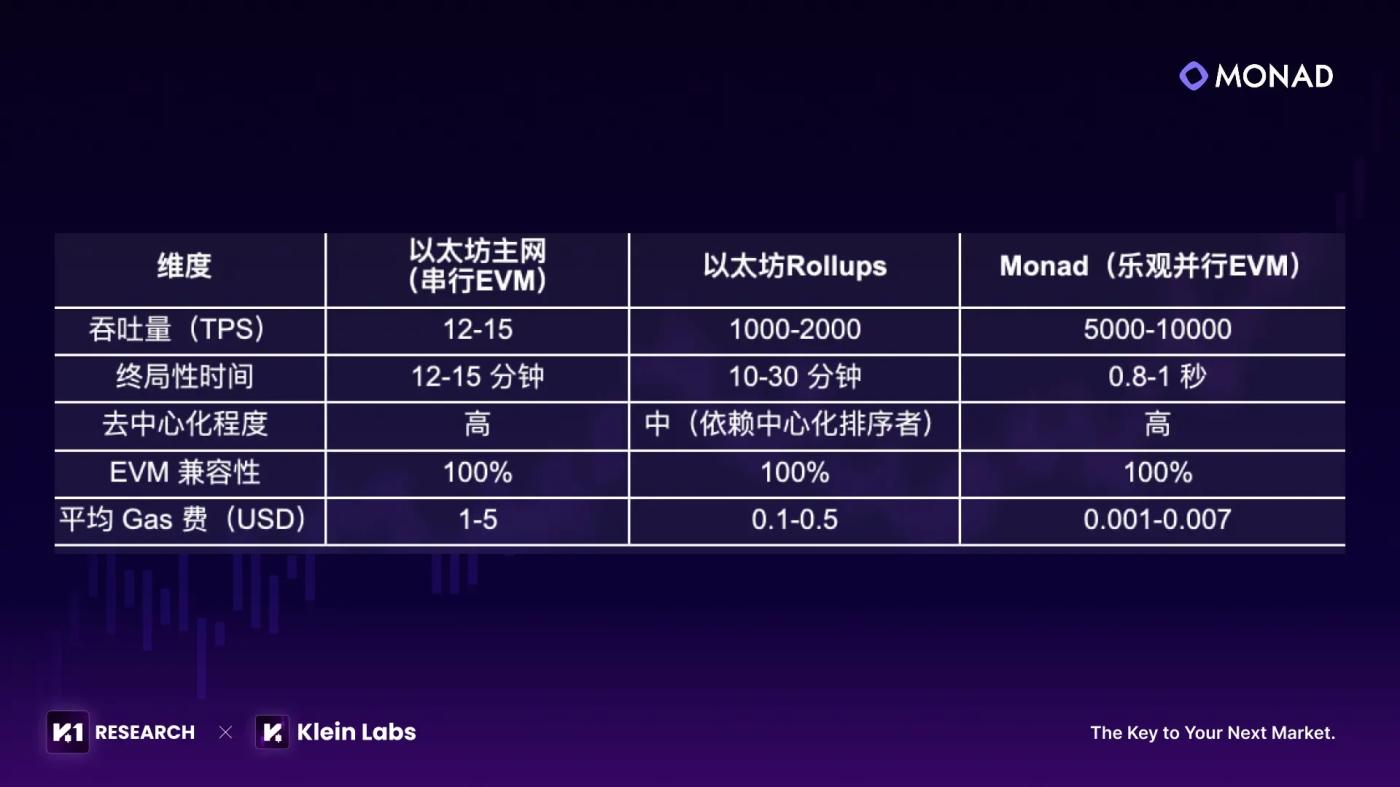

Adopting the "MonadBFT consensus + optimistic parallel EVM" architecture, it can achieve 0.8-1 second single-round speculation finality and 70%-80% parallel execution of transactions. The performance stability in complex scenarios still needs to be further verified after the mainnet is launched.

Compared with parallel EVM projects in the same field, Monad has formed a differentiated advantage with its "independent Layer 1 architecture + full EVM native compatibility + over US$240 million in financing reserves" . In the testnet stage, it has demonstrated the performance potential of 0.5-second block interval.

The ecosystem has gathered more than 280 projects, with a cumulative ecosystem financing of US$1.32 billion . It has promoted the cold start of the ecosystem through support mechanisms such as hackathons and special accelerators, and capital flows are concentrated in DeFi infrastructure and core application layers.

The core strategy of "Builders First" is to attract developers. Although it faces controversies such as the mainnet progress and the decentralization of validators, its ecological friendliness and technological innovation provide support for its long-term value. In the future, it needs to break through the key issues of performance commitment and user scale retention.

1. Monad, a rising star in the public blockchain industry: Background and development milestones

1.1 Monad: Positioning, Origin, and Vision

Looking back at the history of public blockchain development, Ethereum built the largest ecosystem thanks to its EVM compatibility, but performance bottlenecks have consistently constrained its large-scale adoption. Solana, with its ultra-high TPS, once championed the "high-performance public chain," but faced a crisis of trust due to insufficient decentralization and technical stability issues. The experiences and lessons learned from these two leading public chains provide a clear framework for Monad's positioning.

Monad was born to address the current public chain's core pain point of "struggling to achieve both performance and compatibility." Its core positioning is to be a "Layer 1 public chain that combines extreme performance with full EVM compatibility ." Unlike some public chains that sacrifice EVM compatibility for performance, or even compromise performance for EVM compatibility, Monad seeks to overcome this dilemma from a fundamental architectural perspective. It achieves high performance breakthroughs through innovative consensus mechanisms and execution-layer optimizations while maintaining seamless compatibility with the Ethereum EVM. This allows developers to migrate their applications to Monad without refactoring, while providing users with a low-latency, low-cost transaction experience.

From its origins, the birth of Monad directly addresses the real bottlenecks of the Ethereum ecosystem. With the explosive growth of applications like DeFi, NFTs, and GameFi, the Ethereum network frequently experiences peak transaction times of less than 15, gas fees soaring to tens or even hundreds of dollars, and transaction confirmation delays exceeding 10 minutes. For example, during the 2021 bull market, gas fees for a single NFT transaction on OpenSea peaked at $196, forcing ordinary users to withdraw from high-frequency trading. Clearing transactions on DeFi protocols frequently fail due to network congestion, resulting in user asset losses. While Ethereum's Layer 2 expansion plan has alleviated some of this pressure, the interaction costs between Layer 2 and the mainnet and the complexity of cross-chain transactions remain fundamentally unresolved. The Monad team is composed of engineers with many years of experience in blockchain low-level development. They have been deeply involved in the optimization of the Ethereum core protocol and the performance debugging of Solana. Its core members are deeply aware that if large-scale commercial use of blockchain is to be achieved, the three major challenges of "performance, compatibility, and decentralization" must be overcome simultaneously at the Layer 1 level. This has also become the core motivation for the launch of the Monad project.

Monad's long-term vision isn't simply to replace an existing public chain, but to build a "universal platform" for the next generation of blockchain infrastructure . First, by achieving performance targets of 10,000 TPS, 1-second finality, and an average gas fee of "less than 1 cent," it will meet the demands of scenarios currently unavailable to Ethereum, such as high-frequency trading, large-scale gaming, and real-time data exchange. Second, leveraging full EVM compatibility , it will integrate developers and project resources from the Ethereum ecosystem, creating a closed ecosystem of seamless migration and efficient operation. Finally, through a dynamic validator mechanism and distributed storage solutions, Monad will ensure the network's decentralization, enabling even ordinary nodes to participate in network maintenance. From a broader perspective, Monad aims to propel blockchain technology from niche adoption to mass adoption, providing the underlying support for the digital transformation of traditional industries such as finance, logistics, healthcare, and social networking, truly realizing its vision of "empowering the real economy with high-performance blockchain."

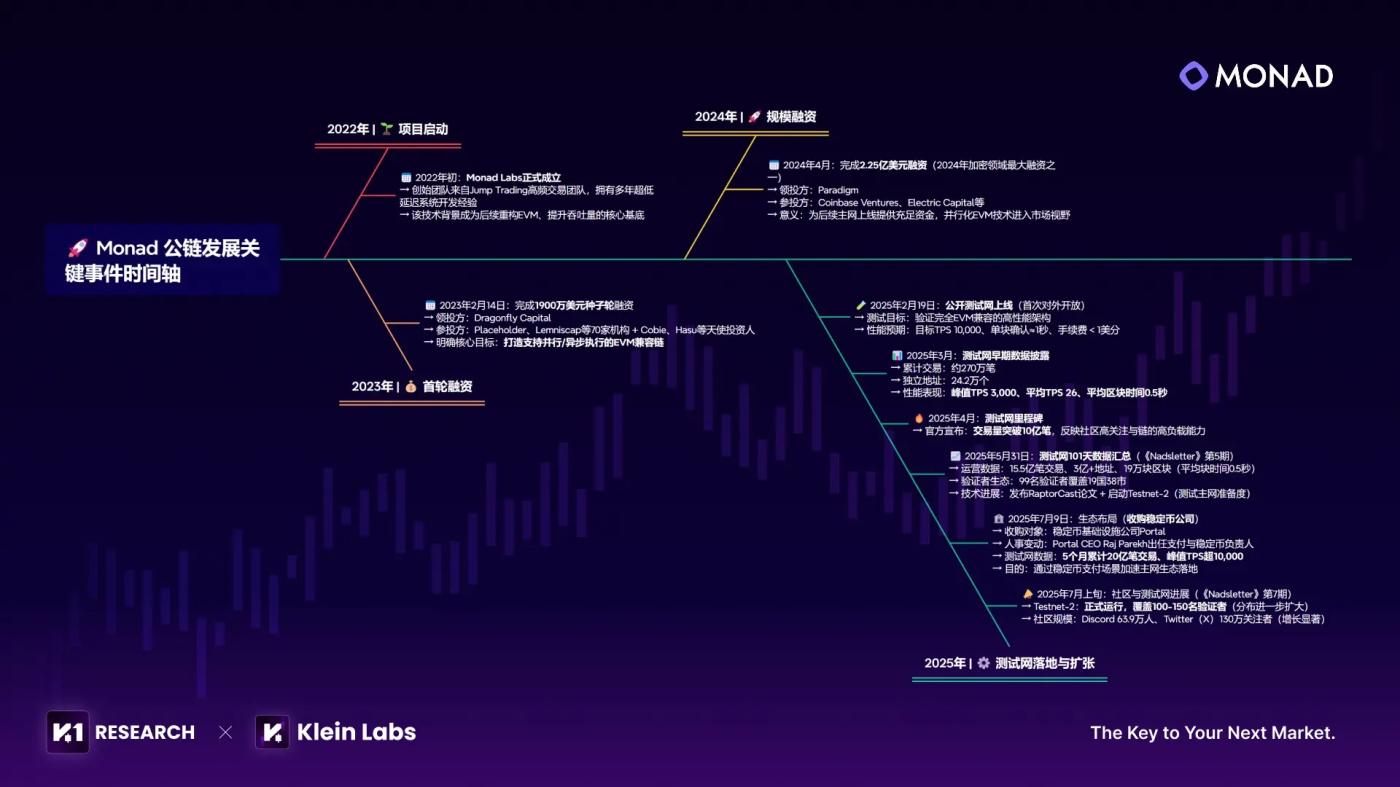

1.2 Overview in One Picture! Monad's "Growth Surge" Timeline

From this timeline, it's clear that Monad's star status is no accident. Rather, it's the inevitable result of the synergy of capital support, talent, and technological implementation capabilities:

In terms of financing, Monad, with its clear technological positioning and promising development prospects, has successfully attracted continued investment from top industry investors. In 2023, it completed a $19 million seed round led by Dragonfly Capital. In 2024, it secured another $225 million in funding led by Paradigm, bringing the total raised across these two rounds to over $240 million. Investors included renowned institutions such as Coinbase Ventures and Electric Capital, and the project's valuation simultaneously climbed to $3 billion, laying a solid financial foundation for technological breakthroughs, team expansion, and ecosystem development.

Core team members come from leading financial and technology institutions such as Jump Trading and Goldman Sachs, and have extensive experience in distributed system design and low-latency transaction optimization. Some members have also been deeply involved in Ethereum core protocol iteration and Solana performance debugging. Their professional technical background provides a key guarantee for the project to overcome the industry pain points of "performance, compatibility, and decentralization."

In terms of technical implementation, the performance of the test network stage further confirmed its potential - the peak TPS after the launch reached 5200, more than 334 million RPC requests were processed within 12 hours, and the total number of on-chain addresses exceeded 300 million. It not only verified the feasibility and stability of core technologies such as parallel EVM and MonadBFT, but also demonstrated its strong appeal to users and developers.

The organic combination of capital, talent, and technology implementation capabilities together constitute the core driving force behind Monad's rapid development in the public chain sector, enabling it to stand out in the fierce competition.

1.3 Uncertainty and Future Outlook

While Monad has faced challenges throughout its development, these challenges also provide opportunities for the project to refine its technology and drive ecosystem growth. Currently, uncertainty surrounding Monad primarily centers on the timing of its mainnet launch, fluctuations in user activity, and the efficiency of funded capital utilization. However, as the testnet continues to operate and the mainnet rollout continues, further clarity will emerge on the project's progress and potential. Community concerns are more based on differing expectations and typical early-stage issues, rather than on any inherent flaws in the project itself.

As we monitor Monad's development, we must not only closely monitor its promised high performance targets, but also pay close attention to the progress of its technical delivery, the effectiveness of its decentralized execution, and the actual implementation of its ecosystem. With the mainnet launch approaching, these factors will determine Monad's true competitiveness in the public blockchain space.

Subsequently, we will conduct an in-depth analysis of Monad from multiple dimensions, including network data and operational indicators , technical deconstruction , competitive landscape and advantage analysis , ecological development , community culture and builder motivations , in order to comprehensively assess its development potential and long-term risks.

2. Network data and operational indicators

2.1 Performance Indicators

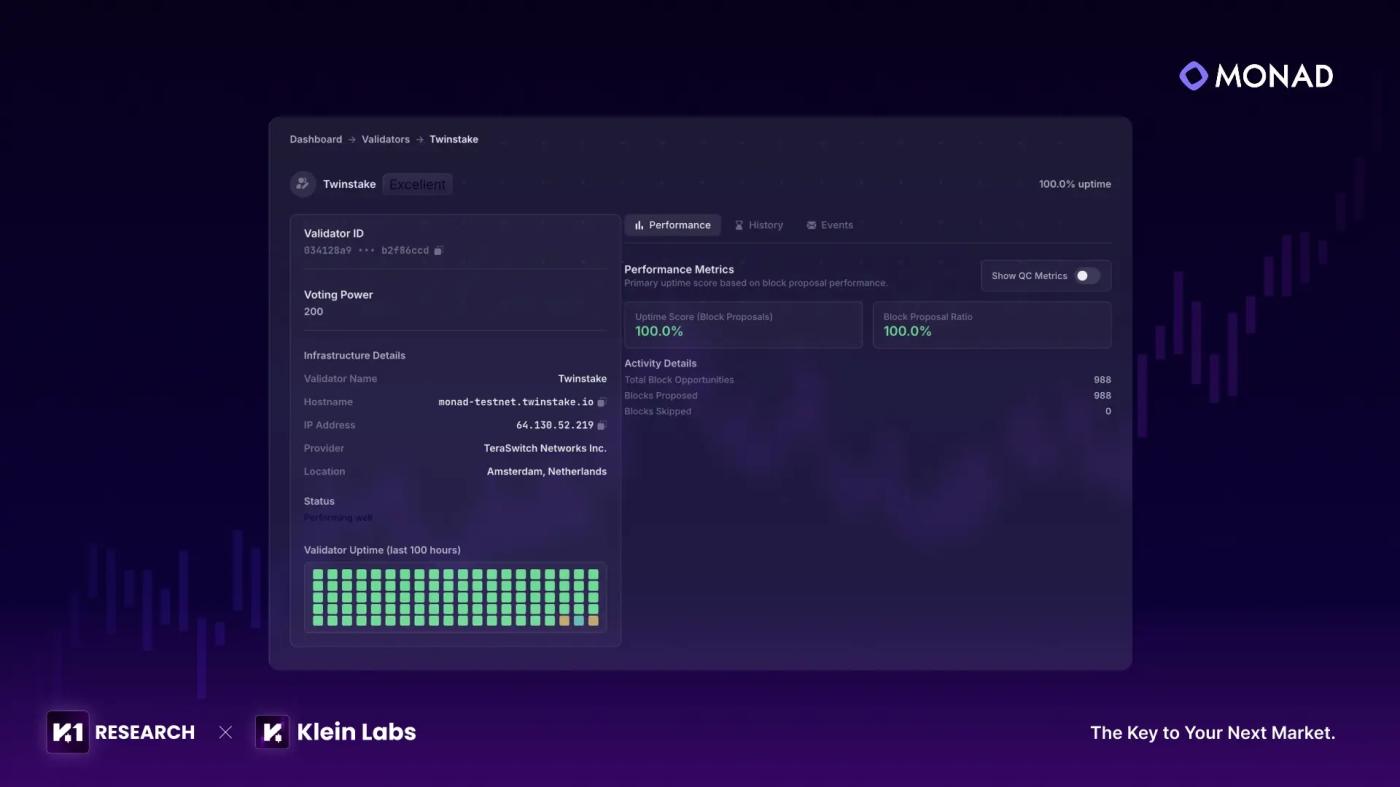

Transaction Throughput and Success Rate : The Monad Testnet Overview Dashboard shows that as of the end of August 2025, the testnet had processed approximately 255 million successful transactions , with an average success rate of 98.18% over the past 90 days. Institutional validator Twinstake's nodes achieved a 100% block production rate and a 100% block proposal rate in Testnet-2 , verifying an average block production rate of approximately 98.75% , demonstrating stable consensus efficiency while maintaining high performance targets.

Source: Twinstake | Monad in the Wild: Institutional Insights from Testnet Deployment

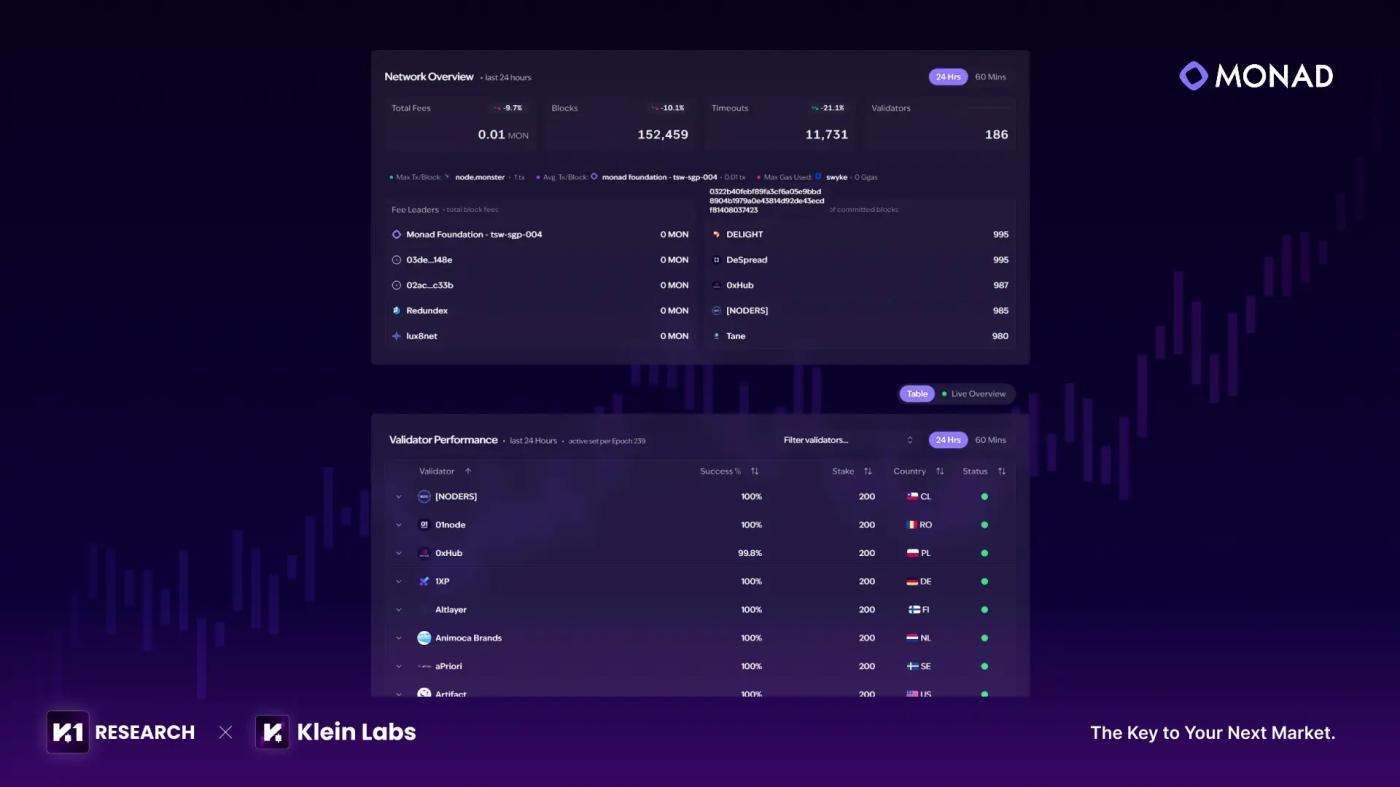

TPS and Fees : The panel shows that the TPS peak reached 300-350 TPS during March-April 2025 (about 100 TPS per week). The actual throughput is still far from the officially claimed theoretical value of 10,000 TPS; the median transaction fee in the past 90 days is about 0.0028 MON.

Block latency : While the panel does not directly provide the average block time, the fact that transaction throughput remained stable and there were no widespread failures between June and July 2025 suggests that the block interval remained at the sub-second level, verifying the stability of the testnet's parallel execution architecture.

2.2 On-chain data

Address and Wallet Activity : The Monad Foundation dashboard counts 310,630,141 unique addresses. The BlockRaptor dashboard defines an "active wallet" as an address that has issued at least one successful transaction, yielding approximately 309,903,696 active wallets, with an average of approximately 7 transactions per wallet .

Source: https://dune.com/monad_foundation/monad-testnet-overview-dashboard

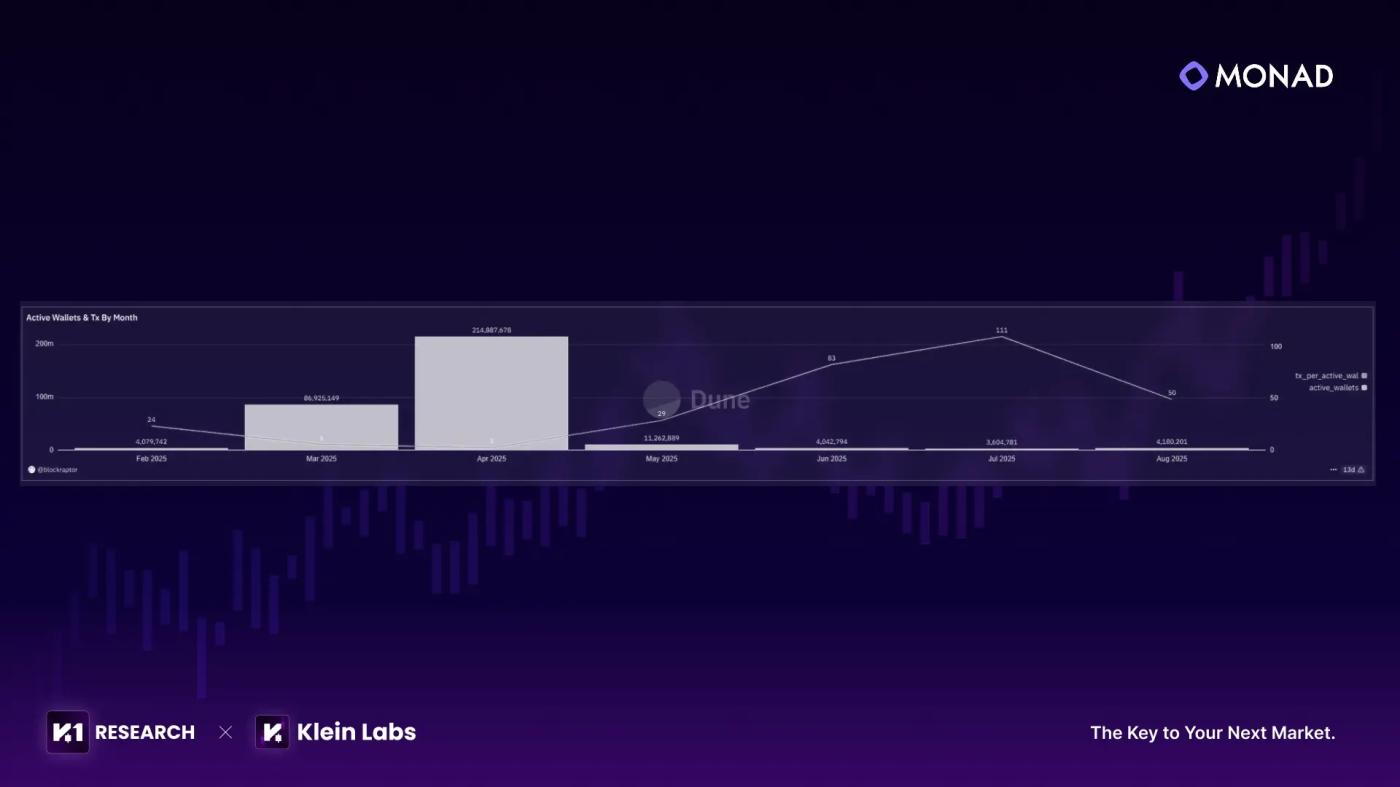

Transaction Distribution and Time Evolution : BlockRaptor 's "Active Wallets & Tx By Month" chart shows that testnet user growth exhibits a significant "surge and then decline" pattern: Active wallets reached 86.92 million in March, surging to 215 million in April , then dropping to 11.28 million in May, and stabilizing at around 4 million from June to August. The corresponding monthly number of transactions per wallet dropped from 6 in March to 3 in April , before rebounding to 29, 83, and 111 transactions in May. This data reveals that the initial surge in registrations driven by "airdrop expectations" has not translated into sustained activity.

Smart Contracts and Contract Creators : The official dashboard shows that as of the end of August, 36,108,124 contracts had been deployed, generated by 2,975,837 contract creators. Monthly statistics from the BlockRaptor dashboard show that contract creation peaked in March and April (60,000–80,000 new contracts per month), then declined, but the cumulative number continued to grow steadily.

Wallet Behavior Distribution : The BlockRaptor dashboard breaks down monthly active wallets by transaction count: In April, 209.5 million wallets, representing 97.5% of all active wallets, performed only one transaction. Only 0.9% of wallets executed more than 10 transactions during the month. Overall, by August, 293,597,158 of all active wallets had only one transaction, representing approximately 89% , further demonstrating that testnet users are primarily short-term, "participatory" users.

2.3 Decentralization

Validators and Contract Creators: The Monad testnet currently has approximately 186 active validators. As can be seen from the validator table, all validators have a uniform staking amount of 200 units, and the success rate is generally close to 100%, demonstrating strong consistency. Validators come from various countries, including Romania, Germany, Ireland, South Korea, and Singapore. This demonstrates that Monad has achieved a preliminary balance between performance and decentralization, leaving room for scaling the validator base for the mainnet phase.

Source: https://www.gmonads.com/validators

Comprehensive data on the Monad testnet in terms of performance, user engagement, and developer activity: billions of cumulative transactions and over 300 million active wallets reflect early market interest, but user stickiness and actual activity are relatively low; on average, only a small number of users maintain high-frequency trading each month, with a transaction success rate stable at over 98% and extremely low transaction fees, indicating that the core technical architecture can support high loads but is still in the climbing stage.

3. Technical Deconstruction

3.1 Consensus Layer: MonadBFT — Making High-Performance Consensus More Reliable

One of the core elements of Monad's high performance lies in its proprietary MonadBFT consensus mechanism . Based on the 2018 HotStuff consensus improvements, it addresses the message congestion issues associated with increased node counts in traditional BFT protocols (such as PBFT) and fixes the "tail fork" vulnerability common in HotStuff, laying the foundation for high performance across the entire chain.

3.1.1 Four Core Innovations of MonadBFT

Anti-tail fork : The new leader must first re-propose the previous valid block, and only propose a new block when the majority of validators have not seen the block, to ensure that valid blocks are not lost;

Fast confirmation : One vote is considered a “basic confirmation” transaction, which is completed within a few hundred milliseconds and will not be rolled back unless the proposer violates the rules;

Flexible response : There is no fixed block time, the network takes 200-300 milliseconds to reach consensus, and rapid switching in the event of leader failure;

Scalable : Validators only communicate with the leader in a one-way manner, and hundreds of nodes participating will not affect performance.

3.1.2 Comparison with HotStuff Family Protocol

3.2 Execution Layer: Optimistic Parallel EVM — Compatibility and Performance

Monad's execution layer uses optimistic parallel EVM, which is fully compatible with the Ethereum EVM ecosystem and breaks through performance bottlenecks through parallel processing.

3.2.1 Core Positioning: Taking Advantage of Ecological Dividends with “Full Compatibility”

It supports the latest Ethereum instructions and pre-made functions. Existing contracts can be deployed without modification. Common tools (such as Hardhat and MetaMask) can be directly connected, significantly reducing the migration cost for developers.

3.2.2 Technological Breakthrough: Optimistic Parallel Execution and Conflict Rollback Mechanism

Monad improves efficiency through an optimistic "execute first, verify later" parallelism mechanism: unrelated transactions are grouped and processed in parallel. If transactions modify the same data, the conflicting results are canceled and re-run in order. In actual tests, 70%-80% of transactions can be processed in parallel, making DeFi scenarios 8-10 times more efficient than Ethereum.

3.2.3 Differentiated Advantages from Ethereum Rollups

3.3 The value of technological collaboration: advantages and practical considerations from an objective perspective

Monad's consensus layer and execution layer attempt to break the public chain trilemma of "performance, compatibility, and decentralization" through technical collaboration, but its actual value needs to be objectively viewed in combination with technical characteristics and implementation challenges.

3.3.1 Proven Core Advantages: Solving Clear Industry Pain Points

Judging from the testnet performance and technical design, Monad's technology combination has demonstrated targeted improvement value:

User experience: Transaction confirmation is compressed from "minutes" to "milliseconds", and gas fees are only 1/20-1/30 of Ethereum, balancing speed and stability.

Developer-friendly: Zero migration cost, making it possible to support applications that are difficult for Ethereum to support, such as high-frequency trading and blockchain games;

Ecosystem integration: Directly connect to Ethereum's $52 billion TVL and massive developer resources to accelerate ecosystem maturity.

3.3.2 Real Challenges to Be Observed: Uncertainty in Technology Implementation

Performance in complex transaction scenarios: The mainnet needs to verify the efficiency of processing multiple cross-dependent transactions;

Decentralization of validators: balancing the entry threshold for ordinary nodes and consensus efficiency;

Ecological differentiation: Attract Ethereum Layer 2 developers to migrate and strengthen scenario advantages.

4. Competitive landscape and advantage analysis

4.1 Comparison of Core Public Chain Performance and Ecosystem: Monad & MegaETH & BSC & Sei

4.2 Comprehensive Review: Monad’s Core Competitiveness and Challenges in the High-Performance EVM Public Chain Track

In the differentiated competition in the high-performance EVM track, Monad has obvious advantages in capital strength, technical routes and ecological compatibility, laying a solid foundation for its rapid growth in the track.

Core barriers in track competition

A dual moat of capital and ecosystem migration: Monad has raised approximately $244 million in cumulative funding, far exceeding MegaETH (approximately $43 million) and Sei, providing strong support for technical development and ecosystem launch. More importantly, Monad's 100% compatibility with Ethereum bytecode provides a nearly zero-cost contract migration path: developers don't need to rewrite contracts, and users don't need to change their wallets or habits. This feature significantly lowers the barrier to migration from Ethereum to Monad, giving it the potential to rapidly attract DeFi and dApps.

Performance advantages of an independent public chain : As an independent L1, Monad utilizes its proprietary MonadBFT consensus and optimistic parallel EVM , targeting a throughput of 5,000–10,000 TPS and finality of 0.8–1 seconds, striving to achieve high performance without sacrificing decentralization. In comparison, MegaETH pursues sub-millisecond latency through a single sequencer, but faces significant centralization controversy. BSC's PoSA model has only 21 validators, resulting in limited decentralization. Sei v2, while capable of batch processing throughput of 28k+ TPS, still requires verification on the Mainnet. Monad's positioning makes it more attractive for scenarios requiring an independent security perimeter.

Overall, Monad, with its ample capital, complete EVM compatibility , and high-performance positioning as an independent public chain , has established a clear advantage in the high-performance EVM race. If it can successfully deliver on its performance targets, enhance decentralization, and cultivate an application ecosystem, it is poised to become a benchmark for "high-performance + fully compatible" independent public chains.

5. Ecosystem Development

5.1 Ecosystem Capital Dynamics: Top Projects Favored by First-Tier Capital

As a new-generation Layer 1 public chain with over $240 million in cumulative funding and a valuation exceeding $3 billion, Monad's inherent capital appeal has also been reflected in its ecosystem. Its leading ecosystem projects have already attracted significant investment from leading institutions such as Pantera Capital and Binance Labs, injecting strong momentum into the ecosystem's initial launch.

Currently, Monad ecosystem projects are primarily focused on seed and angel rounds, with capital investment focused on areas with strong technical adaptability and clear application scenarios. The following will review representative projects within the ecosystem across multiple sectors, showcasing its diverse portfolio.

5.2 Ecosystem Expansion: Portal Acquisition and Stablecoin Layout

In July 2025, the Monad Foundation funded the acquisition of Portal, marking a key step in Monad's strategic development in the stablecoin and payment infrastructure sectors. Portal, a provider of cross-chain stablecoin wallets and payment solutions, already supports millions of dollars in daily stablecoin settlements through this acquisition.

The Monad Foundation's acquisition has the following strategic implications:

Rapidly enter the stablecoin market and reduce dependence on external stablecoins;

Strengthen the underlying financial infrastructure to provide reliable support for DeFi, payment and trading scenarios;

Through direct investment from the foundation, the signal is sent to the ecosystem that the focus is on developing stablecoins and payment scenarios.

Overall, the Portal acquisition is not only a capital investment, but also a forward-looking layout of Monad's financial infrastructure and stablecoin ecosystem before the mainnet launch, providing solid support for the subsequent implementation of DeFi and payment scenarios.

5.3 Ecosystem Scale: Preliminary Layout and Growth Potential Before the Mainnet

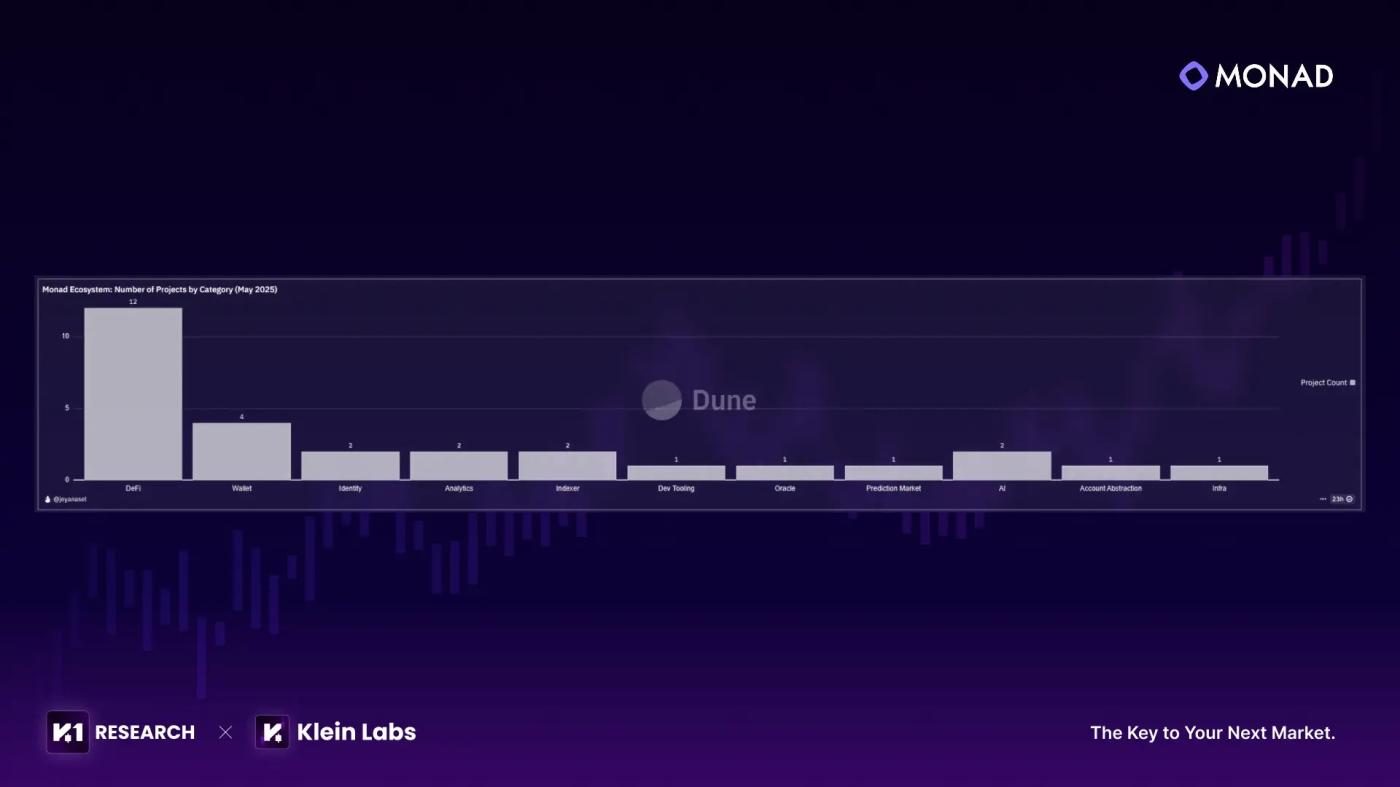

According to Monad's official statistics in 2025, its official ecological catalog has included nearly 280 projects, covering DeFi, infrastructure, AI, games, payments, DePIN and other diverse fields, forming a layout feature of "full track coverage and highlighting key areas".

It's worth noting that despite the official mainnet launch, Monad, with its technological advantages of "high performance (high throughput, low latency) + full EVM compatibility" and the industry influence of leading capital backing, has already attracted a large number of high-quality entrepreneurial teams. The ecosystem has now transitioned from the early "concept incubation" stage to the critical preparation phase of "application function testing and implementation scenario polishing." For example, several core applications in the DeFi sector have completed testnet iterations, and infrastructure projects have achieved initial integration with the ecosystem, laying a solid foundation for rapid growth in user scale and transaction volume after the mainnet launch.

5.4 Ecosystem Composition: Multi-track Project Matrix and Core Cases

The Monad ecosystem presents a pattern of "DeFi as the core, and coordinated extension of multiple tracks": DeFi projects lead the way with 12 projects, becoming the most active core track in the ecosystem; Wallet, as the key entrance for users to reach the ecosystem, has gathered 4 projects; at the same time, "underlying infrastructure" tracks such as Identity, Data Analysis, Infrastructure, as well as innovative tracks such as AI and Prediction Market have all launched projects, reflecting the expansion logic of the ecosystem from "core financial scenarios" to "underlying support + diversified applications."

Source: Monad

Combining financing trends and official support priorities, the following focuses on the core projects in the Monad ecosystem that are intensively funded and officially promoted, analyzing the development potential and implementation progress of each track .

5.4.1 DeFi Infrastructure and Core Applications (Funding-intensive Areas)

1. aPriori (@apr_labs)

Funding: Seed round + strategic investment totaling over US$30 million (led by Pantera Capital, with participation from Binance Labs).

Positioning: MEV-optimized LSD derivatives platform, focusing on the Monad native staking ecosystem.

Highlights: Reduces gas costs by over 30% through MEV capture technology and supports the issuance of multiple types of staking derivatives; receives key support from the Monad Foundation's "Fundraising & Foundry Program," making it a benchmark project for the DeFi ecosystem.

2. Fastlane Labs (@0xFastLane)

Funding: $6 million in strategic funding ( led by Figment Capital and DBA), $2.3 million in seed funding ( led by Multicoin Capital ).

Positioning: Provider of low-latency transaction execution optimization solutions.

Highlights: Transaction confirmation delays are compressed to sub-millisecond levels, making it suitable for high-frequency quantitative and derivatives trading. Transaction packaging logic is optimized for customized MonadBFT consensus, providing a foundational infrastructure for ecological performance.

3. Kintsu (@KintsuFinance)

Funding: $4 million in seed funding led by Castle Island Ventures .

Positioning: Liquidity staking service platform.

Highlights: Supports Monad native tokens and multi-chain asset staking, and is deeply integrated with the Monad consensus mechanism to ensure the security and efficiency of staked assets; it is a core project of the Monad ecosystem's "Staking Layer."

4. Curvance (@Curvance)

Support: During the testnet period, it was awarded the official Monad "Eco-Pioneer" label and ranked in the top 3 in community popularity.

Positioning: Multi-chain lending market (focusing on the Monad mainnet).

Highlights: Supports lending of over 15 asset classes, integrates Monad's low gas advantage, and offers a lending rate 40% lower than Ethereum Layer 2. The number of users in the testnet phase has exceeded 100,000, and it is expected to become an ecosystem "lending hub" after the mainnet launch.

5. Perpl ( @perpltrade )

Funding: Strategic/seed round of approximately $9.25 million (led by Dragonfly).

Positioning: A decentralized perpetual swap exchange (perps DEX), built on the Monad chain, using the EVM architecture, and intending to use an on-chain limit order book (on-chain CLOB) mechanism.

Highlights: ① Plans to launch a testnet by the end of the year, allowing users to try out the platform in advance and help identify bugs; ② Leveraging Monad's low latency and EVM compatibility to improve trading experience and compliance speed (token listings, etc. may be faster than on traditional trading platforms); ③ Centralizing all liquidity in perpetual contracts rather than dispersing it across multiple expiration months (unlike options, which have multiple expiration contracts) to enhance liquidity depth and trading experience.

6. Modus Finance (@Modus_Finance)

Positioning: A highly capital-efficient and composable DeFi lending protocol that supports assets such as LST, LRT, LP tokens, and stablecoins.

Highlights: Provides lending capabilities up to 95% LTV, enhancing leverage and asset utilization efficiency; reduces systemic risk through a modular market, and supports automatic leverage strategies (Looping Vault) to help users maximize returns. It is particularly suitable for Monad ecosystem reward assets.

5.4.2 Infrastructure and User Portal

1. Kuru Exchange (@KuruExchange)

Financing: $11.6 million in Series A funding (the original $2 million seed round was led by Electric Capital, and the subsequent Series A funding was led by Paradigm).

position: The business has been adjusted by launching the Kuru Flow smart aggregator, while still retaining an order book with an integrated AMM and being able to connect to all major liquidity sources on Monad, striving to become the best spot trading venue on Monad.

Highlights: It adopts a dual architecture of "account custody + Uniswap-style Lite mode", taking into account both professional traders and novice users; it is one of the DEXs with the largest trading volume in the ecosystem.

2. Monorail (@monorail_xyz)

Positioning: DEX aggregator (integrating AMM and CLOB liquidity).

Highlights: The first "all-type DEX aggregator" that supports the Monad ecosystem, which can route the best prices from CLOBs and AMMs such as Kuru and CrystalExch, with a slippage reduction of 20% compared to a single DEX; the testnet stage processed more than 50,000 transactions per day.

3. Clober (@CloberDEX)

Positioning: Full-chain order book DEX based on the LOBSTER mechanism (Monad native).

Highlights: The use of Segment Tree's LOBSTER matching engine and the self-developed Octopus Heap data structure significantly reduces matching gas costs and improves efficiency; the asynchronous settlement mechanism decouples transactions from funds and optimizes on-chain execution performance.

5.4.3 Innovation Scenarios and Segmented Tracks

1. CrystalExch (@CrystalExch)

Positioning: The first on-chain CLOB exchange in the EVM ecosystem (Monad native).

Highlights: The order book is fully on-chain, with transparency comparable to that of centralized exchanges; leveraging Monad's high throughput, the matching speed is 10 times faster than Ethereum CLOB.

2. Zona Finance (@zona_io)

Positioning: RWA (real world asset) super application.

Highlights: Supports on-chain prediction, lending, and trading of RWAs such as real estate and commodities; combined with Monad's low-latency characteristics, the RWA price oracle updates at a speed of "seconds", which is the core attempt of the ecosystem to "connect with traditional finance".

3. Levr Bet (@Levr_Bet)

Support: The winning project of the "Most Innovative Award" in the "Monad Madness" hackathon.

Positioning: Decentralized leveraged sports betting platform.

Highlights: Offers 5x leverage for sports betting and achieves "on-chain fair settlement" through smart contracts; during the testnet period, it reached cooperation with data providers of events such as the NBA and the Premier League, setting a benchmark in the "Web3 Sports" ecosystem.

4. Plato2Earn (@plato2earn)

Positioning: "Eat-to-Earn" platform.

Highlights: After consuming at participating restaurants, users can upload their receipts to receive $FAT token rewards. Combined with Monad's low-cost features, the on-chain reward settlement gas fee is less than 1 cent, making it an innovative example of the integration of the "real world + on-chain" ecosystem.

5. RareBetSports (@RareBetSports)

Positioning: Daily fantasy sports platform (Web3 version of DraftKings).

Highlights: Users can create fantasy sports teams on-chain and participate in event predictions through token incentives; during the testnet phase, API data collaborations were established with the NFL and MLB, and the project was ranked in the top 5 of the "most anticipated mainnet launch projects" in a community vote.

6. Kizzy Mobile (@kizzymobile)

Positioning: Social gambling and mobile entertainment applications (Monad native ecosystem).

Highlights: Users can make predictions and bets on social media content and earn rewards through on-chain smart contracts. Combined with Monad's low-cost, high-throughput features, users can instantly claim rewards on-chain for mobile purchases. This is a significant practical example of the integration of "real life + blockchain" within the ecosystem.

5.4.4 Community Culture and Blockchain Games

1. Nad.fun (@naddotfun)

Positioning: Meme coin launch pad (Monad version of Pumpfun).

Highlights: Supports user-defined meme token issuance and features a built-in "PVP trading competition." Deeply integrated with the Monad community's "meme culture" (mascots like molandak and chog are frequently released as secondary tokens), setting a record for a single coin's popularity increasing 1,000-fold in 24 hours during the testnet.

2. Fantasy (@fantasy_top_)

Support: Winner of the “Best Blockchain Game Award” at the “Monad Madness” hackathon.

Positioning: On-chain card competitive game.

Highlights: Combining NFT cards with the DeFi staking mechanism, users can obtain whitelisted NFTs through competitions; the test network had over 50,000 users in the first week of its launch, making it a core project in the integration of the "GameFi+DeFi" ecosystem.

6. Community Culture and Builders’ Motivations

6.1 For builders: full-link empowerment and first-mover opportunities

Monad takes "Builders First" as its core strategy, which is different from the traditional investor-oriented public chain logic. By integrating "capital-resources-technology-traffic" to form an integrated support system, it creates a "Founder Magnet" effect, providing a low-competition, high-growth development environment for early-stage projects. This is also the key to the rapid expansion of its ecosystem.

6.1.1 Full-cycle Support: "Close Escort" from Concept to Implementation

To lower the barrier to entry for developers, Monad has built a support system covering the entire project lifecycle, deeply integrating native ecosystem-driven plans into builder services:

Funding and resource matching: Through the "Foundry Program," we integrate capital resources, market channels, and product strategy guidance to help projects advance from the concept stage to product-market fit (PMF). For example, we connect early-stage DeFi projects with institutional capital such as Pantera Capital and Binance Labs.

Technical support: We provide a complete EVM-compatible toolchain, SDK, and developer documentation to ensure "zero-cost migration" for Ethereum developers. We also collaborate with Mach Accelerator, EVM/Accelerator, and other organizations to launch specialized accelerators, matching teams with experienced mentors in distributed systems, smart contract optimization, and other fields to address technical bottlenecks.

Traffic and exposure activation : Hosting the "Monad Madness" hackathon (with a prize pool of one million US dollars), focusing on high-performance public chain adaptation scenarios (such as high-frequency trading and real-time blockchain games), attracting hundreds of teams from around the world to participate. Winning projects will receive community traffic and ecological resources .

6.1.2 Core Attraction: Technological Dividends and First-Mover Advantages

The builders' choice of Monad is essentially a two-way recognition of "technical performance" and "ecological opportunities":

Technical Performance Bonus: The "MonadBFT consensus + Optimistic Parallel EVM" architecture, while fully compatible with EVM, achieves sub-second finality and a throughput target of 10,000+ TPS, supporting scenarios that Ethereum struggles to handle, such as high-frequency trading, complex DeFi, and real-time blockchain games.

Ecosystem first-mover opportunity: Referring to the cases of Magic Eden and Tensor relying on the early rise of Solana's ecosystem, Monad developers are generally optimistic about the value of "pre mainnet layout" - in the early stage of the mainnet launch, there is little competition for traffic, and projects have the opportunity to quickly occupy the entrance to the segmented track (such as becoming the first order book DEX or the first liquidity staking platform in the ecosystem), and even define the track standard. This "first-mover bonus" is difficult for mature ecosystems (such as Ethereum and Solana) to provide.

6.2 For community users: meticulous operation and inclusive co-construction

Monad is not limited to "developer services". Instead, it builds user consensus through refined user operations and inclusive community strategies, and even transforms "skeptics" into community members, forming a unique community vitality.

6.2.1 Monad Card: Peer-to-peer Activation of Core Users and FOMO Effect

During the 2025 ecosystem operation, the Monad team launched the "Monad Card" operation activity, which became a key node for the community to explode its popularity:

Precisely screen core groups : The team manually selects approximately 5,000 influential users (including blockchain OGs, developers, KOLs, investors, etc.) from over 10,000 X (formerly Twitter) accounts, and grants them exclusive Monad cards in a peer-to-peer manner to strengthen their identity;

The nomination mechanism triggers FOMO: cardholders can nominate others, creating a community-wide diffusion effect. Non-cardholders actively participate in testnet interactions and project feedback to gain eligibility, driving a 3-fold increase in community activity and significantly enhancing testnet user retention.

Inclusive strategies transform doubters: The team deliberately includes critics and skeptics in the scope of card issuance, so that they can shift from "external questioning" to "internal suggestions" due to identity recognition, and even participate in governance discussions, thereby achieving "reducing confrontation and expanding consensus."

6.2.2 Community Tension and Transparent Communication

The current Monad community still has a tension between "passionate anticipation and rational skepticism," but this tension has become a driving force for community activity:

Supporters' perspective: They recognize its combination of "EVM compatibility + high performance" and believe it is a benchmark for the next generation of public chains that "makes up for Solana's compatibility shortcomings and breaks through Ethereum's performance bottleneck";

Critics are concerned about: Mainnet launch progress, the efficiency of using the massive amount of funding raised, and potential centralization issues caused by hardware barriers to entry for validators;

Team response: Maintain transparent communication through regular technical reports (such as RaptorCast papers, Testnet-2 progress), monthly AMAs, public validator rules, etc., and gradually build community trust.

6.3 Summary: The Logic of Ecological Growth in Two Directions

The core of the Monad ecosystem lies in its two-pronged strategy of being "builder-friendly and user-focused": providing builders with full-cycle support and the dual benefits of both technology and first-mover advantage, while designing refined operational mechanisms and an inclusive community atmosphere for users. This strategy avoids both the risk of inaction caused by prioritizing technology over ecosystem and the short-term pitfall of prioritizing popularity over service. By consolidating both "hard power" (developer empowerment) and "soft power" (user consensus), it builds long-term growth certainty, significantly differentiating itself from public chains that rely solely on capital or technological narratives.

Reference Links:

Monad: Bringing Back The EVM - ASXN Daily

https://arxiv.org/abs/2502.20692

#73 - Unpacking MonadBFT: Fast, Responsive, Fork-Resistant, Streamlined Consensus chorus.one/articles/solving-blockchains-transaction-bottleneck-how-monad-revolutionizes-evm-transaction-processing

https://mirror.xyz/100y.eth/7_h6gYxMp118ReqlLT-AJ9m59l5geBpmyjDrBIiU3yo

https://www.digitaltoday.co.kr/news/articleView.html?idxno=553932

https://www.digitaltoday.co.kr/news/articleView.html?idxno=588320