This post is an excerpt from our 2025 Geography of Cryptocurrency Report. Reserve your copy now!

APAC’s leading crypto markets: Distinct paths from India to Japan

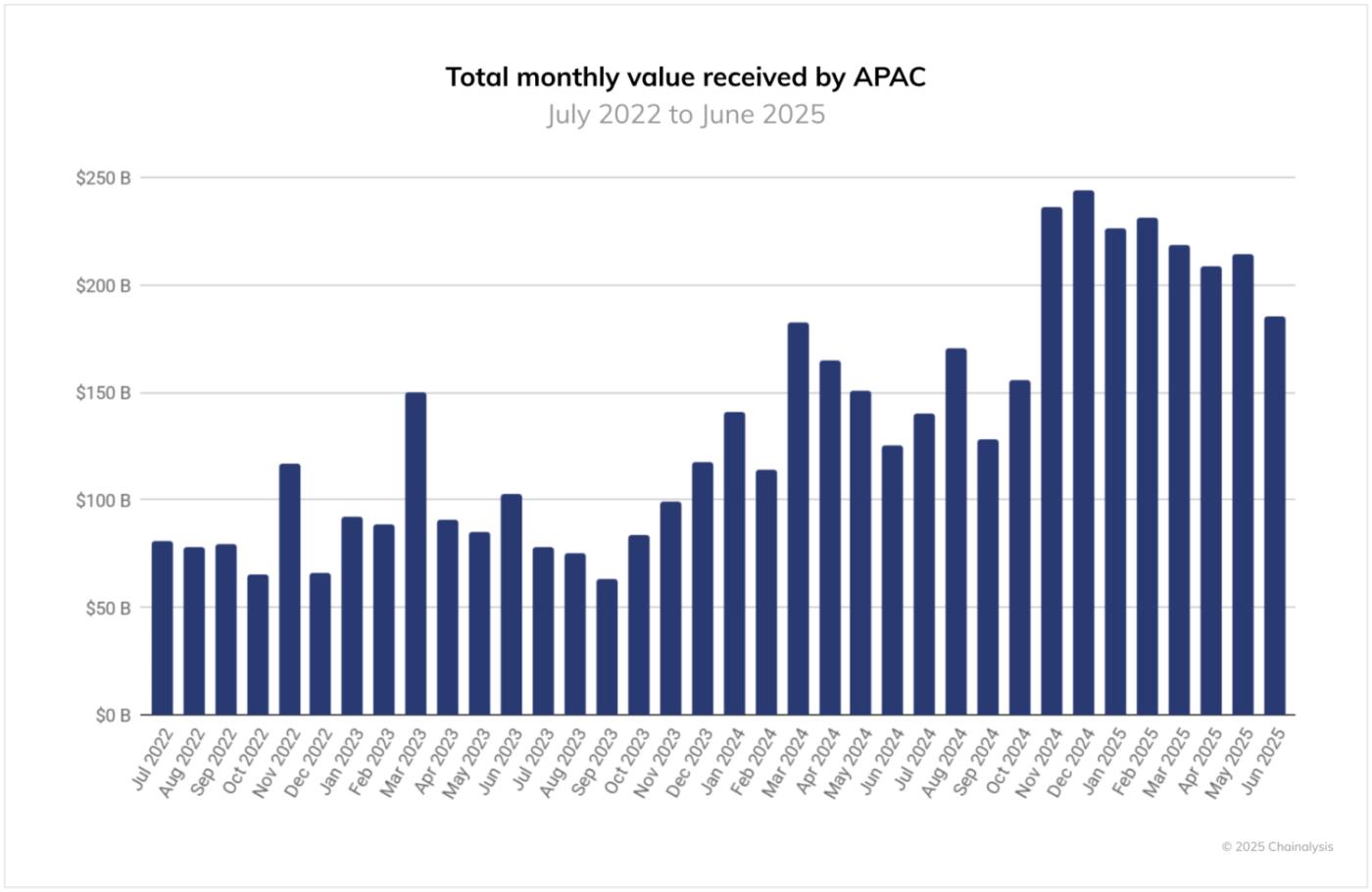

From July 2022 to June 2025, APAC demonstrated strong growth in cryptocurrency activity, with estimated on-chain transaction values showing a clear upward trajectory. Monthly on-chain value received grew from about $81 billion in July 2022 to peak at $244 billion in December 2024, a threefold increase over 30 months.

Notable growth periods include:

- Late 2023 to early 2024, where monthly on-chain value received crossed the $100 billion mark for the first time as cryptocurrency markets recovered.

- Q4 2024, which marked the region’s highest on-chain value received, driven by strong year-end figures in November and December as global markets surged in the wake of the U.S. presidential election.

- While volumes have since declined from their December 2024 peak, on-chain value received remains relatively high at above $185 billion per month through mid-2025.

As the fastest growing region in the world in terms of on-chain value received, APAC has emerged as a key growth driver globally, frequently ranking second only to Europe in terms of volumes and occasionally outpacing North America in monthly totals. The data reflects APAC’s expanding influence in global markets and its sustained momentum heading into the latter half of 2025.

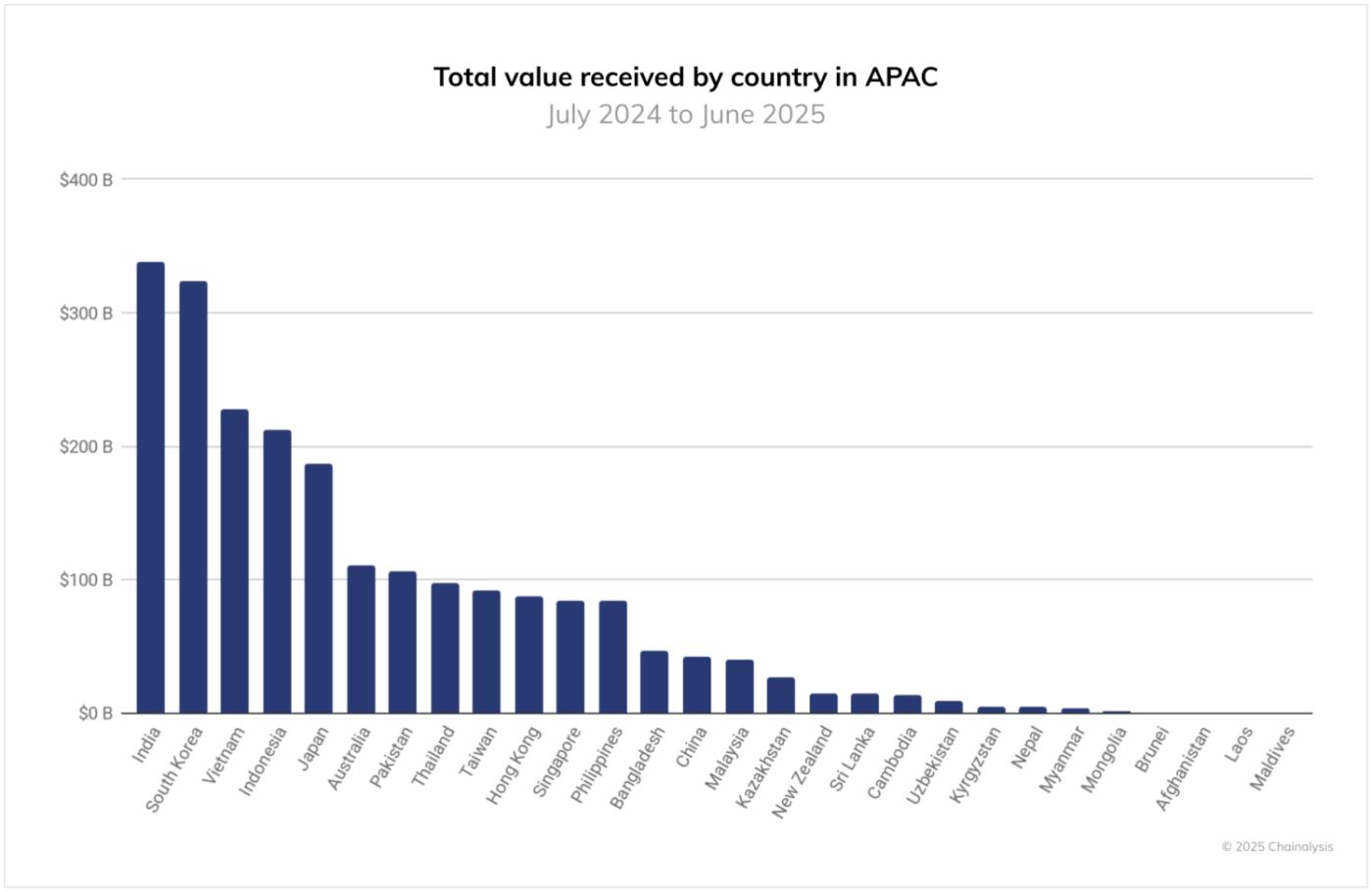

In APAC, the top markets show strikingly different pathways into crypto. India, the largest at $338 billion, blends grassroots adoption with structural gaps in finance: a large diaspora has remittance needs, young adults are using crypto trading as a supplementary income, and fintech rails like UPI and eRupi accelerate usage.

According to experts on the ground, crypto’s use cases vary by market. In South Korea, the second-largest APAC market by value received, cryptocurrencies are traded almost like equities — liquid, speculative, and mainstream — while new rules like the 2024 Virtual Asset User Protection Act are reshaping activity on major domestic exchanges. Vietnam, in third, shows crypto as everyday infrastructure for remittances, gaming, and savings. Pakistan adds a fourth archetype: with a young, mobile-first population and $35 billion in remittances, stablecoins are used to hedge inflation and freelancers get paid in crypto, helped by a government now signaling regulation rather than restriction.

Smaller markets reveal other dynamics. Australia is taking steps forward by modernizing its AML/CFT regime, cleaning up inactive digital currency exchange licenses, and bringing clearer oversight to the sector, laying groundwork for a more mature market. Singapore and Hong Kong continue to see strong policy momentum, with regulators continuing to emphasise strong standards as the route to building a digital asset hub.

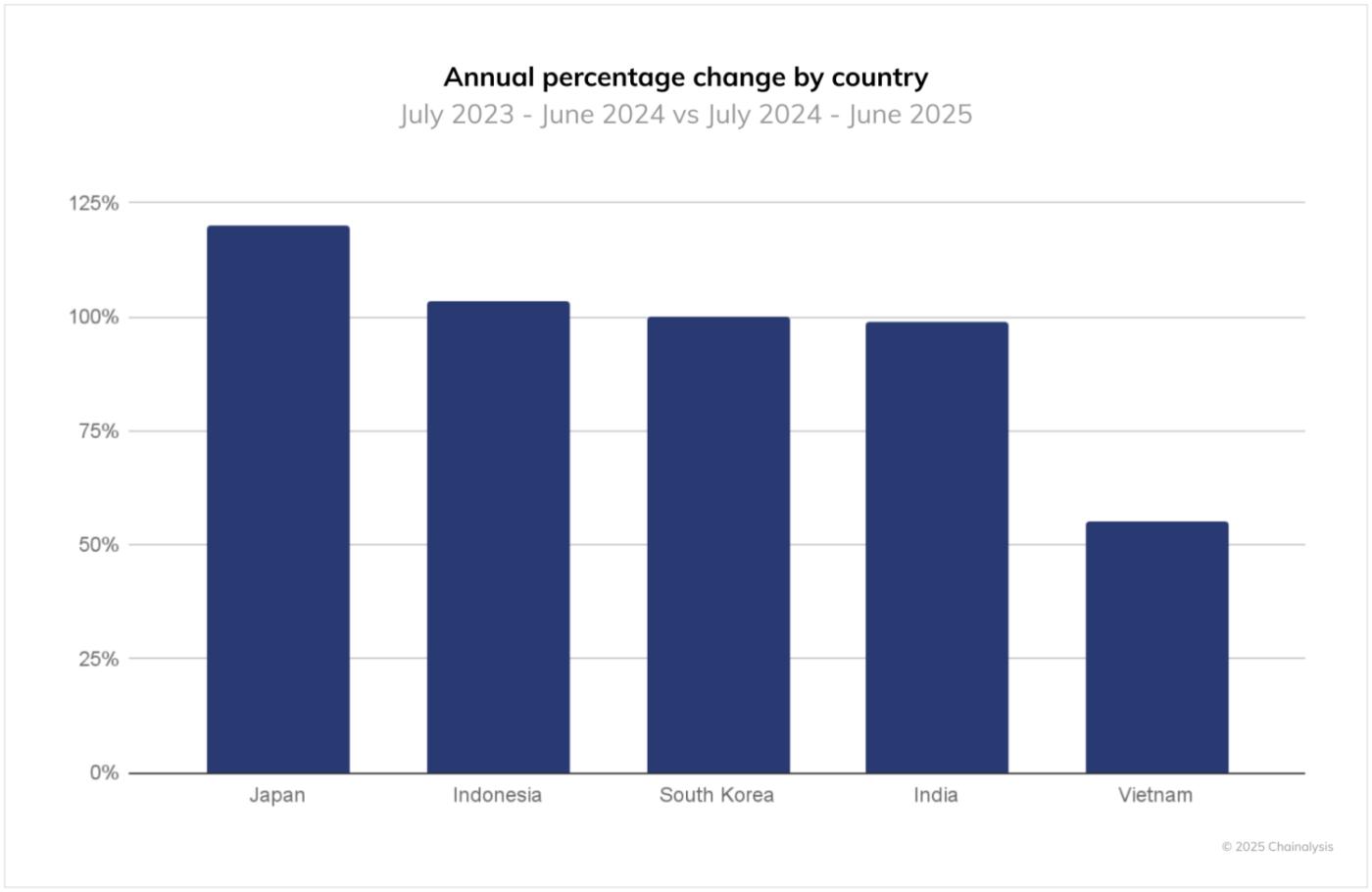

Japan’s crypto momentum fueled by regulatory shifts

Among APAC’s top five markets, Japan saw the strongest growth. On-chain value received grew 120% in the 12 months to June 2025 relative to the 12 months prior, outpacing Indonesia (103%), South Korea (100%), India (99%), and Vietnam (55%). Japan’s market has been relatively subdued in recent years compared to its neighbours, and the latest growth comes amid several policy developments that will support market growth over time (including regulatory reforms to better account for the role of crypto as investment instruments, planned changes to the crypto tax regime, and the licensing of the first yen-backed stablecoin issuer).

In contrast, growth in India, South Korea, and Indonesia reflects continued expansion but from already high baselines, while Vietnam’s lower 55% suggests a maturing market where crypto is already deeply embedded in remittances and everyday financial activity.

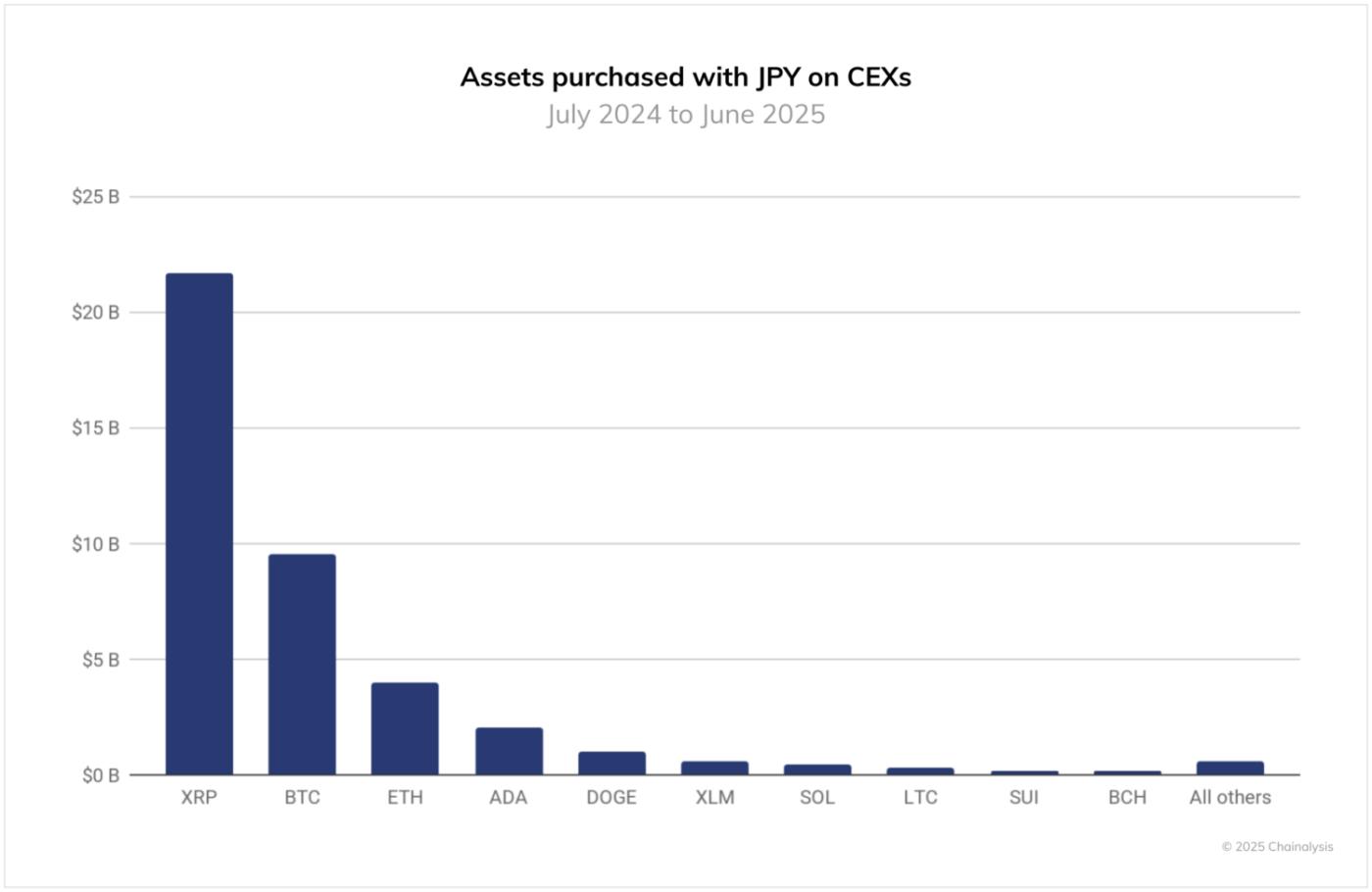

Japan’s growth is on the heels of important advances in its crypto industry. For some time now, regulatory restrictions have constrained the listing of stablecoins on domestic exchanges, although this is now beginning to change. Instead, over the 12 months to June 2025, cryptocurrency purchases using JPY have been channeled predominantly into XRP, which accounted for $21.7 billion in fiat trading activity, BTC ($9.6 billion) and ETH ($4.0 billion). The dominance of XRP trading is particularly interesting, and suggests that investors may be taking bets on the real-world utility of XRP on the back of Ripple’s strategic partnership with SBI Holdings. Looking ahead, markets will be keenly watching how stablecoins such as USDC and JPYC gain traction.

South Korea’s market is driven by professional traders and stablecoin growth

Stablecoin usage in South Korea is rising quickly, with major exchanges like Bithumb and Coinone adding USDT/KRW pairs starting from Dec 2023 and trading volumes surging by more than 50% in early 2025. KRW purchases of stablecoins reached $59 billion in the 12 months to June 2025, suggesting strong demand from traders who use them for liquidity, hedging, and faster rotations between assets. Domestic appetite for stablecoins is driving an impact on the policy landscape, with legislators and regulators alike now considering the development of a regulatory framework for KRW-backed stablecoins.

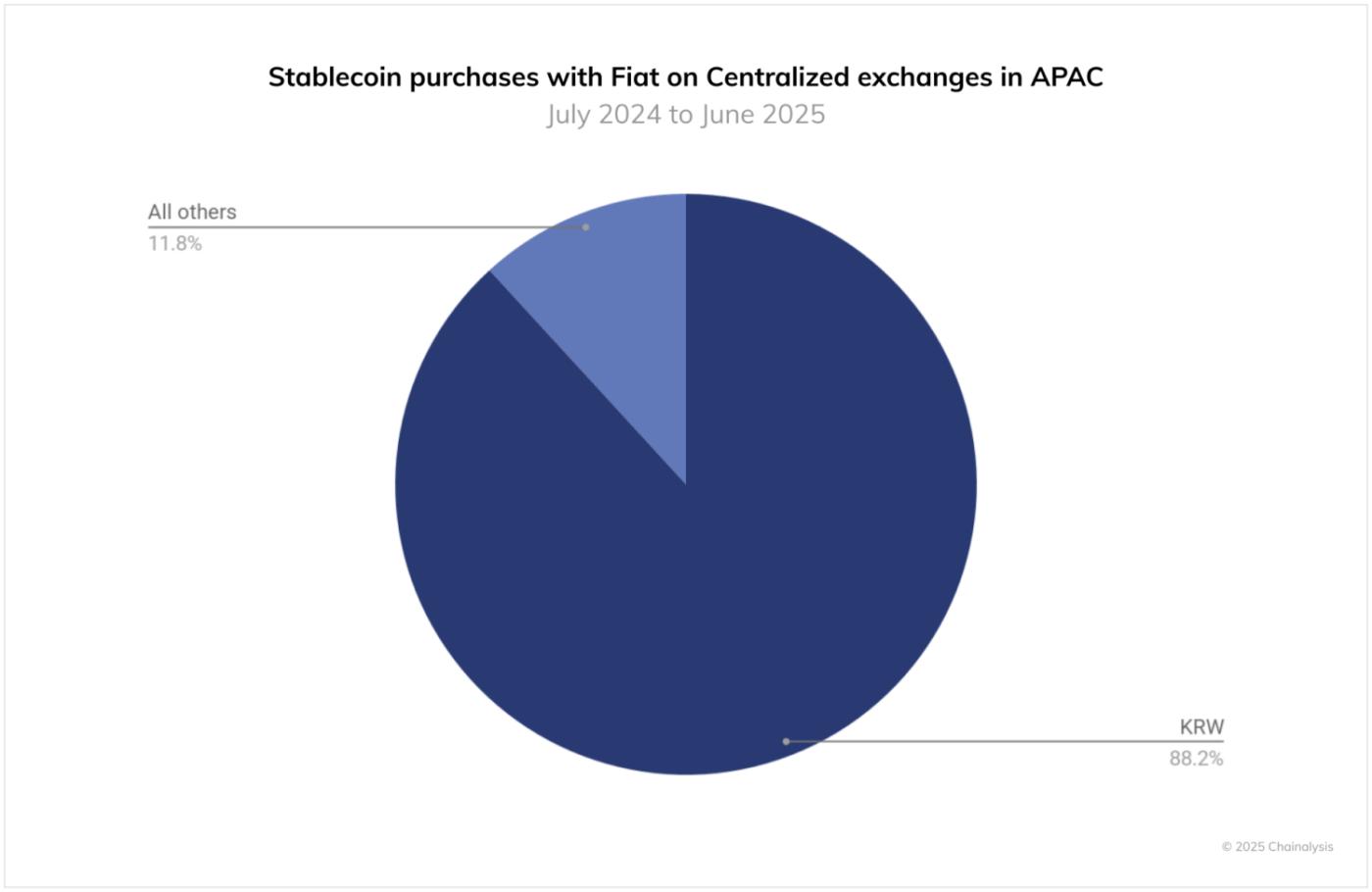

While the current discussions are largely centered on stablecoin issuance by banks and regulated financial institutions, the focus on issuance alone leaves important gaps: there is little debate on how stablecoins will be distributed, listed on exchanges, or traded in secondary markets. This oversight is particularly striking in Korea, where KRW-denominated stablecoins already account for by far the largest activity in the Asia-Pacific region – about $59 billion, compared with just $4.5 billion in THB and smaller volumes across IDR, AUD, and HKD. For stablecoins to continue this adoption in Korea, regulatory clarity will need to expand beyond issuance to cover the full lifecycle from distribution and circulation to integration into payment and settlement systems.

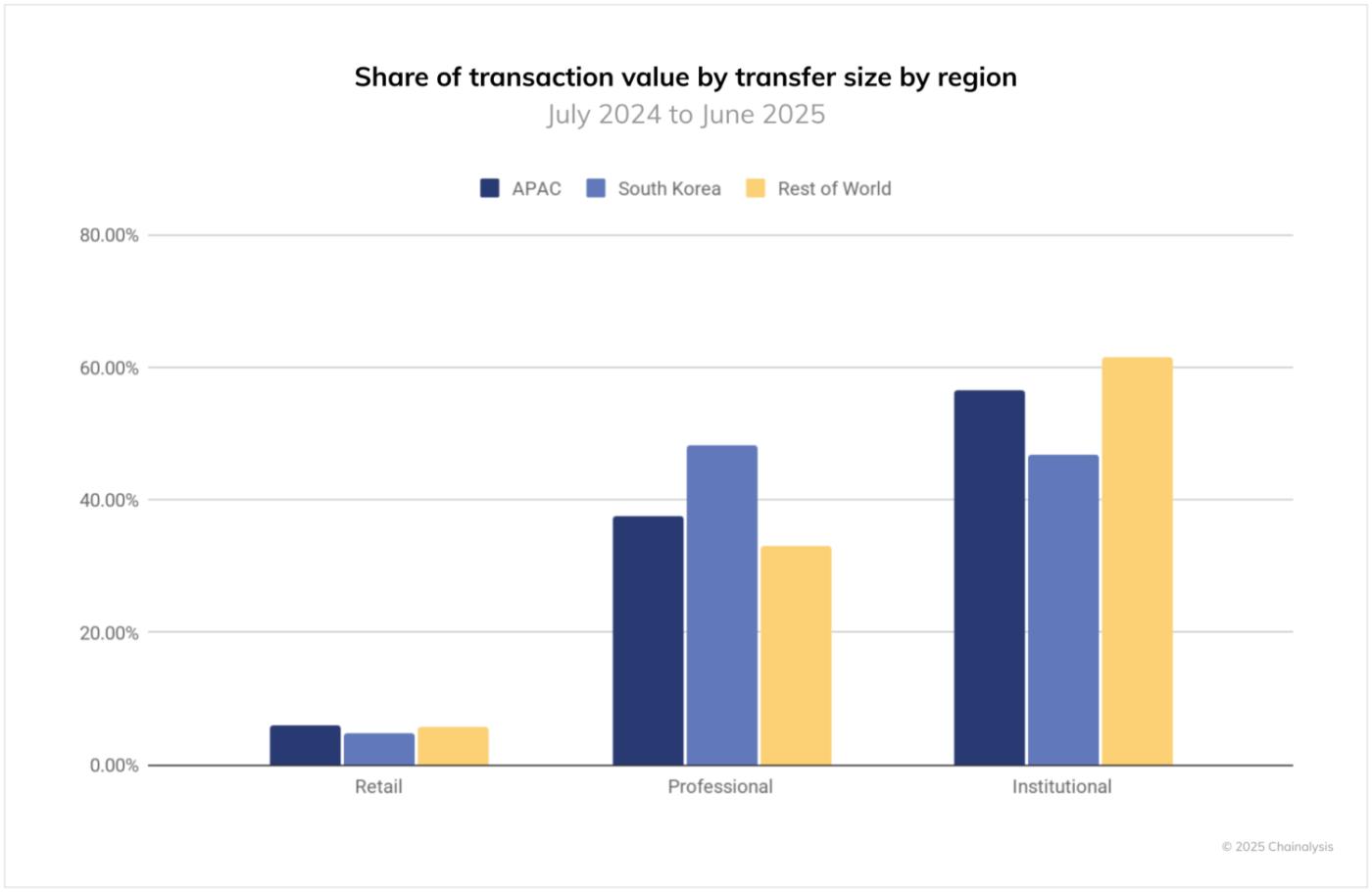

Turning back to on-chain trading volumes, South Korea’s crypto market sees a disproportionately large amount of activity in transaction sizes of $10,000 to $1 million in value, which we have designated as “professional” activity. Nearly half of Korea’s on-chain activity is driven by this segment, far above global levels. This reflects a culture of active trading by users in an advanced economy. While regulations have thus far constrained corporates and institutional players from participating in the Korean market, recent regulatory enhancements are gradually opening the door to corporate participation, potentially adding diversity to the market.

India leads the index with grassroots and institutional strength

India’s crypto market, however, is the clear leader in the region in terms of on-chain transaction volume and placement on the 2025 Global Adoption Index. At number one this year across all subindices, India’s crypto market is both fast-growing and highly complex. Organizations such as the Bharat Web3 Association are normalizing crypto as a secure and legitimate mode of value transfer. At the same time, grassroots adoption is evident in everyday life, from young students experimenting with blockchain and coding to communities using crypto for small-scale income opportunities.

India’s broader digital economy provides strong foundations for this growth. The country’s thriving fintech ecosystem, widespread use of UPI payments, and innovations such as eRupi showcase India’s ability to adapt to new financial technologies at scale. While regulators and law enforcement agencies are collaborating to establish clear frameworks and oversight, the momentum suggests that crypto is becoming an integral part of India’s digital future.

| India’s Rank | |

|---|---|

| Overall Index Score | 1 |

| Retail | 1 |

| CeFi | 1 |

| DeFi | 1 |

| Institutional | 1 |

APAC is now one of the most dynamic regions in global crypto adoption, with countries charting very different but equally impactful paths. From India’s dominance and South Korea’s speculative sophistication to Japan’s embrace of XRP and the experiments in smaller markets, the region highlights crypto’s adaptability to diverse economic and cultural contexts. This diversity not only drives adoption but also positions APAC as a bellwether for how global crypto use will evolve in the years ahead.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

The post APAC Crypto Adoption Accelerates With Distinct National Pathways appeared first on Chainalysis.