Pepe is closing in on the apex of an ascending triangle formation that has been brewing since mid-2024, adding weight to bullish Pepe price predictions.

The setup could mark one of the final buy-the-dip opportunities before the meme coin’s next breakout move, with market narratives continuing to favor a Q4 bull run.

This week’s U.S. Fed speech strengthened hopes for continued interest rate easing, with the potential to stimulate capital rotation into riskier plays like PEPE.

At the same time, speculation is growing around a spot PEPE ETF. With the SEC’s new generic listing standards set to fast-track crypto ETPs, Pepe could soon find its way into TradFi markets.

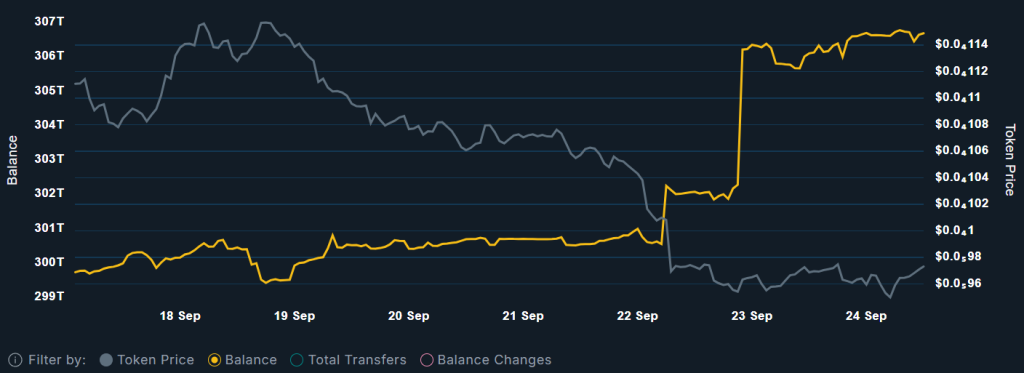

Smart money appears to be taking positions. Nansen data shows the top 100 PEPE wallets have accumulated 6.84 trillion tokens over the past week, bringing their total to 306 trillion.

Pepe Price Prediction: Is a 300% Move Near?

The early-week correction has affirmed the lower boundary of the 6-month symmetrical triangle pattern, further validating the bullish setup as it approaches its apex.

Momentum indicators suggest this could be a reversal point. The RSI has steadied at 40 after a sharp pullback from near-overbought levels, signaling easing sell pressure.

The MACD histogram shows a similar shift, flattening into what could mark a local bottom. Still, the move is not decisively bullish, leaving room for a breakdown scenario.

In that scenario, PEPE could fall 40% to retest strong historical support at $0.0000055, which marked a previous double bottom reversal.

Yet, the broader narrative leans bullish. A sustained reversal could set up another retest of the triangle’s upper boundary.

The breakout path first targets Pepe’s December high near $0.000028 for a 200% move. Fully realized, the setup points toward $0.00005, a 320% gain from current levels.

Though this target likely hinges on catalysts for new demand drivers like rate cuts, corporate treasury adoption, and spot ETFs, to tie Pepe into this cycle’s biggest narrative: TradFi.

Passive Income is Easier Than Ever With This New Pepe Coin

When it comes to large-cap meme coins like Pepe, gains are rare. A chance to triple your investment took over 16 months to build.

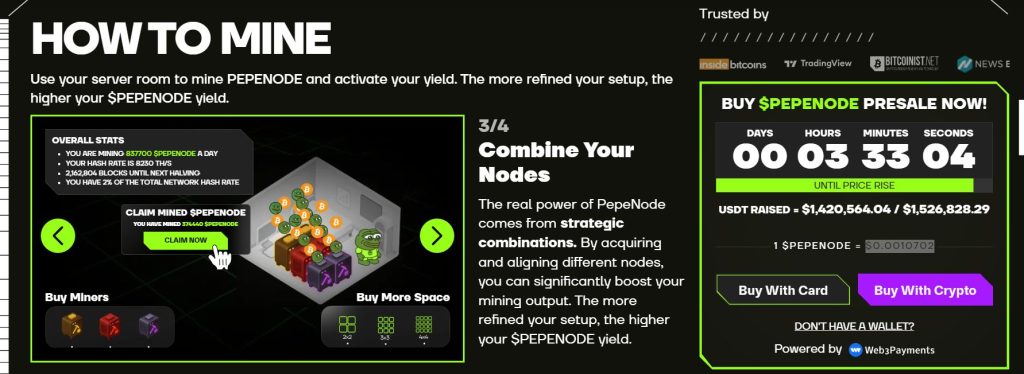

PepeNode ($PEPENODE) offers a different path: the first mine-to-earn meme coin, designed to turn missed potential into ongoing passive rewards.

Instead of costly setups, mining becomes a simple, gamified process

The project lowers the barrier to mining by turning it into a simple, gamified process.

Presale investors can already buy nodes, build rigs, and start earning before the token even launches.

The system is built with scarcity in mind. Each $PEPENODE token spent on rigs and nodes faces a 70% burn, driving long-term deflation to strengthen returns.

Interest is surging. The presale has already crossed $1.4 million in its opening weeks, while early stakers can still claim a staggering 930% APY.

Join the $PEPENODE presale now on the official website to start mining.

The current offering is $0.0010702 per token, but the clock’s ticking on the next price increase.

To stay updated, you can also follow PepeNode on X (formerly Twitter).

Visit the Official Website Here