We are less than seven days away from the end of the third quarter, and Bitcoin (BTC) is still struggling to recuperate following a wave of sell-offs earlier this week.

Currently trading at around $111,600, the world’s largest crypto is down more than 5% on the weekly chart, having lost over $120 billion in market cap in the past seven days.

Bitcoin’s price is down 1.39% in the last 24 hours, with a 26.27% increase in trading volume ($61.35 billion) over the same time frame.

AI predicts Bitcoin price for end of Q3, 2025

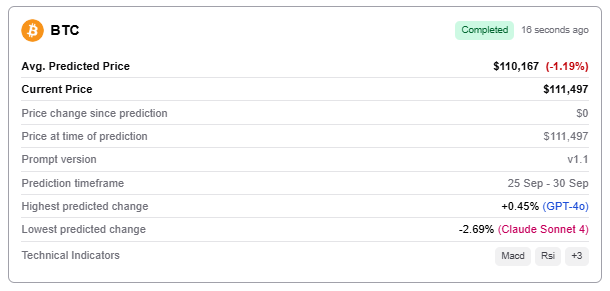

Finbold’s AI Signals, an artificial intelligence (AI) tool that integrates large language models (LLMs) with momentum-driven market indicators, has generated an average BTC price heading into the quarter’s close. Based on the prediction, the cryptocurrency might trade at $110,167, implying a 1.19% dip from the current levels.

GPT-4o was the most bullish of the models used in the analysis, pointing to a price of $112,00 (+0.45%), while Claude Sonnet 4 and Grok 3 projected it would drop to $108,500 (-2.69%) and $110,001 (-1.34%), respectively.

As mentioned, Bitcoin has been having a hard time since a wave of forced liquidations earlier this week erased $1.5 billion from leveraged positions. However, the risk factor has also been amplified by Fed Chair Jerome Powell’s warnings of a “no risk-free path” for monetary policy during his September 23 speech at The Crowne Plaza in Warwick, Rhode Island.

“There is no risk-free path. If we ease too aggressively, we could leave the inflation job unfinished and need to reverse course later to fully restore 2%. If we maintain restrictive policies for too long, the labor market could soften unnecessarily,” said Powell.

Altcoins mirrored Bitcoin’s decline, with Ethereum (ETH) down 4% to $4,010, its seven-week low. Right now, exchange-traded funds (ETFs) remain a key driver, as Bitcoin ETFs recorded $241 million in net inflows on Wednesday, September 23, compared to Ethereum ETFs, which saw over $100 million in outflows.

Featured image via Shutterstock