XRP spent the week boxing in the high-$2 range, slipping from a $3.13 feint and catching its breath above sturdy $2.75–$2.80 support.

XRP Guards $2.75–$2.80 While Resistance Hardens at $3

Price opened near $2.90 per XRP and repeatedly tapped the $3 handle, only to back off as sellers leaned on rallies; spot action cooled into a $2.83–$2.87 lane while ranges narrowed and nerves did not. The daily relative strength index (RSI) oscillator hovered in the low-40s, hinting at seller fatigue without handing bulls a green light.

Technicals kept it tidy: resistance stacked at $2.95–$3.00, then $3.10–$3.20, while bids showed up on dips toward the upper-$2.70s. Momentum signals stayed mixed with a bearish moving average convergence-divergence (MACD) crossover on higher time frames, but the structure resembles a falling wedge—a pattern that can flip the script if volume finally shows.

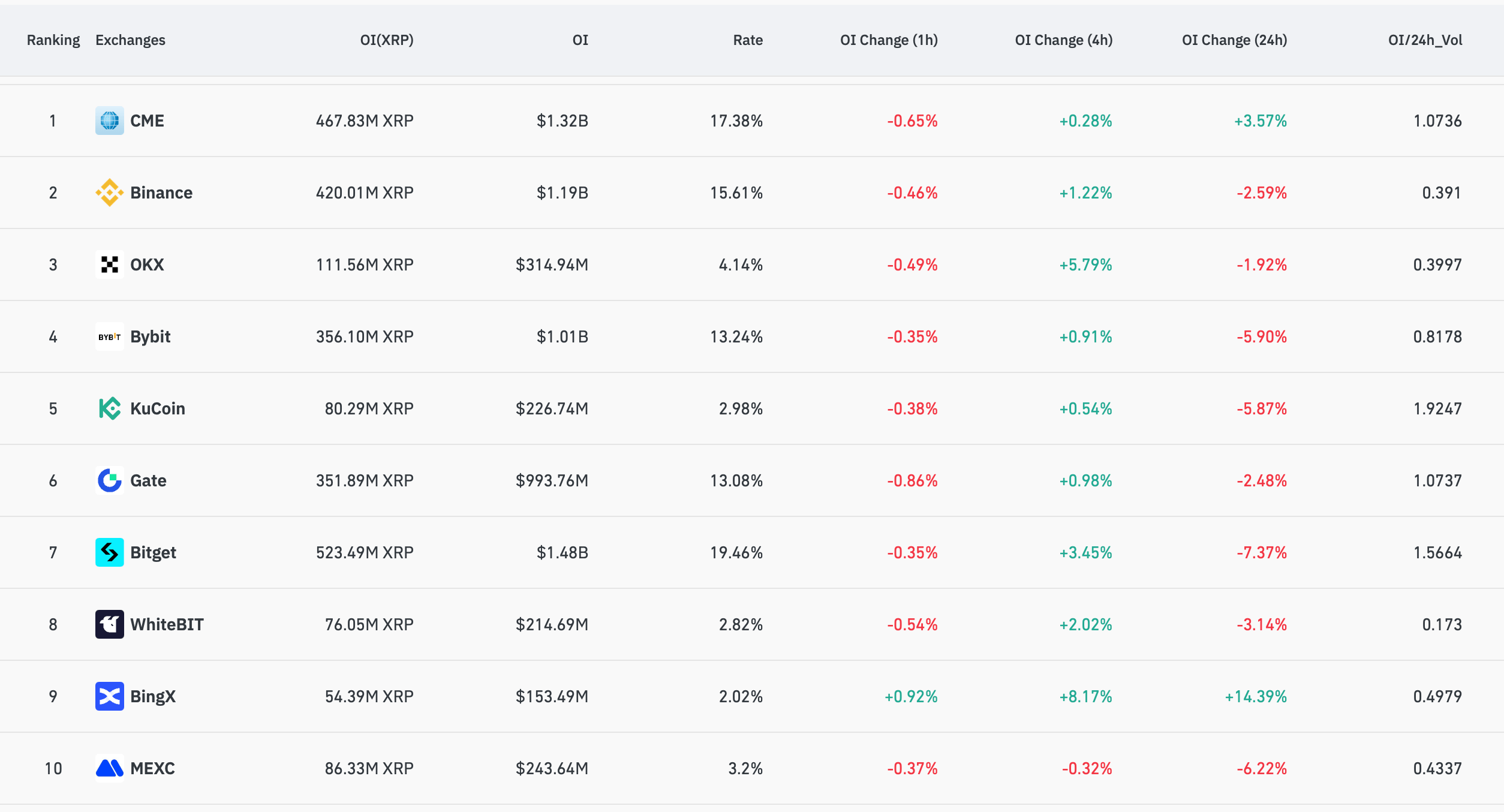

Derivatives wrote the louder subplot. Open interest (OI) nudged higher into week’s end, suggesting traders are reloading for a bigger move. Options traders now have a date to circle: CME Group plans to launch options on XRP futures on Oct. 13, pending review, which could sharpen hedging, skew, and weekend gap management around key levels.

Macro still has a hand on the wheel. A hot-or-not read on inflation and bitcoin (BTC) drift remain the fastest way to swing sentiment; a decisive break above $3.00 likely needs a friendlier backdrop, while losing $2.75 invites a quick jog to the $2.60s before cooler heads reassess.

Under the hood, liquidity looks deeper than midsummer thanks to steady exchange volumes and cleaner order books, but buyers are choosy. Whale flows and funding flips will matter more than social chatter; if net longs get crowded into resistance, expect the usual spring-loaded outcomes.

Near term, call the bias neutral to cautious. A daily close above $3.08 with rising volume would argue for a run at $3.20–$3.30. Fail that and the market probably continues to coil, with $2.70–$2.75 doing the heavy lifting until either bulls or bears miss a step.

Bigger picture, utility headlines—from stablecoin rails to tokenized cash vehicles—keep XRPL adjacent stories in rotation. They don’t set the candle by themselves, but they can tip flows when the tape is indecisive. For now the mission is simple: defend the shelf, reclaim $3 with authority, and make shorts chase into the low-$3s.

Bottom line: XRP is in a hurry to go nowhere until volume votes. Above $3, momentum gets interesting; below $2.75, it’s damage control. Trade the levels, not the noise.