Top altcoin Ethereum has recovered slightly over the past 24 hours, posting a modest 1% gain to trade near $4,000 at the time of writing.

This comes amid an overall improvement in market sentiment across the cryptocurrency sector. However, despite the recovery, on- chain data suggests that bearish pressure remains strong.

ETF Outflows Threaten Ethereum's Short-Term Recovery

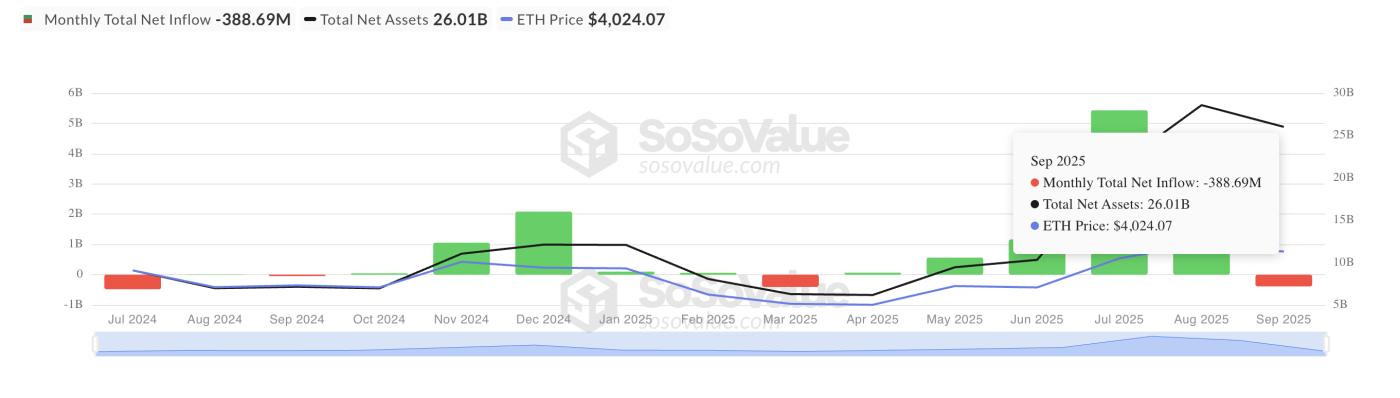

One of the most worrying signs comes from the decline in institutional inflows into the altcoin. According to SosoValue, net outflows from exchange-traded ETH ETFs totaled $796 million this week, bringing the total outflows from these funds for the month to $388 million.

To stay updated on TA and the Token market: Want more Token insights like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Total net inflow into ETH trading ETFs. Source: SosoValue

Total net inflow into ETH trading ETFs. Source: SosoValueIf this pace continues, September will mark the first month of net outflows from ETH ETFs since March. This highlights waning institutional demand for the asset.

ETF flows are a key indicator of investor sentiment, and the continued outflows suggest that institutional investors are slowly exiting positions. With these large investors pulling out, ETH ability to sustain its push above $4,000 is increasingly threatened.

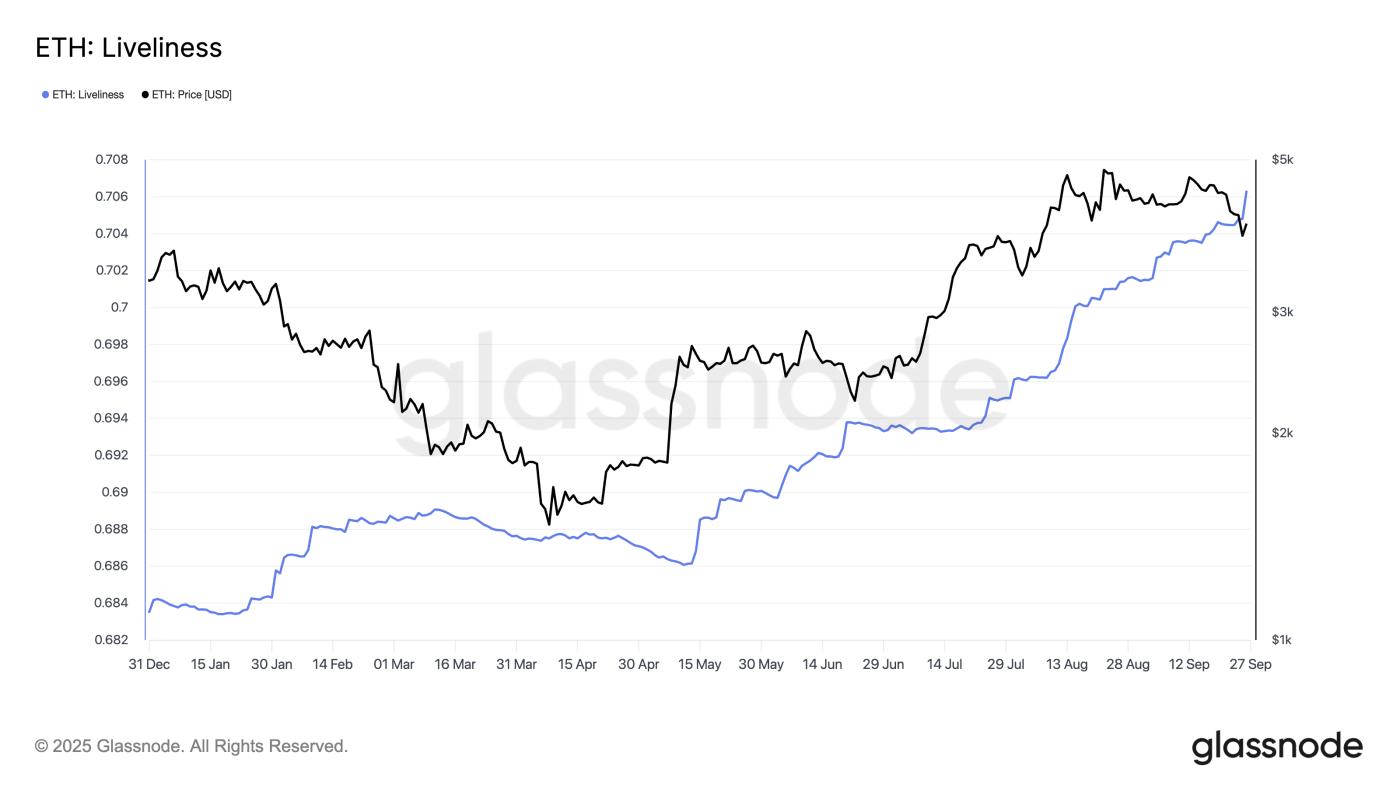

Furthermore, the sentiment among long-term ETH holders has been deteriorating, as reflected in the rising Liveliness index. According to Glassnode, this important index is at a yearly high of 0.70, indicating a strong sell-off from this group of investors.

ETH Liveliness. Source: Glassnode

ETH Liveliness. Source: GlassnodeLiveliness measures the movement of long-held Token by calculating the ratio of days of coin destruction to total days of coin accumulation. As this metric falls, long-term investors are moving their assets off exchanges and choosing to hold.

Conversely, as with ETH, when this index increases, long-held Token are being moved or sold , signaling profit-taking by long-term investors. This trend contributes to downward pressure on ETH and suggests the possibility of further price declines.

Ethereum Holds $3,875 Support—Temporarily

ETH ’s 1% recovery appears fragile with ETF inflows rising and long-term investors selling into the market. While support at $3,875 has held so far, failure to attract fresh buying pressure could see further declines.

In this scenario, the altcoin price could break below this important floor level and drop to $3,626.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingViewHowever, if today's rally strengthens and demand increases, it could push ETH price to $4,211.