Aster, a decentralized exchange launched in early September, has dropped 10% in the past 24 hours alone.

Despite strong support from Binance founder Changpeng Zhao (CZ), market sentiment is starting to show signs of weakening.

Analyst explains why Aster price is falling

At the time of writing, Aster's ASTER Token is trading at $1.87, down 8% over the past 24 hours. The Token is down more than 20% from its local peak of $2.43, set on September 24, 2023.

Aster (ASTER) price performance. Source: TradingView

Aster (ASTER) price performance. Source: TradingViewIn this context, analysts have analyzed the factors that could be causing the price drop of this decentralized exchange (DEX) Token .

Price pressure and user doubts

The sell-off comes amid growing skepticism about the performance of the Aster platform. Investor Mike Ess revealed on X (Twitter) that he sold 60% of his Aster holdings, switching to Bitcoin (BTC) and Plasma (XPL) .

While still profitable, he said his decision was motivated by sentiment following Changpeng Zhao 's recent comments and dissatisfaction with Aster's product.

“If you used HYPE and then switched to Aster, you know what I mean. It feels slower, less smooth, and more like a copycat… The more Capital I have on it, the more risky it feels,” writes Ess.

Other traders have similar concerns. Clemente, another prominent voice on X, revealed that he has completely left his position on Aster to switch to Hyperliquid's HYPE Token .

“Hyperliquid is clearly the leader in every metric except crime and CEX distribution,” the analyst argued .

Mixed signals from CZ

CZ's involvement has been a double-edged sword. On September 28, 2023, the crypto executive described Aster as a project that complements the wider BNB Chain ecosystem despite competing with the Binance exchange .

His investment firm, YZi Labs ( formerly Binance Labs ), holds a minority stake in Aster, which also has a team of employees who worked at Binance.

However, traders like Ess interpreted CZ’s tone on a recent Spaces call as distant, raising doubts about his level of involvement. For some, that perception was enough to trigger a risk reduction.

“If CZ stops talking about it, HYPE will completely win,” Ess warned.

There are still optimistic voices, however. A user named Cooker expressed his belief that Aster will make a lasting mark on the perp DEX market.

Meanwhile, others, like Crash, argue that Aster could outperform Solana and Ethereum in terms of percentage in the next cycle.

Solid foundation, lingering uncertainty

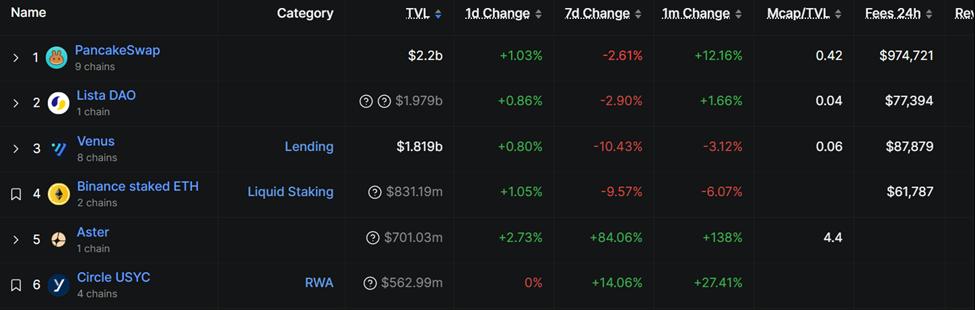

By many measures, Aster's fundamentals remain solid. Since its launch, the platform has generated over $82 million in fees, while the TVL has grown to $701 million on the BNB Chain. For a project that is only a few weeks old, these numbers reflect significant adoption.

Aster on BNB Chain. Source: defillama

Aster on BNB Chain. Source: defillamaHowever, this rapid decline highlights the challenge of balancing initial growth with user confidence and product reliability.

Analysts warn that competition with Hyperliquid is increasing , and without continued product improvements, momentum could wane.

As such, Aster’s price trajectory remains controversial, with supporters seeing it as a bold new player with CZ’s approval in a rapidly expanding ecosystem. On the other hand, skeptics argue that Aster may be incomplete and overhyped.