Infrared Finance is the core liquid staking protocol on Berachain and boasts the highest TVL in the ecosystem, reaching approximately $570M, representing approximately 43% of the total value. As Berachain's native flagship project, Infrared began its early days within the Build-A-Bera incubator program and has consistently focused on optimizing and implementing the PoL model. This not only gives it a first-mover advantage within the Berachain ecosystem but also establishes long-term competitiveness in both technology and mechanisms, earning it widespread attention in its early stages of market launch.

Infrared has also amassed strong capital support. During its seed and token rounds, the project attracted renowned investors, including Binance Labs. In March 2025, Infrared completed a Series A funding round, raising $14 million, led by Framework Ventures and joined by Berachain's Build-A-Bera Fund, bringing its total funding to approximately $18.75 million. This round of financing not only provides a solid foundation for ecosystem expansion but also further strengthens its core position within the Berachain network.

Infrared Finance LSD Hub on Berachain

In fact, Berachain's PoL mechanism is essentially an improvement on the traditional PoS model. It addresses the long-standing liquidity inefficiency problem in PoS by incentivizing users to provide liquidity to maintain network security and governance. Focusing on Infrared Finance, the protocol is designed entirely around Berachain's PoL optimization, further lowering the barrier to user interaction with PoL and capturing revenue.

The Infrared Finance protocol itself includes two core LSD assets, iBGT and iBERA.

iBGT

iBGT, the LSD version of Berachain’s governance token BGT, is backed at a 1:1 ratio. Users simply deposit LP certificate tokens from the whitelist reward vault into Infrared to directly receive rewards in iBGT.

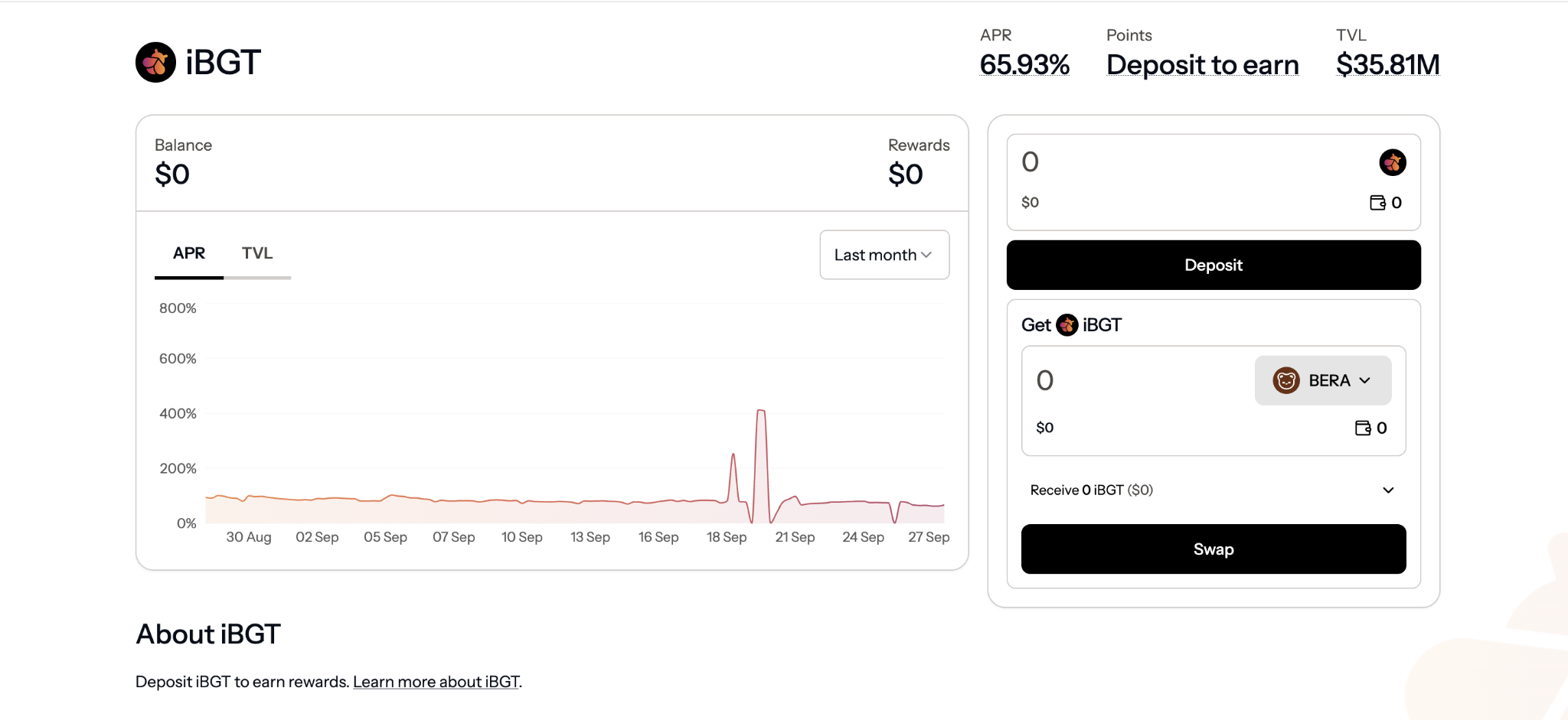

The iBGT obtained can be pledged again in Infrared to obtain Boost income, which is currently about 65+%

iBGT has two use cases: it can be staked to obtain BGT's underlying Boost income, and it can also be used as a composable DeFi asset for staking, lending, or trading on DEX.

iBGT avoids the inherent non-transferability restrictions of BGT (which inherently lacks liquidity), allowing the token to participate in the ecosystem more flexibly. For example, users can further use iBGT in Kodiak or BEX liquidity pools, significantly improving capital efficiency and capturing a new layer of returns.

iBERA

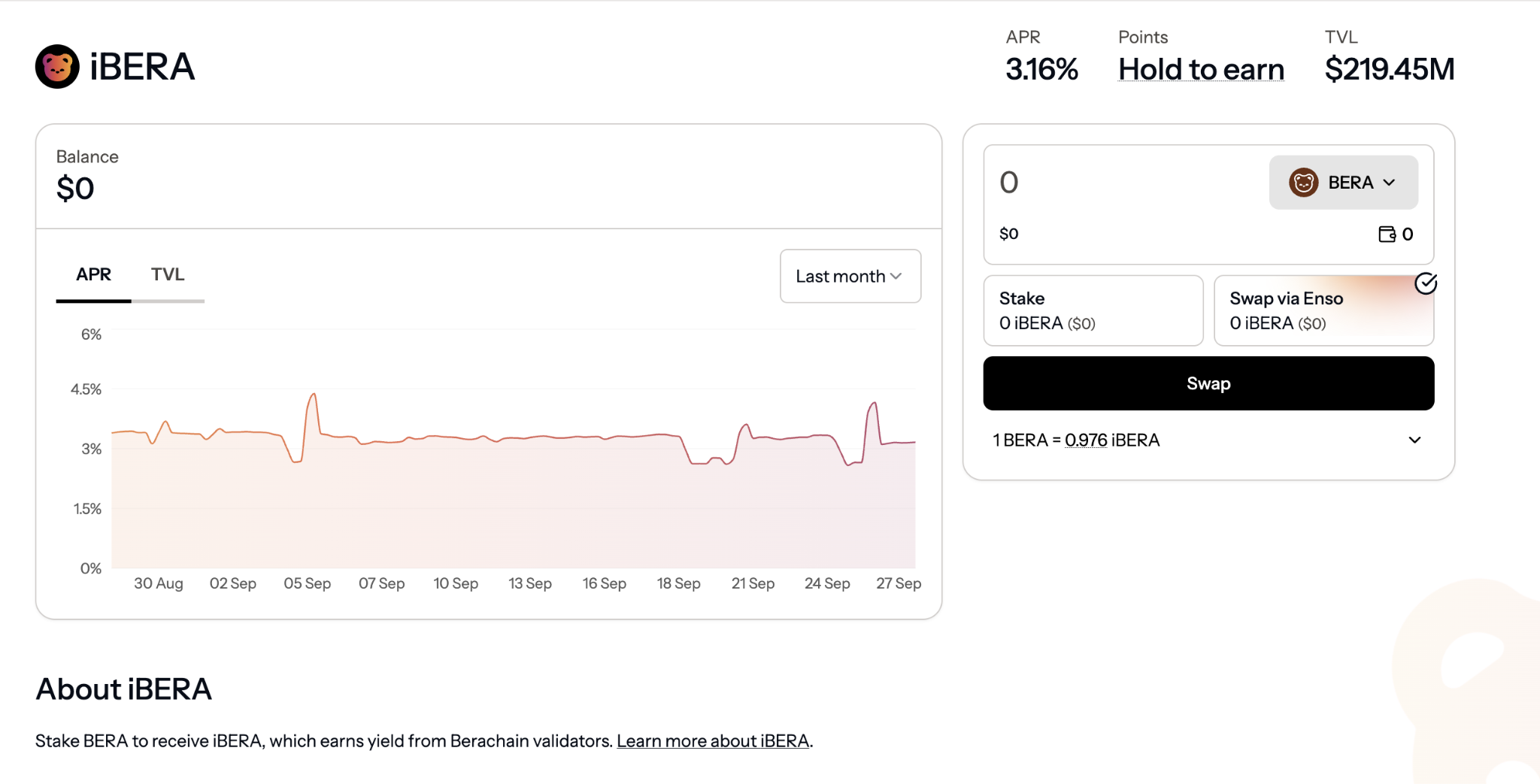

The second product is iBERA, the LSD version of Berachain's gas token, BERA. By staking BERA, users receive iBERA at a 1:1 ratio (usually, but not guaranteed). This product maintains the base yield of BERA while providing liquidity and allowing for free use in DeFi.

iBERA's value lies in its flexible management, allowing users to adjust their strategies based on market conditions. It is also designed to support cross-protocol composability. For example, on the Beraborrow platform, iBERA can be used as collateral. When combined with iBGT, it can form a revenue cycle, from staking to lending to re-staking, thus achieving a compound interest effect.

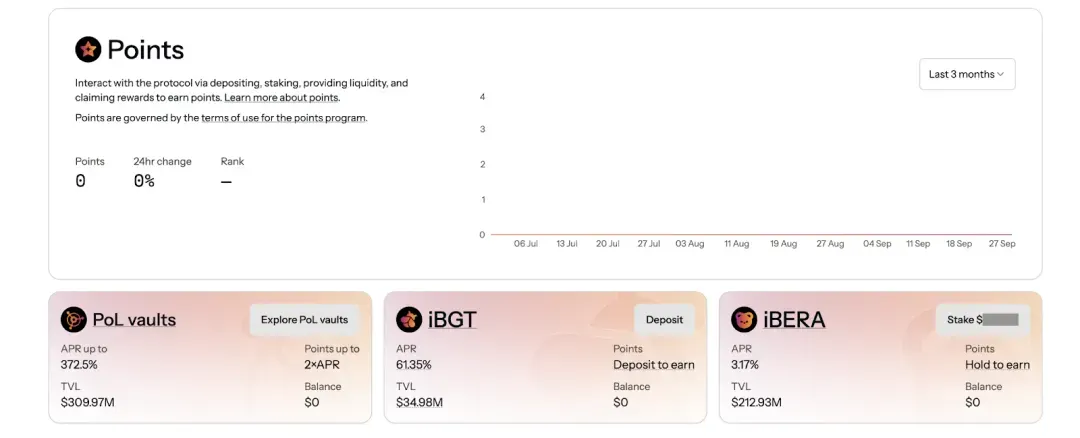

In addition to iBGT and iBERA, Infrared Finance's PoL Vaults section supports the use of most assets on Berachian to easily access various types of income with one click.

PoL Vaults

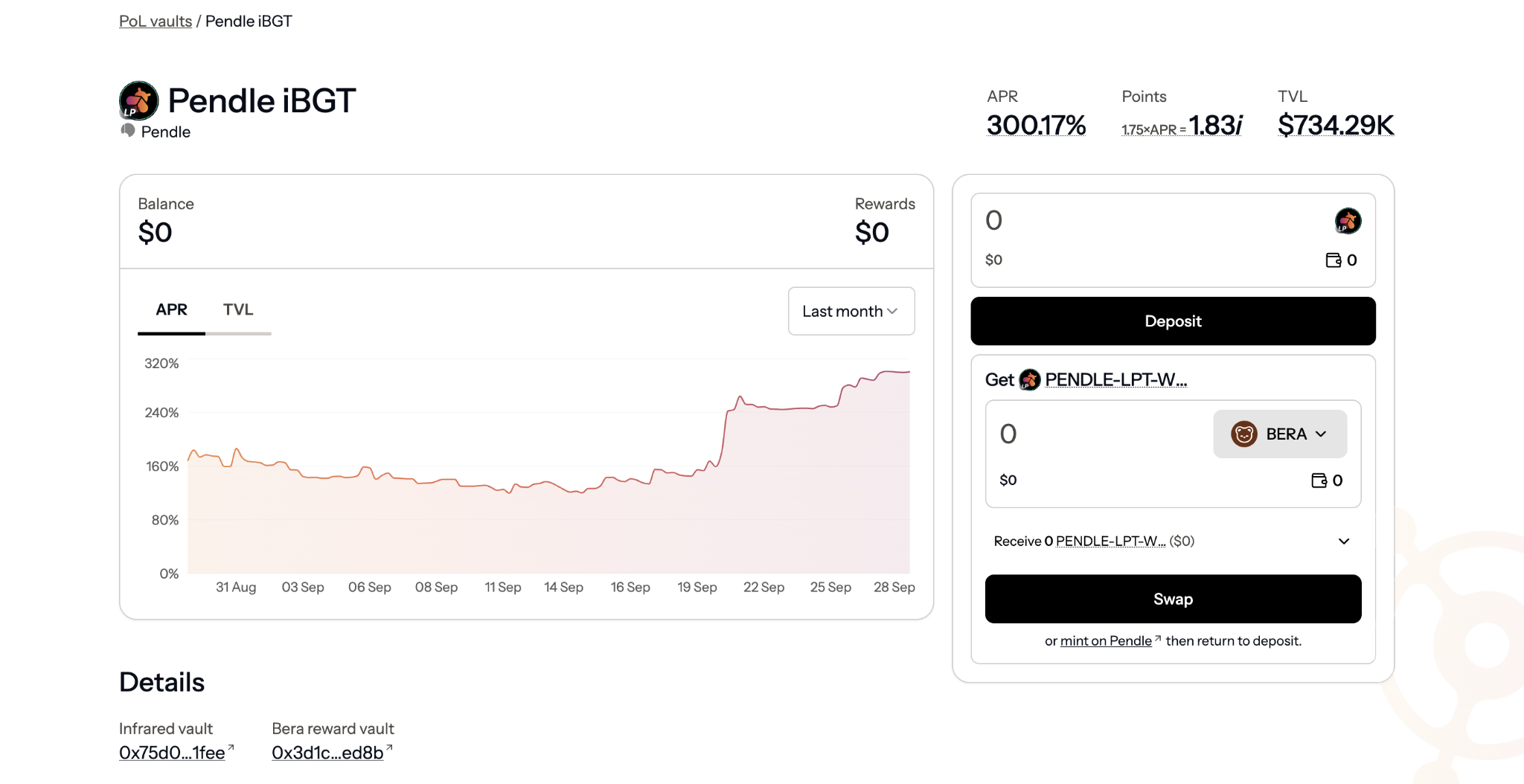

Infrared Finance's PoL Vaults section lists all major whitelisted PoL pools on Berachain and visually displays the returns of each pool. Users no longer need to filter or navigate through each pool individually. Instead, they can use PoL Vaults as a unified entry point to capture Berachain's native returns in one click.

For example, the Pendle iBGT pool featured in the current section offers an APR of up to 300%. If a user wishes to participate in this pool but lacks the corresponding LP assets, they can simply swap their existing assets for the desired LP in the Swap module (most mainstream assets on Berachain, such as BERA, iBGT, IBERA, HONEY, and WBERA, are currently supported). Then, by staking in the Deposit module, they can easily access the income path. This allows users to not only earn farming income but also receive BGT incentives from the PoL pool, distributed as iBGT, maximizing multiple benefits.

It's worth noting that while Infrared Finance hasn't yet held a TGE, the protocol has implemented a points system since April 2025. Users can accumulate points in a variety of ways, which are expected to be used as airdrop tokens during the TGE. Common methods include depositing iBGT into PoL Vaults, holding iBERA in a wallet, or providing liquidity in designated pools and depositing LPs into Vaults (the weighting of points varies across pools). Generally speaking, the more you invest and the longer you hold, the higher the points you accumulate.

Value Flywheel

Building on the aforementioned mechanism, Infrared Finance has effectively created a self-reinforcing value flywheel. When users deposit BERA or LP certificates from whitelisted vaults into the protocol's liquidity pool, they receive iBERA or iBGT, respectively. These LSD assets not only continue to earn base returns but can also be widely used in DeFi scenarios such as lending and liquidity provision, thereby continuously adding new layers of returns.

Infrared also ties governance to revenue through a bribery mechanism. The protocol and other participants can use token incentives to guide validators to allocate more BGT emissions to specific pools, further amplifying the returns of those pools. Ultimately, the interests of liquidity providers, protocol token holders, and validators are aligned: users receive higher returns, the protocol gains governance leverage, and validators gain enhanced security and influence due to increased liquidity.

Compared to traditional liquid staking protocols, Infrared Finance's greatest strength lies in its abstraction and simplification of complex logic. Users no longer have to directly contend with the restrictions of BGT's non-transferability or delve into the details of PoL voting. With a single click, they can capture returns and indirectly participate in governance. This design makes Infrared not only the LSD hub on Berachain, but also a key driver in unleashing the liquidity benefits of the PoL model within the Berachain ecosystem.