XRP 's recent bullish attempt failed after the altcoin failed to break out of a Falling Wedge pattern. The price of the cryptocurrency is currently stalling, with whale activity suggesting that large investors' confidence is waning.

As XRP struggles to regain momentum, investor sentiment continues to weaken amid prolonged market uncertainty.

Investors holding XRP sell

XRP whales have been dumping their holdings over the past few days, contributing to the price slowdown. Addresses holding between 100,000 and 1 million XRP have sold more than 100 million Token in just 10 days, indicating a significant decline in confidence among large investors.

This $300 million sell-off brought whale holdings to their lowest level in nearly 34 months. The sharp drop in supply from large investors reflects growing hesitation about XRP's short-term potential .

The drop in accumulation shows that many whales are seeking safety, anticipating further price corrections.

Want more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

XRP whale holdings. Source: Glassnode

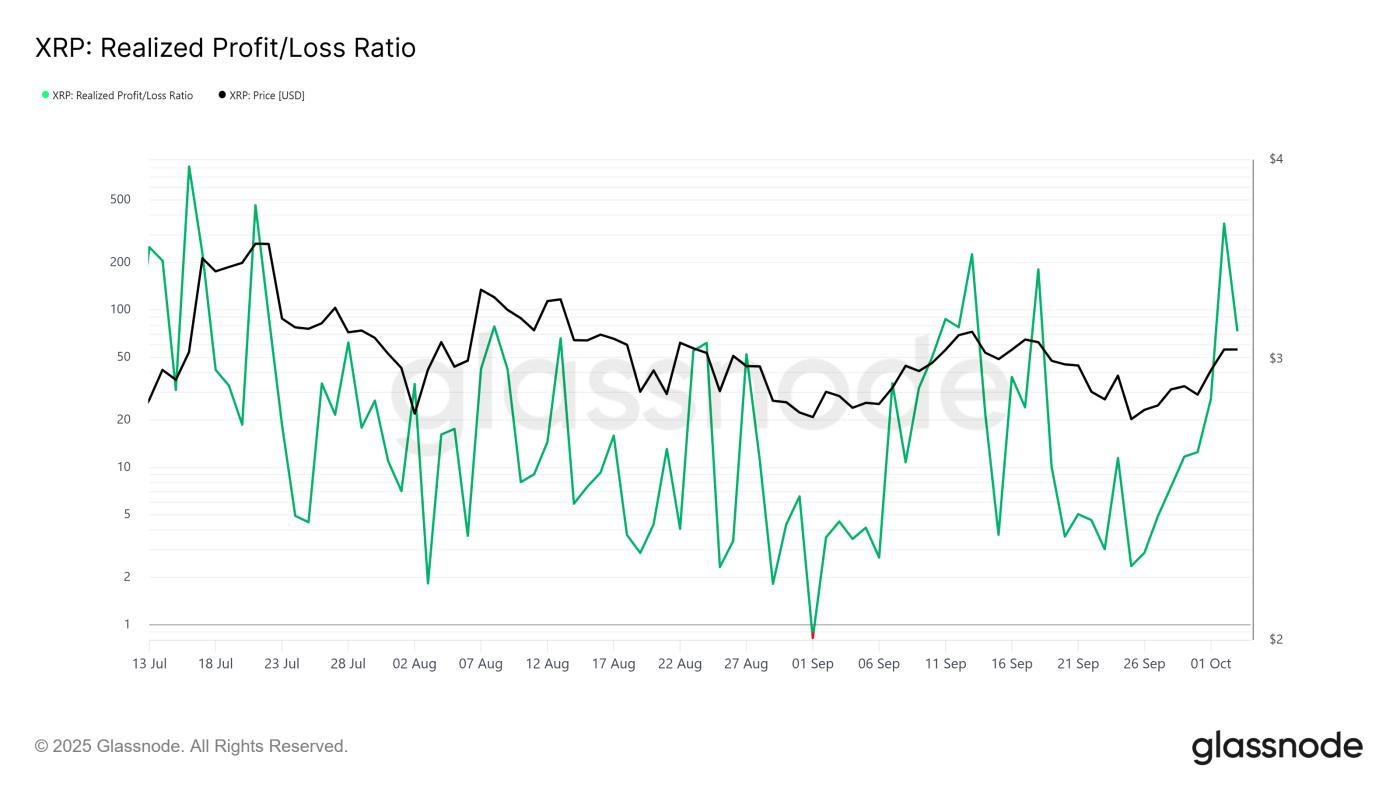

XRP whale holdings. Source: GlassnodeOn- chain data reinforces this bearish trend. The Realized Profit/Loss Ratio has risen to a two-month high, suggesting that investors are selling on price increases rather than accumulating.

This increase suggests that market participants are taking advantage of recent price increases, expecting that prices will not rise much in the short term.

The increase in this ratio also underscores the current bearish sentiment. With profit-taking accelerating, XRP ’s market structure appears fragile. Unless new buying pressure emerges soon, continued selling could maintain downward pressure on the Token’s price, delaying any significant recovery.

XRP Real Profit/Loss Ratio . Source: Glassnode

XRP Real Profit/Loss Ratio . Source: GlassnodeXRP price fails to break out

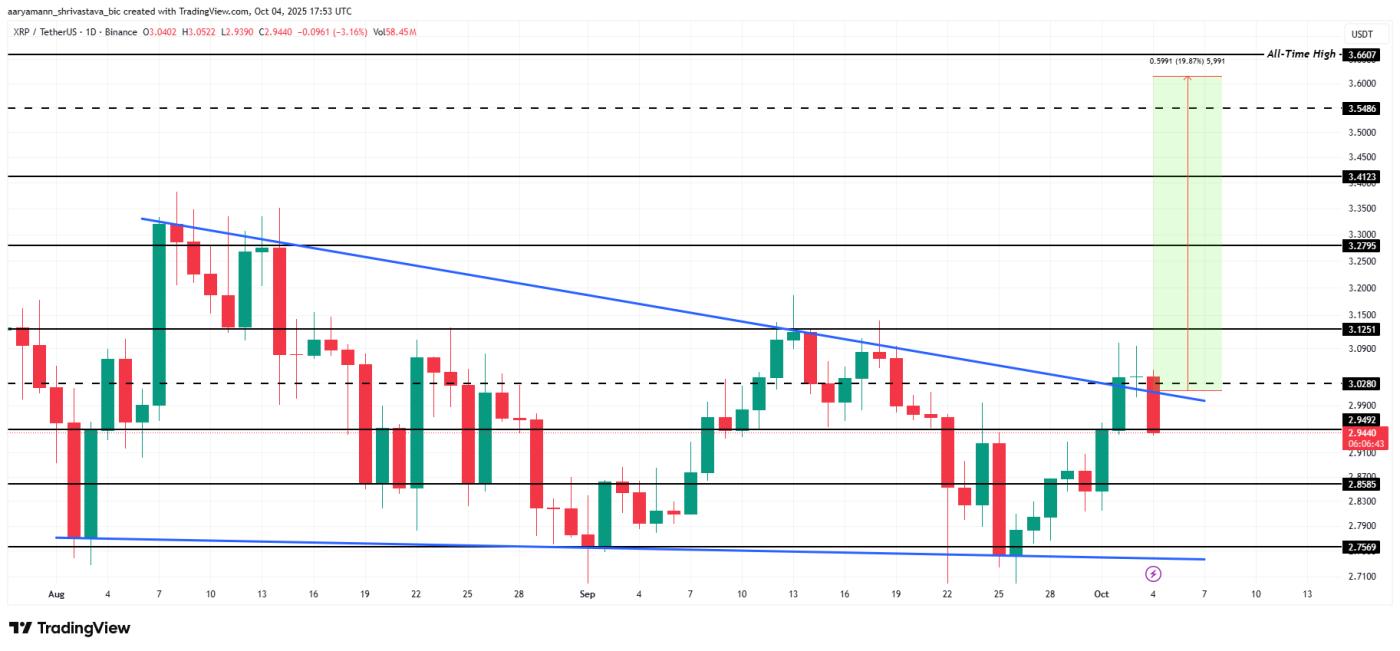

At the time of writing, XRP is trading at $2.94, struggling to hold this level as a support floor. The drop came after failing to break out of a Falling Wedge pattern. Initially, the altcoin showed signs of a possible further increase but ultimately lacked the momentum to sustain.

In the current conditions, XRP could face further downside pressure. A continued decline could take the Token to $2.85 or even lower if the bearish sentiment continues. Such a move could trigger further selling from short-term traders.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingViewHowever, an improvement in overall market conditions could restore optimism. If XRP can break above $3.12, it could target $3.27 in the short term. A confirmed breakout could trigger a 19% rally, taking the price to $3.61 and invalidating the bearish thesis.