Original | Odaily Odaily( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

Bitcoin has once again reached the pinnacle of history.

The BTC price has broken through $125,000, setting a new all-time record. OKX's market cap shows the current price at $125,277. With this breakthrough, Bitcoin's market capitalization surpassed Amazon, reaching $2.49 trillion, moving it up to seventh place in the global asset market capitalization ranking.

Among the "Four King Kongs", BNB also set a record high, reaching a maximum of US$1,192, and has now fallen back to US$1,179. The price of ETH rebounded to US$4,553, and the price of SOL rebounded to US$232.

Regarding derivatives, data from coinglass.com shows that in the past 24 hours, a total of 112,700 people worldwide experienced margin calls, totaling $256 million. Long positions saw $117 million in liquidations, while short positions saw $139 million in liquidations. Both long and short positions suffered losses , demonstrating the suddenness of this new high. BTC margin calls alone accounted for $72.47 million, representing 28% of the total. The largest single liquidation occurred on Bybit, worth $3.1153 million in BTCUSDT.

In terms of capital flows, data from sosovalue.com shows that BTC spot ETFs have seen net inflows for a week in a row, and the scale of capital inflows has continued to expand . On October 3, the single-day net inflow of funds reached US$985 million, becoming an important driving force for BTC to reach new highs; ETH spot ETFs also recorded net inflows for a week in a row, but the momentum of capital inflows is slowing down.

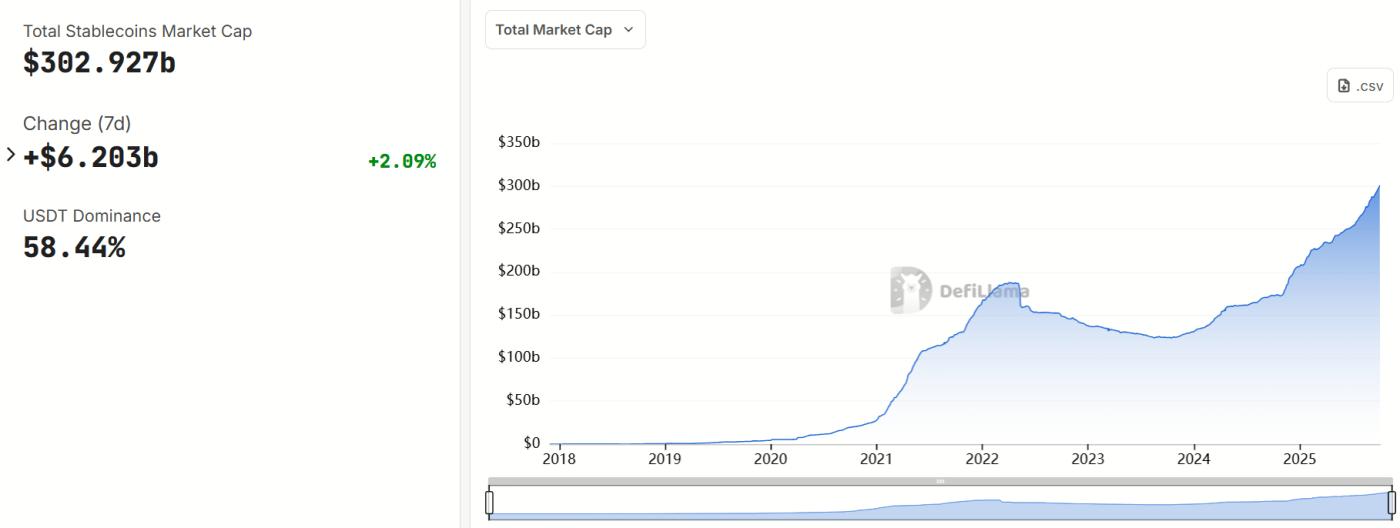

According to DeFiLlama.com data, the total market value of stablecoins has exceeded US$300 billion, setting a new high.

Macro: US government shutdown

On October 1, the U.S. federal government officially entered a shutdown after Congress failed to pass a funding bill for fiscal year 2026, causing federal spending authority to expire at midnight. However, this is not the first time the federal government has experienced a government shutdown.

President Trump said a shutdown is "probably unavoidable," which will affect millions of federal employees and multiple government services. However, historically, the impact on the crypto market has typically only caused short-term disturbances and has not reversed long-term trends .

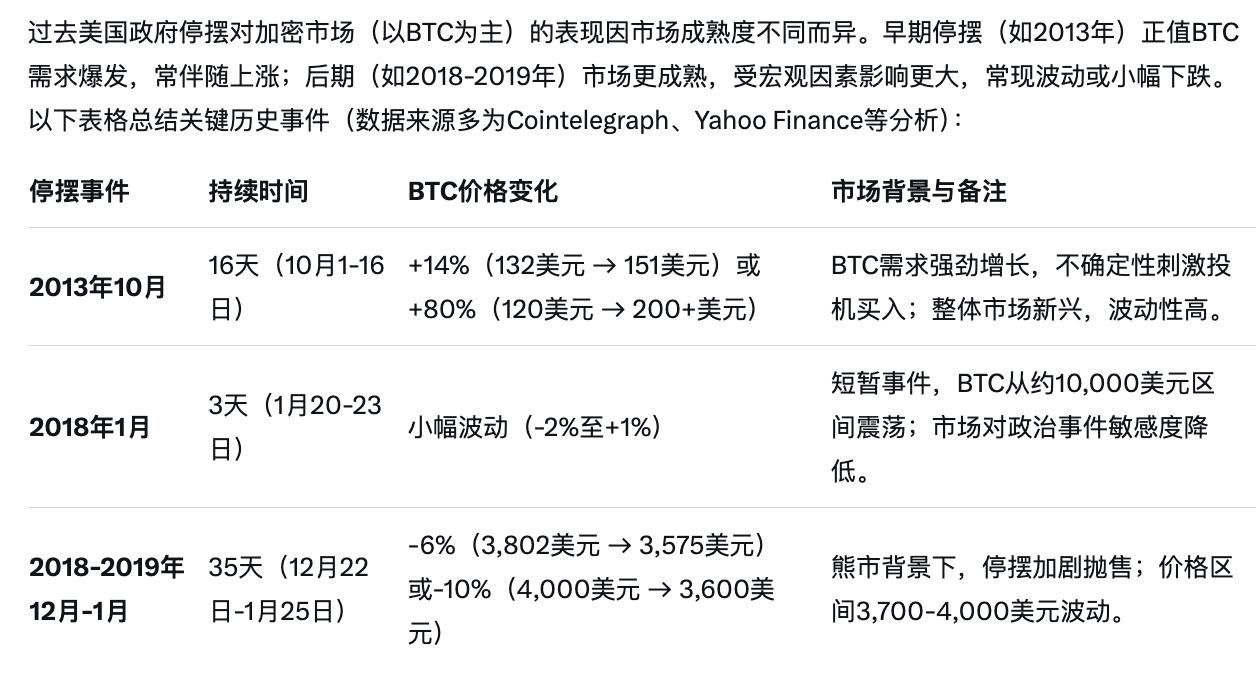

The following is historical data reference:

U.S. Treasury options pricing indicates that the U.S. government shutdown, which began on October 1, will last at least 10 days and could last as long as 29. Due to the shutdown, the U.S. non-farm payroll report for September was not released as planned.

In an interview, US President Trump stated that he is considering distributing some of the tariff revenue directly to citizens in the form of "dividends," with amounts up to $2,000 per person. Some believe this move, similar to the pandemic stimulus checks from 2020 to 2021, could bring new liquidity to the crypto market and boost Altcoin prices .

Market View

Jia Yueting: Relaxing CAMT rules is a huge benefit to companies with treasuries

Faraday Future founder Jia Yueting has recently been frequently commenting on crypto-related topics, stating, "The surge in the crypto market is driven by the US Treasury's proposed relaxation of CAMT (Corporate Alternative Minimum Tax) rules, which will no longer impose a 15% tax on unrealized Bitcoin gains held by companies like MicroStrategy. Previously, mark-to-market accounting standards taxed unrealized profits, sparking protests from MSTR and COIN, who called this unfair and detrimental to global competition. This is a significant boon for companies with treasuries. Long-term holding of crypto assets as a store of value and a hedge against fiat currency devaluation is gaining tacit approval and support from regulators. This will fundamentally change the asset allocation logic of large institutions ."

Caixin: This US government shutdown may have a greater impact than previous ones, and the surge in BTC and ETH shows market anxiety

Caixin analysis points out that the United States has experienced 14 federal government shutdowns since 1981, most lasting one or two days. However, due to Trump's current tariffs and dispute with Federal Reserve Chairman Jerome Powell, this shutdown is likely to have a greater impact than previous ones. When the shutdown was confirmed in the early morning of October 1st, gold spot and December futures prices reached record highs of $3,862 and $3,903 per ounce, respectively. Cryptocurrencies such as Bitcoin and Ethereum also soared, demonstrating market uncertainty and a strong desire for safe havens .

Standard Chartered Bank: Bitcoin may hit a record high next week and is expected to rise to $135,000

Geoff Kendrick, Head of Global Digital Asset Research at Standard Chartered Bank, stated in a recent report that Bitcoin could reach a new all-time high next week and potentially rise further to $135,000. Yesterday, Bitcoin surpassed $121,000, continuing its fourth-quarter "Uptober" rally. Kendrick noted that Bitcoin's performance has broken the traditional pattern of an 18-month price decline following the halving, and that it should have entered a period of weakness after the April 2024 halving, but has instead shown stronger performance.

JPMorgan Chase: Bitcoin could reach $165,000 based on gold's record gains

JPMorgan analysts predict that Bitcoin could reach $165,000 by the end of 2025, citing its undervaluation compared to gold and increasing ETF inflows.

Conclusion

Bitcoin's return to $120,000 is not only a numerical milestone, but also a revival of confidence.

Legendary trader Eugene said that Bitcoin will break all upper limits if it hits a new high. Whether you are bullish or not, this is what you want to see if you want to continue the "easy money model."

However, it should be noted that a reversal of sentiment does not mean that the risk has disappeared, and we must still remain restrained and rational in our capital operations.