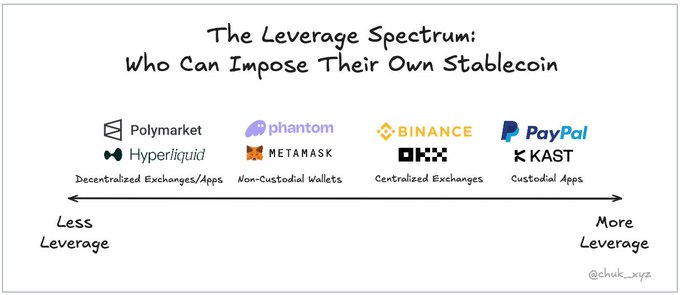

Everyone wants their own stablecoin. Most will never leave their gardens Wallets, exchanges and even blockchains are realizing how much yield leaks to Circle and Tether each year. If you already hold user balances, why let someone else earn the float? That’s why we’re seeing an explosion of new stablecoins, each trying to keep yield (and control) in-house. But issuing is easy. Adoption isn’t. In open systems, liquidity rules. USDC and USDT dominate because they control the four pillars of usage: liquidity, ramps, utility, and interoperability. Closed systems are different but it's not a given. Fully custodial platforms can simply decide what sits behind a user’s “USD” balance but there are still UX tradeoffs. The closer you are to custody and UI control, the more leverage you have. So yes, expect 1,000 new stablecoins. But most will be walled gardens: profitable and contained. Many will grow to be very large (most of BUSD was held on Binance) but only a few will reach scale out in the open, where network effects, not issuance, decide who wins. What does it take to overcome those network effects?

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content