MYX Finance has seen a sharp decline in market value, falling nearly 67% over the past week.

This altcoin sell-off reflects a growing decoupling from Bitcoin, which has surged to new All-Time-High . Investors appear increasingly uncertain about MYX's ability to recover amid this divergence.

MYX Finance and Bitcoin Chia ways

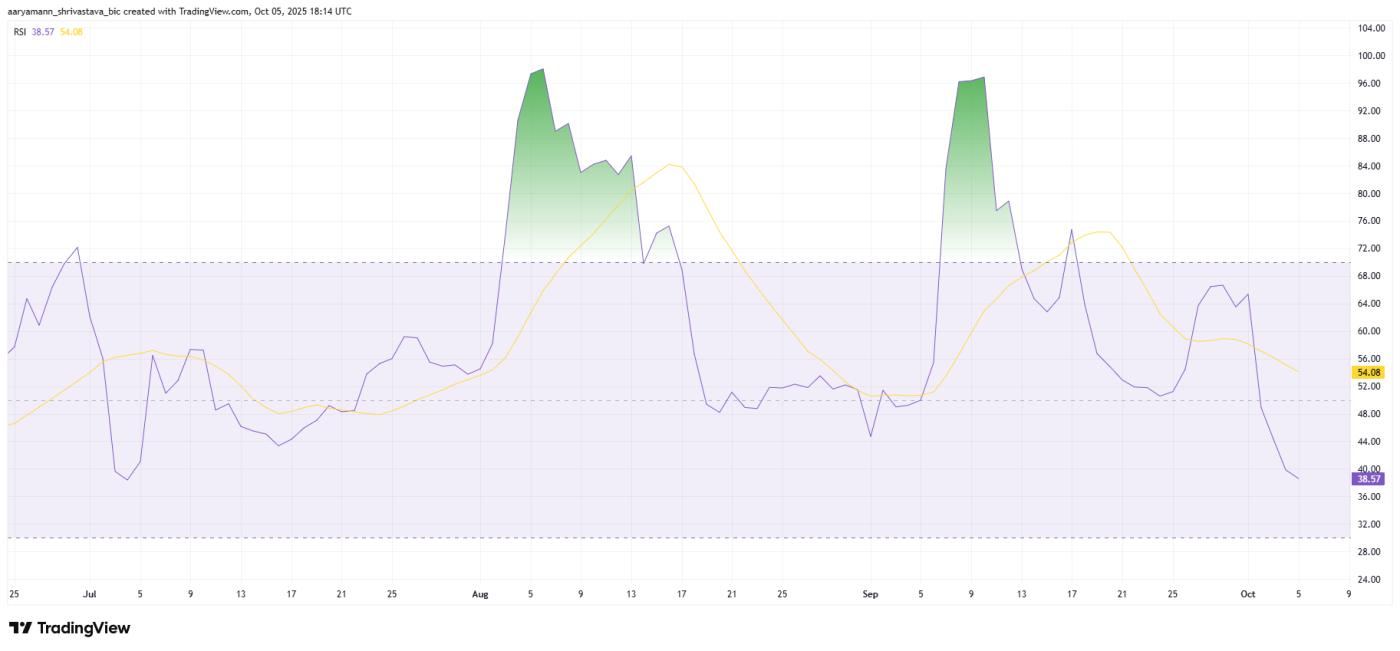

The Relative Strength Index (RSI) is showing a negative turn for MYX Finance. The indicator is currently below the neutral level of 50.0, firmly in negative territory. This suggests that the positive momentum has dissipated, leaving sellers in control. MYX’s inability to attract buying pressure has reinforced concerns of a prolonged decline.

Additionally, MYX is still far from oversold territory, suggesting that there is room for further decline before a reversal. The lack of positive signals suggests that traders are still hesitant, preferring to wait for stability before re-entering. This sentiment paints a bleak picture in the short term, as sellers continue to dominate the market.

Want more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

MYX RSI. Source: TradingView

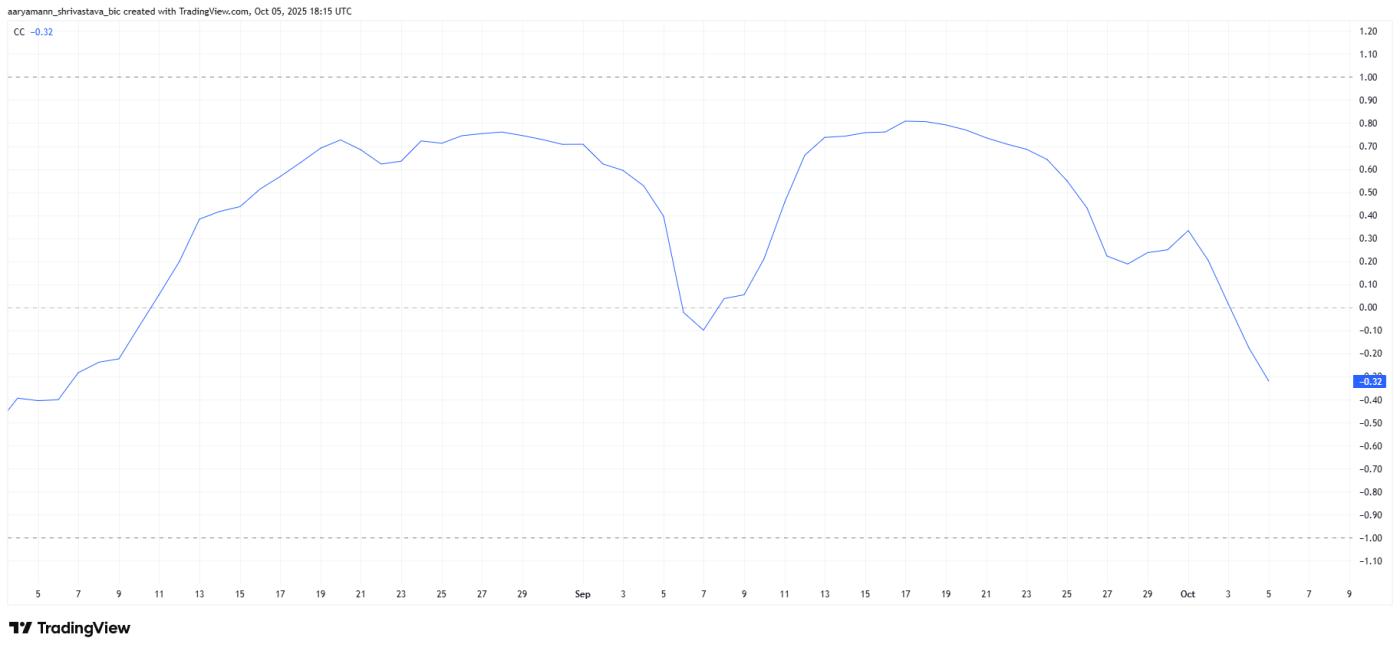

MYX RSI. Source: TradingViewMYX's overall momentum is weakening due to its decoupling from Bitcoin's trend. The altcoin's correlation with BTC has dropped to -0.32, indicating an inverse relationship between the two. This negative correlation is worrying, especially as Bitcoin hit a new All-Time-High today, causing MYX to move in the opposite direction.

Historically, MYX has benefited from Bitcoin’s strength, as market optimism often spills over to smaller altcoins. However, the current divergence suggests investors are moving Capital out of MYX, adding to its volatility. As Bitcoin’s momentum increases, MYX could remain under pressure unless it reestablishes alignment with the broader market trend.

MYX Correlation To Bitcoin. Source: TradingView

MYX Correlation To Bitcoin. Source: TradingViewMYX price could drop by $5.00

MYX Finance’s price has dropped 37.6% in the past 24 hours, trading at $5.16 at the time of writing. The Token has just held above the important psychological support level of $5.00, which could determine its next move.

The recent break below the 50-day exponential moving Medium (EMA) confirms the short-term negative trend, supporting signals from technical indicators. If the selling continues, MYX could slide below $5.00 and drop to $3.45 in the coming sessions.

MYX Price Analysis. Source: TradingView

MYX Price Analysis. Source: TradingViewConversely, if investors step in to accumulate at low levels, MYX could see a recovery. A bounce from $5.00 could push the price to $7.00 and potentially above $8.90. This would invalidate the current bearish outlook and signal the start of a recovery.