Many memecoins on BNB Chain have dropped more than 30% in just 24 hours , as the price of BNB has dropped the most in history , falling to $1,246 .

This sell-off begs the question: is the Binance “ meme season” over , or is it just a setback before a new cycle?

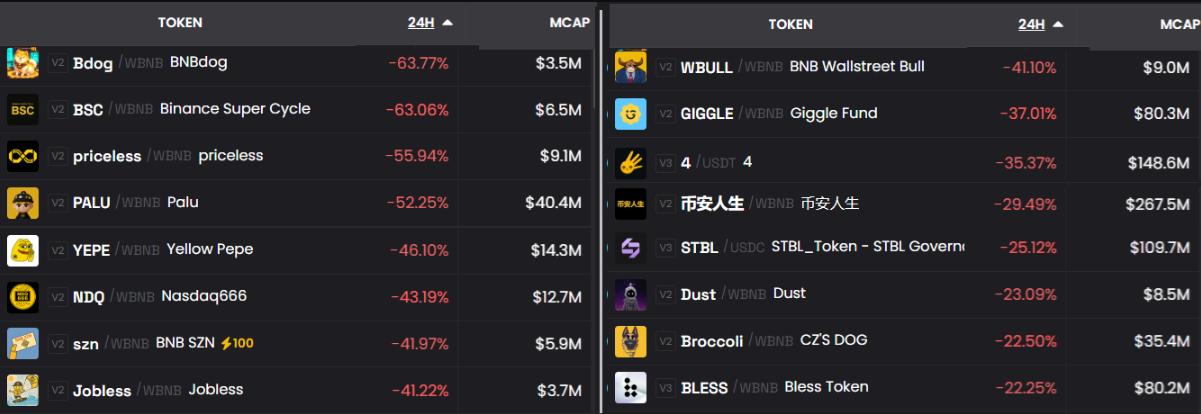

BNB Chain memecoin price at decentralized exchanges, 24-hour chart | Source: DEX Screener.

BNB Chain memecoin price at decentralized exchanges, 24-hour chart | Source: DEX Screener.

💥 Shock after a chain of hot increases

According to data from DEX Screener , most memecoins on BNB Chain plunged sharply on Thursday.

Token like PALU , GIGGLE , 4 , and Binance Life (币安人生) — which had surged earlier in the week — all lost more than 30% of their value .

The event comes as Binance launches a new platform “Meme Rush” , in partnership with Four. Meme , available exclusively to Binance Wallet users .

Some analysts believe that this announcement caused investors to shift Capital to new meme projects , leading to a wave of sell-offs on old Token .

🧩 “Meme Rush” – An effort to clean up the memecoin game

Unlike the usual “degen” model, Meme Rush applies:

Bonding Bonding Curve

Automatic listing on DEX when reaching $1 million valuation

KYC requirement & fair issuance

Binance's goal is to reduce fake trading and fraud , and pave the way for more sustainable Meme token .

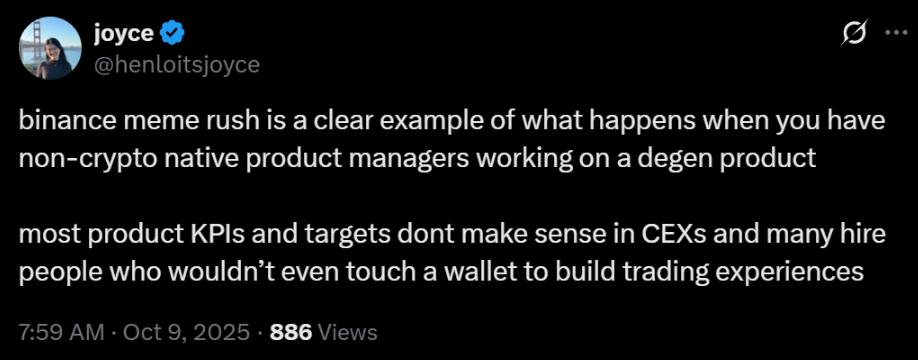

However, some X users (like @henloitsjoyce ) argue that this “security” model goes against the free spirit of memecoin , causing the community to lose interest.

Source: X/ henloitsjoyce

Source: X/ henloitsjoyce

📉 Why did memecoin BNB Chain plummet?

The strong correction was not only due to profit taking or Capital turnover.

Community analysis points to three main reasons :

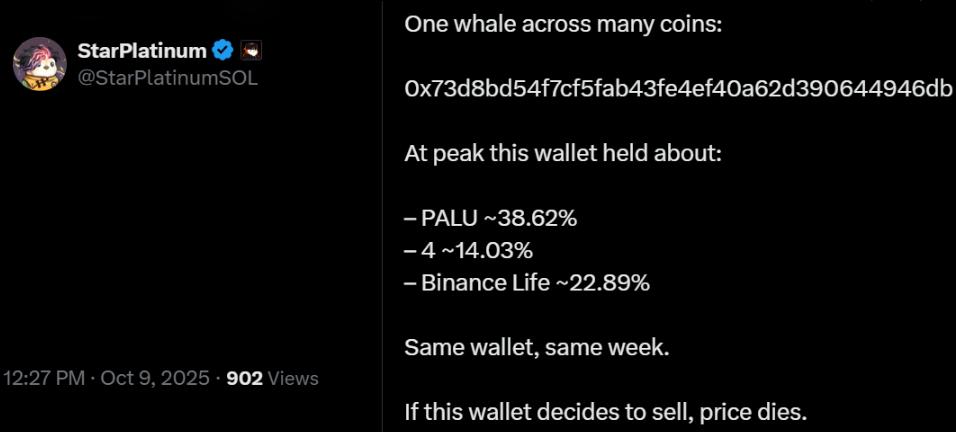

Focus on shark wallet too high:

According to @StarPlatinumSOL , one wallet controls up to 39% of PALU , 23% of Binance Life , and 14% of 4 — a massive concentration of risk. Source: X/ StarPlatinumSOL

Source: X/ StarPlatinumSOLLiquidation :

Many Token have only ~2.5% of their supply in the liquidation pool → prices are easily inflated when buying, and dropped dramatically when selling.Fake volume :

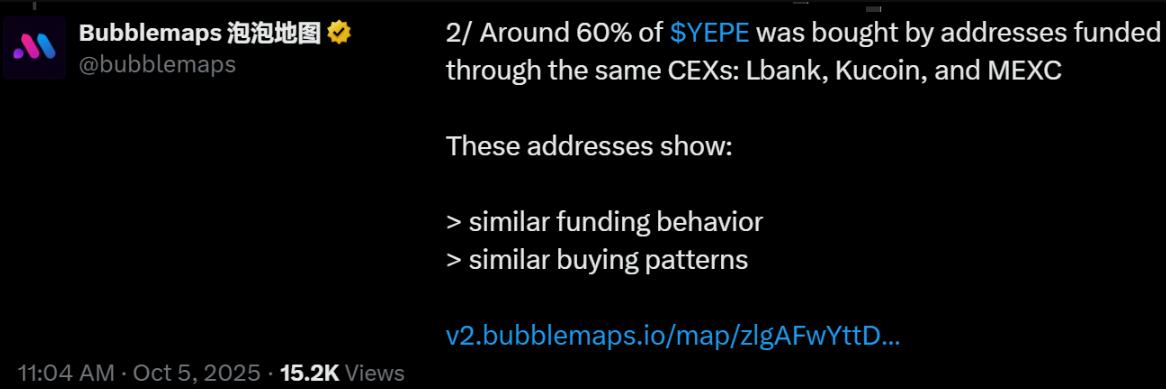

Data from @Bubblemaps shows a wallet purchased $100,000 PALU just minutes before CZ (Changpeng Zhao) posted the Token logo, raising suspicions of coordinated trading. Source: X/ Bubblemaps

Source: X/ Bubblemaps

“Some projects like YEPE show insiders holding up to 60% of the supply — a sign of price manipulation.” – Bubblemaps.

🪙 Impact spreads to BNB price and the entire ecosystem

At the same time, BNB fell 9.5% from a peak of $1,357 to $1,246 , putting the memecoin market under double pressure.

The “risk-off” mentality causes investors to withdraw from small, low- liquidation Token to preserve Capital.

🔮 Outlook: Is Binance Meme Season Revived?

The future of the memecoin wave on BNB Chain will depend on two factors:

Will BNB Recover to $1,300?

How successful is Meme Rush in creating new trust in the community?

If Binance can balance “safety – freedom – profit” , a whole new meme season could start sooner than expected .

📊 Quick Summary

|

| ||

| BNB down 9.5% | Spreading selling pressure | ||

| Memecoin down >30% | Losing FOMO momentum, money flows out of old Token | ||

| Meme Rush Launches | Capital flow is about to rotate | ||

| High Control Shark Wallet | Increased risk of manipulation | ||

| Prospects | Depends on BNB momentum & community reaction |

🧠 Conclusion:

This sharp drop doesn’t necessarily mean the “end” of memecoin BNB Chain — but rather could be a market restructuring before the Meme Rush begins a new cycle.

Investors should monitor wallet concentration ratio , liquidation depth , and BNB performance to spot reversal signals.