Weekends typically bring quieter trading, but that also means more volatility for those paying attention. While much of the market remains choppy, especially as BTC corrects nearly 4% from its All-Time-High, a few notable altcoins are signaling that they need a closer XEM .

From breakout patterns to whale activity and fresh accumulation from smart investors, these three coins show short-term setups that could last for the next 48 hours.

Zora (ZORA)

ZORA is a creator-focused Token on the Base network that has been gaining traction this week. The Token has surged more than 73% in the past 24 hours, fueled by a large inflow into the DEX of around $420,000, according to data from Gecko Terminal.

DEX Volume for ZORA: Gecko Terminal

DEX Volume for ZORA: Gecko TerminalOn the 12-hour chart, Zora broke out of an inverted head and Vai pattern, breaking above the neckline around $0.06. This move confirmed the breakout, and the Token is now trading near $0.09. Based on the pattern prediction, Zora still has the potential to rise to the $0.10 region — a target measuring approximately 53% from the neckline.

Want more information on Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

ZORA Price Analysis: TradingView

ZORA Price Analysis: TradingViewAdding to this momentum, the Smart Money Index (SMI) — which tracks buying from smart or early traders — has continued to rise since yesterday.

The sustained SMI uptrend shows that there is still momentum in the bull run, making ZORA one of the most notable altcoins this weekend as long as it stays above the $0.06 support. However, if selling takes over and ZORA falls below $0.05 (the right Vai of the pattern), the bullish structure will be invalidated.

Pudgy Penguins (PENGU)

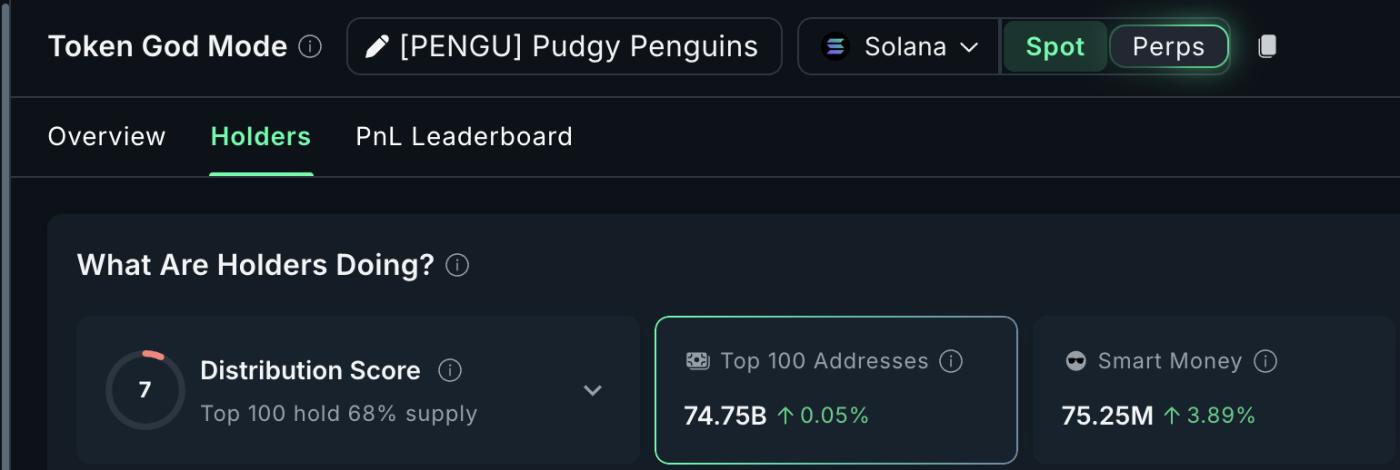

PENGU, the Token associated with the Pudgy Penguins network on Solana, is one of the notable altcoins this weekend . While its price remains near $0.031, data shows steady interest from large wallets and short-term traders.

Over the past week, Smart Money holdings have increased by approximately 2.8 million Token (3.89%), confirming silent accumulation despite the broader market being choppy. This is consistent with the Smart Money Index (SMI) on the 12-hour chart, which has begun to form higher highs — a sign that smart traders are positioning for a rally. The SMI graphic is presented later in this section.

PENGU Holder: Nansen

PENGU Holder: NansenFrom a technical perspective, PENGU is trading within a Falling Wedge pattern, a bullish chart pattern that typically signals the end of a downtrend. Between October 4 and October 9, the Token formed a higher Dip , while the Relative Strength Index (RSI), which measures momentum, created a lower Dip , creating a hidden bullish divergence that supports the case for a recovery.

PENGU Price Analysis: TradingView

PENGU Price Analysis: TradingViewA breakout above $0.032 would confirm this wedge pattern and could open the way to $0.034, the next major resistance level and a 10% increase from current levels.

A close above that level could invite further upside momentum over the weekend. However, if PENGU price falls below $0.027, the recovery setup could fail and sellers could regain control. However, for the structure to turn bearish in the short term, a drop below $0.026 may be needed. That could open up opportunities for short-term traders.

For now, with smart money flows improving and a bullish pattern still intact, PENGU remains one of the more attractive altcoins to watch this weekend.

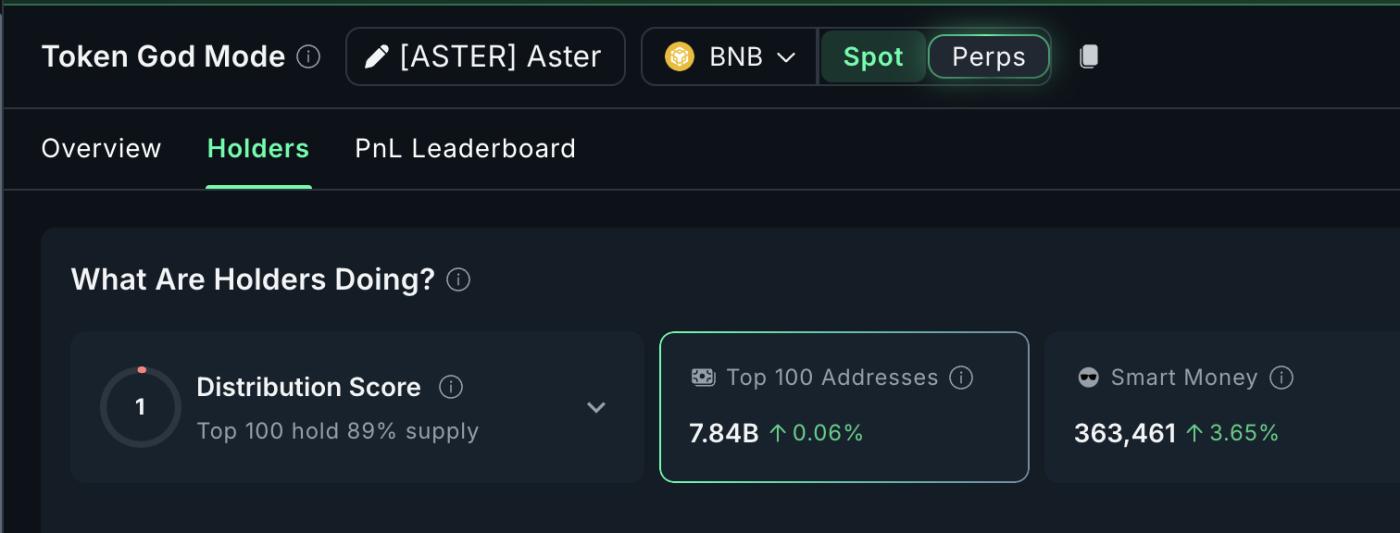

Aster (ASTER)

Aster (ASTER) — a new DEX on the BNB network — has seen its surge quickly fade. After surpassing $2, the Token has fallen nearly 17% over the past week, currently trading near $1.59.

While the price trend appears weak, on- chain data tells a more complex story. Smart money holdings increased by 3.65% over the past 24 hours, while mega whales (top 100 addresses) added 0.06% to their supply. In total, that’s about 172.9 million new ASTER Token , or nearly $275 million at current prices—a significant change after a week of steady selling.

ASTER Holder: Nansen

ASTER Holder: NansenThis sudden accumulation comes after a prolonged decline and signals renewed interest from large and smart investors.

On the chart, ASTER’s Falling Wedge pattern — typically a bullish reversal structure — is developing on the 1-hour timeframe. Since ASTER has a limited trading history, the 1-hour chart provides the clearest signal for short-term price action. In such cases, the hourly perspective helps identify quick momentum reversals that can last for 24–48 hours, making it a practical setup to watch over the weekend.

ASTER Price Analysis: TradingView

ASTER Price Analysis: TradingViewBetween 09/10/2023 and 10/10/2023, the price made a lower low, while the RSI made a higher low, confirming the bullish divergence and suggesting that selling pressure is weakening.

If ASTER price holds above $1.52 and breaks above $1.72, it could test the upper wedge boundary near $1.84. A successful breakout could open up short-term targets around $1.89–$2.02, suggesting a recovery over the weekend.

However, a close below $1.52 would invalidate this recovery setup and return control to the sellers.

After a sharp 17% correction, ASTER’s combination of whale activity, smart money flows, and bullish structure makes it one of the altcoins to watch this weekend, especially for traders aiming for quick technical recoveries.