While the majority of the market is still struggling to recover from the severe crash caused by the impact of tax policy, a few altcoins have overcome the crisis and made headlines with gains of up to 100% in just 24 hours .

These Token have been outperforming the rest of the market, demonstrating strong on-chain activity and strong demand from retail investors , even as large - cap assets remain weak.

This article will analyze three prominent altcoins that have weathered the crash and how their price charts are shaping up amid a generally weak market.

Radiant Capital (RDNT)

Radiant Capital — a DeFi lending platform built to connect cross- chain liquidation — has become one of the few altcoins to weather the crypto market crash .

Over the past 24 hours, RDNT is up nearly 100% , reaching around $0.029 . This bullish momentum is fueled by a clear divide between retail investor enthusiasm and large investor caution .

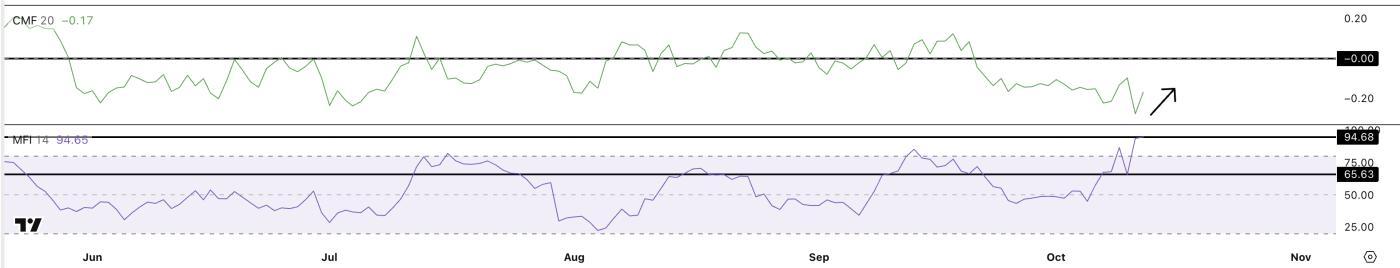

The Chaikin Money Flow (CMF) index — which measures the amount of Capital from large or institutional wallets — is still below zero , but is slowly rising , suggesting that large investors are starting to return to the market , albeit cautiously.

To confirm strong institutional buying, CMF needs to make a decisive breakout above the 0 mark .

In contrast, the Money Flow Index (MFI) — which reflects volume and cash flow from retail investors — has spiked to 94.68 , a “hot” zone that shows extremely strong buying pressure from retail investors . This shows that retail investors are chasing every short-term increase and correction , creating a wave of excitement around Radiant.

Technically, while RDNT 's 100% rally looks impressive, the chart warns of a correction risk :

From April 25 to October 11, the price made a higher high, but the RSI made a lower high — a bearish divergence that often signals a potential correction before a new uptrend forms.

At the same time, RDNT has just broken out of a multi-month long downtrend channel pattern . This is a positive signal, but not enough to confirm a solid uptrend .

To maintain the recovery momentum, Radiant needs to hold above $0.029 and close the daily candle above $0.034 . Otherwise, selling pressure could return, dragging the price to the $0.020 area or lower .

Morpho (MORPHO)

Morpho has quietly emerged as one of the DeFi Token to weather the market crash , showing that decentralized lending projects are leading the recovery wave .

While most altcoins remain deeply bearish, MORPHO is down just 10% on the week and up 4.2% in the past 24 hours , reflecting the resilience of the DeFi sector .

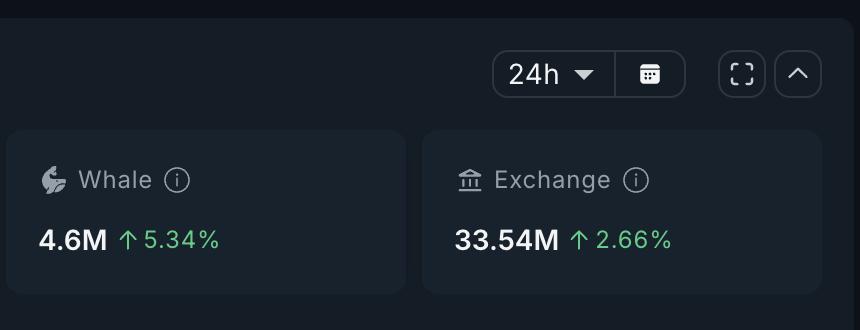

Over the past 24 hours, whale wallets have increased their MORPHO holdings by 5.34% , bringing the total to 4.6 million Token — equivalent to nearly $8 million at a price of $1.68 .

This accumulation occurred even as Token balances on exchanges increased by 2.66% , showing that retail investors are still taking profits , while the "big guys" quietly bought up stocks .

Before the crash, MORPHO traded in a rising wedge pattern — usually a sign of a short-term correction.

After the crash, the pattern broke down to the downside, but price has now recovered back above the lower trendline , showing signs of early stabilization .

The Bull Bear Power (BBP) indicator — which measures the correlation between buying and selling pressure — also confirms this: red candlesticks have been falling sharply since October 10, indicating that selling pressure is waning and buyers are taking back control .

At the time of writing, MORPHO is trading around $1.69 . To maintain the recovery momentum, the price needs to hold above $1.61 and break above $1.91 to retest the higher resistance zones at $2.47 and $2.85 . If it fails, the nearest support zones are at $1.55 and $1.44 .

Despite the market-wide volatility, steady accumulation from whales and waning selling pressure suggests that Morpho could be one of the few DeFi Token that continues to outperform , as long as large money continues to sustain buying momentum .

Succinct (PROVE)

PROVE , the native Token of Succinct - a zero-knowledge proof (ZK-proof) infrastructure project, also stood out in weathering the market crash .

Over the past 24 hours, PROVE is up nearly 19% , showing renewed confidence in DeFi infrastructure projects even as the majority of the market remains weak.

on-chain data shows:

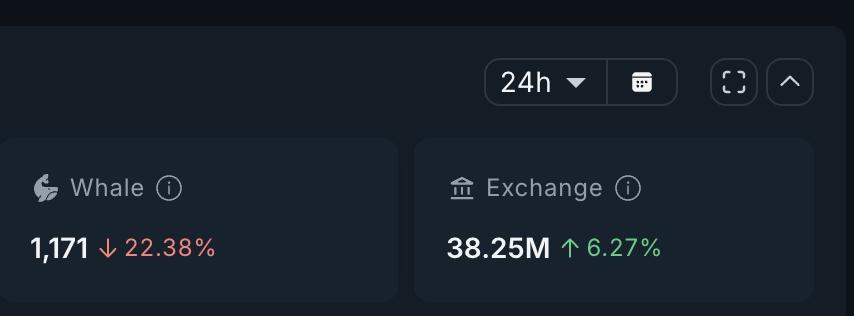

Whale holdings down 22.38% to just over 1,171 Token

Meanwhile, the exchange balance increased by 6.27% to 38.25 million Token , showing that a large portion of large investors have taken profits .

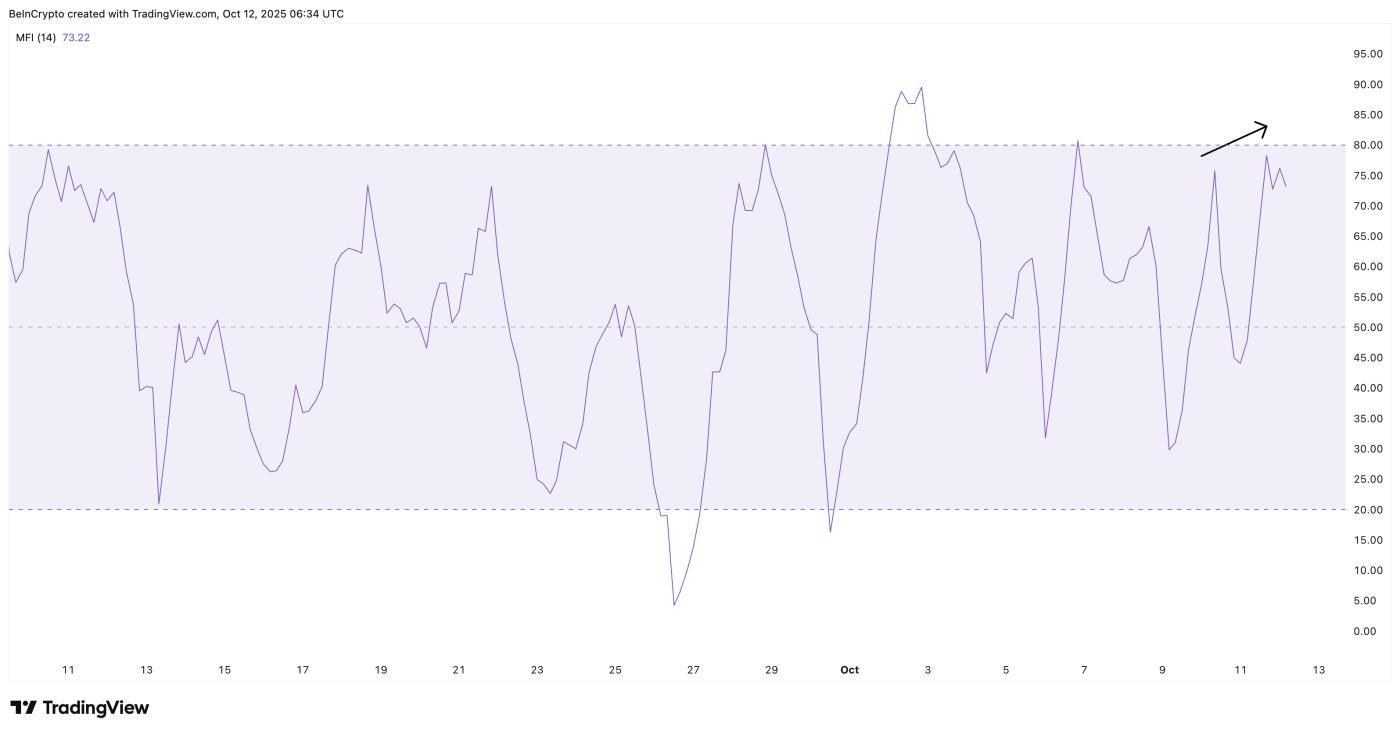

The MFI is currently at 73.22 , approaching overbought territory — meaning investors are still actively buying , but the driving force is mainly coming from retail investors . For the rally to continue, the market needs the return of whales .

Technically, PROVE is still trading within a Falling Wedge pattern , which is usually a signal for a bullish reversal when confirmed.

Between September 26 and October 10, price made a lower Dip while RSI made a higher Dip — bullish divergence , indicating weakening selling momentum .

Currently, PROVE is trading around $0.74 .

If the 4-hour candle closes above $0.85 , the possibility of an extension to $0.94 – $0.98 is very high (about 25–30% increase).

Conversely, if $0.72 is broken, the price could retreat to $0.67 , where an important support zone exists.

Currently, PROVE's recovery momentum is mainly coming from retail investors , but the decision for long-term growth will depend on whether whales return to the market or not .

Notable: Zcash (ZEC )

Besides the three DeFi Token above, Zcash (ZEC) — the privacy-focused coin also deserves a mention for completely going against the market trend .

ZEC is up over 74% on the week and nearly 10% in the past 24 hours , trading around $290 .

Both retail and institutional money continue to pour in, maintaining the Token 's steady rally even as most other altcoins are still recovering slowly.