#BTC

- Bitcoin trading below 20-day moving average indicates short-term bearish pressure

- MACD negative reading suggests continued downward momentum despite Bollinger Band positioning

- New competitor Remittix creating market uncertainty but Bitcoin's fundamentals remain strong

BTC Price Prediction

Technical Analysis: Bitcoin Trading Below Key Moving Average

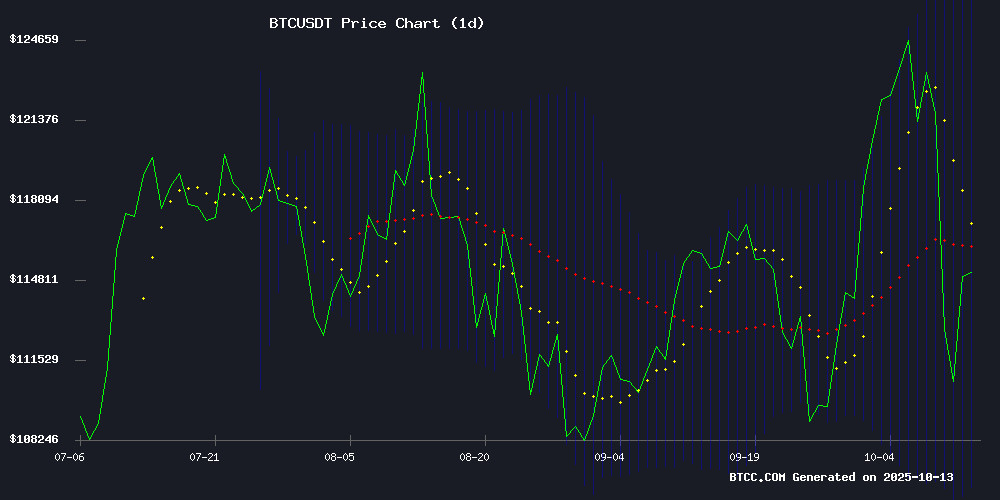

Bitcoin is currently trading at $114,457, below its 20-day moving average of $116,657, indicating short-term bearish pressure. The MACD reading of -3,900 shows continued downward momentum, though the Bollinger Bands position suggests BTC is trading in the lower range of its recent volatility band between $106,223 and $127,090.

According to BTCC financial analyst John, 'The technical picture shows Bitcoin in a consolidation phase. Trading below the 20-day MA with negative MACD suggests we may see further testing of support levels before any significant upward movement.'

Market Sentiment: Bitcoin Faces Competition Amid Remittix Challenge

The emergence of Remittix as a new competitor in the digital payments space has created some uncertainty in the cryptocurrency market. While Bitcoin maintains its dominant position, new challengers can temporarily impact investor sentiment and capital flows.

BTCC financial analyst John notes, 'Competitive pressures from new entrants like Remittix typically create short-term headwinds, but Bitcoin's established network effects and store-of-value proposition provide strong fundamental support. The technical analysis aligns with this sentiment, suggesting we're in a period of market digestion rather than a structural downtrend.'

Factors Influencing BTC's Price

Bitcoin Ownership and Market Outlook Amid New Challenger Remittix

Bitcoin remains the undisputed leader in the cryptocurrency space, yet its ownership is strikingly concentrated. Only about 983,000 wallets hold at least one full BTC, while global adoption surveys suggest just 1.29% of the world's population owns any Bitcoin at all. The market's sensitivity to large holders is evident—top 100 wallets control 14-15% of circulating supply, and a mere 2,000 wallets hold over 1,000 BTC each. For BTC to surpass $400,000 by 2026, fresh inflows from retail, institutions, and untapped markets will be essential.

Meanwhile, the crypto market's recent 7% downturn underscores its volatility. Emerging projects like Remittix aim to disrupt the payments infrastructure space, positioning themselves as cross-chain DeFi solutions. While Bitcoin's scarcity and institutional appeal keep it at the forefront, challengers like Remittix highlight the sector's relentless innovation.

How High Will BTC Price Go?

Based on current technical indicators and market conditions, Bitcoin appears to be in a consolidation phase. The price of $114,457 sits below the 20-day moving average of $116,657, while the MACD remains negative at -3,900, indicating continued downward pressure.

| Indicator | Current Value | Interpretation |

|---|---|---|

| Current Price | $114,457 | Below 20-day MA |

| 20-day MA | $116,657 | Resistance level |

| MACD | -3,900 | Bearish momentum |

| Bollinger Upper | $127,090 | Near-term target |

| Bollinger Lower | $106,223 | Support level |

BTCC financial analyst John suggests, 'We expect Bitcoin to test the $127,000 resistance level if it can reclaim the 20-day moving average. However, the emergence of competitors like Remittix may temporarily cap upside potential. The broader bullish thesis for Bitcoin remains intact, but investors should prepare for continued volatility in the near term.'