#XRP

- Technical Breakout Potential: XRP's current position near lower Bollinger Band with positive MACD divergence suggests imminent upward movement toward key resistance levels

- Institutional Adoption Acceleration: ETF filings and $30B market inflows indicate growing institutional confidence and potential for sustained price appreciation

- Long-term Fundamental Strength: Remittance market positioning and regulatory progress provide solid foundation for multi-year growth trajectory despite short-term volatility concerns

XRP Price Prediction

XRP Technical Analysis: Bullish Momentum Building Despite Short-Term Pressure

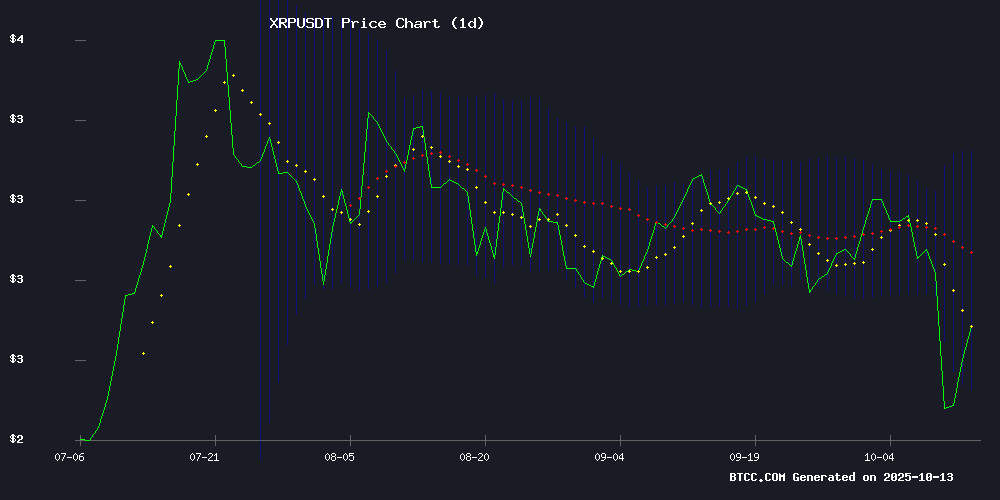

XRP is currently trading at $2.5921, showing resilience below the 20-day moving average of $2.8106. The MACD indicator at 0.0780 remains above the signal line at 0.0461, indicating sustained bullish momentum with a positive histogram reading of 0.0318. According to BTCC financial analyst Mia, 'XRP's position NEAR the lower Bollinger Band at $2.4246 suggests potential for upward movement toward the middle band at $2.8106, with the upper band at $3.1966 serving as a key resistance level.'

XRP Market Sentiment: Regulatory Progress and Institutional Interest Drive Optimism

Recent developments including 21Shares' CME-linked XRP ETF filing and the $30 billion FLOW back into XRP markets after trade-war induced selling pressure have created positive sentiment. BTCC financial analyst Mia notes, 'The 8% rebound coupled with institutional ETF interest signals strong fundamental support, though investors should remain cautious of market volatility and heed community warnings about harmful trading behaviors.' The emergence of XRP and Remittix as standout performers during market turbulence further reinforces the asset's resilience.

Factors Influencing XRP's Price

XRP Community Warned Against Harmful Investor Behaviors by Longtime Figure

Vincent Van Code, a software engineer and prominent voice in the XRP community, has pinpointed eight pitfalls investors should avoid. His advisory comes amid heightened speculation and noise surrounding the digital asset.

The warnings focus on behaviors and content consumption that may cloud judgment or lead to poor financial decisions. Van Code's analysis draws from years of observing market cycles and community dynamics.

XRP Rebounds 8% as $30B Flows Back In After Trade-War Rout

XRP surged 8.5% in a 24-hour window, reclaiming $30 billion in market capitalization after a steep sell-off triggered by geopolitical tensions. The rally from $2.37 to $2.58 was fueled by institutional buying, with volume spikes exceeding twice the daily average. Analysts now watch for a potential weekly close above $3.12, which would mark the asset's strongest performance since launch.

Technical indicators suggest bullish momentum, with an ascending channel forming between $2.37 support and $2.59 resistance. A decisive break above this range could target $2.75, while failure to hold $2.50 may invite a retest of lower levels. The recovery comes despite broader market weakness, with traditional indices like the Dow and Nasdaq shedding hundreds of points.

21Shares Files for CME-Linked XRP ETF Amid Crypto Market Turmoil

The race to launch the first spot XRP ETF intensifies as major asset managers including 21Shares, Bitwise, and Grayscale submit amended filings to the SEC. 21Shares' proposal tracks XRP's price using the CME CF XRP-Dollar Reference Rate, a benchmark favored by institutional investors.

The fund will custody XRP with Coinbase and list on Cboe BZX Exchange, offering mainstream investors exposure through traditional brokerage accounts. Unlike active ETFs, the product will employ a passive strategy without leverage or derivatives.

Regulatory tailwinds may accelerate approval timelines. Recent SEC rule changes streamline ETF listings, potentially benefiting crypto products. However, filings explicitly warn investors about the absence of FDIC insurance and heightened volatility risks.

XRP and Remittix Emerge as Standouts Amid Crypto Market Turbulence

Global cryptocurrency markets faced heavy selling pressure following former U.S. President Donald Trump's proposal for 100% tariffs on Chinese tech imports, sparking fears of renewed trade tensions. XRP plunged 14% to $2.44, mirroring broad-based declines across digital assets.

Despite the downturn, analysts highlight XRP's resilient fundamentals in cross-border payments through Ripple's institutional partnerships. Technical support appears firm near $2.30, with liquidity likely to fuel a rapid rebound when market sentiment stabilizes.

Remittix (RTX) gains attention as a potential hedge, with its PayFi infrastructure positioning it for growth in the remittance sector. Market participants anticipate both tokens could lead the recovery as the payment-focused crypto segment regains momentum.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, XRP shows strong potential for long-term growth. The combination of technical bullish signals and increasing institutional adoption through ETF filings positions XRP for sustained appreciation.

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $3.50 - $4.20 | ETF approvals, technical breakout above Bollinger upper band |

| 2030 | $8.00 - $12.00 | Mainstream adoption, regulatory clarity, cross-border payment integration |

| 2035 | $18.00 - $25.00 | Global remittance market dominance, institutional portfolio allocation |

| 2040 | $35.00 - $50.00 | Mature market position, decentralized finance integration, technological advancements |

BTCC financial analyst Mia emphasizes that 'while these projections reflect current momentum, investors should monitor regulatory developments and market conditions, as cryptocurrency markets remain highly volatile.'