Binance spends $283 million to compensate users after the terrible depeg. Photo: CoinGape

Binance spends $283 million to compensate users after the terrible depeg. Photo: CoinGape

Binance announces $283 million compensation package

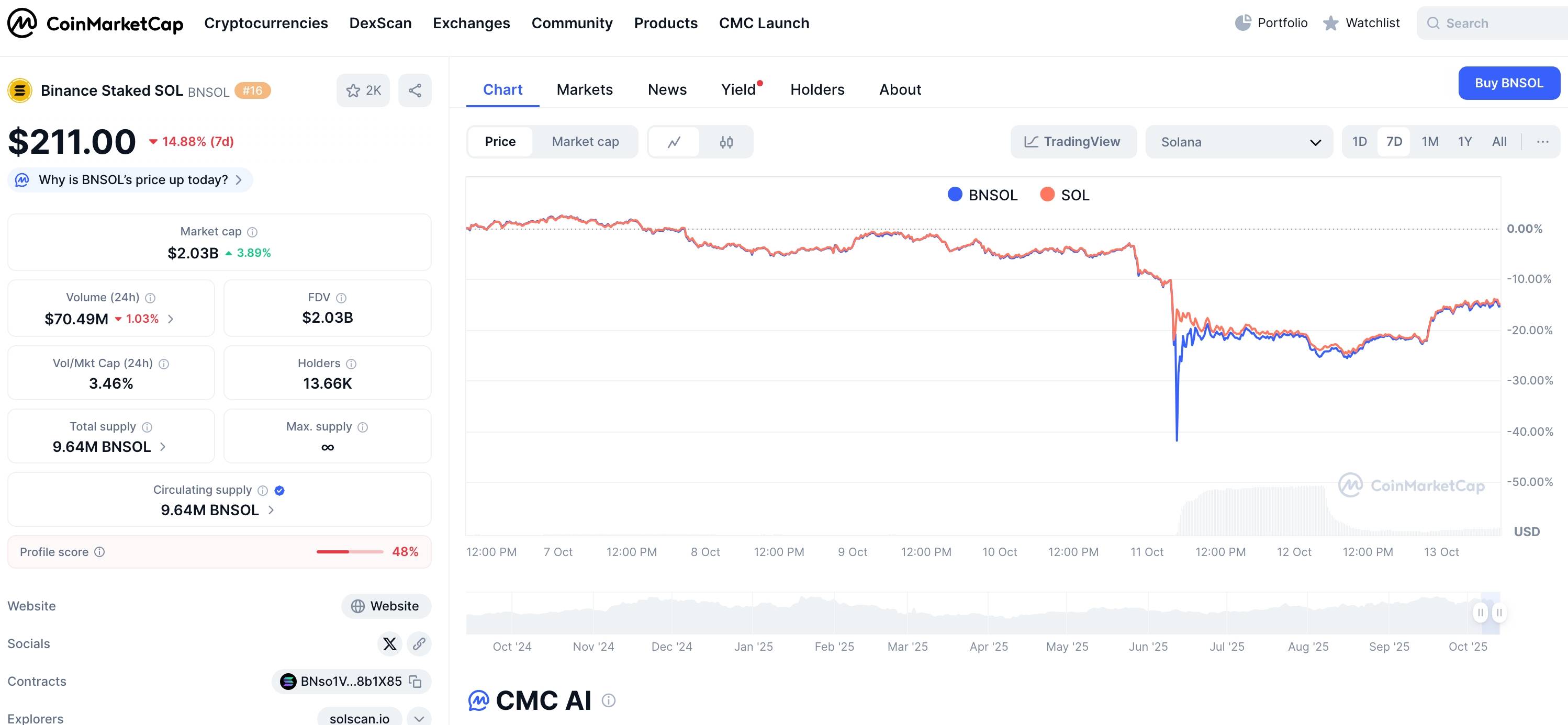

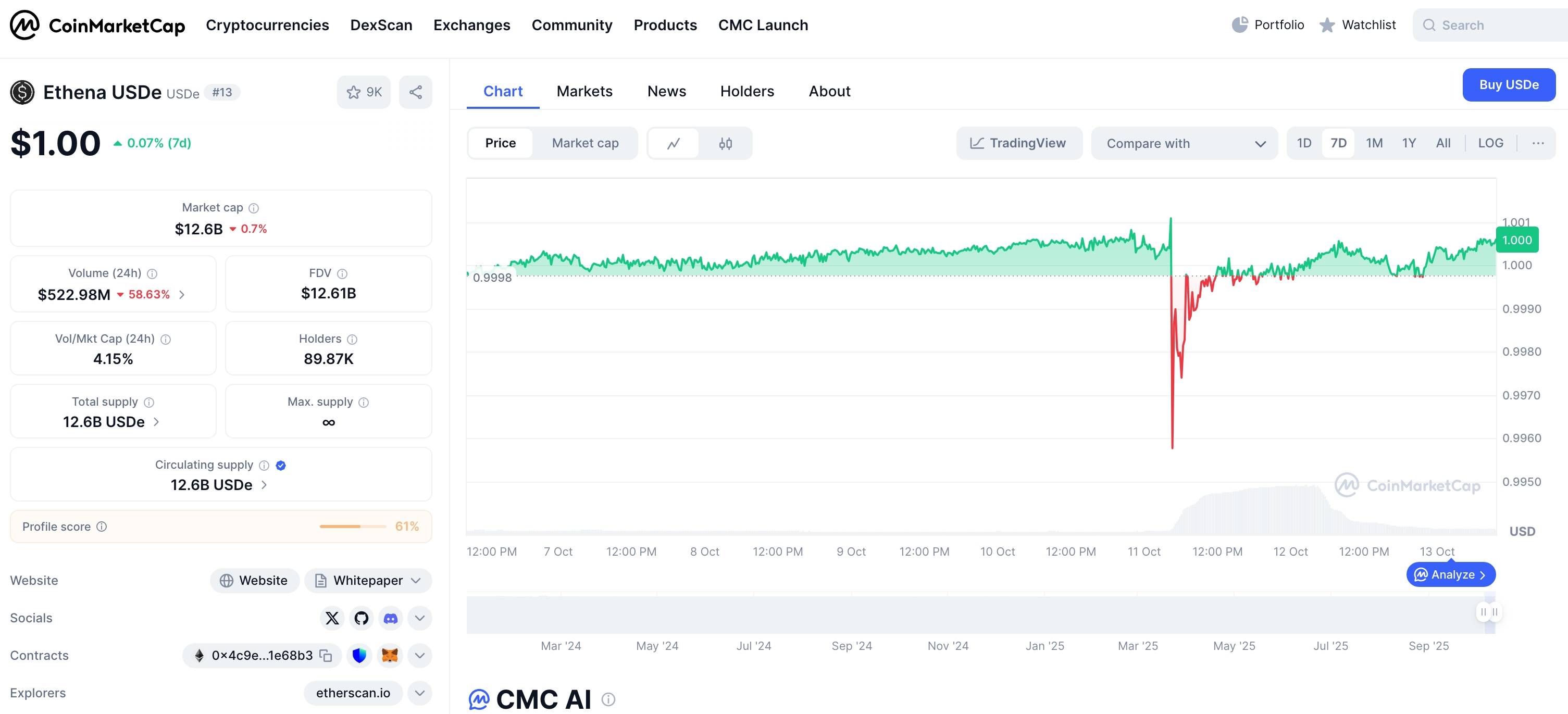

- When the global cryptocurrency market free fall In the early morning of October 11 (Vietnam time), a series of Token on Binance such as wBETH, BNSOL and USDe has plummeted, causing a wave of liquidation of more than 20 billion USD in just a few hours.

- Initially, many believed that this was a “coordinated attack” or a serious system error from Ethena. However, the latest facts show that the truth is more complicated, an internal oracle error on Binance caused the world's largest exchange to crash itself.

- By the evening of October 11, Binance confirmed that it had paid $283 million in compensation for users affected by the depeg incident, Chia into two payments. The exchange also denied rumors that a cyber attack was the cause of the series of depegs that led to the market collapse.

- Binance emphasized: “The extreme market decline occurred before the depeg began. Data shows that the sharpest price drop occurred between 21:20 and 21:21 (UTC) on October 10, while the severe depeg began after 21:36 (UTC).”

- According to Yi He, co-founder and Chief Customer Officer of Binance, the incident occurred amid a surge in users and severe liquidity liquidation . She apologized to users and stated that Binance will XEM each case individually to determine appropriate compensation, but only applies to losses caused by system errors, not including market fluctuations or unrealized profits.

- So who will be compensated?

- The automatic compensation applies to users on Futures, Margin, and Loan who used USDe, BNBSOL, or wBETH as collateral and suffered losses between 21:36 and 22:16 UTC, when the prices of these Token plummeted due to mispricing.

- In addition, Binance is also XEM compensation for users with verifiable losses from internal transactions or refunds of Binance Earn products, along with some special cases that are manually reviewed. Co-founder Yi He affirmed that the exchange will handle each specific case to ensure that users who suffered losses due to Binance's errors will be properly compensated.

- However, Binance emphasized that losses due to natural market fluctuations or unrealized profits will not be compensated, in order to ensure fairness to those actually affected by the system failure.

- In one In a separate post , Binance said it will change the way it prices affected assets, adding the redemption price of Token to the index weighting to avoid unusual fluctuations, and setting a soft floor for the USDe reference index.

88% fall causes chaos at night

- Back to that terrible night, price wBETH (wrapped beacon ether) on Binance suddenly fell to $430, representing an 88% discount compared to the ETH price of more than $3,800.

- BNSOL (BNB Staked SOL) also dropped to $34.90, while the composite stablecoin USDe Ethena's price fell to $0.65.

- Contrary to initial assumptions, sources close to the matter and Ethena itself claim that the problem does not originate from USDe or the project's delta-neutral mechanism, but rather Binance's internal oracle error . While other DeFi exchanges (like Curve or Uniswap) kept the USDe price stable, Binance's oracle - which draws data from its internal orderbook rather than external liquidation sources - was severely distorted when the market was congested.

- This caused Binance to create a significantly lower “artificial” price, triggering a series of liquidation orders and chain sell-offs.

- According to Brave New Coin, Binance announced the switch to using an external oracle on October 6, but the actual implementation date was October 14. The depeg incident happened on October 11, which is within the 4-day “vulnerable window” when the old pricing system was still active.

- Some analysts believe that the attacker may have used this time gap to push the price of wrapped Token down, profiting from Short positions or arbitrage. However, there is still no solid evidence for this hypothesis.

"Sequelae" of the incident

- At the same time, Binance recorded unusual price fluctuations in other Token such as IOTX and ATOM . ATOM even “plunged” to $0.001 before bouncing back to the $3.50 zone.

- Binance explained that some old limit orders from 2019 were still in the system. When the market was in free fall and there was a lack of buyers, these orders were continuously filled, pushing the price down sharply in a short time.

- Moreover, the couple IOTX/ USDT shows a price of 0 USD - which is actually a display error due to the limitation of the number of decimal places on the interface. Binance said it will fix this error in an upcoming update.

Major infrastructure updates

- Within 24 hours of the incident, Binance implemented a series of emergency measures:

Switch to a conversion ratio pricing mechanism, instead of relying solely on spot prices that are prone to noise.

Add the redemption price of wrapped Token to the price index formula.

Set a soft price floor for assets like USDe to avoid temporary collapse.

Increase the frequency of reviewing risk management parameters to ensure the system responds promptly to market shocks.

- Binance confirmed that the exchange's core transactions remained operational throughout the incident and the error was primarily in the oracle/pricing module.

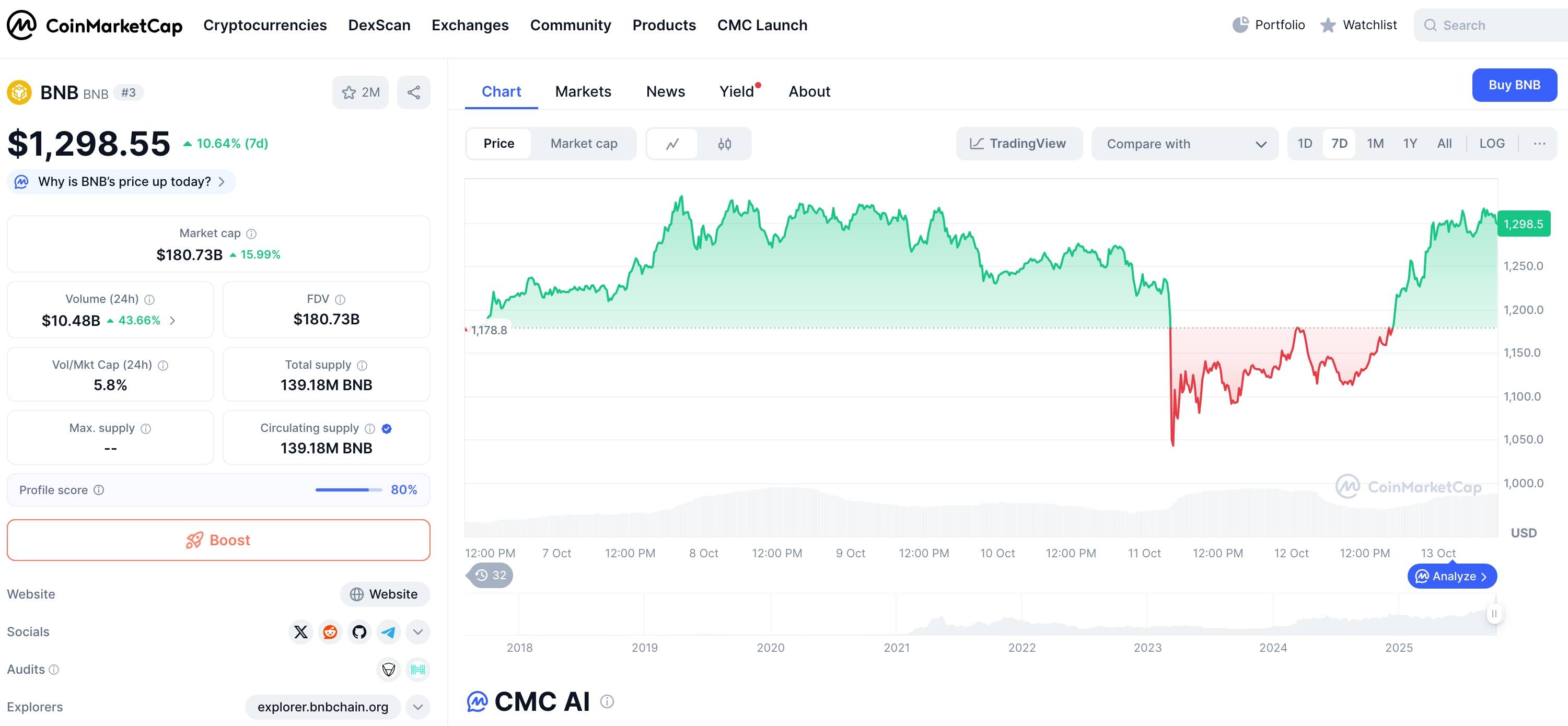

- After a historic drop, BNB - the coin of the Binance ecosystem - has increased by 17% in the past 24 hours. However, Binance said it is still processing additional compensation cases, pledging to review all data to ensure users are properly compensated.

Evidence

wBETH price movement against ETH during the depeg period, screenshot on CoinMarketCap at 09:30 AM on 10/13/2025

wBETH price movement against ETH during the depeg period, screenshot on CoinMarketCap at 09:30 AM on 10/13/2025

BNSOL price movement against SOL during the depeg period, screenshot on CoinMarketCap at 09:30 AM on 10/13/2025

BNSOL price movement against SOL during the depeg period, screenshot on CoinMarketCap at 09:30 AM on 10/13/2025

USDe price movement during the depeg period, screenshot on CoinMarketCap at 09:30 AM on 10/13/2025

USDe price movement during the depeg period, screenshot on CoinMarketCap at 09:30 AM on 10/13/2025

BNB price movement over the past 7 days, screenshot on CoinMarketCap at 09:30 AM on October 13, 2025

BNB price movement over the past 7 days, screenshot on CoinMarketCap at 09:30 AM on October 13, 2025

Source: Coin68