Two days after the Black Friday crypto crash, market sentiment has begun to stabilize and crypto whales have started to take action. On chain data shows some altcoins are re-accumulating as large strategic investors rebuild positions while prices remain low after the crash.

These three coins are supported by large whale inflows, product launch excitement, and improving technical setups. Some are also seeing investment from smart investors, while others are looking to break out of key patterns (or higher targets), signaling early signs of strength.

Dogecoin (Doge)

Dogecoin (Doge) has become one of the first altcoins that crypto whales bought after the Black Friday crash. Previously, large whales holding over 1 billion Doge were the first to react, buying heavily during the sell-off.

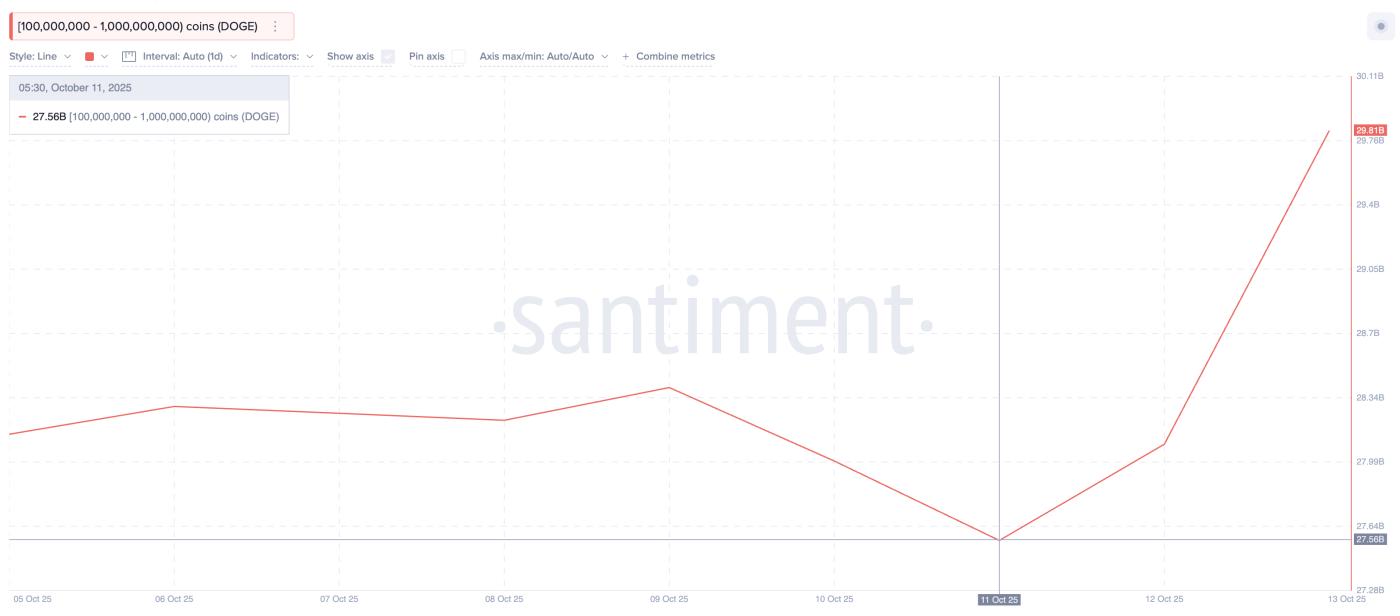

The momentum has now shifted to mid-sized whales holding between 100 million and 1 billion Doge.

These whales have increased their balances from 27.56 billion to 29.81 billion Doge since October 11. That's a net increase of about 2.25 billion Doge, worth about $475 million at current Dogecoin prices.

Dogecoin Whales In Action: Santiment

Dogecoin Whales In Action: SantimentWant more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

This second wave of accumulation shows renewed confidence in the recovery, suggesting that large investors are positioning for a further recovery.

On the 4-hour chart, which is used to spot early trend changes, Doge price is trading just below the key resistance at $0.214, forming a symmetrical triangle pattern. A 4-hour candle breakout above $0.214 could confirm a short-term uptrend towards $0.242, $0.254, and $0.270.

However, a drop below $0.205 could delay this move and take Doge to $0.185 and $0.178.

Dogecoin Price Analysis: TradingView

Dogecoin Price Analysis: TradingViewAdding to the conviction of this setup, the Smart Money Index (SMI), which tracks activity from experienced investors versus retail investors, has started to rise. This increase suggests that seasoned traders are joining the whales.

Synthetix (SNX)

Synthetix (SNX) has been one of the strongest recoveries from the Black Friday crash, rising more than 80% in 24 hours and reaching a 10-month high. The rally was fueled by renewed excitement around the upcoming perpetual DEX on Ethereum .

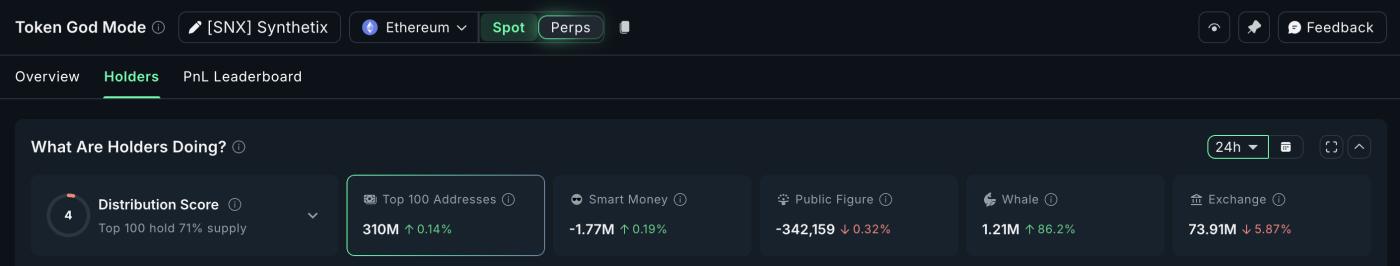

Behind that price action, however, on chain data suggests that whales are playing a larger Vai in driving the move.

Whale wallets holding large amounts of SNX increased their positions by 86.2% in just one day. This group now controls about 1.21 million SNX. That means they added about 560,000 SNX, worth nearly $1.23 million at an Medium price of $2.20.

Synthetix Holders: Nansen

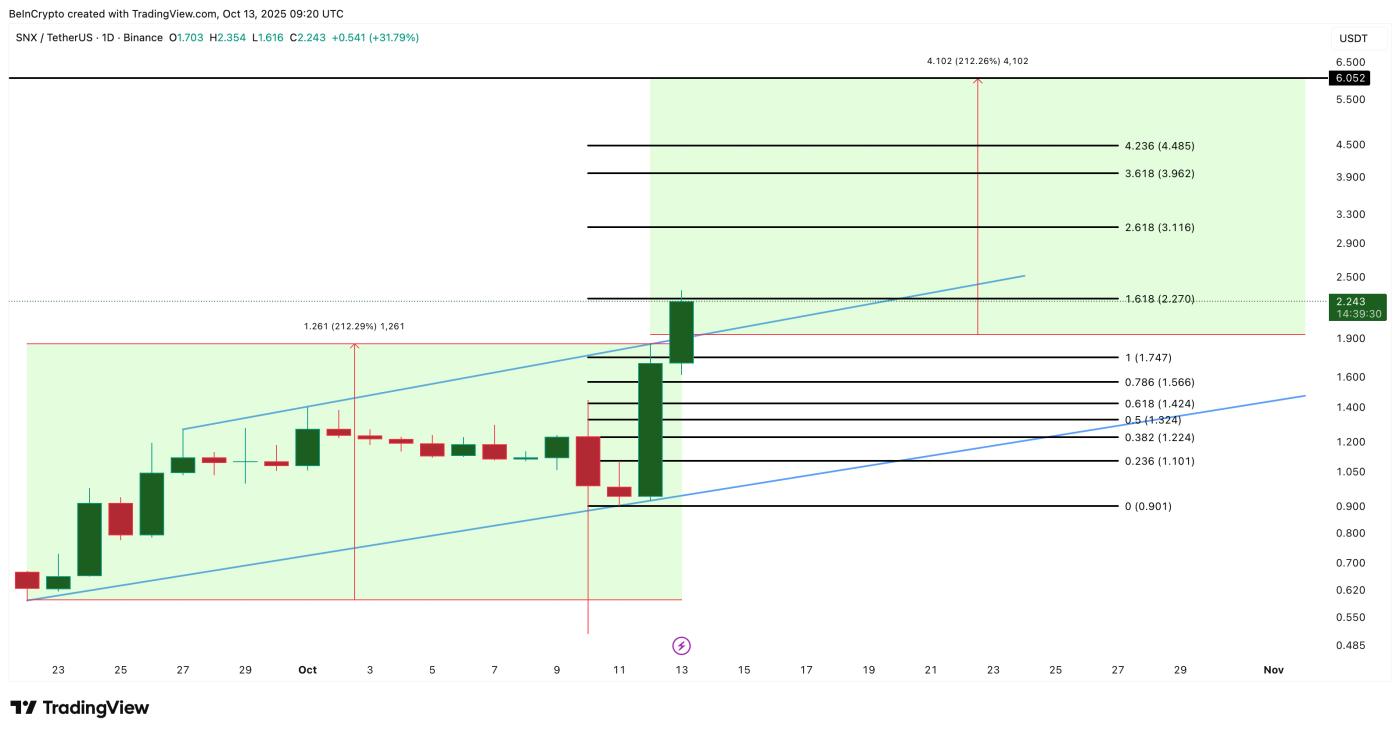

Synthetix Holders: NansenFrom a technical perspective, SNX broke out of an ascending channel on the daily chart, a bullish pattern that signals continuation when confirmed.

This breakout projects a potential upside of 212% from the breakout point, which equates to an extension target near $6.0. Currently, the first resistance is near $2.27, followed by $3.11 and $3.96. A breakout above $4.48 would confirm a larger move.

On the downside, key supports lie at $1.74, $1.56, and $1.10. A drop below the latter ($1.10) would turn the SNX price structure bearish.

SNX Price Analysis: TradingView

SNX Price Analysis: TradingViewIf whale accumulation continues at this pace, it could support SNX to hold above immediate support and extend towards higher targets, especially as the DEX launches and broader market sentiment stabilizes.

Aster (ASTER)

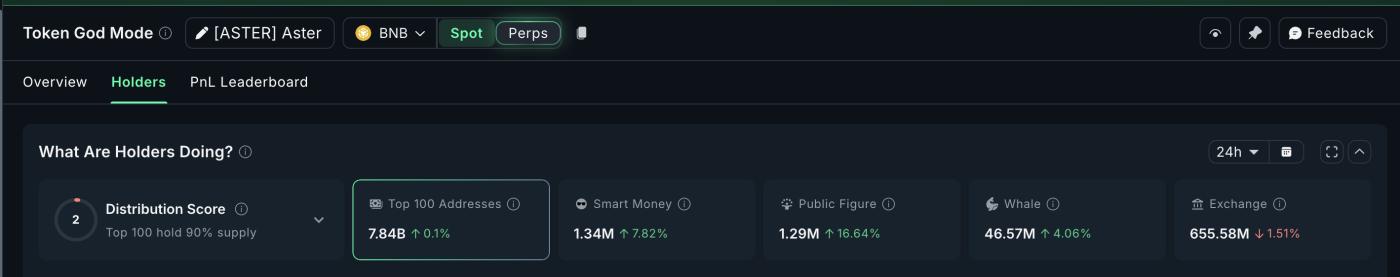

Aster (ASTER), a rapidly growing perpetual DEX project on the BNB Chain, has quickly gained attention after its explosive launch and cross-chain trading model. The project allows users to trade with lucrative collateral, a feature that attracted whales and smart money after the Black Friday market crash.

Whales have increased their holdings by 4.06% in the last 24 hours, now holding 46.57 million ASTER. This means they have added about 1.82 million ASTER, worth about $2.7 million at an Medium price of $1.50.

This steady accumulation is consistent with a similar pattern seen in smart money wallets and public figure wallets, which increased holdings by 7.82% and 16.64% respectively.

Aster Holder: Nansen

Aster Holder: NansenSuch synchronized accumulation across major investor segments shows growing confidence that ASTER's recovery is more than just a short-term bounce.

Technically, Aster’s 4-hour chart shows the Token is trading within a bullish pennant pattern, a pattern that usually signals continuation. For the bullish setup to be confirmed, the 4-hour price must break above $1.75 (breakout of the upper trendline). This could be followed by a move above $1.88, opening the doors to $2.10 and $2.20.

ASTER Price Analysis: TradingView

ASTER Price Analysis: TradingViewOn the other hand, losing the $1.43 mark, a key support level, could push the Token lower to $1.27 or $1.15.