The 1011 Black Swan crash reflected on the safety boundaries of contract trading: either open a isolated margin or place an order with a stop-loss to isolate risks and avoid a mixed bag of risks. The fallacy of copy trading: Everyone knows DYOR, but when you give your money to someone else, no one is responsible for you in the end. Especially when a KOL who leads the trade goes cross margin 2 minutes before a crash, it’s hard not to doubt their motives.

This article is machine translated

Show original

林克Clean

@CryptoSociety42

10-13

直播聊聊

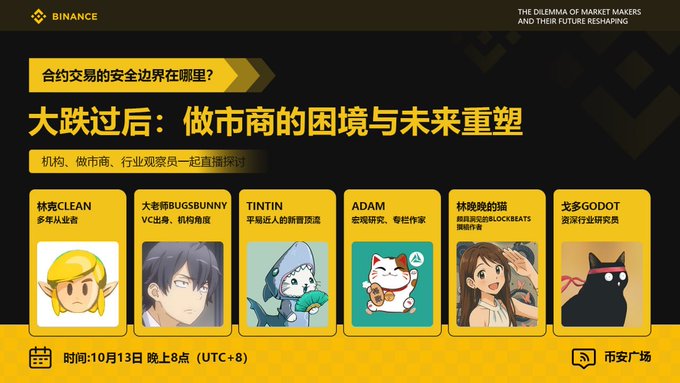

做市商在这次暴跌中到底干了什么

同时和机构、宏观分析师、研究员朋友 大老师 @octopusycc 、戈多 @GodotSancho 、Adam @BTC__options ,共同探讨如何通过期权窥见市场真相;

也邀请了顶流Tintin @Tintinx2021 一起,分享KBW与2049见闻;

与 @linwanwan823

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content