Ngan Luong was identified by the investigation agency as an important link in tracing the direction of money flow in the ecosystem of Shark Binh.

Ngan Luong is in the focus of investigation in the Shark Binh case.

At the press conference on the afternoon of October 14, Hanoi City Police said that the Ngan Luong Payment Gateway is one of the payment gateways in the ecosystem of defendant Nguyen Hoa Binh (Shark Binh) - Chairman of the Board of Directors of NextTech Group Joint Stock Company (NextTech Group).

According to the investigation agency, Ngan Luong is a payment gateway that is of “special interest” through the money transfer activities of electronic wallets. Currently, the police are clarifying many activities related to the money transfer of this Payment Gateway as well as other financial activities, not only related to virtual currency.

Hanoi City Police emphasized that tracing the money flow through Ngan Luong is key to determining the scale and direction of the money flow in the NextTech Group ecosystem, thereby clarifying the acts of money laundering, concealing the origin of assets or appropriation of the defendants.

Diverse service ecosystem helps Ngan Luong dominate the payment market

According to research, Ngan Luong Payment Gateway Joint Stock Company (Ngan Luong) was established in 2012, headquartered in Hanoi, operating in the field of electronic payment with the outstanding product being the Nganluong.vn portal.

This company introduces itself as “Vietnam’s largest internet banking payment gateway”, allowing users to make online payments via banks or e-wallets Nganluong.vn. According to the company’s introduction, this platform has millions of users, hundreds of thousands of active wallet accounts and payment traffic accounting for more than 50% of the market share.

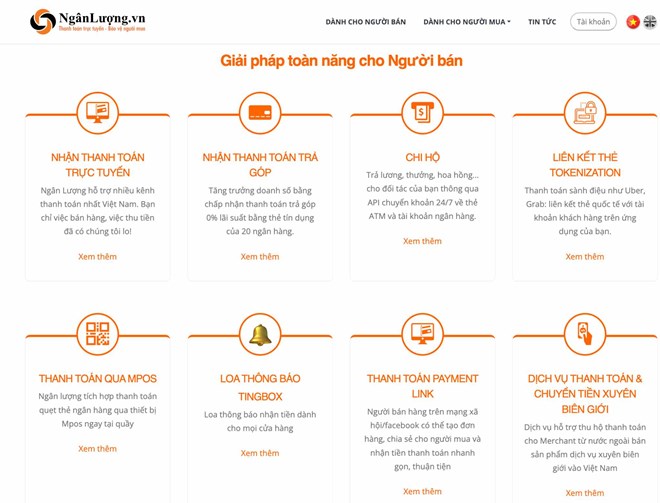

Ngan Luong introduces a comprehensive solution for sellers such as receiving online payments with the most payment channels in Vietnam, including: International cards, domestic ATM cards, Internet banking, QR-Pay, e-wallets, bank transfers. The company also accepts installment payments, payment on behalf, Tokenization card linking, payments via MPOS, Tingbox announcement speakers and Payment Link payments.

Ngan Luong also supports cross-border payment and money transfer services. According to the introduction, this payment gateway collects payments in VND for foreign merchants from customers in Vietnam; supports all popular payment methods such as international cards, domestic cards, QR-Code, Mobile Banking, e-wallets...

NganLuong's affiliated banks will transfer money (converted to foreign currencies such as USD, CNY...) to overseas merchants after deducting taxes and fees according to Vietnamese law on cross-border e-commerce transactions.

For buyers, Ngan Luong introduces support for users to pay online for many public administrative services such as: payment of financial obligations on land, personal taxes, electricity bills, traffic violation fines, payment of voluntary social insurance and health insurance for households, payment of fees, charges...

Strong fluctuations in Capital, personnel and violations are handled

By early 2024, Ngan Luong suddenly registered to change its charter Capital , reducing it by more than 85%, from nearly 370 billion VND to just over 52 billion VND. Along with the Capital reduction, the company also changed senior personnel when Mr. Dinh Hong Quan (born in 1988) was appointed as General Director and legal representative.

In addition, Mr. Dinh Hong Quan also represents other enterprises including: Godgame Service Joint Stock Company and HTTPS Vietnam Technology Joint Stock Company.

In terms of business operations, NganLuong had a golden period in 2016-2018, with revenue reaching thousands of billions of VND, bringing hundreds of billions of VND in profits to NextTech. However, with the development of the market, the popularity of the Nganluong.vn platform has decreased compared to before due to fierce competition with emerging e-wallets in the market and has gradually become less mentioned among the general consumer group.

In the Rikvip case - a trillion-dollar gambling ring, authorities pointed out the Vai of payment intermediaries, in which Ngan Luong was listed as one of the related gateways.

By 2023, the Ngan Luong e-wallet continued to appear as a deposit method on the Exness forex exchange – an unlicensed exchange in Vietnam. At that time, Ngan Luong said that this was a transaction from a personal wallet and the company had locked the account to request an explanation.

In June 2024, the Hanoi Tax Department inspected and concluded a series of tax violations at Ngan Luong. As a result, the company was charged and fined a total of more than 1.2 billion VND.