Author: Baheet

Compiled by: TechFlow

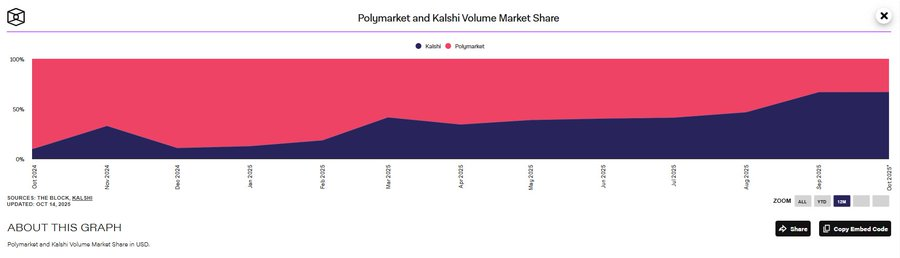

The prediction market industry is undergoing a rapid transformation, driven primarily by the fierce competition between Kalshi and Polymarket.

Kalshi recently closed a $3 billion funding round at a $5 billion valuation, while Polymarket raised $2 billion from Intercontinental Exchange (ICE).

This means one thing: we're about to witness a new round of competition between the two companies in product launches.

The stage is set, and now it depends on which platform will stand out.

But the core of this article is:

Kalshi is executing on its well-thought-out on-chain scaling strategy.

@Kalshi has been criticized by crypto-native competitors for not fully implementing an on-chain platform. This criticism centers on the fact that Kalshi operates as a regulated, centralized exchange with complete control over the market, user funds, and settlement processes, which stands in stark contrast to the decentralized nature of blockchain.

However, Kalshi has already begun executing on-chain scaling plans, the first step of which was recruiting @j0hnwang as Head of Crypto Operations.

Now, they’re taking it a step further by opening up Kalshi’s market data to Web3 users and applications.

Let’s get into the details;

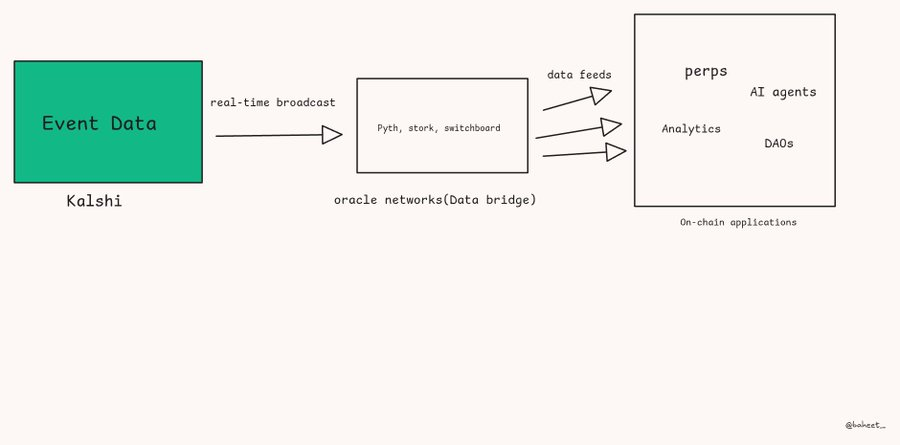

Multi-oracle collaboration: Pyth and Stork

By partnering with oracle networks like Pyth, Switchboard, and Stork, Kalshi is distributing its centralized, federally regulated prediction market data to multiple blockchains. This is a deliberate move to bring its prediction market data to the decentralized Web3 ecosystem.

Pyth Network:

The partnership with @PythNetwork enables Kalshi to stream real-time, regulated prediction market data to over 100 blockchains. Developers can now leverage Kalshi’s probabilistic data for DeFi applications, risk modeling, and more.

Original tweet link: Click here

Stork: Kalshi’s collaboration with @StorkOracle ’s open data marketplace further enhances the availability of Kalshi data in the Web3 ecosystem.

Original tweet link: Click here

Switchboard: @switchboardxyz oracle also announced support and integration of Kalshi data.

Original tweet link: Click here

This strategy not only helps Kalshi expand its influence beyond its own platform, but also helps it maintain its regulated status, a key differentiator from its main on-chain competitor @Polymarket .

The strategic significance of Kalshi

Expanding Impact : By distributing data through a multi-oracle network, Kalshi ensures that its regulated data can be used by more Web3 developers, institutions, and decentralized applications (dApps) across multiple blockchains.

Empowering DeFi Products : Kalshi’s real-time market probability data can serve as a building block for new types of DeFi tools, including derivatives, insurance markets, gaming mechanics, and governance systems.

Acting as a “referee” : With its robust and regulated data stream, Kalshi has the potential to become a trusted arbitrator in decentralized prediction markets, providing trust to markets that rely on its data for settlement and enhancing the credibility of the entire ecosystem.

Staying Competitive : This strategy allows Kalshi to more effectively compete with fully on-chain platforms like Polymarket. By combining regulated status and on-chain integration, Kalshi offers the best of both worlds.

Solana and Base ecosystem hub

To support applications developed based on its data and platform, Kalshi first launched the @KalshiEco ecological center in collaboration with @solana and @base .

The program provides funding, technical support, and resources to attract developers, traders, and creators to the prediction market space and drive innovation both on and off-chain.

Compared with Polymarket: What are Kalshi’s advantages?

The competition between Kalshi and Polymarket is not just about market share; both platforms clearly dominate.

Frankly, this is more of a clash of philosophies.

Kalshi's methodology : Focusing on compliance and promoting the institutional development of the prediction market. This approach has been consistent throughout the company since its inception.

Polymarket’s methodology : Representing the experimental frontier of crypto-native, it was originally built on the Polygon blockchain, allowing users to trade on a wide range of topics, but was ultimately banned in the United States due to the regulatory risks posed by its non-custodial model.

While Polymarket is now also on the road to compliance and has gained institutional support, Kalshi's compliance-first strategy and long-term institutional support give it a significant advantage in attracting mainstream users and greater capital flows.

I think Kalshi currently has some advantages over polymarket;

Wider coverage and legitimacy: By distributing data across multiple oracle networks, Kalshi’s regulated data has wider coverage and can become the fundamental “source of truth” for real-world event data in DeFi, enhancing its legitimacy and influence.

Mainstream user adoption: Kalshi has partnered with traditional brokerage firms such as Robinhood to attract a wider range of non-crypto native users and capture a larger market share in the prediction market space.

Hybrid Model: While the debate on CT often pits Kalshi and Polymarket against each other, both are moving toward a hybrid model. Kalshi is attracting the Web3 community through on-chain innovation, while Polymarket is attracting more institutional capital by obtaining US regulatory approval. Nevertheless, Kalshi's long-standing regulatory compliance foundation remains a lasting and trusted advantage.

Looking Ahead: Kalshi's Next Phase

I believe Kalshi’s current momentum and recent funding round have charted a clear path for its next phase of strategic direction.

In my opinion, based on its strong regulatory foundation and growing on-chain presence, the next phase of Kalshi should include the following aspects:

Increase institutional adoption: Kalshi should further integrate its data streams into mainstream financial systems through more partnerships. Polymarket hit a key milestone when it secured support from Intercontinental Exchange (ICE), and Kalshi should aim for similar or even larger partnerships. This would attract more institutional liquidity and establish prediction markets as a new type of financial derivatives.

Global Expansion and Localization: Kalshi has already expanded to 140 countries, but the platform should leverage its recent funding and on-chain infrastructure to accelerate its expansion into more international markets and tailor its products to local regulatory frameworks and user preferences.

Diversify product offerings: Kalshi should continue to innovate in its product lineup, such as expanding parlay-style wagers, supporting scalar markets, and developing more advanced financial products based on event outcomes.

Enhanced support for the development of the Web3 ecosystem:

Kalshi should further support its ecosystem by providing more developer tools, dedicated grants, and resources to encourage innovative decentralized applications (dApps) based on its regulated event data. This will solidify its role as an infrastructure provider, rather than just a marketplace platform.

in conclusion

This extension of Kalshi provides developers with a unique opportunity. Developers can now build on a robust, Commodity Futures Trading Commission (CFTC)-regulated data source, ensuring the integrity and legality of their applications.

Kalshi's move gives developers the confidence to build products with peace of mind knowing their solutions are backed by a compliant and high-quality data source.

Here are some application ideas I can think of:

DeFi Tools: Leverage Kalshi’s data to create new perpetual futures, options, and interest rate swaps that can be triggered based on economic indicators like CPI or interest rate decisions.

Arbitrage Tools: Develop AI agents and professional data dashboards to use Kalshi’s data to identify pricing differences between different markets, providing new opportunities for information arbitrage.

DAO : Develop automated governance mechanisms where voting rights or proposal weights can be based on market probabilities provided by Kalshi, such as project milestones, product releases, or even internal forecasts.

The launch of @KalshiEco and its funding program sends a clear invitation to the developer community.

This moment presents a unique opportunity to build and shape the future of prediction markets, transforming them from a speculative project into a vital component of financial and information infrastructure.

I believe that developers who seize this opportunity to innovate will be at the forefront of this change.

Let’s build the next generation of financial applications together!