#XRP

- Technical Positioning: XRP trades below key moving averages but shows some bullish momentum through MACD, with Bollinger Band support being tested

- Corporate Development: Ripple's $1 billion treasury plan and GTreasury acquisition signal strong institutional commitment and long-term value creation

- Price Target Viability: The $3 target represents significant upside from current levels, requiring both technical recovery and fundamental catalysts to achieve

XRP Price Prediction

XRP Technical Analysis: Current Market Position and Trend Indicators

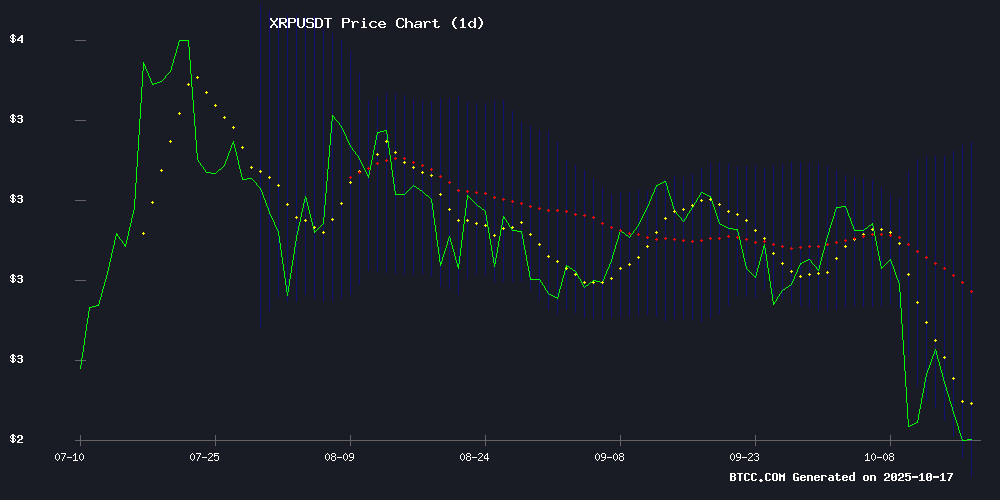

According to BTCC financial analyst Olivia, XRP is currently trading at $2.22, below its 20-day moving average of $2.72, indicating potential short-term bearish pressure. The MACD reading of 0.2448 above the signal line suggests some bullish momentum remains, though the price sits NEAR the lower Bollinger Band at $2.19, which may act as support. The current technical setup shows XRP testing crucial support levels while maintaining some positive momentum indicators.

Ripple's Strategic Moves Signal Strong Institutional Confidence

BTCC financial analyst Olivia notes that Ripple's announced $1 billion XRP treasury plan and GTreasury acquisition represent significant institutional developments. While these corporate strategies could drive long-term adoption, the immediate market reaction has been muted with xrp price testing technical support. The combination of treasury expansion and institutional infrastructure investments creates a fundamentally positive backdrop, though technical factors currently dominate short-term price action.

Factors Influencing XRP's Price

Ripple Plans $1 Billion XRP Treasury to Boost Institutional Adoption

Ripple is orchestrating a $1 billion XRP treasury initiative through a special purpose acquisition vehicle, signaling a strategic push to cement XRP's role in corporate finance. The digital asset treasury will blend newly acquired tokens with existing reserves, leveraging Ripple's current holdings of 4.5 billion XRP and its control of 37 billion in escrow.

The move follows Ripple's $1 billion acquisition of GTreasury, underscoring its focus on institutional-grade digital asset management. With 59 billion XRP in circulation, Ripple's latest maneuver aims to accelerate enterprise adoption while reinforcing its market dominance.

XRP Price Prediction and BlockchainFX Presale: A Tale of Two Crypto Opportunities

XRP continues to captivate the crypto market with long-term price predictions reaching $8 by 2030, while BlockchainFX's presale emerges as a disruptive force. The altcoin's steady growth trajectory contrasts sharply with BlockchainFX's immediate upside potential, drawing comparisons to Binance's early days.

BlockchainFX has already attracted 14,500 participants and raised $9.5 million in its presale, offering tokens at $0.028 with a projected launch price of $0.05. The platform's hybrid approach combining DeFi with traditional markets positions it as a potential game-changer in crypto exchange infrastructure.

Expert Tells Investors to Focus on XRP: Here’s Why

Prominent analyst Ted Pillows has identified XRP as a standout cryptocurrency poised for significant gains. The asset's potential is tied to the growing institutional interest in altcoins with exchange-traded funds (ETFs), a trend Pillows emphasizes in his latest investment strategy.

Market observers note that XRP's unique positioning—bridging traditional finance and blockchain—could make it a prime candidate for ETF consideration. "The next wave of crypto profits won't come from speculative plays, but from assets with clear utility and regulatory clarity," Pillows remarked, without directly referencing recent SEC developments.

The World Is Sleeping on XRP, Expert Says

Crypto commentators argue that XRP's potential to disrupt the financial market is being overlooked, especially as Ripple makes a strategic push into the $120 trillion treasury market. The sentiment follows Ripple's $1 billion acquisition, designed to revolutionize business payments and liquidity management.

Ripple's latest move signals a broader ambition to reshape global finance, yet market participants remain underweight on XRP's role in this transformation. The acquisition underscores the growing convergence between blockchain innovation and institutional finance.

Ripple Announces $1 Billion XRP Buyback to Stabilize Token Price

Ripple is orchestrating a $1 billion fundraising initiative to repurchase XRP tokens for a new digital asset treasury, Bloomberg reports. The deal, structured through a special purpose acquisition company (SPAC), will also include contributions from Ripple's existing holdings. Final terms remain under negotiation, but the company is advancing swiftly.

The buyback arrives as XRP struggles to maintain support above $2.40, weighed down by spot ETF delays and regulatory ambiguity. A billion-dollar demand injection could alleviate selling pressure and recalibrate supply dynamics—hundreds of millions of tokens may exit circulation into locked treasury reserves.

Concurrently, Ripple acquired GTreasury for $1 billion to bolster institutional infrastructure, signaling a dual strategy: immediate market stabilization paired with long-term ecosystem development. Market observers note the buyback could serve as the bullish catalyst XRP holders have anticipated.

Ripple’s $1B XRP Treasury Plan Could Reshape Crypto Corporate Strategy

Ripple Labs is preparing a landmark $1 billion XRP acquisition through a specialized treasury vehicle, signaling a strategic consolidation of its native token ecosystem. The initiative involves creating a digital asset treasury via a SPAC structure, combining fresh purchases with existing reserves from Ripple’s 4.5 billion circulating XRP and 37 billion escrowed tokens.

Concurrent with this move, Ripple acquired treasury management firm GTreasury for $1 billion, accelerating its integration of blockchain tools for stablecoins and tokenized deposits. The dual maneuvers underscore Ripple’s push to bridge traditional finance with digital assets while tightening control over XRP liquidity.

Ripple Enters Treasury Payments Sector with GTreasury Acquisition

Ripple's strategic acquisition of GTreasury marks its formal entry into the $120 trillion treasury payments market. The move positions XRP as a potential beneficiary of institutional cash management flows.

Market analysts speculate that capturing just 3% of the global treasury market could significantly impact XRP's valuation. The altcoin's price trajectory may hinge on its ability to displace legacy settlement systems in corporate finance departments.

GTreasury's existing client base provides Ripple with immediate access to treasury professionals. This contrasts with previous blockchain projects that attempted to build financial infrastructure from the ground up.

XRP Price Slips Despite Ripple's $1B GTreasury Acquisition, Technical Support Tested

Ripple's strategic $1 billion acquisition of GTreasury failed to buoy XRP's market performance, with the token shedding 5.6% amid broader crypto market pressures. The drop erased $137.21 billion in market capitalization despite $7.58 billion in daily volume, pushing prices to a critical $2.29 support level.

Technical indicators flash warning signals as XRP breaches the $2.47 support floor. The MACD histogram shows bearish momentum accelerating, while RSI readings plunge into oversold territory. Traders now watch the $2.14 level as the next potential downside target should current supports fail.

Ripple Acquires GTreasury for $1 Billion to Expand Corporate Treasury Services

Ripple Labs has made a strategic $1 billion acquisition of GTreasury, a Chicago-based corporate treasury management firm. This marks Ripple's third major purchase in 2025, following earlier acquisitions of Hidden Road and Rail. The deal positions Ripple to provide institutional-grade digital asset management solutions, including stablecoin and tokenized deposit services with 24/7 liquidity and cross-border settlement capabilities.

The acquisition serves as a gateway to the multi-trillion dollar corporate treasury market. GTreasury's infrastructure will enable Ripple to offer Fortune 500 companies access to global repo markets and real-time payment networks through the XRP Ledger. Recent partnerships with BBVA, Franklin Templeton, and DBS Bank demonstrate Ripple's growing institutional footprint in digital asset custody and tokenized trading.

Concurrently, Ripple is leading a $1 billion fundraising initiative via special purpose acquisition company to establish a dedicated XRP treasury. This move signals growing institutional demand for cryptocurrency treasury management solutions as traditional finance increasingly adopts blockchain technology.

Ripple Advances Financial Infrastructure with $1.25B GTreasury Acquisition

Ripple's latest acquisition of GTreasury marks its seventh strategic move to bridge traditional finance with blockchain solutions. The $1.25 billion deal integrates Ripple's payment technology with GTreasury's liquidity management systems, enabling corporations to manage stablecoins and tokenized assets more efficiently.

Crypto lawyer John Deaton highlights Ripple's end-to-end financial infrastructure buildout, spanning treasury dashboards to on-chain settlements. The company's acquisition spree includes Hidden Road, Metaco, and Fortress Trust—each strengthening its capabilities in prime brokerage, custody, and regulatory compliance.

CEO Brad Garlinghouse's vision positions XRP at the center of a reimagined treasury ecosystem. The GTreasury integration could accelerate institutional adoption of blockchain-based cash management solutions.

Ripple Plans $1B XRP Purchase Amid Treasury Expansion Speculation

Ripple is reportedly advancing plans to acquire $1 billion worth of XRP, according to a Bloomberg News report. The move could signal a strategic accumulation of the cryptocurrency as the firm explores scaling its treasury holdings to $10 billion.

Market analysts are weighing the potential price impact of such a large-scale purchase, given XRP's liquidity profile and Ripple's historical influence on its market dynamics. The proposed buy-in would represent one of the largest corporate acquisitions of a single cryptocurrency since MicroStrategy's bitcoin accumulation strategy.

Will XRP Price Hit 3?

Based on current technical and fundamental analysis, XRP faces both opportunities and challenges in reaching $3. The current price of $2.22 requires approximately 35% upside to achieve the $3 target.

| Factor | Current Status | Impact on $3 Target |

|---|---|---|

| Price Position vs MA | Below 20-day MA ($2.72) | Negative Short-term |

| Bollinger Band Position | Near Lower Band ($2.19) | Support Test Ongoing |

| MACD Momentum | Positive but Weak | Moderately Bullish |

| Ripple Treasury Plan | $1B Announcement | Long-term Positive |

| Institutional Adoption | GTreasury Acquisition | Fundamentally Supportive |

According to BTCC financial analyst Olivia, while Ripple's corporate developments provide strong fundamental support, technical indicators suggest the $3 target may require consolidation and renewed bullish momentum. The combination of institutional adoption and technical recovery could potentially drive prices toward $3 in the medium term, but immediate breakthrough appears challenging given current market conditions.