After a sharp drop to $103,000 , Bitcoin (BTC) is slowly recovering, while Bitwise Investments believes that the current fear is an opportunity to accumulate .

Market sentiment is clearly down, but some analysts say this could be the “end of fear” phase before the market bounces back .

Notably, in that context, a Bitcoin infrastructure project is attracting attention – Bitcoin Hyper (HYPER) , a Layer-2 platform that is expected to help scale the Bitcoin network.

Investor Sentiment Hits Record Low

According to data from CoinMarketCap , after a sharp drop on October 10 , Bitcoin price Dip at $103,133 , then quickly bounced to $116,044 after just three days, before stabilizing around $108,000 .

The Crypto Fear & Greed Index has now fallen to 22 , its lowest level of the year – down sharply from 71 just a week ago. However, according to Bitwise experts , this is not a negative signal , but rather a familiar “upstream accumulation” phase before each recovery cycle .

“Extreme fear is often accompanied by exhaustion of selling pressure,” the Bitwise report noted, arguing that much of the decline comes from “ Derivative liquidations, rather than reflecting market fundamentals.”

The company’s data also recorded a record $11 billion drop in Bitcoin futures open interest – a sign that the selling pressure has been almost completely absorbed.

This typically signals a strong recovery in the fourth quarter , according to Bitwise .

Small Cash Flow Accumulates

A report from Glassnode shows that retail investors are increasing their buying , offsetting the selling by whales.

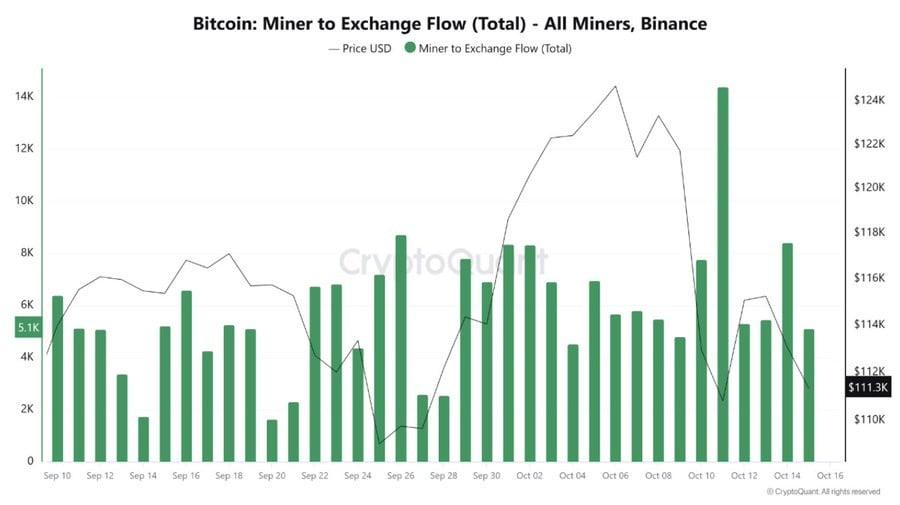

In contrast, data from CryptoQuant shows that some Miners pools have moved about 51,000 BTC onto exchanges – a move XEM a hedging sale rather than a large-scale exit.

Combining these on-chain signals, analysts believe that the market is in a “redistribution” phase rather than a sell-off , opening up opportunities for new projects with solid applications and infrastructure.

Bitcoin Hyper – A Scalable Second-Layer Solutions for the Bitcoin Network

While fear prevails, some investors are turning to new infrastructure projects that could potentially expand processing capacity and reduce transaction fees – most notably Bitcoin Hyper (HYPER) .

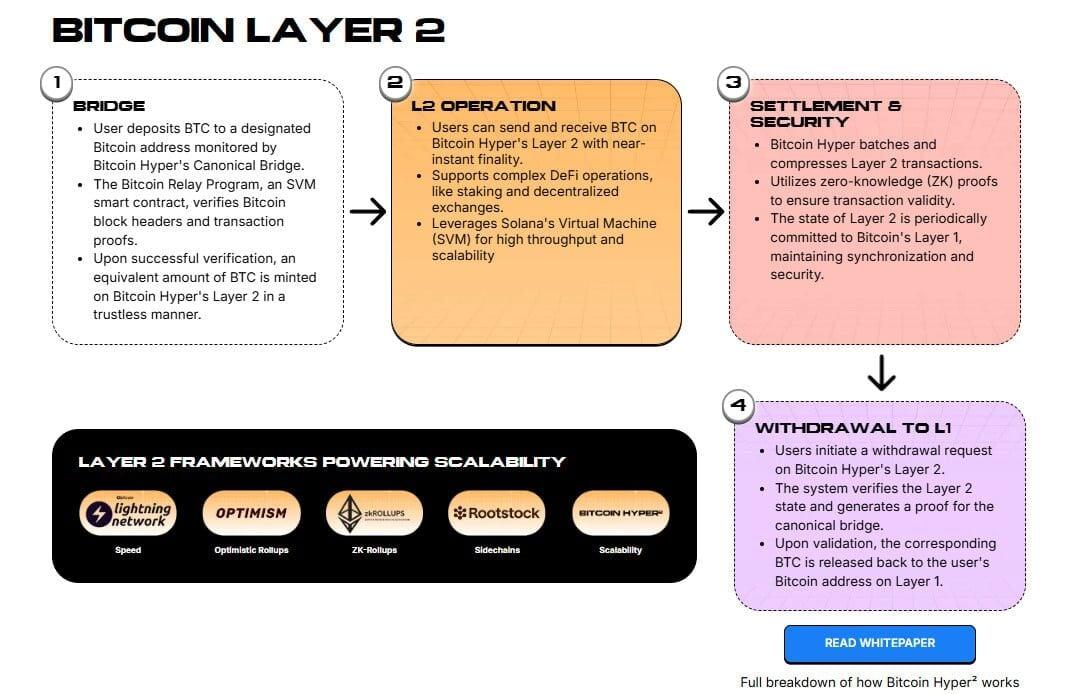

The project is built as a Layer-2 , combining a canonical bridge and Solana Virtual Machine (SVM) , allowing for thousands of transactions per second while maintaining the same level of security as the original Bitcoin .

Users can deposit native BTC via the bridge to receive wrapped BTC on the Hyper network , from there participating in decentralized applications (dApps), trading digital assets or Staking .

The system is also designed with multi-threaded parallelism , helping to optimize speed and reduce costs to nearly 0 - a superior point compared to traditional Layer-1 networks.

According to information from the development team, Bitcoin Hyper has raised nearly 24 million USD for the platform deployment phase, along with a dynamic Staking model with flexible interest rates.

This demonstrates the early investor community's confidence in Bitcoin's expansion potential in the new era.

Bitwise Signals and Long-Term Perspective

Bitwise Investments – one of the largest digital asset managers in the US – believes that the combination of:

- Fear index at record low ,

- Derivative contract volume decreased sharply ,

- And the accumulation trend of small investors returns

are all positive signals for the fourth quarter of 2025 .

If the “extreme fear → strong recovery” scenario repeats itself like at the beginning of the year, Bitcoin and related infrastructure projects like Bitcoin Hyper could become a bright spot in the next cycle .

Note: This is a promotional article from a partner in the Press Release section of Bitcoin News, not investment advice. You should research carefully before taking action, we are not responsible for your investment decisions.