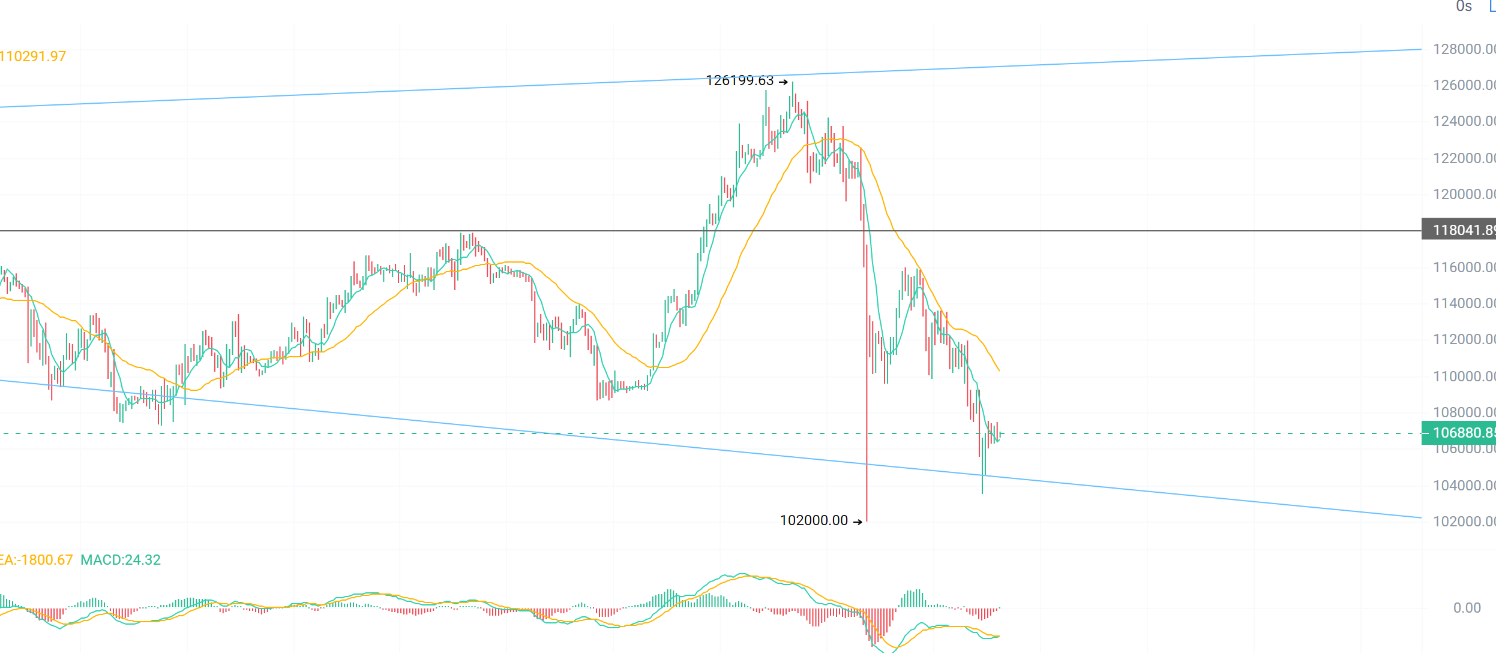

Hey everyone, this market is truly terrifying. Bitcoin has been breaking through multiple levels, and everyone's asking: Is it really going to fall below 100,000 this time? Should I buy the buy the dips? Should I run? I want to say—don't panic, but don't hold on either.

Let's take a global look: Gold is hitting new highs, US stocks are soaring, and even A-shares are experiencing a resurgence. Bitcoin, however, is turning downward, a dangerous sign in itself. The peak of the four-year cycle has passed, and the bear market has already begun. Any rebound now presents an opportunity for investors to exit and reposition long-term short positions. Those with spot positions should not miss this window of opportunity.

According to the data, of the 26 technical indicators on Bitcoin's daily chart, 14 indicate sell, 10 indicate neutral, and only 2 indicate buy . While a short-term rebound is possible, the medium- to long-term outlook remains bearish.

Remember: a rebound does not equal a reversal. Don't imagine selling at the peak; if you can get out at a relatively high level, you've already won. Historically, every bear market has seen Bitcoin ultimately drop 80%.

Let's look at #Ethereum . On October 14th, a concentrated trading zone formed above $4,300, with the candlestick chart forming an "evening star" pattern. The 4-hour chart remains down. While recent small green candle with lower shadows and strong volume suggest buying resistance, the daily chart hasn't yet broken its downward trend, and the MACD bearish structure hasn't reversed, limiting potential for a rebound. A true rebound will only begin when the daily chart stabilizes and the 4-hour chart resonates.

To put it bluntly, now is not the time to blindly buy the dips. The market is extremely fragile; a single bit of bad news can destabilize the market, while good news can barely lift it. Whether you're trading short-term or medium- to long-term, controlling your position and preserving your principal are paramount. For short-term trading, set stop-loss orders and enter and exit quickly. For medium-term trading, you can invest in batches, but absolutely avoid going all in.

However, not all sectors are bleak.

- #SOL : It is still the currency with the strongest performance repair in this round. The target range of this round is 260-300. The short-term suppression by BSC is just an episode.

- #LINK : The leading oracle, the "data steward" of the DeFi world. If you're not watching it now at $15.8, what else can you buy? Conservatively, there's 50% upside.

- #ARB : Whales are quietly accumulating, with 24-hour net inflows exceeding $140 million and TVL exceeding $18 billion. The short-term floor of $0.25 has not been breached. I remain bullish structurally, with targets at $0.58 → $1.18 → $2.43.

- #YGG : The doubled money in the last round has been pocketed, waiting for the 0.12-0.14 range to take over again, the opportunity is approaching.

In real-time trading: WLD exited with a 100% profit, YGG doubled its investment, SOL remained flat, DOGE saw a slight loss, and PEOPLE and JTO were still in a correction phase. The overall strategy remains to wait and see with a light position, with quick in and outs .

A market downturn doesn't mean opportunities are gone. A bear market is never a sign of despair, but rather a period of accumulation for the next bull market. Only those who can maintain a steady mindset and protect their capital will be able to wait for the next takeoff.

——Miao Jie muttered: Don’t be afraid of the market falling, be afraid of not having enough bullets when it falls. The market bottom is never found by copying, but by persevering.

The opportunity is gone in the blink of an eye, so hurry up! Don’t let hesitation delay the best time to make a fortune, and don’t be ripped off by the air coins. Follow Sister Miao and enjoy this bull market together! Communication + V: Mixm5688

If you can't add the WeChat above, you can contact the author on the homepage! QQ: 3806326575