Is the bull still here? No one can say for sure. What really determines the outcome is who survives this round of plunge.

This past week, the familiar scenario repeated itself with the leverage cleanup on the 11th and the forced sell-off on the 17th. Fear was amplified and confidence was eroded, but fortunately, the market did not break the bottom in its second test, and the bottom remains strong.

My biggest lesson this year was blindly increasing my holdings in altcoins and getting trapped. My current holdings are primarily in $SOL, $BNB, and $BGB, which are resilient and generally stable. The truth in the crypto is simple: if you don't withdraw your earnings, they're all illusions.

I won't be adding to my investment going forward. The tail end of a bull market is the most dangerous. With the Fear Index at 30, confidence is even more scarce than the market at this point. If you're panicking, it's a good idea to reduce your holdings on rallies; but if you still believe, hold on to your holdings. The short-term outlook is indeed bearish, but a turnaround is possible in early November. Focus on the US government shutdown, the trade war, and institutional meltdowns.

10.20 Market Analysis:

The market rebounded slightly over the weekend, with the broader market rebounding in small steps.

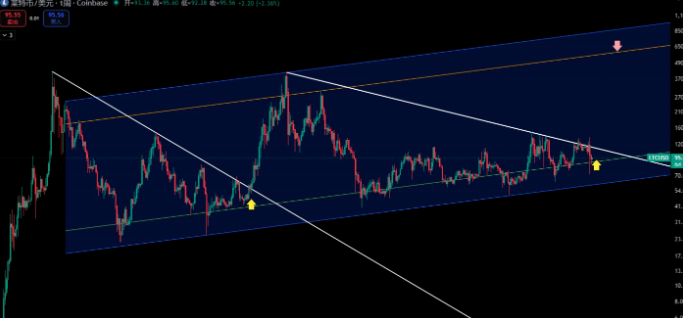

#BTC: The daily chart structure is decent, but it remains in a downward trend. If it can hold above $112,000, upward momentum will open up, with the target range at 116,000–118,000. This week's key level to watch: whether 112,000 can be broken and stabilized.

#ETH: Bullish volume has significantly increased, with a short-term target of $4,150. Last night, a 4H green candle candlestick with large volume broke through the range, followed by two consecutive bullish closes, confirming a true breakout. The MACD fast and slow lines are diverging upward, indicating bullish momentum over Bitcoin. The upper line has shifted from resistance to support. If it holds above resistance, the bullish trend will remain. A "second test" signal has already appeared on the daily chart.

On the macro level: With an expected interest rate cut at the end of the month and no intensification in US-China negotiations, the macro environment is likely to improve in November. The market is currently in a transitional phase between partial bull and bear markets, with no "outright bear market" in sight. New sectors like payments, AI, and forecasting are poised for explosive growth and represent potential investment opportunities. Regarding copycat stocks, it's crucial to invest in leading companies and avoid chasing high prices. Currently, it's more appropriate to invest in primary projects or to profit from them, as the risks of acquiring secondary market shares are high.

Ideas for copycat coins:

#LTC: It has retraced to the bottom support of the channel several times, and the end of the pattern is approaching. You can bet on a rebound with a light position.

#ZIL: Trading sideways in the range of 0.0076–0.0089. A confirmation signal will be generated only if it breaks through the upper limit. Otherwise, it is still in consolidation.

#NMR: 4H formed an ascending triangle structure. When it breaks through the resistance and the volume increases, it may usher in a bullish trend. It is currently in the accumulation stage.

Now is the bottoming period, not the time to escape. Don't ask whether the bull is still there. When the wind picks up again, the winner will give the answer.

——Miao Jie muttered: The market fluctuates, and people's hearts are even more unstable. Remember, only those who can survive are worthy of waiting for the bull market.

The opportunity is gone in the blink of an eye, so hurry up! Don’t let hesitation delay the best time to make a fortune, and don’t be ripped off by the air coins. Follow Sister Miao and enjoy this bull market together! Communication + V: Mixm5688

If you can't add the WeChat above, you can contact the author on the homepage! QQ: 3806326575