Perp DEX (decentralized perpetual swap exchange) has become one of the most explosively competitive sectors in the current on-chain application landscape. Through this research, OKX Ventures aims to systematically chart the evolution of Perp DEX from its inception, explosion, and differentiation. This research also provides an in-depth analysis of representative projects at different stages, showcasing how this core sector continues to reinvent itself amidst the cycle of bull and bear markets and technological advancements.

Based on an in-depth review, we will focus on the rise and fall of two early dominant players, dYdX and GMX. We will also explore how new players like Hyperliquid and Aster have emerged from the fierce competition: Is it due to architectural innovation? Restructuring of trading philosophy? Or the evolution of community economic models?

Through a systematic comparison of successes and failures, this study hopes to reveal the most critical, difficult, yet inspiring "trade-off moments" in the construction of Perp DEX, providing reusable experience and in-depth inspiration for the new generation of entrepreneurs in product, technology, and market strategies.

1. Market Background

1.1 History of Perp DEX Market Development

The core of the first phase was proof of concept and the dawn of Layer 2 (2017-2021). The theory of perpetual DEX/perpetual swap can be traced back to dYdX's 2017 white paper, "dYdX: A Standard for Decentralized Margin Trading and Derivatives," and Hart Lambur's 2019 white paper, "BitDEX: A Decentralized BitMEX using Priceless Financial Contract." In 2020, dYdX launched the first BTC perpetual contract on the Ethereum mainnet, putting the theory into practice. That same year, Perpetual Protocol launched version 1 on the xDai chain. Its innovative virtual AMM mechanism allowed users to trade without order book matching. However, these early explorations were invariably constrained by the performance constraints of the Ethereum mainnet. High gas fees and slow transaction confirmations made the user experience inferior to that of centralized exchanges (CEXs). Daily trading volumes hovered between millions and hundreds of millions of dollars, a tiny fraction of the massive $100 billion traded on CEXs at the time.

The real turning point came in 2021, when, with the maturity of Ethereum's Layer 2 technology, Perp DEX experienced its first surge of growth. Seizing the opportunity, dYdX migrated its product to StarkWare's Layer 2 solution, significantly improving speed and reducing costs. Building on this momentum, dYdX issued a governance token and launched transaction mining in August of the same year. This incentive instantly ignited the market. On September 28, 2021, dYdX's daily trading volume soared to approximately $9 billion, exceeding not only all other DEXs combined but even the same period figures for major CEXs like Coinbase. This milestone demonstrated, for the first time at scale, Perp DEX's potential to challenge CEXs and charted the course for the entire industry: embracing Layer 2 is the only path to growth.

The second phase (2021-2023) was dominated by innovation in the AMM model and the rise of GMX. After dYdX demonstrated the feasibility of L2 order books, the market began exploring more diverse protocol models. GMX, launched alongside the Arbitrum mainnet in September 2021, became the standard-bearer of this new wave. GMX innovatively employed a multi-asset liquidity pool (GLP) model combined with oracle price feeds. With the GLP pool acting as the counterparty for all traders, it achieved the unique advantages of zero-slippage trading and impermanent loss for LPs. GMX's success was due to its precise market selection (positioned early in the Arbitrum ecosystem's growth), its LP-friendly incentive structure, and the shift in market trust brought about by the collapse of centralized giants like FTX in 2022. As a result, GMX rapidly grew in 2022 to become the dominant Perp DEX of the cycle.

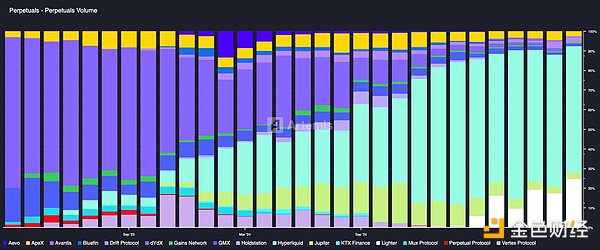

During the same period, projects like Synthetix's synthetic asset perpetual contracts and Gains Network's oracle trading further expanded the Perp DEX landscape. This phase was characterized by a diversification of models and intensified competition. Despite the bear market, Perp DEX trading volume remained resilient, steadily increasing its share of the crypto derivatives market. A key trend was the sharp decline in dYdX's market share from 73% in January 2023 to 7% by the end of 2024, signaling the end of its dominant position. Intensified competition also spurred a battle over the underlying infrastructure: dYdX announced its transition to an independent Cosmos Application Chain (v4), high-performance DEXs such as Mango and Drift emerged on Solana, and specialized application chains such as Sei began to emerge, setting the stage for the arrival of the third wave.

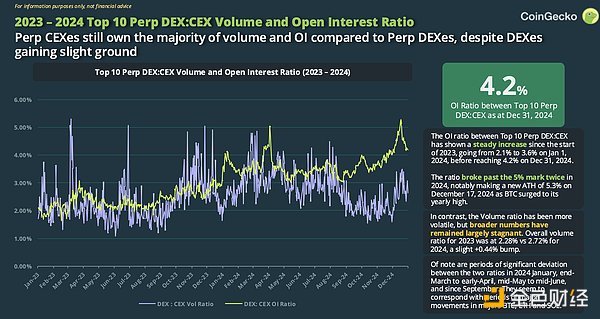

Figure: The overall trend of perp DEX's trading volume and open interests as a percentage of perp CEX is slowly rising in 2023-24.

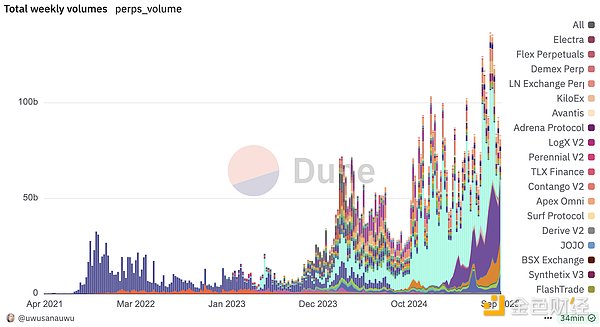

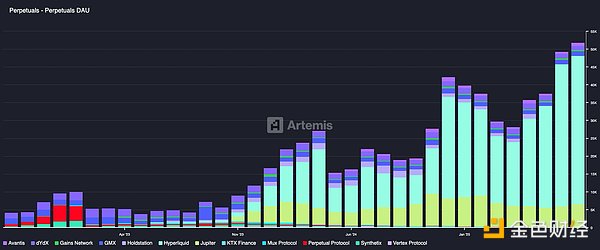

The third phase is the high-performance revolution (2023-present), led by Hyperliquid. This wave is characterized by the pursuit of extreme on-chain performance and a professional trading experience, aiming to truly rival CEX in speed and depth. Hyperliquid launched in early 2023 and achieved exponential growth thanks to its "dedicated high-performance chain + CLOB order book" technical architecture and aggressive market incentives. The tipping point was the HYPE token airdrop on November 29, 2024, which allocated 31% of the total supply to early adopters, greatly stimulating community enthusiasm. Its growth momentum continued after the airdrop, reaching a monthly trading volume of $160 billion by December 2024, with a market share of approximately 66%. On January 19, 2025, Hyperliquid reached a record high of $21 billion in daily trading volume.

The rise of Hyperliquid has completely reshaped the market landscape. In 2024, total perpetual DEX trading volume across the industry reached $1.5 trillion, a year-on-year increase of 138%, with Hyperliquid alone contributing over half of this volume in the fourth quarter. By mid-2025, Hyperliquid held over 75% of the market share, while the former leaders dYdX and GMX saw their shares drop to single digits. Even established projects are actively responding to this challenge: dYdX officially launched its technologically advanced Cosmos standalone chain (v4) in November 2023, decentralizing its matching engine, but this failed to reverse its declining market share; GMX, through incremental improvements, similarly failed to stem user churn. Meanwhile, Jupiter, part of the Solana ecosystem, rapidly climbed to second place in the market, demonstrating the pull of its powerful ecosystem.

The third wave has clarified future technological trends: high-performance on-chain order books have become a key focus. Hyperliquid's success demonstrates the potential for achieving both decentralization and high performance through dedicated chains. However, this also presents a new trade-off: the performance advantages of dedicated chains versus their shortcomings in ecosystem composability. As Multicoin Capital has pointed out, dedicated chains face challenges such as insufficient cross-chain asset support and reliance on bridges. To address this, projects like dYdX and Hyperliquid are working to address these challenges, for example by integrating native USDC or launching EVM-compatible child chains. It is foreseeable that the Perp DEX sector will continue to explore the trade-off between performance and ecosystem, seeking the optimal combination of speed, depth, and DeFi composability.

1.2 Market Data

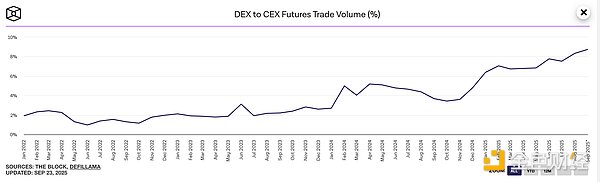

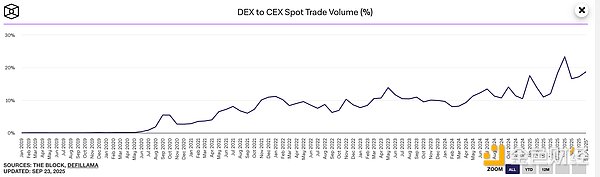

Figure: DEX trading volume divided by CEX Volume: Spot dex is 20%, Perp dex is 8%; Perp dex will grow rapidly after mid-2024

From 2021 to 2023, the market was largely dominated by DYDX and GMX. After DYDX's large-scale token airdrop in August 2021, weekly volume remained around $10 billion, while GMX's weekly volume remained around $2 billion. Hyperliquid emerged around May 2023, maintaining weekly volume between $2 billion and $3 billion until the end of 2023, flipping GMX. By August 2024, it had grown to around $10 billion, flipping DYDX v4.

Figure: From the perspective of market share, Hyperliquid has occupied 50%-70% of the perp dex market since November 2024.

Figure: From the perspective of DAU, after Hyperliquid's airdrop at the end of November 2024, DAU has been maintained at 25k+ for a long time and has increased to 40k in recent months.

2. Building the core modules and fundamental challenges of Perp DEX

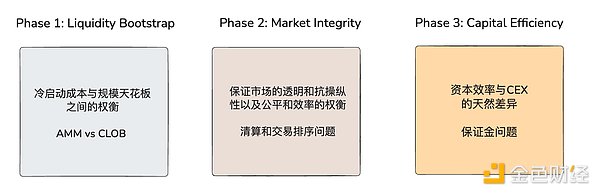

2.1 The Trade-off Between Liquidity Cold Start Cost and Scale Ceiling (AMM vs. CLOB)

The primary challenge Perp DEX faced in its early days was a liquidity cold start, centered around a trade-off between "cold start costs" and "scaling ceilings." This trade-off was primarily reflected in the choice of two mainstream underlying architectures: automated market makers (AMMs) and central limit order books (CLOBs).

1) About the AMM model: the advantages of low threshold startup and inherent scale bottlenecks

The core advantage of AMM-based liquidity pools (typically Oracle-based AMMs, such as the architecture used by GMX) lies in their significantly lower barrier to entry for liquidity provision through the design of the LP Pool. Any user can deposit assets into the pool to become a liquidity provider, enabling the protocol to quickly and cost-effectively aggregate initial liquidity early on, effectively addressing the cold start challenge. However, this architecture also presents two interrelated inherent bottlenecks that limit its scalability:

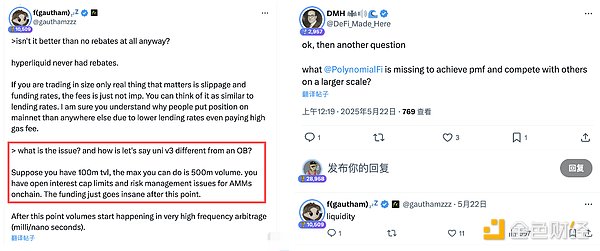

Bottleneck 1: LPs' passive risk exposure and the difficulty of attracting professional market-making capital. The essence of an AMM liquidity pool is that it serves as a collective counterparty for all traders. This model is passively managed, and LPs cannot actively manage their quotes and risk like order-book market makers. This directly exposes LPs to directional risk: when traders' positions collectively skew in one direction (for example, a large number of long positions in a bull market), the LP pool must assume a net short position in the opposite direction. If the market continues to move in a unilateral direction and traders collectively profit, the LP pool will suffer corresponding systemic losses. Although GMX v2 introduces a dynamic funding rate mechanism compared to v1, which somewhat balances the holding costs of long and short positions and mitigates the risk skewness of the pool, this is still limited by the underlying mechanism's risk mitigation rather than its elimination. For large-scale professional market-making capital seeking precise risk control and active strategy execution, this passive, collective risk exposure has limited appeal. Therefore, a pure AMM pool model is more difficult to attract top-tier market makers than an order-book model.

Bottleneck 2: TVL Caps Open Interest. The aforementioned risk model directly necessitates that AMM protocols impose a hard cap on the total amount of open interest they can support. The size of this cap is directly related to the protocol's TVL. To protect the solvency of the LP pool and prevent bad debts from extreme market volatility or over-skewed positions, the protocol must limit its risk exposure, meaning that total OI cannot grow indefinitely. This cap is typically set as a multiple of TVL (the total OI cap is approximately 5 times TVL, depending on asset volatility and the protocol's risk management parameters). For example, for a liquidity pool with $100 million TVL, the protocol might cap the total OI of both long and short positions at $500 million to mitigate risk. Once OI approaches this threshold, the protocol's risk control mechanisms (such as a sharp increase in funding rates) kick in, significantly increasing the cost of holding positions and discouraging users from further opening unbalanced positions. This design is particularly critical during periods of high volatility or consistent market sentiment. While it ensures protocol security, it also clearly limits market growth potential.

Figure: Polynomial founder Gautham is discussing order book vs amm in perp DEX application

2) Regarding the order book model: High ceiling advantage and severe cold start challenge

The CLOB (Central Limit Order Book) model is a well-established paradigm in traditional financial markets, such as stock and futures exchanges, and is also adopted by many high-performance Perp DEXs, such as Hyperliquid. Its core mechanism facilitates transactions by directly matching limit orders submitted by buyers and sellers in a peer-to-peer manner.

The order book model fundamentally circumvents the scale limitations faced by the AMM pool model in its underlying design.

• Decoupled liquidity and risk : Unlike relying on a single liquidity pool as a collective counterparty, order book liquidity is decentralized and provided by numerous independent market makers and order makers. Trades are directly matched between buyers and sellers, and risk is transferred between individuals rather than concentrated in a single pool.

• Unlimited OI Cap : Because it doesn't rely on a fixed TVL (TVL) for the liquidity pool, the order book model's Open Interest scale is theoretically unlimited. Its upper limit depends solely on the total liquidity and risk-bearing capacity of all market participants. As long as there are sufficient market makers and traders participating, the market size can continue to grow.

• Superior trade execution quality : This competitive pricing environment enables better price discovery. For large trades and high-frequency arbitrage strategies, the order book provides extremely low slippage and tighter bid-ask spreads, deeper liquidity, and more accurate pricing.

Overall, the order book model is an ideal choice for carrying large-scale, professional market-making liquidity. Its theoretical scale ceiling is extremely high and it is generally regarded as the final form of Perp DEX's maturity.

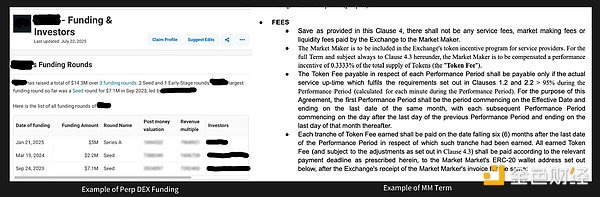

However, the enormous advantages of the order book model come with a significant challenge—high cold-start costs. A healthy and active order book market presupposes the presence of multiple professional market makers who consistently provide deep, tight, two-sided quotes from day one. However, market makers are only profitable when there is sufficient taker flow, while traders are only willing to enter the market when there is sufficient liquidity. This creates a classic "chicken and egg" dilemma. To break this deadlock, new platforms must invest substantial capital and resources in the early stages of operations, attracting and coordinating the entry of the first batch of market makers through market maker incentive programs (such as token rewards and fee rebates).

Figure: A recent Twitter post titled "Deadly Perp DEX Traps (and the Paths Out)" reveals that if a team charges a 0.035% fee, after distributing it to market makers and rebates, they may only have 0.015% left. Assuming the team's monthly operating costs are $500,000, they need at least $111.1 million in taker orders per day to break even.

2.2 Establishing fair market rules

After solving the initial liquidity problem of Perp DEX, the core challenge shifted to issues related to market integrity, including transparency, anti-manipulation, and the trade-off between fairness and efficiency. These issues are mainly reflected in transaction sorting and liquidation mechanisms.

1) Regarding transaction ordering: a game of fairness vs. efficiency

In a blockchain environment, the final order in which transactions are packaged directly determines their outcomes, giving rise to the phenomenon known as MEV. This problem is particularly acute in Perp DEXs, where the nature of leveraged trading amplifies price sensitivity. MEV strategies such as front-running and sandwich attacks can exponentially increase user losses in a leveraged environment, hindering the participation of ordinary retail traders and making market makers' orders vulnerable to exploitation by high-frequency traders (HFTs), leading to sustained losses and exposure to so-called "toxic flow."

This forces protocol designers to face a fundamental trade-off: prioritize fairness, protecting ordinary users and small market makers from exploitation by MEV, or prioritize efficiency, allowing fierce competition among HFTs to drive deeper liquidity and faster price discovery. This is a philosophical choice with no perfect answer, and different protocols offer vastly different responses.

Hyperliquid's design clearly favors a protectionist approach, prioritizing fairness. To achieve this, the protocol introduces key mechanisms known as "speed bumps," including: mempool buffering ( which provides approximately three blocks of processing time for transactions) and Cancel Order First ( in the matching engine, cancel orders are prioritized over new orders). This design provides a strong layer of protection for makers, especially small and medium-sized market makers. When they detect a loss-making taker order entering the mempool, they have ample time and authority to preemptively cancel or modify their orders, thus avoiding being targeted by HFT strategies.

Opponents like GTE, however, favor a Darwinian approach that prioritizes efficiency. They argue that while Hyperliquid's "speed bump" mechanism protects some participants, it does so at the expense of overall market efficiency and potentially limits the depth of liquidity. Their argument is that true market efficiency and price discovery stem from unfettered, fierce competition among the top, most sophisticated market makers. This is because top exchanges, whether in crypto or in traditional finance like Nasdaq and CME, lack similar protective "speed bumps" for market makers. The majority of trading volume on top exchanges stems not from "market maker versus retail investors" but from "market maker versus market maker." Protecting vulnerable market makers, allowing them to easily avoid losses, effectively undermines the profitability of top market makers with true alpha (excess return) potential, potentially squeezing them out of the market and ultimately harming overall liquidity.

2) Regarding the liquidation mechanism: balancing transparency and resistance to manipulation

The liquidation mechanism is the lifeline of any leveraged trading protocol. Its core mission is to prevent the accumulation of systemic risk by forcibly closing positions when losses exceed margin coverage, thereby maintaining the protocol's solvency and overall user trust. However, this seemingly simple safety valve is incredibly complex to design, as it must strike a delicate balance between multiple, conflicting objectives: transparency, fairness, anti-manipulation, sensitivity, and stability.

The difficulty of the liquidation mechanism lies in the price used to determine whether a position should be liquidated. If the platform's internal last traded price is used directly, a single large transaction or a small trade during periods of liquidity depletion could cause sudden and drastic price fluctuations, triggering a large number of undesirable "unfair liquidations." To address this issue, the industry generally adopts a mark price mechanism. The mark price is not a single transaction price, but rather a synthetic price designed to reflect the "fair value" of the asset. It is typically derived by aggregating spot prices from multiple mainstream, highly liquid markets (such as the median or weighted average on Coinbase) and smoothing it using factors such as funding rates. The mark price is only used to calculate unrealized profit and loss and determine liquidations, while the last traded price is used to settle realized profit and loss. This design greatly improves the fairness and resistance to manipulation of liquidations: due to the diverse and decentralized price sources, it is difficult for a single entity to manipulate multiple markets simultaneously, effectively filtering out isolated abnormal fluctuations and ensuring the objectivity of the liquidation basis.

Figure: Hyperliquid's XPL incident: On August 26, 2025, a whale drove the price of the XPL token from $0.6 to $1.8 in a matter of minutes, liquidating $25 million worth of short positions. Meanwhile, the CEX price remained stable. This is because in the pre-market, where there's no reliable external price source, internal prices are easily manipulated.

However, in the pursuit of a perfect mark price, protocol designers also face the dilemma of sensitivity versus stability. This dilemma is well summarized in Yaoqi's recent article, "Oracle, Oracle, Oracle: How Price Feed Design Turned $60 Million Into a $19 Billion Catastrophe." A highly sensitive oracle that closely tracks real-time market fluctuations, while able to promptly reflect price fluctuations, is also more susceptible to short-term manipulation. For example, the recent $60 million USDe sell-off was completely absorbed by its sensitive oracle, ultimately triggering a cascading liquidation of $19.3 billion. Conversely, an oracle designed to be overly stable (e.g., using an excessively long time window for TWAP)—while resistant to short-term manipulation—may be slow to react to a genuine, sustained market decline. This sluggishness can cause the protocol to miss the optimal window for liquidating losing positions, leading to the accumulation of bad debt risk and potentially even more severe systemic deficits.

2.3 Margin Capital Efficiency Issues

Margin capital efficiency is another challenge Perp DEX faces when competing with centralized exchanges, and it's an area designers are continuously improving. For example, Kyle Samani's 2020 articles "DeFi's Invisible Asymptotes" and "On Forking DeFi Protocols" both mentioned early on that this direction would be a focus of future development. The fundamental reason for the difference in margin efficiency between Perp DEX and CEX lies in the differences in their underlying architectures:

1) The high efficiency of CEXs is rooted in their core principle of "centralized trust." Users completely entrust the custody of their assets and the execution of trades to a single entity. This entity thus possesses a holistic perspective, acting like a central brain, providing real-time insight and calculation of the total risk exposure of all users on the platform. This omniscience enables easy implementation of complex risk hedging. For example, when a user holds both long and short positions, the CEX can identify that their net risk is virtually zero, significantly reducing margin requirements. More importantly, because the CEX effectively controls users' assets, it can re-trade or lend funds that are temporarily idle and used as margin, generating additional returns for users. This essentially recycles idle capital.

2) Perp DEX's design philosophy is precisely the opposite. Its first principle is "code is law," and the system's security relies not on any intermediaries but on transparent smart contracts. This principle grants users absolute sovereignty over their assets, but it also imposes profound constraints. To serve as margin, users' assets must be authorized with their private keys and "locked" in a specific smart contract. This locking process is rigid and isolated. Once capital enters a contract's vault, it is isolated, its sole purpose serving to support that single position. It cannot flow elsewhere, nor can it be used to generate interest like in CEXs. This leads to severe capital fragmentation, with each transaction acting like an independent risk island, requiring its own dedicated margin to maintain security.

This asset isolation and risk atomization leads to two consequences: First, it makes it difficult for protocols to identify hedged positions. Because smart contracts cannot see a user's behavior in other contracts, they can only mechanically require users to provide sufficient collateral for each opposing position, forcing users to carry out unnecessary over-collateralization. Second, the modular nature of DeFi leaves lending and trading protocols operating independently, making their liquidation logic and risk parameters difficult to reconcile. This makes it difficult for capital to flow seamlessly between the two systems, further exacerbating capital fragmentation.

To address these challenges, various solutions have emerged within the industry. Marginfi's unified collateral pool and Drift Protocol's multi-subaccount mechanism can be seen as "simulating" centralized efficiency within a decentralized framework. Through more complex contract design, they attempt to re-integrate users' fragmented capital, creating a shared margin environment similar to a CEX within the protocol, thereby enhancing flexibility. GMX's GLP pool takes a different approach, concentrating risk in a single liquidity pool and simplifying the counterparty model.

Tarun Chitra and the Bain Capital team recently published a paper titled "Perpetual Demand Lending Pools," addressing the challenges of integrating perpetual swap (PEX) and lending models. Their proposed "Perpetual Demand Lending Pool" (PDLP) represents a first-principles reconstruction. Rather than attempting to mimic the functionality of a CEX, it returns to the essence of financial risk, viewing perpetual swap trading and lending as two sides of the same coin. This model posits that the risk of a long position is essentially equivalent to borrowing the underlying asset, while a short position is equivalent to borrowing a stablecoin. Based on this insight, PDLP unifies these two aspects into a holistic framework, creating a unified asset pool where capital serves as both trading margin and lending liquidity.

3. Perp Dex Operational Data Comparison

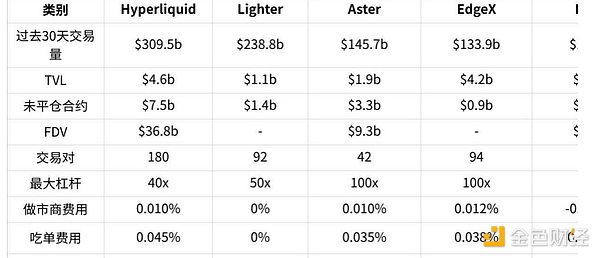

Data source: defillama, perpetualpulse.xyz (October 20, 2025)

The core of liquidity is "how quickly traders can complete a transaction with minimal cost." This cost includes the bid-ask spread, slippage, and transaction fees. To quickly attract users in the early stages, many platforms use token incentives to stimulate trading. This has the direct negative impact of leading to widespread "wash trading"—users frequently engage in fake trades to earn rewards. While this type of trading inflates the platform's "trading volume" figures, it doesn't generate real liquidity. When incentives are reduced, this false boom disappears (a prime example being dYdX) .

A key indicator of healthy liquidity is the ratio of open interest to trading volume (OI vs. Volume). According to OI/Volume data provided by Coinglass, Binance's ratio is 92%, OKX's is 80%, and Bybit's is 184%. In comparison, many Perp DEXs that rely on token incentives have very low ratios, indicating that their trading activity is more about wash trading than actual holdings. However, this alone shouldn't be used as the sole reference; it's important to extend the timeframe and examine the behavior of major active addresses . (Recently, the OI to volume ratio has become a source of conflicting narratives in many project communities, such as those of Hyperliquid and Lighter .)

Data source: perpetualpulse.xyz (October 20, 2025)

4. Comparison of the four hottest Perp Dex projects: Hyperliquid, Aster, Lighter, and edgeX

4.1 Hyperliquid

4.1.1 Founder Jeff's Trading System Design Philosophy - Transprent Market, Non-toxic Flow

In June of this year, Hyperliquid founder Jeffrey P. Miller took to Twitter and podcasts to discuss his controversial "Transparent Market" trading system philosophy, which challenged traditional market structures and garnered widespread industry attention. A deeper understanding of his thesis is crucial to understanding the disruptive nature of Hyperliquid's development. The following explanation is divided into two parts: clarifying user fundamentals and risks, and establishing fundamental principles.

I. Core Motivations of Market Participants and Risk Analysis

Market Participant Goals : In a trading market, participants' goals can be clearly divided into two categories. The core goal of liquidity demanders (Takers) is to achieve "best execution," meaning completing trades at the best price, with the fastest speed, and with minimal market impact. The core goal of liquidity providers (Makers or market makers) is to earn the spread by continuously providing buy and sell quotes. However, the primary risk they face is trading losses due to information asymmetry.

Core Risk Identification: "Toxic Flow": The core risk faced by market makers manifests itself in the form of "toxic flow." This type of trading involves arbitrage exploiting asymmetric technical advantages, which instantly invalidates the market maker's quotes, resulting in losses upon transaction. In contrast, "non-toxic flow"—trading that doesn't rely on instantaneous information advantages, such as buying and selling to establish long-term positions—poses a much lower risk to the market maker. Therefore, the rational strategy for market makers is to avoid trading with "toxic flow" while actively serving "non-toxic flow."

The impact of market transparency on market maker behavior: Market transparency directly determines market maker behavior. In opaque markets, unable to distinguish between toxic and non-toxic flows, market makers are forced to adopt defensive strategies, widening bid-ask spreads and reducing order book depth to protect themselves. However, this increases transaction costs for all liquidity demanders, including non-toxic traders. In contrast, in fully transparent markets like Hyperliquid, publicly available on-chain addresses and historical behavior enable market makers to identify and assess counterparty intentions. When they can identify lower-risk non-toxic flows, their perceived risk is significantly reduced, leading them to be more willing to offer narrower spreads and better liquidity depth, ultimately allowing non-toxic demanders to achieve their trading goals at a lower cost.

II. Ideal Market Design Principles Based on the Above Analysis

The Counterparty Principle: At its core, the quality of a transaction is fundamentally determined by the identity and intentions of the counterparty. The conventional wisdom holds that dark pools or OTC platforms offer superior execution due to their "privacy," but Jeff believes this is a misunderstanding. Their true advantage lies in screening counterparties through an access control system, excluding "toxic flows." "Screening" is the fundamental reason, while "privacy" is merely a means to achieve it. Hyperliquid's solution is more radical. Through fully transparent on-chain addresses, the actions of all participants are public, allowing the market to perform its own screening. Market makers, based on publicly available trading history, proactively partner with reputable "non-toxic" traders and avoid "toxic" addresses with arbitrage intentions. This creates a more efficient and decentralized screening mechanism.

The Competition Principle: It adheres to a fundamental economic principle: the best price comes from maximum competition. Jeff argues that in traditional OTC trading, a large trader might only be able to inquire about prices from a handful of market makers, limiting the scope of competition. However, in a transparent on-chain marketplace like Hyperliquid, trading intentions can be broadcast to all market makers on the platform. This incentivizes hundreds or even thousands of market makers to fiercely bid for predictable, "non-toxic" orders, continuously driving down their own bids. Maximizing competition inevitably leads to optimized execution quality, as any bid attempting to extract excess profits will be instantly replaced by a more competitive counterparty.

The Repeated Games Principle emphasizes the fundamental difference between participant behavior in one-time transactions and long-term relationships. In anonymous markets, transactions are one-time games, and the optimal strategy for participants may be to maximize their own interests at the expense of their opponents, leading to widespread distrust. Hyperliquid transforms the market into a repeated game scenario through immutable on-chain addresses. Every action taken by each address builds its own reputation. If an address frequently conducts "toxic" transactions, it will quickly be identified and avoided by the market maker community. To maintain a reputation that allows for continuous trading, all participants are more motivated to behave honestly and predictably, thereby driving the market towards a healthier and more benign equilibrium.

The Full Transparency Principle: Information asymmetry is the most dangerous state in information processing. The worst-case scenario is when information is known only to a select few. For example, if an insider on a centralized platform knows the location of a user's stop-loss order, they can precisely "hunt" that order without external competition. The optimal state is complete information symmetry, meaning everyone knows it. When stop-loss orders are known to everyone, any attempt to trigger liquidation by slashing prices will be foreseen by other rational market participants. These participants will act as "anti-hunters," placing buy orders near the stop-loss price to acquire cheap chips, making hunting extremely costly or even unprofitable, thus forming a self-defense mechanism for the market.

4.1.2 Hyperliquid Products and Technology Implementation

Hyperliquid's excellence lies not only in its groundbreaking "transparent market" theory but also in its ability to seamlessly translate this philosophy into a high-performance, fully vertically integrated trading system through robust full-stack engineering capabilities. Every technical decision precisely serves the four principles of Jeff's design philosophy mentioned above (counterparty, competition, repeated games, and full transparency).

1. Building HyperCore, a dedicated L1 public chain for optimal execution

Faced with the common question of "which public blockchain should it be built on?", Hyperliquid's answer was "become that blockchain ourselves," a move that was a non-negotiable choice within its product vision . (Some also believe that Hyperliquid may have been backed by professional market makers from the very beginning, and that they only accepted order book, so "ultra-high performance" and "the ability to place and cancel orders comfortably before takers" naturally became Hyperliquid's core design points.)

Jeff's "competitive principles" require the system to be able to handle the massive, high-frequency order updates and bidding from global market makers. Hyperliquid's L1 is "specifically designed to support high-frequency order book trading and near-instant trade finality." In practice, it has supported processing capabilities of up to 100,000 orders per second, physically reducing the space for "toxic flows" to exploit latency for arbitrage.

2. Speed Bump and Cancel Order First Mechanisms Protect Market Makers

Hyperliquid's speed bump mechanism, also known as the cancel order first system, is a core design feature of its L1 blockchain. This mechanism prioritizes cancel orders during block execution, prioritizing other orders that require immediate execution. This essentially provides a short "buffer period" for market makers, allowing them to adjust or cancel their bids before taker orders are executed. Meanwhile, taker orders are buffered in the mempool for approximately three blocks, mitigating the risk of makers being "sniped" by fast-moving taker orders.

Why this design: The core purpose of this mechanism is to protect market makers from toxic flow, allowing them to more confidently provide liquidity without worrying about HFT takers quickly picking up outdated quotes. This aligns closely with founder Jeff's thesis: he believes that traditional order books often lead to a "loser's curse" between HFT takers and makers, where makers are hit by takers before they can cancel their orders, leading to degraded liquidity, widened spreads, and ultimately compromised execution quality for end users (such as retail traders). By prioritizing cancellations, Hyperliquid optimizes the end-user experience, encouraging makers to provide tighter quotes and deeper liquidity rather than maximizing trading volume or fees. The design also prioritizes decentralization: a dedicated L1 chain ensures the platform remains solvent during extreme volatility and allows community liquidity pools like HLP (Hyperliquidity Provider) to step in when makers retreat, enabling profitable liquidity provision. Overall, this is an improvement over traditional CLOBs, prioritizing retail and maker traders over toxic takers, thereby building a fairer and more efficient ecosystem.

Community Commentary: While this mechanism is effective (Hyperliquid currently has a high percentage of retail users, resulting in a good trading experience and depth), it has also sparked controversy. Critics like the GTE team believe it restricts HFT MM transactions, thereby limiting overall trading volume growth and potentially making it difficult for Hyperliquiquit to flip Binance. Others, like Dan Robinson, have a positive view of the mechanism.

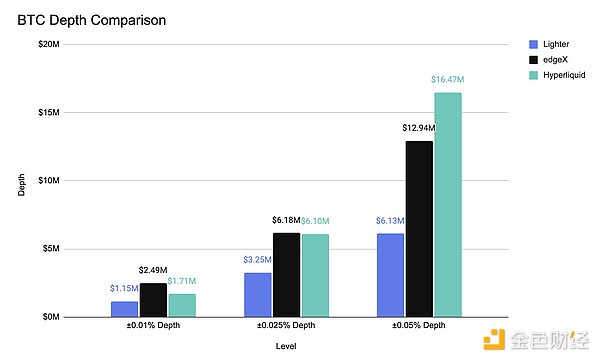

Figure: BTC Trading Pair Depth Comparison (Hyperliquid, Lighter, EdgeX). @andyandhii conducted a test using one-hour data from Lighter, EdgeX, and Hyperliquid. The results show that Hyperliquid maintains depth even when handling large orders exceeding $16 million, and its performance is comparable to EdgeX for orders of $6 million, demonstrating that Hyperliquid is indeed the best venue for large traders.

3. Redefining “Decentralization” — A Fully On-Chain Central Limit Order Book (CLOB)

To understand the core technology of Hyperliquid, one must first understand its redefinition of the term "decentralization." In a recent article titled "Deadly Perp DEX Traps," a collaborative effort by EdgegX, GTE, and others analyzing the challenges of Perp DEX development, there's a line: "Decentralization is often misused in the Perp DEX space—most Perp DEXs simply shift centralized risk from the "custody layer" to the less visible "execution and settlement layer."

Hyperliquid's solution is to run all core components—order books, matching, and clearing—entirely on a transparent chain, ensuring that the protocol cannot unilaterally interfere with or liquidate user funds. This means that any movement of funds (whether trades or liquidations) must strictly adhere to public, verifiable, and hard-coded rules within the on-chain protocol. No single "administrator" or "centralized server" can override these rules. The ultimate technological form for achieving this goal is a fully on-chain CLOB.

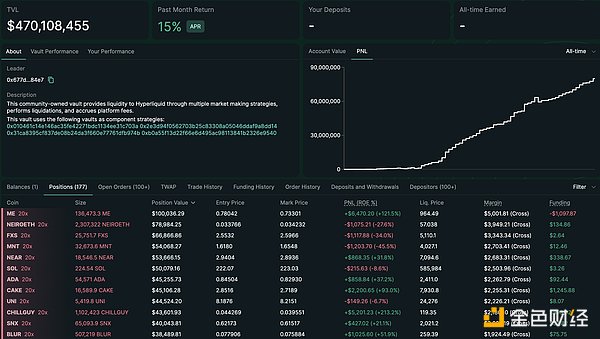

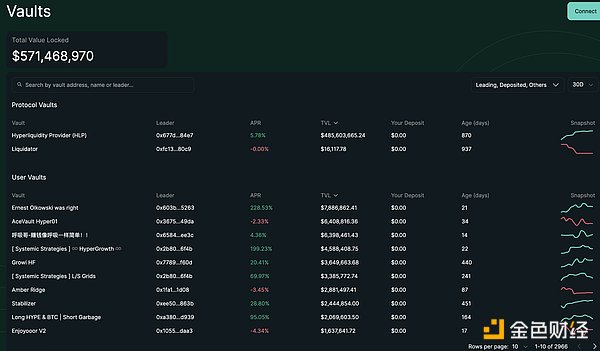

4. Liquidity Engine HLP — Two roles: Market Making + Backstop Liquidations

After building a fair and transparent CLOB framework, Hyperliquid faced the challenge of injecting initial and ongoing liquidity. Its solution wasn't a one-time, fully decentralized approach, but rather a phased evolution centered around the Hyperliquidity Provider (HLP). Initially, the protocol's built-in "Protocol Vault" would assume the responsibility of providing a safety net for market making and clearing, and then gradually delegate liquidity to open, community-based Maker Vaults.

HLP Bootstrapping Trading Liquidity: Hyperliquid first established a framework called "Market Making Vaults," with the team leading the operation of its flagship market making vault, HLP. The founding team personally guided early liquidity, with the vision of "democratizing market making." HLP charges no management fees, and profit and loss are shared proportionally to depositors (currently at $80 million). While strategies currently operate off-chain, positions, pending orders, trading history, deposits, and withdrawals are all visible on-chain in real time for anyone to audit.

Founder's Background and Strategy: Jeff Yan leveraged his market-making experience at Hudson River Trading, a top quantitative firm, to proactively manage HLP through professional strategies. He "synthesized" a core AMM-like experience for early users: an always-on, permissionless counterparty. However, HLP's market-making strategy is passive, accounting for less than 2% of the platform's total trading volume; the vast majority of trading occurs between non-HLP users.

The difference between HLP and GLP (LP pool of GMX):

Using HIPs (Hyperliquid Improvement Proposals) to improve the sky towards decentralized autonomy : After HLP completed the historical mission of the first phase of cold start, Hyperliquid gradually returned the power of liquidity supply to the market through community governance proposals HIPs.

HIP-1: Native Token Standard — A transparent and open mechanism for listing new assets. Liquidity presupposes the availability of liquid assets. HIP-1 is the first step towards decentralization, establishing a transparent, market-based mechanism for issuing new assets. Through USDC auctions, any project can compete for listing rights (a Dutch auction, where a new listing right is publicly auctioned every 31 hours, starting at twice the previous price, then gradually decreasing until a buyer purchases). This addresses the issue of listings relying on centralized review and an opaque process, bringing a steady stream of fresh liquidity to the order book.

HIP-2: Hyperliquidity — Ensuring Baseline Liquidity for Newly Listed Long-Tail Assets. HIP-1 introduced new assets, but initial liquidity for these long-tail assets presented a new challenge. To address this, Hyperliquid launched HIP-2: an automated market maker strategy that combines passive liquidity provision with CLOBs. Think of Hyperliquidity as akin to an automated robotic liquidity provider that lives inside the order book. When a new HIP-1 token is launched, the deployer can initialize the Hyperliquidity strategy with some USDC and define a price range. The protocol then automatically places buy and sell orders symmetrically within the range, updating it every block (approximately every 3 seconds). This essentially acts as a grid market maker, ensuring that even newly listed tokens have base liquidity from day one.

5. HyperEVM — the smart contract layer on Hyperliquid L1

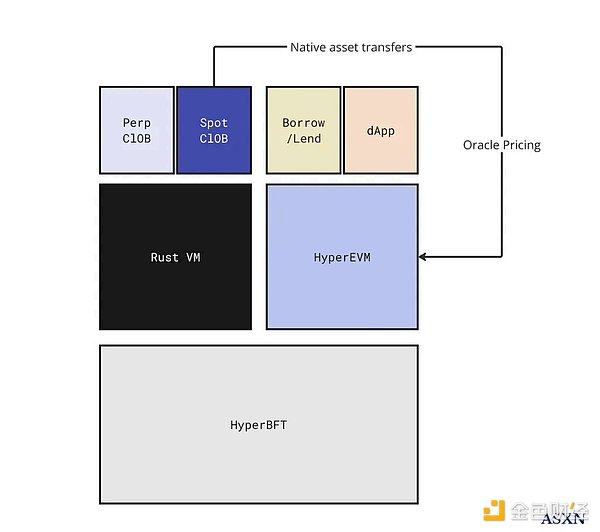

Summary: HyperEVM and HyperCore constitute the two major engines on Hyperliquid L1, one focusing on exchange business and the other supporting generic smart contracts development. The two engines share a Unified State.

Figure: Hyperliquid Chain: HyperCore (Rust VM) + HyperEVM Architecture

Compare the entire Hyperliquid to a high-performance computer:

• Unified State: All data, whether it is order book status, user margin, or EVM smart contract code and storage, is stored here

• HyperBFT consensus: The operating system kernel. Its sole responsibility is to receive all incoming instructions (transactions), sort them, and package them into an immutable set of instructions (blocks) that tells the computer what to do next.

• HyperCore (RustVM) and HyperEVM: HyperCore is a dedicated processor designed for trading that handles specific tasks such as order book matching and liquidation with extreme efficiency; HyperEVM is a general-purpose processor that can execute any smart contract instructions that comply with Ethereum standards.

• When a new block is generated, HyperBFT distributes the instruction set to the corresponding processors. Transaction instructions are executed by HyperCore, and smart contract instructions are executed by HyperEVM, both of which read and write the same unified state.

• Specific use cases: Seamless process from idea to on-chain market:

• Tokens issued by projects on HyperEVM can be directly listed and traded on HyperCore

• Deploy contract: A project can use standard EVM tools (such as Hardhat) to deploy its ERC20 token contract (such as XYZ) on HyperEVM.

• Online Trading: The project party can directly participate in the HIP-1 spot auction on HyperCore without any permission, creating a native order book market for its XYZ token.

• State Link: The protocol links the contract address on HyperEVM with the spot assets on HyperCore.

• Seamless experience: From now on, the XYZ tokens held by users can be used in HyperEVM's DeFi applications and traded on HyperCore's high-performance order book.

4.1.3 Hyperliquid Business and Ecosystem Operation Strategy

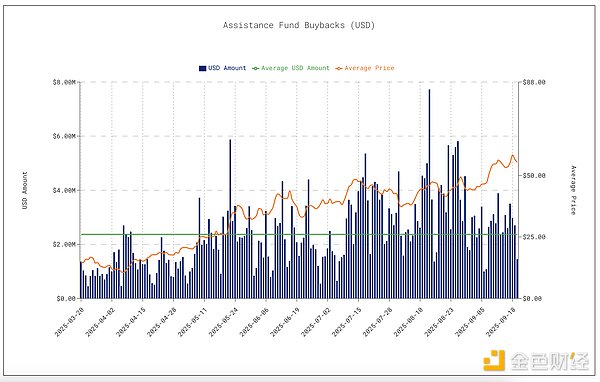

1. Protocol Income Distribution and Token Repurchase

Hyperliquid's main source of revenue is transaction fees, and monthly fee revenue has reached tens of millions of dollars in 2025 - its annualized revenue runway is close to $1 billion (about $83 million per month), reflecting the huge transaction scale of the protocol.

Hyperliquid adopts a highly transparent and community-oriented revenue distribution strategy, returning nearly all protocol revenue to token holders and the ecosystem to avoid the "team sell-off" phenomenon common in traditional projects. 97% of transaction fee revenue is used to repurchase HYPE tokens and fund the ecosystem . This portion of funds goes to the "Assistance Fund," which continuously repurchases HYPE tokens through the secondary market, achieving a permanent deflationary burn plan. Only 3% of transaction fee revenue is allocated to the HLP market-making treasury to incentivize liquidity providers.

Figure: 97% of transaction fee income is remitted to the Assistance Fund, which continuously repurchases HYPE through the secondary market.

2. Market Making Funds

The HLP Vault is the core market-making and liquidation mechanism of the Hyperliquid protocol. It serves as the platform's passive market maker and liquidator of last resort, similar to an exchange's "insurance fund" combined with a "market-making pool." Any user can deposit USDC into the HLP Vault and participate in the profits and losses of the market-making strategy, democratizing the profit opportunities traditionally reserved for professional market makers to the general public .

HLP strategies run automatically in the background (some strategies are currently executed off-chain, but position and funding changes are publicly visible on-chain), assuming the responsibility of matching counterparty liquidity in the order book and handling forced liquidation positions. In return, the HLP vault receives a portion of the protocol's handling fees (approximately 3% as mentioned above) and liquidation proceeds, which are used to increase the vault's yield.

Since its launch in mid-2023, the HLP vault has seen significant growth in size and performance: its TVL quickly climbed to $500 million. Its annualized yield has reached 8-15% between 2023 and 2024. More importantly, its returns are lowly correlated, or even negatively correlated, with crypto market trends, achieving impressive risk-adjusted returns amidst relatively low volatility. (For example, from mid-2023 to 2024, HLP's correlation with BTC was -9.6%, with a significantly higher Sharpe ratio than BTC.) This makes HLP particularly attractive to users: it offers a stable source of income distinct from simply hoarding coins while also providing a degree of hedging against the risk of a single market trend.

In terms of risk management, the HLP vault employs a loss isolation principle, ensuring that even vault losses do not impact other parts of the protocol. Each trading market and account uses margin on a per-position basis, ensuring that losses incurred in one asset do not spill over into other asset markets. When a leveraged position is liquidated, HLP's liquidation module (also known as the Liquidator Vault) first attempts to close the position through order book matching. If market liquidity is insufficient to close the position and there is a risk of bad debt, the protocol activates the Auto-Deleveraging (ADL) mechanism, using unrealized gains from profitable positions in the underlying asset to hedge losses. This mechanism is only triggered in extreme circumstances and is rarely used.

Token Airdrop

Hyperliquid has adopted an aggressive community-driven token distribution strategy: a combination of large-scale airdrops and trading incentives to rapidly build user engagement and convert users into shareholders. During the HYPE token TGE at the end of November 2024, 31% of the total supply was airdropped directly to early adopters, reaching over 100,000 active Hyperliquid traders.

4. HIP-3 Decentralized Market Deployment Mechanism — Building Hyperliquid into the “AWS of Liquidity”

HIP-3: Builder-Deployed Perpetuals is a major upgrade Hyperliquid will launch in 2025. It delegates the creation of perpetual contract markets from validator governance to the community and third-party developers, enabling a fully permissioned deployment mechanism across the entire chain. Previously, launching new markets relied on inefficient centralized processes. HIP-3, through auction and staking models, opens up market creation and stimulates external innovation. Ventuals, a perpetual project currently in the pre-IPO market, is part of the HIP-3 ecosystem.

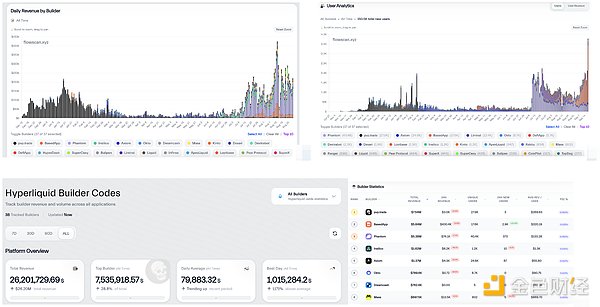

5. Builder Code – Finding More Growth Engines from the Front End of Traffic Entrance

Builder Codes is an innovative product launched by Hyperliquid that provides a protocol-native, programmable business model for third-party developers (such as wallets, other front-end trading applications like prediction markets, trading bots, etc.). Its core logic abandons simple API calls and replaces them with a rigorous on-chain workflow.

Take Phantom's partnership with Hyperliquid's Builder Codes in July of this year as an example: the Builder Code mechanism allows Phantom to route user transactions to Hyperliquid's order book through a custom interface, allowing Phantom to earn additional fees from these transactions. The total fee paid by the user is a combination of Hyperliquid's base transaction fee and the Builder (Phantom)'s additional routing fee.

Data Source: https://www.flowscan.xyz/

6. USDH

USDH is the native USD stablecoin of the Hyperliquid ecosystem, designed to replace the dominant USDC on the platform and capture significant interest income flowing back into the ecosystem. In September 2025, Hyperliquid launched an open bidding process, attracting proposals from giants such as Paxos, Frax, and Ethena. After nine days of validator voting, Native Markets emerged as the winner.

The $5.5 billion USDC on the Hyperliquid chain primarily consists of USDC held by users as margin or liquidity. The interest generated by these funds (approximately $200 million per year) is retained by USDC issuer Circle for its operations and profits, rather than being distributed directly to USDC holders. This is because USDC is an interest-free stablecoin; holders only benefit from a 1:1 USD peg, while the issuer earns income from managing its reserves.

Now, let's switch to Native Markets issuing USDH. The situation is similar: USDH is also an interest-free stablecoin. Native Markets doesn't plan to pay any interest directly to USDH holders (i.e., 0%). However, they have pledged to use 100% of the net interest income generated from its reserves for the Hyperliquid ecosystem: 50% will be allocated to the Assistance Fund to repurchase HYPE tokens from the secondary market (increasing HYPE's value), and the other 50% will be used to expand USDH's use cases, such as incentivizing Builder Code front-end integration, using USDH for pricing in the HIP-3 market, user incentives, and partnerships. This means that USDH holders won't receive interest directly, but will indirectly benefit from ecosystem growth (such as higher liquidity, incentives, and HYPE appreciation if they also hold HYPE). This design aims to "internalize" returns within Hyperliquiquit, rather than having them flow outward like USDC.

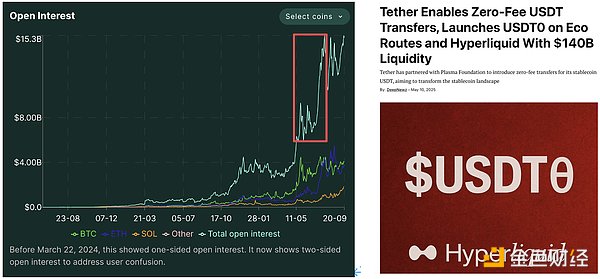

PS: Speaking of stablecoins, it’s worth mentioning that Hyperliquid’s open interest has seen a huge surge since May (daily OI has risen directly from $5b to $12b+). This is mainly due to the USDT0 collaboration, which has attracted USDT users to Hyperliquid.

7. Community Feedback: The team conducts thorough market research and flexibly adjusts strategies at different stages to provide users with the products they need.

According to Xiaohuanxiong, a prominent user in the Hyperliquid Chinese community, in the podcast "web3 101: Why Do Whales Love Hyperliquid?", Hyperliquid captured users in the following six stages:

• Early users of the precision perp dex track: The early team proactively DMed on Twitter the deep users of the early perp dex track such as GMX and the community to invite them to participate in the Private Beta test

• Copy trading system: The second wave of early users mainly come from the capital pool of the “copy trading system”. This type of order is healthier for market makers and LPs.

• Packaged Token Index Portfolio: The third wave of user growth was also the period when Hyperliquid experienced the most concentrated user data growth. This was when they launched a FriendTech Ecosystem Token ETF product. Although it may not have been profitable, it brought a lot of attention.

• Airdrop: The next big wave of user growth will be the airdrop of Memecoins Purr, rather than waiting a year and a half to issue governance tokens.

• Whale positions: The latest buzz comes from “whale positions”. Traders like James Wynn or Aguila Trades, who have large positions and large profits and losses, have become a phenomenon with the support of Chinese media.

4.2 Aster

Aster is a perp dex born on March 31, 2024, from the merger of the multi-asset liquidity protocol Astherus and the perpetual contract protocol APX Finance. It is highly integrated with the BNB ecosystem, providing perp trading backend integration for pancakeswap, and is wholly invested by YZi Labs, with strong support in ecological resources and traffic.

4.2.1 Aster Team's Thesis

In May 2025, when a high-volume liquidation incident involving prominent crypto trader James Wynn sparked market controversy, Hyperliquid's Jeff publicly tweeted about the "Transparent Market Theory" in response. Meanwhile, the Aster team tweeted that now was the perfect time to launch a dark pool perp DEX.

Aster CEO Leonard has a completely different view on Jeff's transparent market theory: he believes that large trades can significantly impact market prices, leading to slippage and losses. Professional traders and institutions need effective ways to conceal their trading intentions to avoid being exploited by other traders (especially those using "front-running" strategies).

We think it may be difficult to define whose theory is right or wrong. Jeff's theory is to achieve end game and kick out all "arbitrage bad guys" who have no effect on the risk pricing of the trading system through the game mechanism. This theory is subversive to the traditional trading system (because even traditional stock exchanges do not have similar speed bump mechanisms to protect market makers). In theory, this environment may be more friendly to many medium-sized market makers, and the space for arbitrage using tech asymmetry in the system will be lower. However, tradeoffs may sacrifice a certain degree of price discovery efficiency. In addition, from the perspective of takers, they will face the problem of absolute transparency and targeted attacks.

Aster provides a specific solution for these two tradeoffs, which may attract different users (especially takers who are more sensitive to large transactions and are afraid of being front-run or targeted and causing losses).

4.2.2 Aster Products and Technology Implementation

1. Dual-Mode Architecture (GMX + Hyperliquid) — Serving Two Completely Different User Groups

Aster is known for its dual-mode trading experience. For casual users, Aster offers Simple Mode: a market-making mechanism based on an on-chain liquidity pool. Users can trade directly with the pool, similar to GMX's GLP + Oracle Priced AMM model. This eliminates the need for order matching, with the LP acting as the counterparty. This model supports ultra-high leverage of up to 1001x, known as the "Degen Mode," catering to retail investors who prefer heavy trading. Simple Mode eliminates the need to pre-fund a platform account; users can directly trade with assets in their wallets, lowering the barrier to entry.

For professional traders, Aster offers Pro Mode: a high-performance matching environment using the CLOB mechanism for quantitative institutions and market makers. Professional Mode features grid trading bots, advanced APIs, and privacy orders. Pro Mode's fees are specifically tailored to Hyperliquid: Aster makers pay 0.010% and takers pay 0.035%, while Hyperliquid charges 0.015% and 0.045%.

2. Differentiating Features: Private Orders — A Theory Opposing Jeff’s Transparent Market Trading System Philosophy

1) Aster's main solution - Hidden Orders

Following the above ideas, Aster lists three types of privacy solutions for transaction orders on the market and their respective trade-offs:

• Dark Pools : Execute large trades in a completely anonymous private venue separate from the public order book.

• Iceberg Orders : A large order is split into many smaller orders, with only a small portion (the “tip of the iceberg”) showing up on the public order book. When a small portion is filled, the remaining portion is automatically filled until the entire order is filled.

• Hidden Orders : Place completely invisible limit orders directly into the open market matching engine, which will only be seen by the market after the order is executed.

Aster believes that hidden orders are the best choice for the high-leverage, fast-paced crypto perp market. They balance confidential execution, centralized liquidity, and minimal market impact, providing traders with a trading experience superior to dark pools and iceberg orders.

2) The general technical logic of Hidden Orders

The fundamental problem that Hidden Order solves is how to execute a completely confidential and private transaction on a completely transparent and p