Author: Daren Matsuoka, Robert Hackett, Jeremy Zhang, Stephanie Zinn, Eddy Lazzarin

Translator: zkBernard, ChainCatcher

This year , the whole world began to go blockchain.

When we published our first State of Cryptocurrency report , the industry was still in its adolescence . The total market capitalization of cryptocurrencies was about half of what it is today , and blockchains were slower, more expensive, and less reliable.

Over the past three years , cryptocurrency builders have weathered severe market downturns and political uncertainty — yet have continued to make significant infrastructure improvements and other technological breakthroughs. These efforts have brought us to today , a moment when cryptocurrency is becoming a vital part of the modern economy.

The story of cryptocurrency in 2025 is a story of industry maturation. In short , cryptocurrency has grown up :

- Traditional financial giants like Visa , BlackRock , Fidelity and JPMorgan Chase — as well as tech-native challengers like PayPal , Stripe and Robinhood — are offering or launching cryptocurrency products.

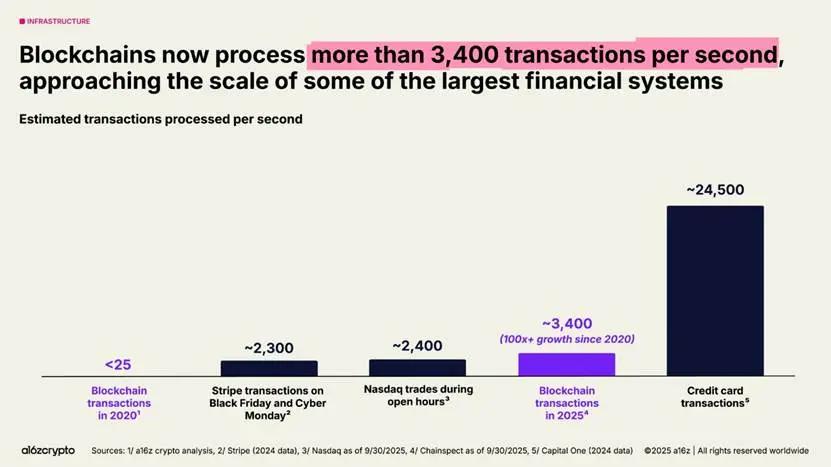

- The blockchain now processes over 3,400 transactions per second ( an increase of over 100 times in the past five years ) .

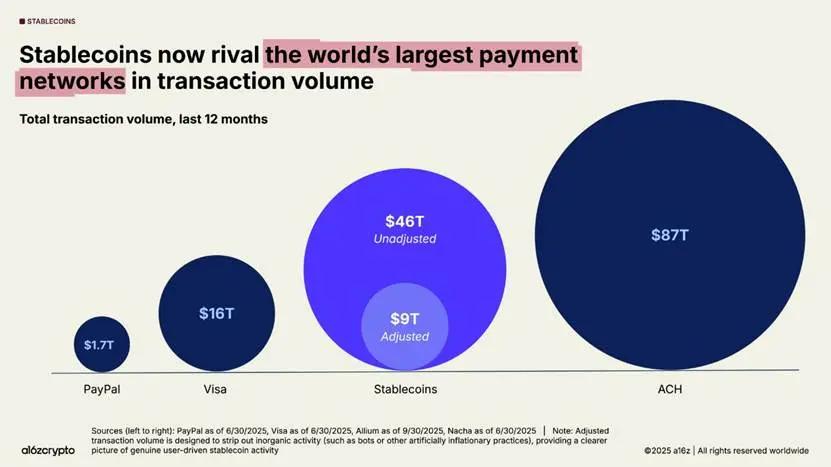

- Stablecoins support $ 46 trillion ( $ 9 trillion adjusted ) in annual transaction volume , comparable to Visa and PayPal .

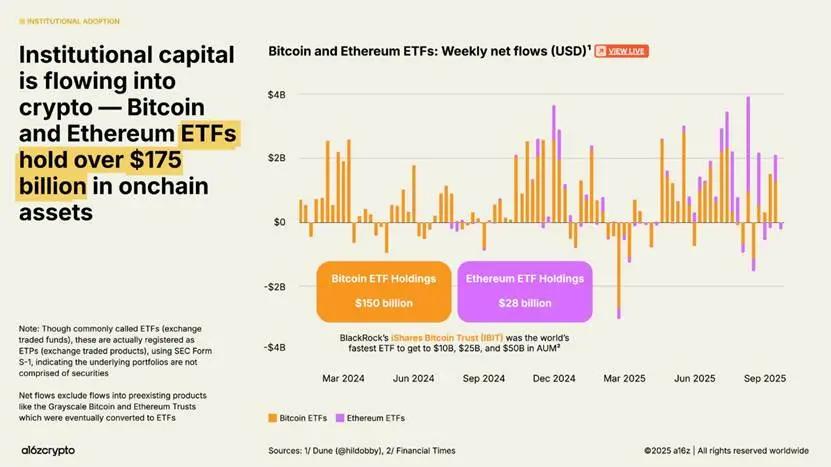

- Over $ 175 billion is invested in Bitcoin and Ethereum exchange-traded products.

Our latest State of Crypto report delves into the industry's transformation , from institutional adoption and the rise of stablecoins to the convergence of crypto and AI . We also debuted a new way to explore data and track the industry's evolution through key metrics: the State of Crypto dashboard .

Now let’s look at what the research found …

Key Points

- The cryptocurrency market is large, global, and growing

- Financial institutions fully embrace cryptocurrencies

- Stablecoins enter the mainstream

- Cryptocurrency is stronger than ever in the United States

- The whole world is going blockchain

- Blockchain infrastructure is ( almost ) ready for prime time

- Cryptocurrency and AI are merging

The market is large, global and growing

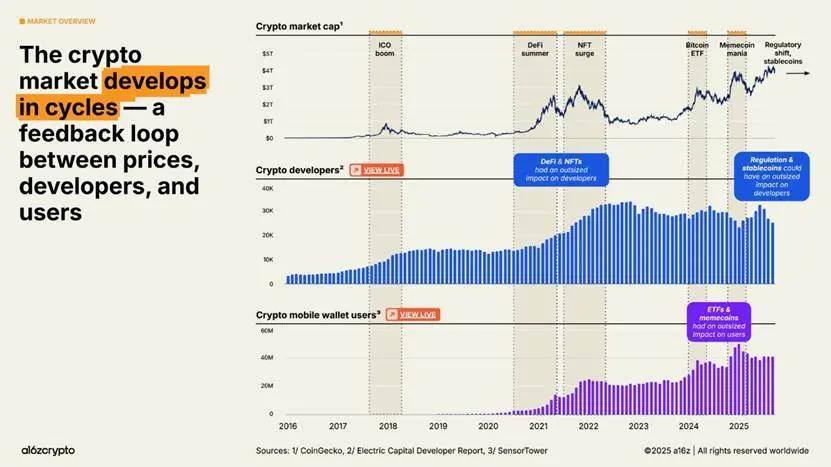

In 2025 , the total cryptocurrency market capitalization surpassed $ 4 trillion for the first time , signaling widespread progress across the industry. The number of mobile cryptocurrency wallet users also reached a record high , with a 20% year-over-year increase.

The shift in the regulatory environment from hostile to more supportive , coupled with the accelerating adoption of these technologies — from stablecoins to tokenization of traditional financial assets to other emerging use cases— will define the next cycle.

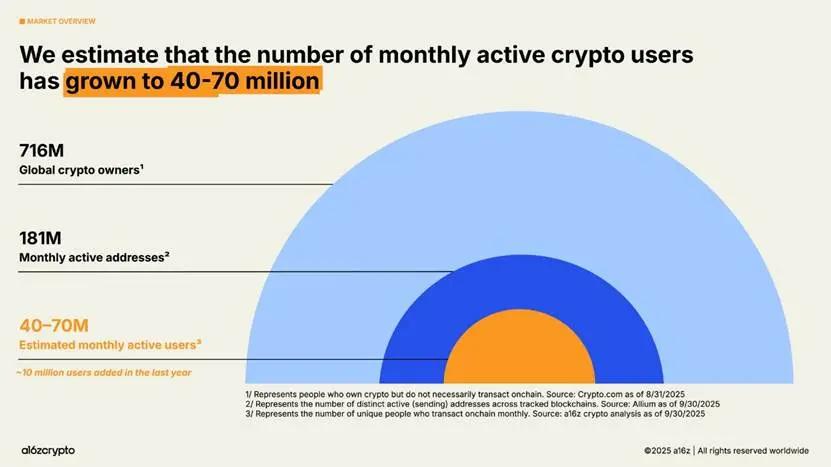

Based on analysis using our updated methodology, we estimate there are currently approximately 40 million to 70 million active cryptocurrency users, an increase of approximately 10 million from last year.

That’s just a fraction of the estimated 716 million people who own cryptocurrency, a 16% year-over-year increase. It’s also just a fraction of the roughly 181 million monthly active addresses on-chain, an 18% year-over-year decrease.

The gap between passive cryptocurrency holders (people who own cryptocurrency but do not conduct on-chain transactions) and active users (people who conduct on-chain transactions regularly) provides cryptocurrency builders with an opportunity to reach more potential users who already own cryptocurrency.

So where are all these cryptocurrency users? And what are they doing?

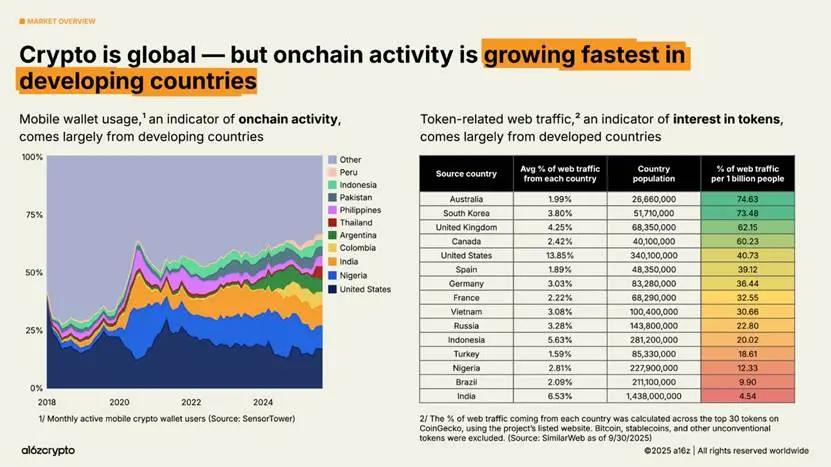

Cryptocurrency is global, but different parts of the world seem to be using it differently. Mobile wallet usage, an indicator of on-chain activity, has grown fastest in emerging markets like Argentina, Colombia, India, and Nigeria. (Argentina, in particular, has seen a 16-fold increase in cryptocurrency mobile wallet usage over the past three years amid an escalating currency crisis.)

Meanwhile, our analysis of the geographic origins of token-related web traffic shows that indicators of token interest are skewed towards developed countries. Activity in these countries—particularly Australia and South Korea—may be more focused on trading and speculation than on user behavior in developing countries.

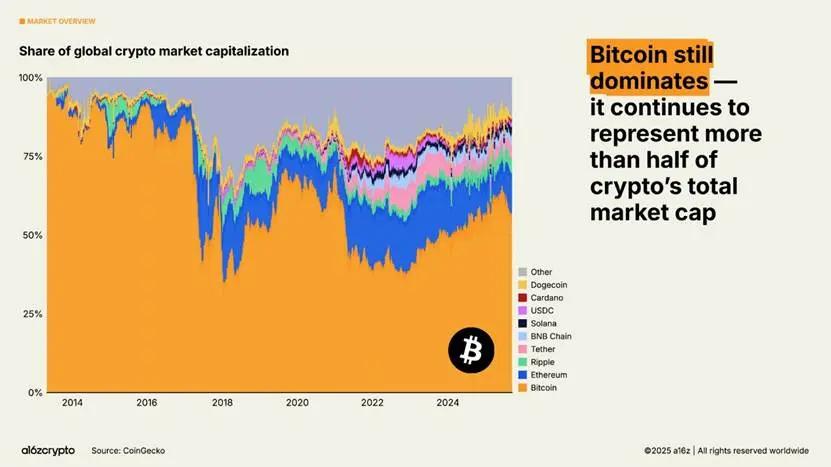

Bitcoin, which still accounts for more than half of the total cryptocurrency market capitalization, hit a new all-time high of over $126,000 as it grows in popularity among investors as a store of value. Meanwhile, Ethereum and Solana have recovered most of their losses from their post-2022 slump.

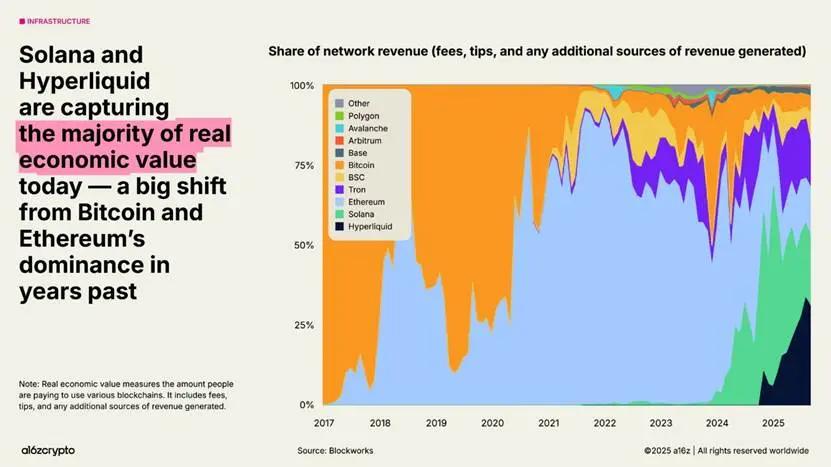

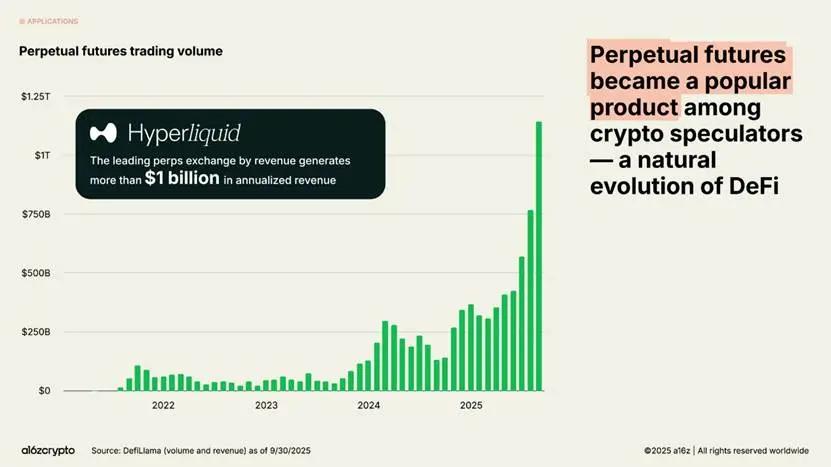

As blockchains continue to scale, fee markets mature, and new applications emerge, certain metrics become increasingly important; one of these is "real economic value"—a measure of how much people actually pay to use the blockchain. Hyperliquid and Solana currently account for 53% of revenue-generating economic activity, a significant shift from the dominance of Bitcoin and Ethereum in previous years.

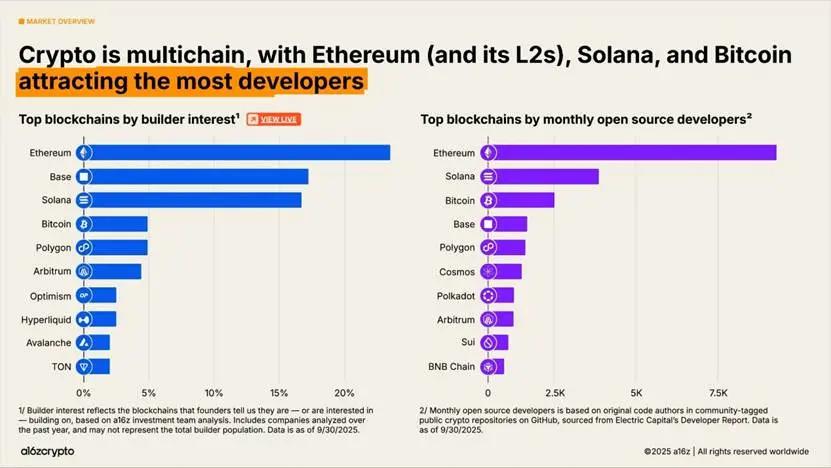

When it comes to builders, cryptocurrencies remain multi-chain, with Bitcoin, Ethereum (and its Layer 2), and Solana attracting the most developers. Ethereum and its Layer 2 will be the top destinations for new developers in 2025. Meanwhile, Solana is one of the fastest-growing ecosystems, with builder interest increasing by 78% over the past two years. The chart below reflects the number of ecosystems founders told us they are building or interested in building—based on analysis by the a16z crypto investment team. (You can take a closer look at these and other trends in our State of Crypto dashboard.)

Financial institutions fully embrace cryptocurrencies

2025 is the year of institutional adoption. Just five days after last year's State of Crypto report concluded that stablecoins had found product-market fit, Stripe announced its intention to acquire Bridge, a stablecoin infrastructure platform. The race is on: Traditional financial firms are also preparing to openly enter the stablecoin space.

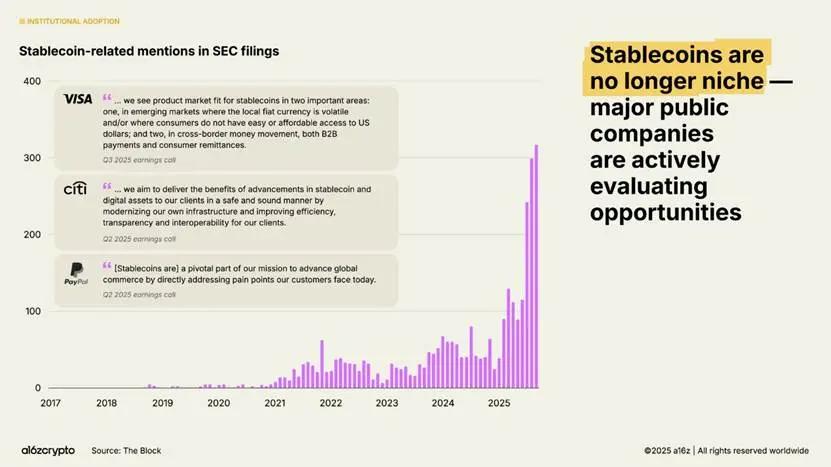

A few months later, Circle's multi-billion dollar IPO signaled the arrival of stablecoin issuers as mainstream financial institutions. In July, the bipartisan GENIUS Act was signed into law, providing builders and institutions with the clarity they needed to move forward. In the months since, mentions of stablecoins in SEC filings have increased by 64%, and major financial institutions have continued to make a series of announcements.

Institutional adoption is rapidly increasing. Traditional institutions—including Citigroup, Fidelity, JPMorgan Chase, Mastercard, Morgan Stanley, and Visa—are now (or plan to) offer cryptocurrency products directly to consumers, allowing them to buy, sell, and hold digital assets alongside stocks, exchange-traded products, and other traditional instruments. Meanwhile, platforms like PayPal and Shopify are doubling down on payments and building the infrastructure for everyday transactions between merchants and customers.

Beyond direct products, major fintech companies—including Circle, Robinhood, and Stripe—are actively developing or have announced plans to develop new blockchains focused on payments, real-world assets, and stablecoins. These initiatives could bring more payment traffic onto blockchains, encourage enterprise adoption, and ultimately create a larger, faster, and more global financial system.

These companies have vast distribution networks. If development continues, cryptocurrencies could become deeply integrated into the financial services we use every day.

Exchange-traded products are another key driver of institutional investment, with on-chain cryptocurrency holdings now exceeding $175 billion, a 169% increase from $65 billion a year ago.

BlackRock's iShares Bitcoin Trust (IBIT) is considered the largest-ever Bitcoin exchange-traded product offering, and subsequent Ethereum exchange-traded products have also seen significant inflows in recent months. (Note: While often referred to as exchange-traded funds or ETFs, these are actually registered as ETPs, or exchange-traded products, using the SEC's Form S-1, indicating that the underlying portfolio does not contain securities.)

These products have made cryptocurrencies more accessible, unlocking a flood of institutional capital that has historically remained on the fringes of the industry.

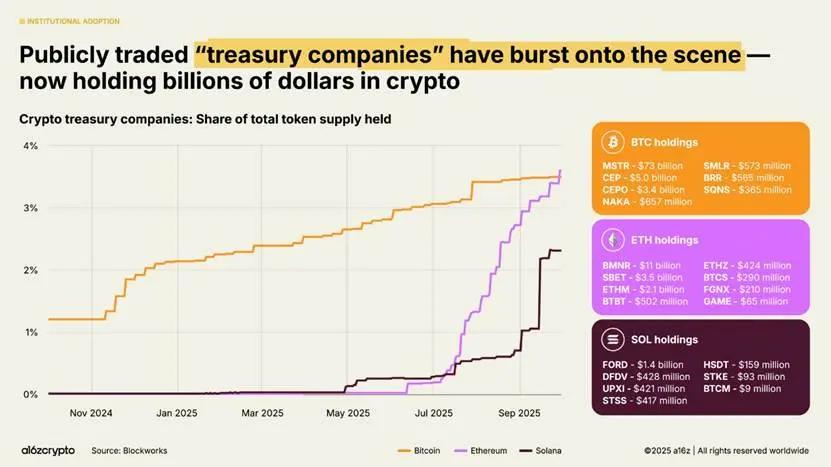

Publicly traded “digital asset treasury” (DAT) companies—entities that hold cryptocurrencies on their balance sheets, much like a corporate treasury holds cash—now collectively hold about 4% of all Bitcoin and Ethereum in circulation. Together, these DATs and exchange-traded products now hold about 10% of the total Bitcoin and Ethereum token supply.

Stablecoins enter the mainstream

In 2025, nothing better signals the maturation of cryptocurrencies than the rise of stablecoins. In years past, stablecoins were primarily used to settle speculative cryptocurrency trades; in recent years, they have become the fastest, cheapest, and most global way to send U.S. dollars—in less than a second, for less than a penny, to nearly anywhere in the world.

This year, they have become the backbone of the on-chain economy.

Stablecoin transaction volume reached $46 trillion in the past year, a 106% year-over-year increase. While this isn’t a completely apples-to-apples comparison, as this figure primarily represents financial flows (rather than retail payments through card networks), it’s nearly three times Visa’s volume and close to the level of the ACH network for the entire U.S. banking system.

On an adjusted basis—a better measure of organic activity that attempts to filter out bots and other artificially inflated activity—stablecoins handled $9 trillion in transactions over the past 12 months, an 87% year-over-year increase. That’s more than five times the throughput of PayPal and more than half that of Visa.

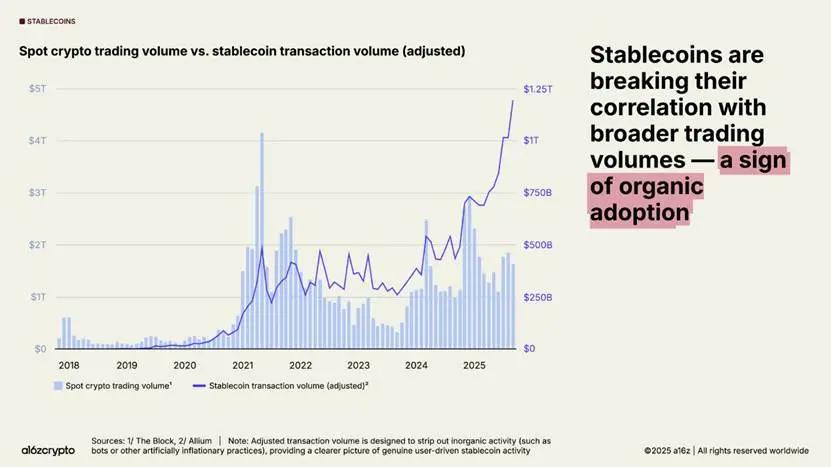

Adoption is accelerating. Monthly adjusted stablecoin trading volume has surged to an all-time high, reaching nearly $1.25 trillion in September 2025 alone.

Notably, this activity is largely uncorrelated with broader cryptocurrency trading volumes – suggesting non-speculative uses for stablecoins and, more importantly, their product-market fit.

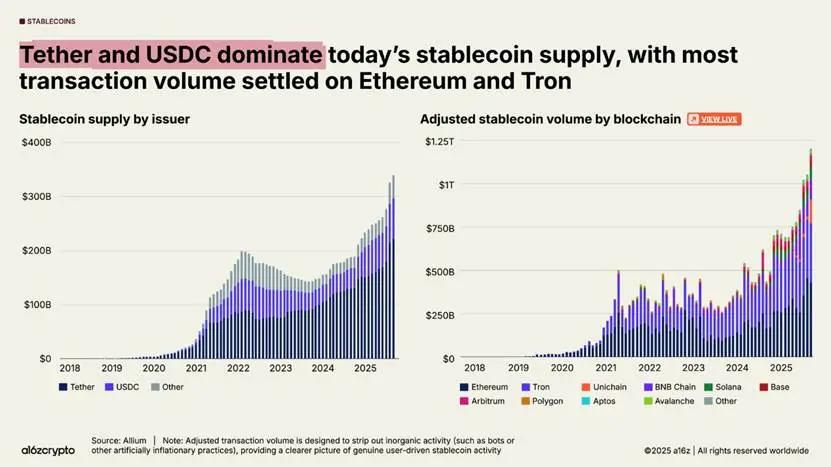

The total supply of stablecoins has also reached a record high, now exceeding $300 billion.

The largest stablecoins dominate the market: Tether and USDC hold 87% of the total supply. In September 2025, $772 billion in stablecoin transactions (adjusted) were settled on the Ethereum and Tron blockchains, representing 64% of all trading volume. While these two issuers and chains account for the majority of stablecoin activity, growth among new chains and issuers is also accelerating.

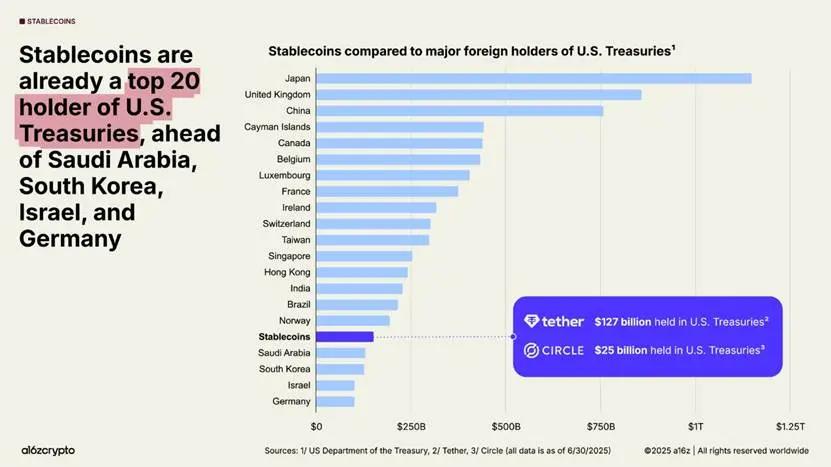

Stablecoins are now a global macroeconomic force: over 1% of the US dollar now exists in tokenized stablecoins on public blockchains, and stablecoins are now the 17th largest holder of US Treasuries, up from 20th place last year. Overall, stablecoins hold over $150 billion in US Treasuries—more than many sovereign nations.

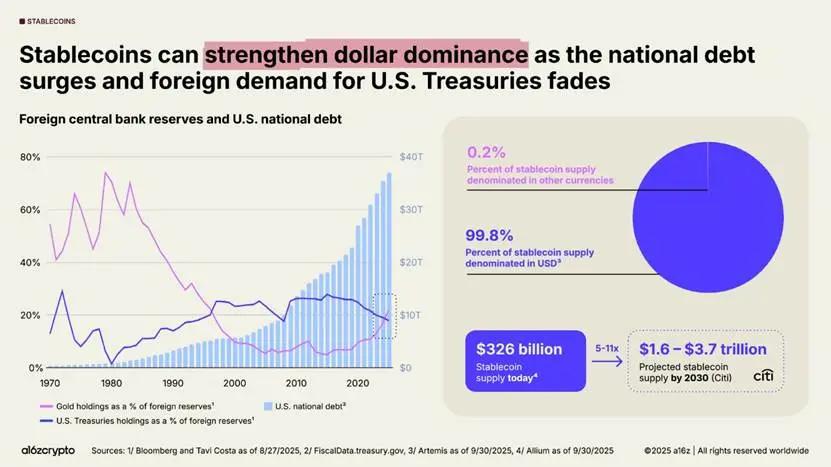

Meanwhile, U.S. Treasury bonds are surging, even as global demand for that debt is waning. For the first time in 30 years, foreign central banks hold more gold in their reserves than U.S. Treasury bonds.

But stablecoins are bucking this trend: over 99% of stablecoins are denominated in U.S. dollars, and their value is projected to grow tenfold to over $3 trillion by 2030, providing a potentially strong and sustainable source of demand for U.S. debt in the coming years.

Stablecoins are strengthening the dollar’s dominance even as foreign central banks reduce their holdings of U.S. Treasuries.

Cryptocurrency is stronger than ever in the United States

The United States has reversed its previously hostile stance towards cryptocurrencies, restoring confidence among builders.

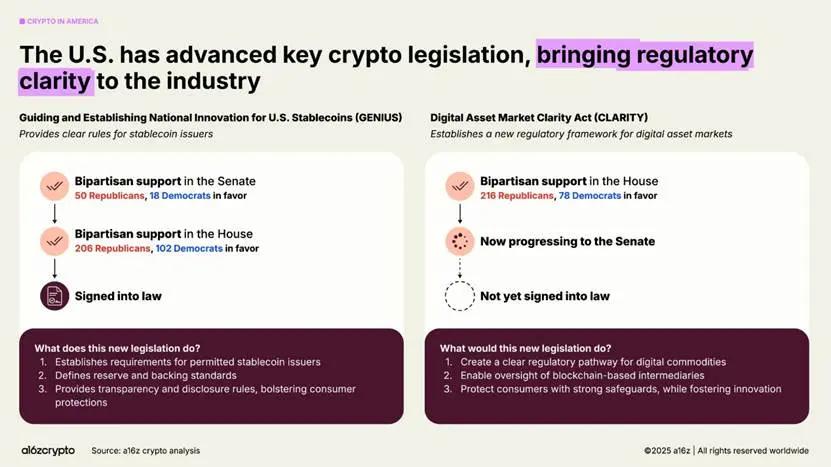

This year's passage of the GENIUS Act and the House-approved CLARITY Act signal bipartisan consensus that cryptocurrencies are not only here to stay but poised to thrive in the United States. Together, these bills establish a framework for stablecoins, market structure, and digital asset regulation, striking a balance between innovation and investor protection. This legislation is complemented by Executive Order 14178, which reverses earlier anti-crypto directives and creates an interagency working group to modernize federal digital asset policy.

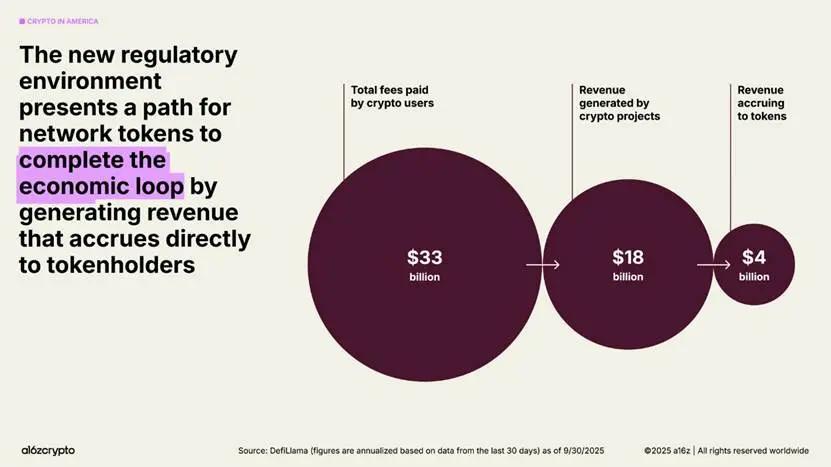

The regulatory landscape is opening the way for builders to realize the potential of tokens as new digital primitives, similar to how websites served previous generations of the internet. As regulatory clarity improves, more network tokens will be able to complete their economic cycles by generating revenue that accrues to token holders—creating a new economic engine for the internet that is self-sustaining and gives more users a stake in the system.

The whole world is going blockchain

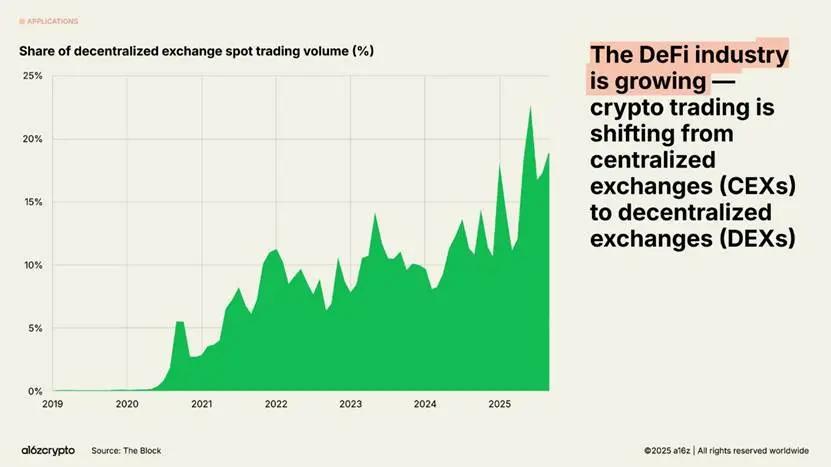

The on-chain economy—once a niche playground for early adopters—has evolved into a multi-sector market with tens of millions of monthly participants. Nearly one-fifth of all spot trading volume now occurs on decentralized exchanges.

Perpetual swaps have exploded in popularity among cryptocurrency speculators, with trading volume increasing nearly eightfold over the past year. Decentralized perpetual swap exchanges like Hyperliquid have processed trillions of dollars in trades and generated over $1 billion in annualized revenue this year—figures that rival those of some centralized exchanges.

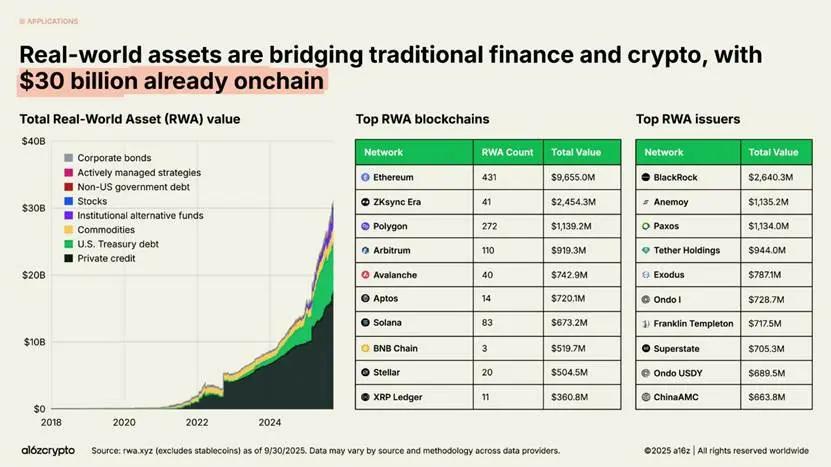

Real-world assets (RWAs)—traditional assets like U.S. Treasuries, money market funds, private credit, and real estate, represented on-chain ("tokenized")—bridge the gap between cryptocurrency and traditional finance. The total market size for tokenized RWAs is $30 billion, having grown nearly fourfold in the past two years.

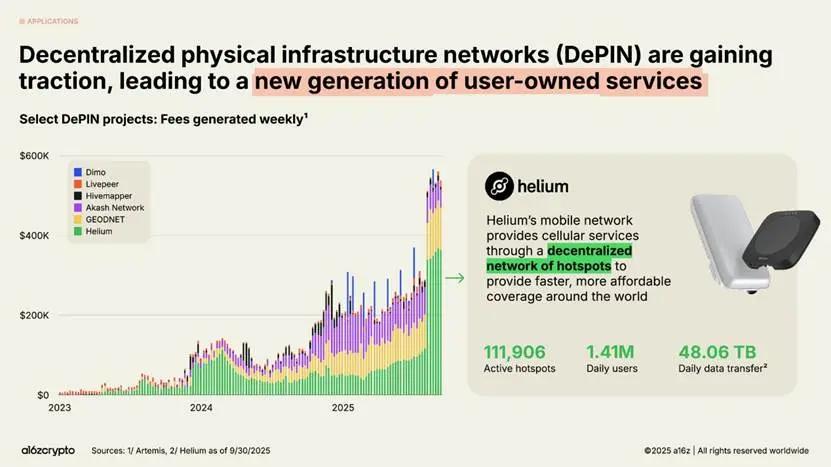

Beyond finance, one of the most ambitious frontiers for blockchain in 2025 is DePIN, or the Decentralized Physical Infrastructure Network.

Just as DeFi reimagined finance, DeFi is reimagining physical infrastructure, including telecommunications and transportation networks, energy grids, and more. The opportunity is enormous: the World Economic Forum predicts that the DeFi category will grow to $3.5 trillion by 2028.

The most notable example is the Helium Network, a grassroots wireless network that now provides 5G cellular coverage to 1.4 million daily active users via over 111,000 user-operated hotspots.

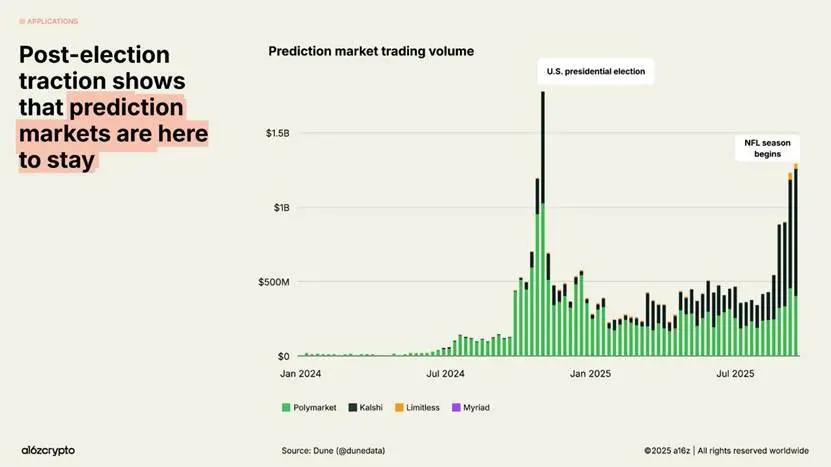

Prediction markets entered the mainstream during the 2024 U.S. presidential election cycle, with the most popular platforms, Polymarket and Kalshi, collectively seeing billions of dollars in monthly trading volume. Despite questions about their ability to maintain engagement in a non-election year, these platforms' trading volume has increased nearly fivefold since the beginning of 2025, approaching previous highs.

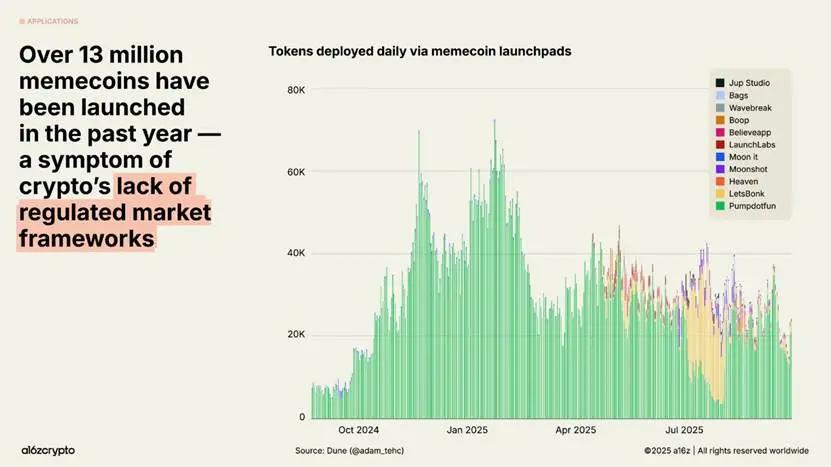

In the absence of regulatory clarity, memecoins have flourished, with over 13 million coins launched last year. This trend appears to be cooling in recent months—with issuance in September down 56% from January—as sound policy and bipartisan legislation clear the way for more productive blockchain use cases.

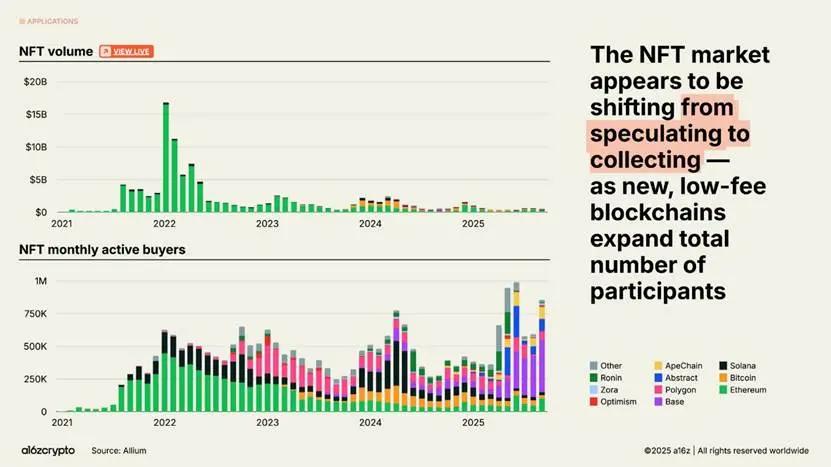

NFT market transaction volume is far from its 2022 peak, but the number of monthly active buyers has been growing. These trends appear to signal a shift in consumer behavior from speculation to collecting, a shift facilitated by the emergence of cheaper block space on chains like Solana and Base. (For more on the intersection of cryptocurrency and the creator economy, see our Voices Onchain project.)

Blockchain infrastructure is (almost) ready for prime time

All of these activities would not be possible without significant advancements in blockchain infrastructure.

In just five years, the aggregate transaction throughput of major blockchain networks has increased more than 100-fold. Back then, blockchains processed fewer than 25 transactions per second. Now they handle 3,400 transactions per second, comparable to Nasdaq's completed transactions or Stripe's global throughput on Black Friday—and at a fraction of the historical cost.

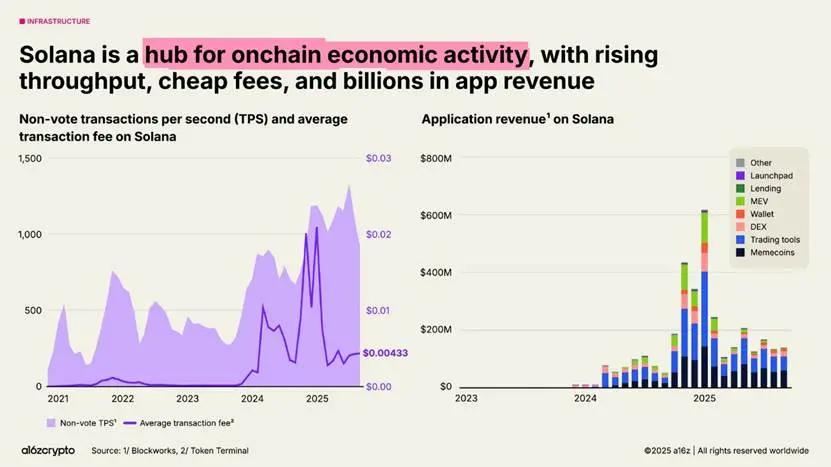

Solana has become one of the most prominent players in the blockchain ecosystem. Its high-performance, low-fee architecture now powers everything from decentralized lending projects to NFT marketplaces, and its native applications generated $3 billion in revenue over the past year. Planned upgrades are expected to double the network's capacity by the end of the year.

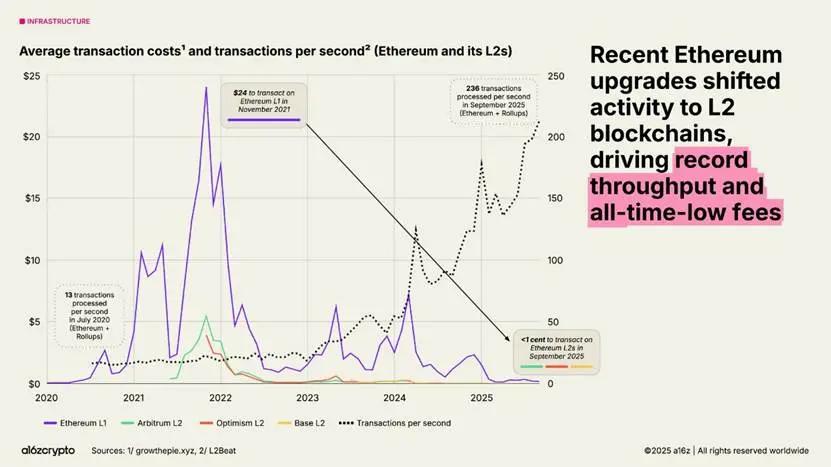

Ethereum continues to execute on its scaling roadmap, with the majority of its economic activity migrating to Layer 2 (L2) platforms such as Arbitrum, Base, and Optimism. The average transaction cost on L2 has dropped from approximately $24 in 2021 to less than 1 cent today, making block space on Ethereum cheap and plentiful.

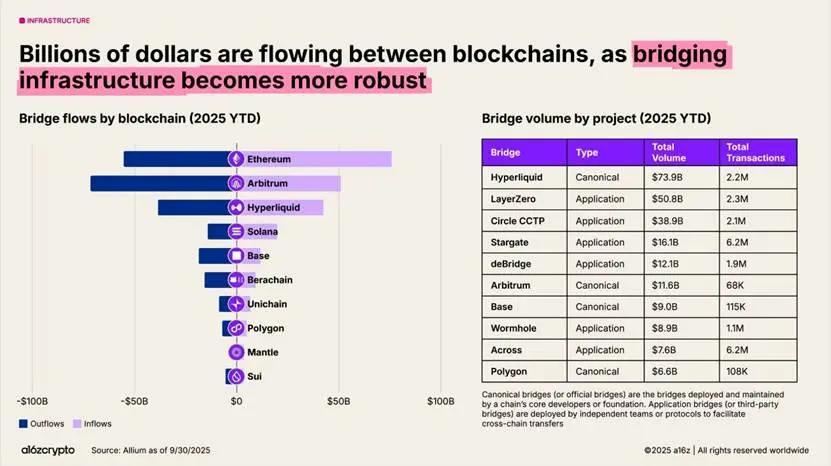

Cross-chain bridges are enabling blockchains to interoperate. Protocols like LayerZero and Circle's Cross-Chain Transfer Protocol allow users to move assets across multiple blockchain systems. Hyperliquid's canonical cross-chain bridge has also seen $74 billion in transaction volume year-to-date.

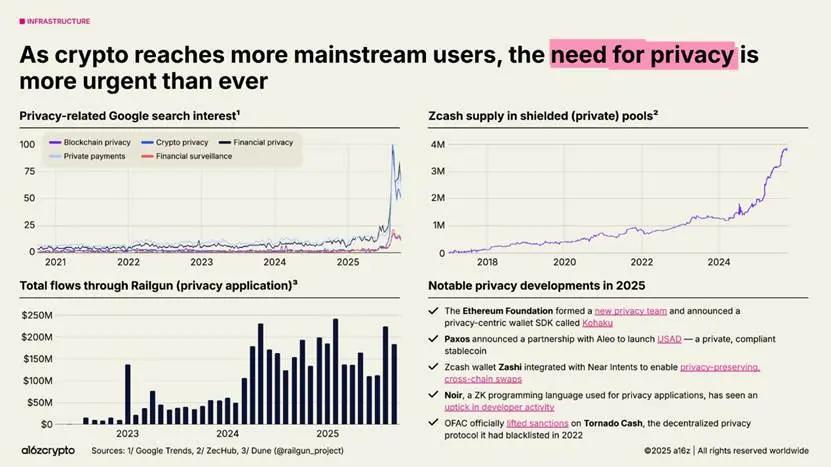

Privacy is returning to the forefront and may become a prerequisite for wider adoption. Indicators of growing interest: Google searches related to crypto privacy surge in 2025; Zcash’s shielded pool supply grows to nearly 4 million ZEC; and Railgun’s transaction flow exceeds $200 million per month.

More momentum: The Ethereum Foundation launched a new privacy team; Paxos partnered with Aleo to launch a compliant, private stablecoin (USAD); and the U.S. Office of Foreign Assets Control lifted sanctions on Tornado Cash, a decentralized privacy protocol. We expect this trend to gain further momentum in the coming years as cryptocurrencies continue to move toward mainstream adoption.

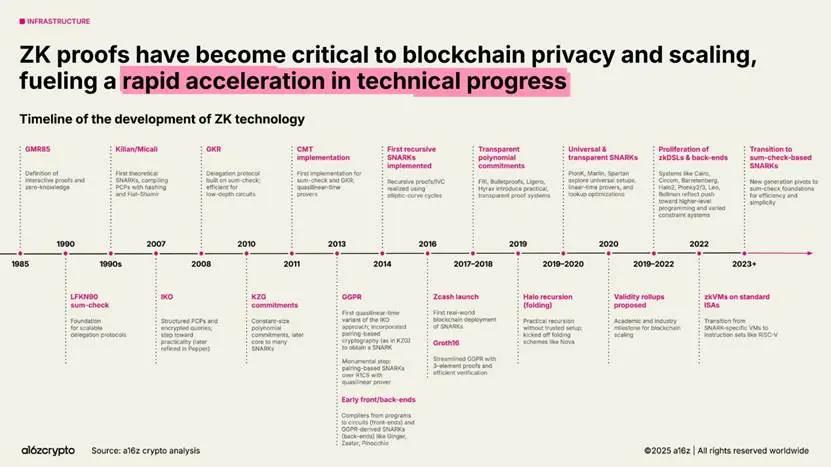

Similarly, zero-knowledge (ZK) proofs and succinct proof systems are rapidly evolving from decades of academic research to critical infrastructure. Zero-knowledge systems are now integrated into Rollups, compliance tools, and even mainstream web services—Google’s new ZK identity system is an example.

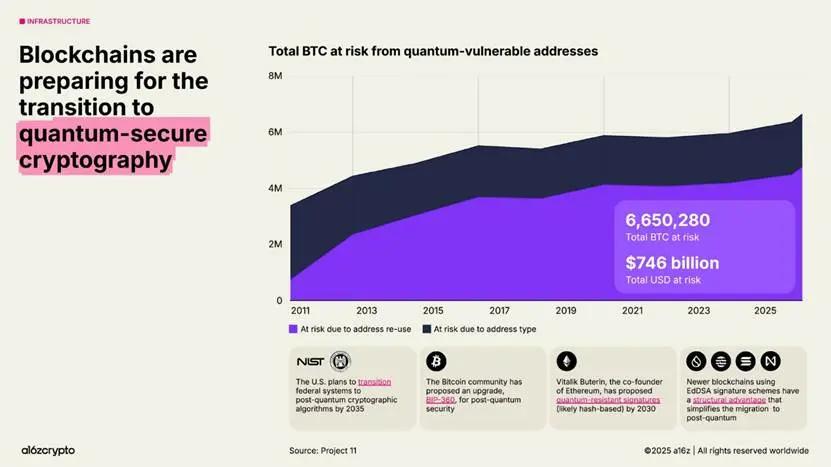

Meanwhile, blockchain is accelerating its post-quantum roadmap. Approximately $750 billion in Bitcoin is stored in addresses vulnerable to future quantum attacks. The U.S. government plans to transition federal systems to post-quantum cryptographic algorithms by 2035.

AI and cryptocurrency are merging

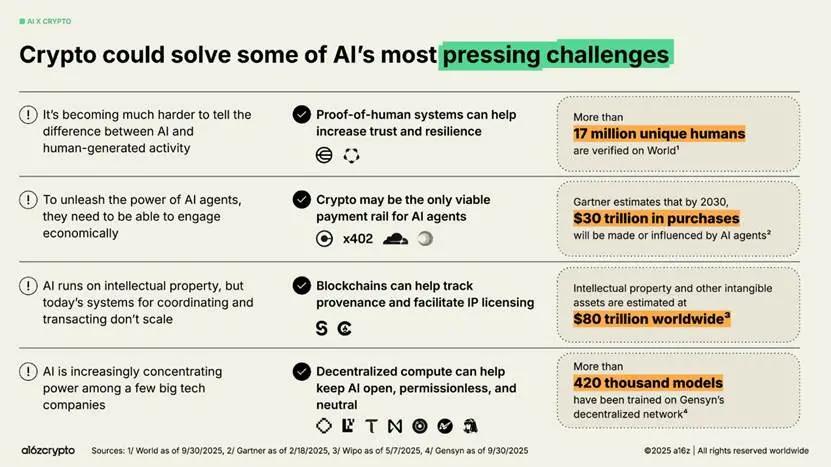

Among other advances, the launch of ChatGPT in 2022 brought AI to the forefront of public attention—creating a clear opportunity for cryptocurrencies. From tracing provenance and licensing IP to providing payment rails for agents, cryptocurrencies could be a solution to some of AI’s most pressing challenges.

Decentralized identity systems like World, which has verified over 17 million people, can provide “proof of humanness” and help distinguish humans from bots.

Protocol standards like x402 are emerging as the potential financial backbone for autonomous AI agents, helping them conduct microtransactions, access APIs, and settle payments without intermediaries—an economy Gartner estimates could reach $30 trillion by 2030.

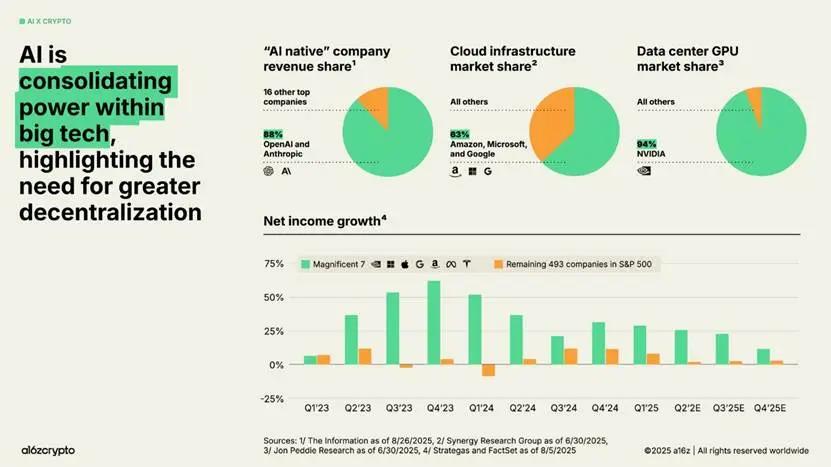

At the same time, the computing layer of AI is consolidating around a handful of tech giants, raising concerns about centralization and censorship. Just two companies, OpenAI and Anthropic, control 88% of the revenue of "AI-native" companies. Amazon, Microsoft, and Google control 63% of the cloud infrastructure market, while Nvidia holds 94% of the data center GPU market. These imbalances have driven double-digit quarterly net revenue growth for the "Big Seven" companies over the past few years, while overall earnings growth for the rest of the S&P 500 has failed to exceed the rate of inflation.

Blockchain provides checks and balances on the apparent centralized power of AI systems.

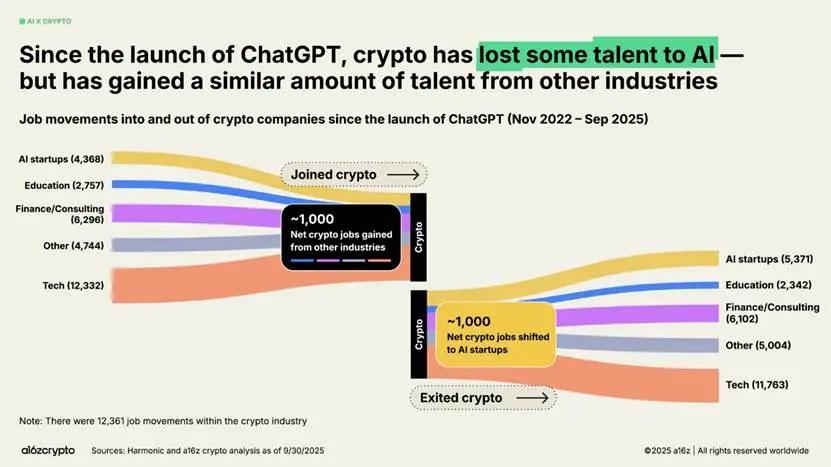

Amid the AI boom, some developers have shifted from cryptocurrency to other fields. Our analysis shows that since ChatGPT launched, approximately 1,000 jobs have shifted from cryptocurrency to AI. However, this number has been offset by an equal number of developers from other fields, such as traditional finance and technology, joining the cryptocurrency field.

Future Outlook

Where does this leave us? With greater regulatory clarity on the horizon, a path is opening up for tokens that generate real revenue through fees. Cryptocurrency adoption by traditional finance and fintech will continue to accelerate; stablecoins will upgrade legacy systems and democratize financial access globally; and new consumer products will bring the next wave of cryptocurrency users onto the blockchain.

We have the infrastructure, distribution channels, and hopefully soon the regulatory clarity needed to bring this technology to the mainstream. It's time to upgrade the financial system, rebuild the global payment rails, and create the internet the world deserves.

Seventeen years on, cryptocurrencies are leaving adolescence and entering adulthood.

Original link