The European Union has passed its 19th package of sanctions against Russia — the first targeting a cryptocurrency.

The bloc has banned the ruble-backed stablecoin A7A5 as part of a broader crackdown on energy and financial networks funding the war in Ukraine.

Brussels expands measures to include stablecoins and LNG

The EU will ban all A7A5 transactions across the bloc starting November 25, according to the Council statement . The coin, issued in Kyrgyzstan and backed by deposits at PSB Bank, has been used by Russian companies to make cross-border trade payments and bypass SWIFT restrictions.

The EU has also sanctioned the coin's developer and trading platform operator.

“It is becoming harder and harder for Putin to finance his war. Every euro we deny Russia is a euro they cannot spend on aggression. The 19th package of sanctions will not be the last.”

— Kaja Kallas, EU High Representative for Foreign Affairs and Security Policy

The council also tightened restrictions on Rosneft and Gazprom Neft and banned imports of Russian liquefied natural gas from 2027. But attention has focused on digital assets, with officials describing A7A5 as a “shadow ruble system” created to bypass Western controls.

Before the ban, the Token had daily turnover in the hundreds of millions of dollars, making it the largest non-dollar stablecoin in Eurasia. EU officials warn that such coins pose a systemic risk by allowing sanctioned countries to build parallel payment networks outside the dollar and euro zone.

Brussels also expanded sanctions against Chinese and Gulf intermediaries involved in Russian oil exports, banning European institutions from interacting with Moscow’s “Mir” and “Fast Payments” systems.

By targeting both fiat and blockchain channels, the EU aims to close off the remaining routes funding the Kremlin’s war economy.

Moscow Legalizes Cross-Border Cryptocurrencies as EU Closes Loopholes

In response, Moscowhas moved to legalize cryptocurrencies for international transactions while criminalizing unlicensed domestic use. Finance Minister Anton Siluanov said the goal is to “restore order” under strict anti-money laundering and know-your-customer oversight.

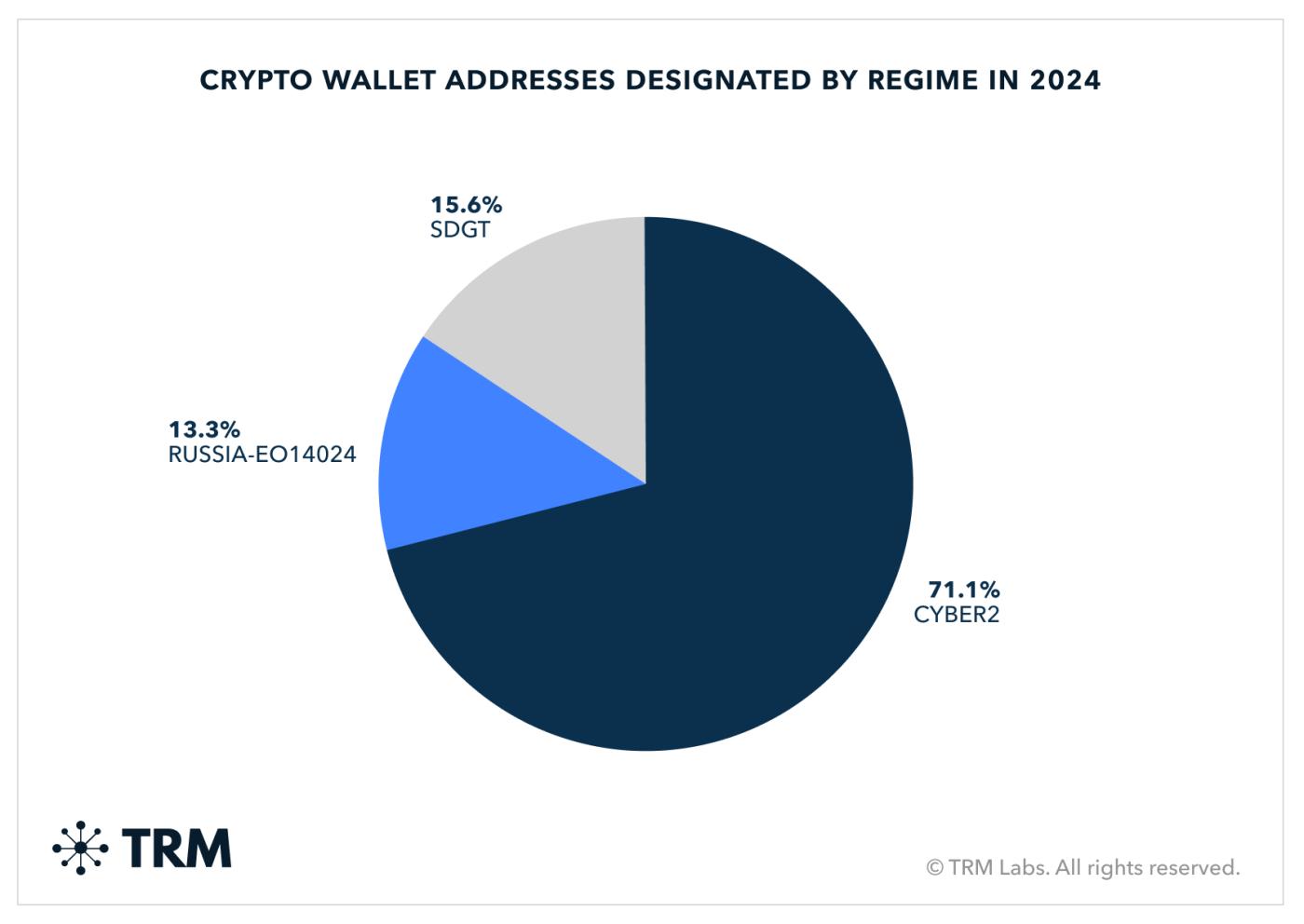

Source | TRM Labs

Source | TRM LabsAnalysts XEM the EU’s digital asset sanctions as part of a broader effort to choke off Russia’s alternative payment routes. A report by TRM Labs found that sanctioned entities will account for a third of global illicit cryptocurrency flows by 2024. Russian exchanges like Garantex are among the top offenders.

The study also notes that cross-border bridges and stablecoins have become key tools for sanctions evasion.

A7A5 recently moved $6 billion through banned wallets despite US sanctions. This case highlights how enforcement remains difficult across jurisdictions.

Industry experts XEM stablecoins as core financial infrastructure, not speculative assets.

In a statement to BeInCrypto, Stablecore CEO Alex Treece described USD- Peg Token as a “modern Eurodollar system” that meets global USD demand beyond banks.

They already account for about 8% of GDP-level flows in Latin America and Africa, he said — reinforcing the dollar's dominance and putting pressure on EU regulators to accelerate their MiCA-compliant euro framework.

As Russia’s war enters its fourth year, Europe’s sanctions strategy has shifted from symbolic containment to systemic disruption—now extending from LNG shipments to blockchain transactions and the shadow networks that sustain them.