This article is machine translated

Show original

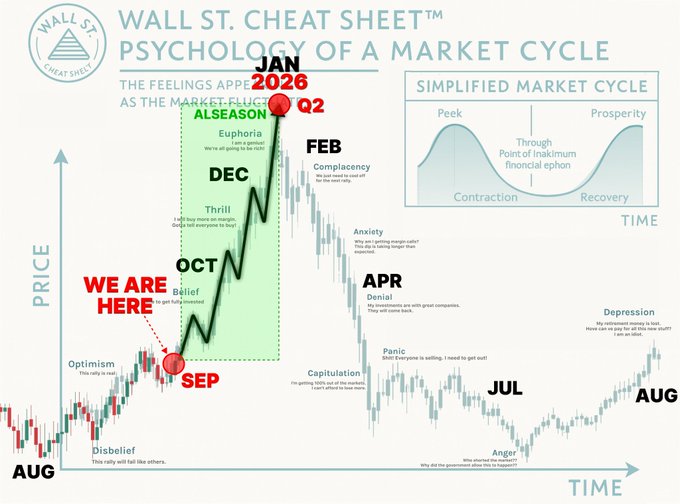

🚨 The Bitcoin cycle has not broken down.

It's no longer a 4-year cycle, but has shifted to a 5-year cycle.

Bitcoin will peak in January 2026, not 2025.

Here are the reasons for the cycle change 👇🧵

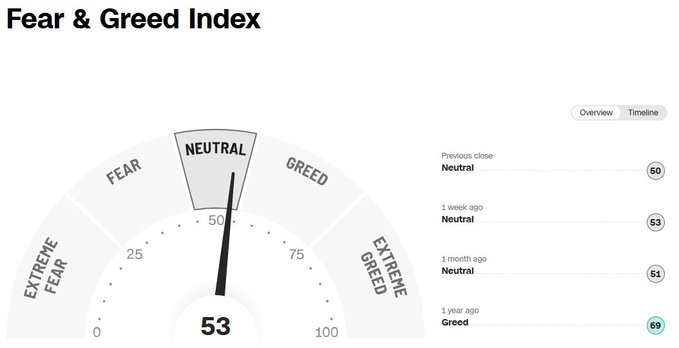

Despite record liquidity and the Altcoin season frenzy, mass sentiment has not yet reversed, with the Fear & Greed Index remaining near 50 – a neutral zone. Non-fervent communities and retail investors remain skeptical of the trend's resilience, another argument for a further shift in the pulse to Q1 2026.

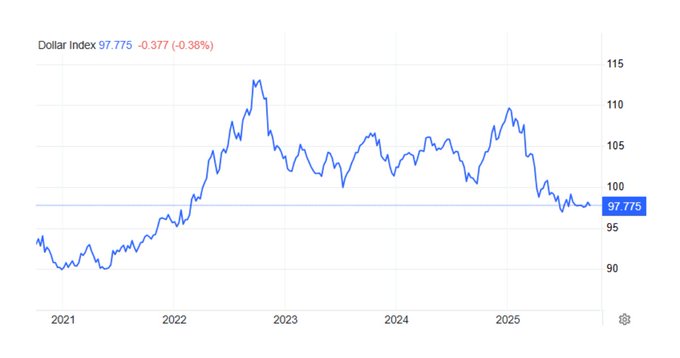

The dollar's hegemony is crumbling - the DXY index is plummeting.

Capital is fleeing safe-haven assets in search of growth.

Cryptocurrencies have traditionally become the preferred choice when trust in the dollar declines.

The strongest rallies always begin with this skepticism.

We now have a clear monitoring list:

ISM exceeds 50 → Economic expansion begins

M2 growth → Funds seek risk assets

DXY decline → Weak US dollar boosts BTC and Altcoin

ETFs continue to attract capital → Demand remains strong

The strategy is simple: track macroeconomics, not the halving date, maintain the $BTC base, and only increase Altcoin during deep pullbacks and periods of accelerated manufacturing activity and liquidity growth.

Don't fall into FOMO, and don't mistake short-term market noise for a trend reversal.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content