Source: Wall Street News

Original title: " Big Short " Burry issues a subtle warning: Sometimes we see bubbles , and the only winning strategy is to not play them.

After two years of silence, Michael Burry , the real-life inspiration for the film "The Big Short," spoke out again on Friday, warning of the risk of a market bubble bursting.

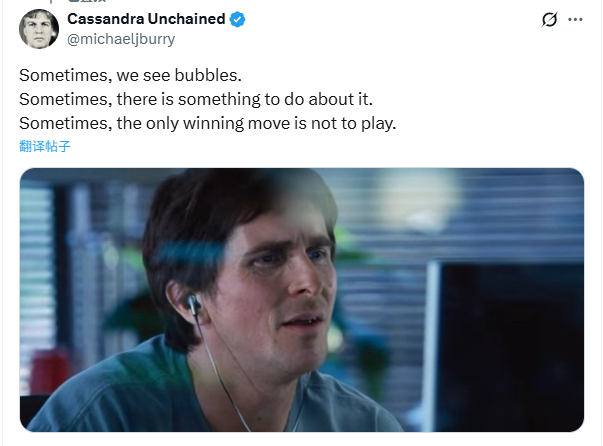

Burry shared a still from the movie "The Big Short" on social media platform X, showing Christian Bale, the actor who plays him, staring blankly at a computer screen. He captioned the image: "Sometimes we see the bubble. Sometimes we can make a difference. Sometimes, the only way to win is not to play."

It is understood that Burry's quote is taken from the 1983 film *WarGames*. In the film, an artificial intelligence (AI) system simulates thousands of nuclear wars between the US and the Soviet Union, only to find that they all end in mutual destruction. It ultimately concludes: "It's a strange game, and the only way to win is not to play."

Clearly, Burry's post implies that he believes the current market is rife with unsustainable speculation and that the bubble will eventually burst. He himself has chosen not to participate in the AI craze, refraining from betting or short, which he sees as "the only winning strategy."

While Burry didn't explicitly define what the bubble was, it's widely believed he was referring to the current AI boom. Amid the AI wave, the market capitalization of large tech companies like Nvidia has soared. Since the beginning of 2023, Nvidia's stock price has surged over 1200%, and this week its market capitalization surpassed $5 trillion for the first time, also driving the S&P 500 and Nasdaq indices to new highs recently.

Burry updated his profile name to "Cassandra the Unbound," after the cursed priestess in Greek mythology who could foresee the future but was disbelieved. His bio also changed to: "Someone ready to share what they know."

Similar to his return to social media in November 2021, Burry once again changed his homepage header image to Jan Blücher's famous painting "The Irony of Tulip Mania," alluding to the first recorded asset bubble in human history. It's worth noting that the Nasdaq peaked three months later and subsequently entered a bear market.

Burry is best known for his successful prediction of the US subprime mortgage crisis, which brought him fame after being featured in the book "The Big Short." Later, he also positioned himself in advance in GameStop and short Tesla, Cathy Wood's flagship ARK fund, Apple, and chip stocks including Nvidia.

Back in the summer of 2021, Burry warned that the market was in the midst of the “largest all-asset speculative bubble in history” and warned that meme stock and cryptocurrency buyers would face a “century crash.”

This series of pessimistic predictions also drew ridicule from Musk at the time, who called Bury "a broken clock" that kept sending wrong signals.

In early 2023, Burry posted a single word on social media platform X: "Sell," sparking heated discussion in the market. However, he soon admitted that he had misjudged the situation. Burry's willingness to admit his mistake is extremely rare on Wall Street; virtually no analyst would do this, as they would typically wait a while before issuing new predictions.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush