November is just around the corner — and so is the debate over the future of the world’s second-largest cryptocurrency. Experts remain Chia on Ethereum’s trajectory, leaving the market with a key question: Is Short ETH now a wise move or a risky gamble?

Recent research and ETF developments suggest caution, but on-chain and Derivative data paint a different picture.

Why Some Analysts Recommend Shorting Ethereum

10x Research believes Ethereum is a better hedge than Bitcoin for short-sellers in the current environment. Their analysis, Chia amid ETH 's recent drop below $4,000 , highlights a major weakness that could amplify downside risks.

The bearish thesis is that Ethereum’s “digital treasury” narrative is fading — it was once a magnet for institutional Capital . This model, epitomized by BitMine’s strategy of accumulating ETH at Capital and selling it back to retail investors at a premium, created a self-reinforcing cycle over the summer. However, 10x Research argues that cycle has broken down .

“Market stories don’t die in the headlines — they die quietly, when new money stops believing. Ethereum’s institutional treasury story has been convincing to many, but the buying power behind it is not what it seems. Institutional options positions are quietly choosing sides, even as retail investors look the other way,” the post reads.

Additionally, spot ETFs are seeing significant outflows. Data from SoSoValue shows that ETH ETFs recorded net outflows of $311.8 million and $243.9 million in the third and fourth weeks of October, respectively.

“Yesterday, the ETH ETF had $184,200,000 in outflows. BlackRock sold $118,000,000 in Ethereum,” said analyst Ted Pillows.

Technically, one analyst pointed out that ETH is forming a bearish crossover, a technical analysis signal that suggests a possible downtrend. He noted that the last time this pattern appeared, Ethereum fell from around $3,800 to $1,400.

Ethereum Price Prediction. Source: X/Borg_Cryptos

Ethereum Price Prediction. Source: X/Borg_CryptosBearish Sentiment Meets Bullish Data: Can Ethereum Recover in November?

However, not all signals are consistent with the bearish view . Some suggest a possible Ethereum recovery in November.

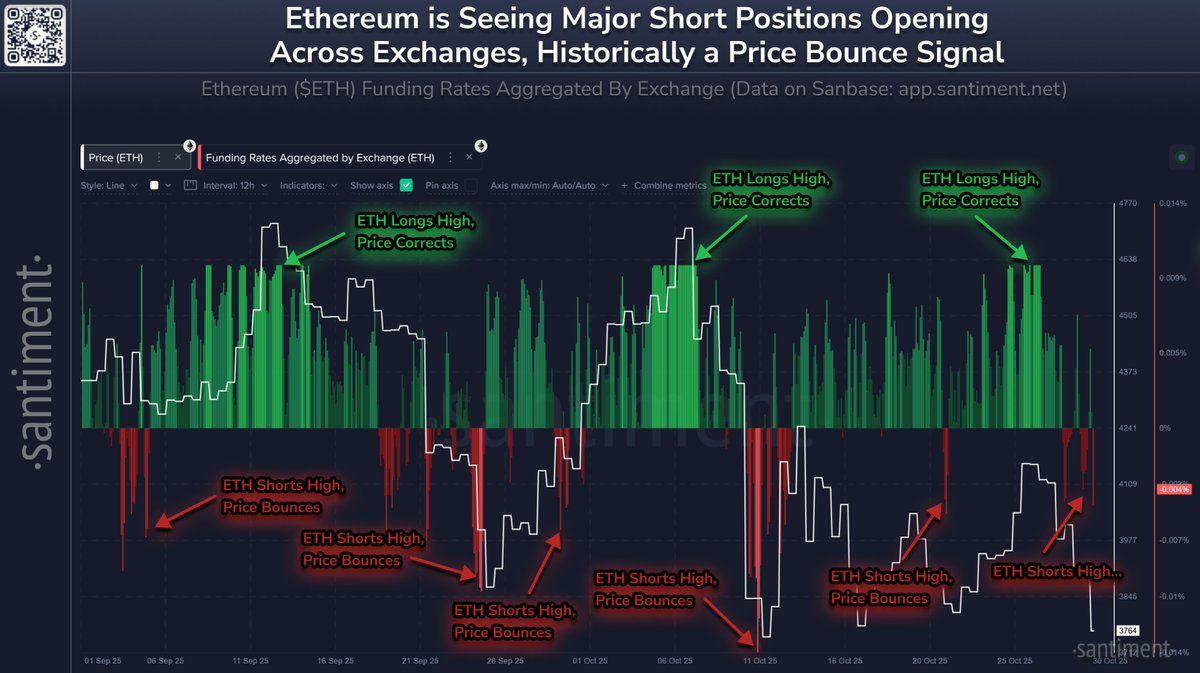

Santiment said that as Ethereum slid to $3,700, traders began to open Short positions again — an ironic behavior that often precedes price increases. The post noted that over the past two months, the funding rate on exchanges has become a key indicator of ETH's next move.

When the funding ratio turns positive, indicating that Longing positions are dominant, prices often correct as excessive optimism builds up. Conversely, when Short dominate and the funding ratio turns negative, the probability of a recovery increases.

“When large Longing dominate (greed), the price will correct. When large Short dominate, the probability of a bounce is very high,” Santiment emphasized.

Correlation between Funding Rate and ETH price. Source: X/Santiment

Correlation between Funding Rate and ETH price. Source: X/SantimentAnother analyst said Ethereum’s “Ecosystem Daily Activity Index” has hit a record high, indicating strong network interaction.

This surge in on-chain activity creates a solid fundamental foundation for Ethereum, suggesting market strength is driven by real user growth rather than speculation.

“Such high participation could become a strong support for future price increases,” CryptoOnchain noted .

So, the outlook for Ethereum heading into November remains fairly balanced. On the one hand, institutional momentum, ETF outflows, and negative technical patterns call for caution. On the other hand, stronger on-chain activity and Derivative data point to rising user engagement and resilience.

Whether ETH continues to decline or reverses to an eventual recovery may depend on which force prevails in the coming weeks.