The October crypto market crash will be looked back on as one of the “worst days in retrospect,” a cryptocurrency analyst said.

A widely used cryptocurrency market sentiment indicator remains in volatile territory despite a clear improvement in trade relations between the United States and China, after US President Donald Trump reached a trade deal with China this week.

However, some crypto analysts believe that this announcement could soon have a positive impact on the crypto market.

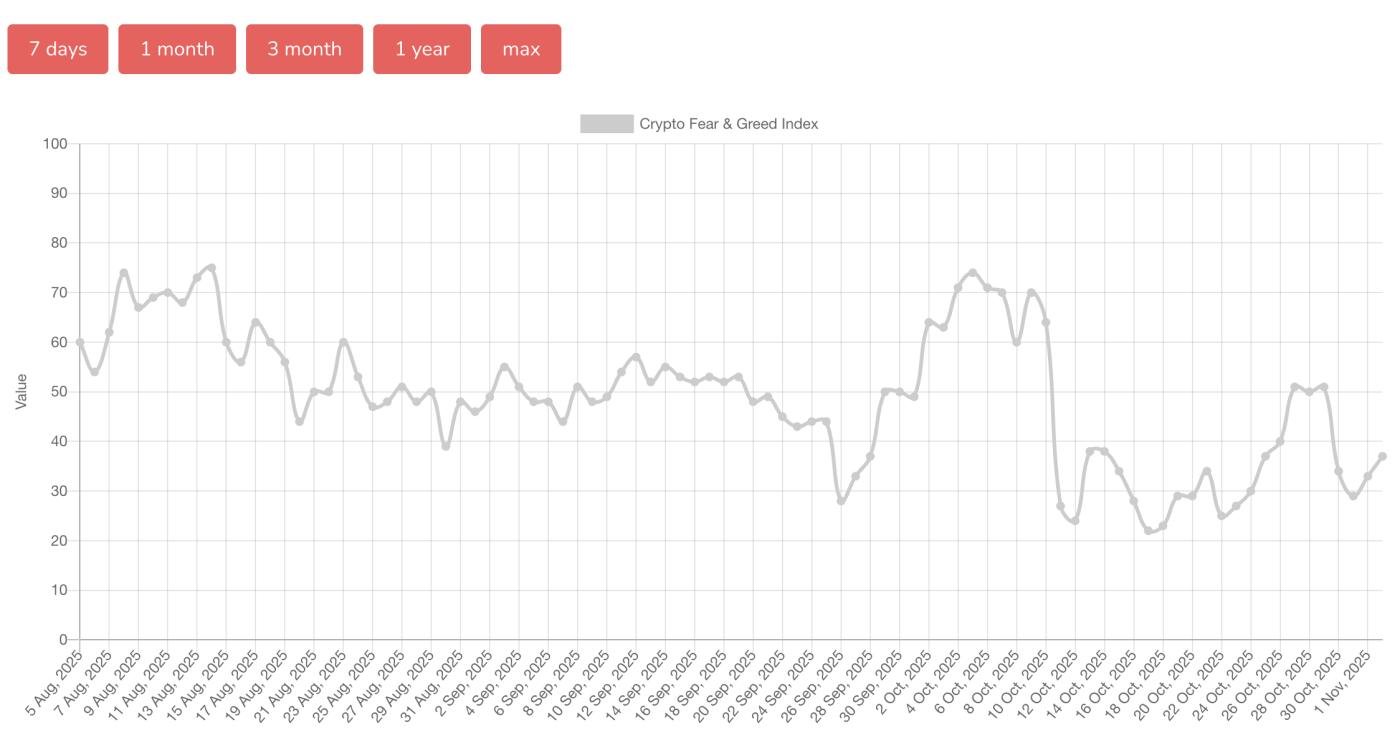

The Crypto Fear & Greed Index, a gauge of overall crypto market sentiment, posted a “Fear” score of 37 on Sunday, up 4 points from Saturday’s “Fear” score of 33. The slight increase came after the White House released a comprehensive statement on the trade deal reached between President Trump and Chinese President Xi Jinping.

Trade developments between the United States and China are being closely watched by the industry.

“A major victory that protects America’s economic strength and national security while putting American workers, farmers, and families first,” the White House said in a statement on Saturday.

Many in the cryptocurrency industry have been closely following developments between the US and China trade relations, as tariff announcements since the Trump administration took office in January have often been associated with significant volatility in the cryptocurrency market.

After Trump announced a 90-day tariff pause on April 9, the Crypto Fear & Greed Index spiked over the next 24 hours, from an “Extreme Fear” of 18 to a “Fear” of 39 the following day.

Most recently, Trump’s threat to impose 100% tariffs on China was blamed for the recent cryptocurrency market crash, which saw $19 billion liquidated in just 24 hours on October 11.

The cryptocurrency market has struggled to recover since then. In a post on X on Saturday, Michael van de Poppe, founder of MN Trading Capital, said that day will be remembered as one of the “ Dip days in retrospect.”

Analyst says market is still in the “early stages” of the bull run

“That is why we are still in the early stages of the bull cycle for Altcoins and Bitcoin right now,” said van de Poppe.

The White House said the United States will maintain a pause on “imposing high retaliatory tariffs on imports from China” until November 10, 2026.

Related: BX Affiliate Season 3 – BingX Partner Exclusive Event with $44,000 Prize Pool

Cryptocurrency trader Ash Crypto said, “This is bullish for the market.” Echoing a similar sentiment, cryptocurrency trader 0xNobler said this is “BIG NEWS.”

The recent trade deal has yet to have a noticeable impact on the cryptocurrency market. Bitcoin is trading at $110,354 and Ether at $3,895, up 0.26% and 0.84% respectively over the past 24 hours, according to CoinMarketCap.

Source: Cointelegraph