Bitcoin prices dropped below the key, psychological level of $100,000 on Tuesday, November 4, reaching their lowest since June as the market struggled with fatigue.

“The best explanation for BTC’s recent drop is simply exhaustion,” Tim Enneking, managing partner of Psalion, via email. “There has not been any bad news, but the market is a bit tired.”

He made this statement on a day when the world’s most prominent digital currency fell to roughly $99,000, according to Coinbase data from TradingView. At this point, it was trading at its most depressed value since approximately June 22.

Enneking shed further light on the situation, emphasizing that crypto markets are facing multiple challenges.

“Caution because of interest rates in the US, on-going concerns related to the US-declared trade war on seemingly the entire rest of the world, doubts that the tradfi equities markets can continue to set, or even hold on to, the new records we’ve seen this year, and, treasury companies selling a bit of their inventory to cover operating and debt costs all have created head winds.”

Julio Moreno, head of research for CryptoQuant, also outlined multiple challenges the markets are facing.

When asked to describe what caused the latest drop in prices, he stated via Telegram that “It seems like a follow up correction as the fundamentals remain weak after October’s big liquidation event.”

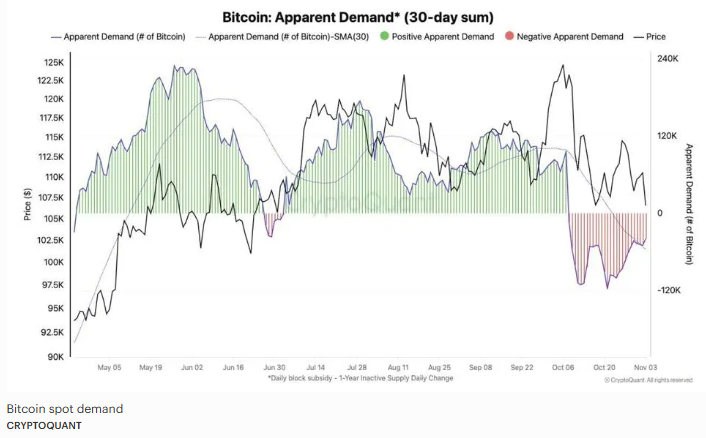

For starters, spot demand for bitcoin has continued to decline, he emphasized.

The chart below, from CryptoQuant, illustrates this development:

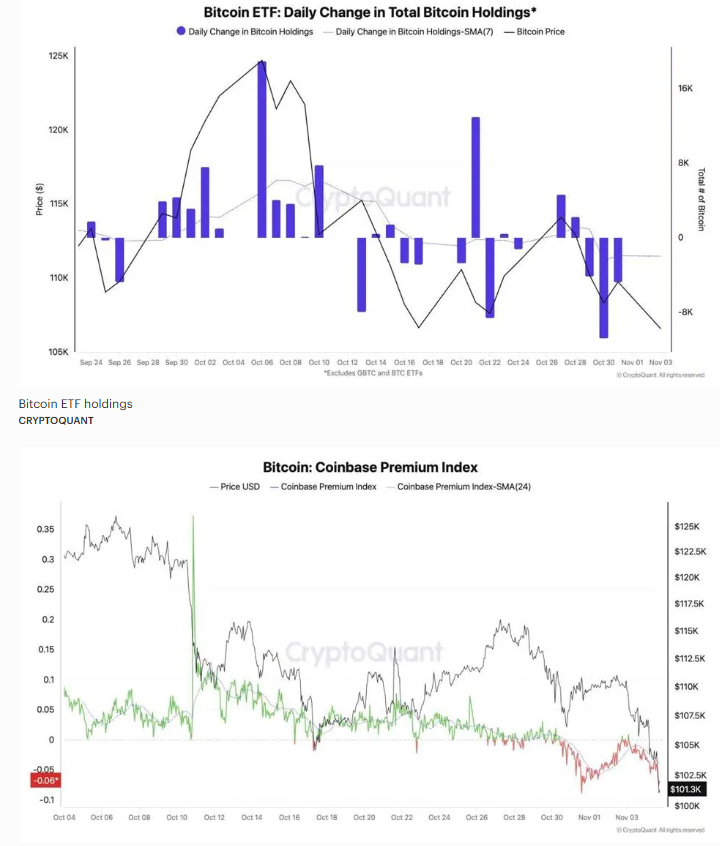

He also focused in on changes in the world’s largest economy, specifying that “In the US, investors have also lowered their demand for Bitcoin, as seen in negative ETF flows and the negative Coinbase price premium.”

The two charts below depict this:

Market Stability

Other analysts focused on the market obtaining a greater sense of stability after some of the notable losses it experienced in recent weeks.

Brian Huang, cofounder of fintech firm Glider, commented on such matters, stating via email that “We’re now seeing the market stabilize after the chaos of last week.”

“What’s most interesting isn’t the liquidations themselves but how capital has repositioned,” he added. “We can see that stablecoins are waging on and dominating the market as investors are chasing yield and safety, however, on-chain activity is already showing signs of quiet accumulation.”

“If Bitcoin can sustain momentum above key levels, this pullback may be remembered as a recalibration, rather than a collapse,” concluded Huang.

DeFi Protocol Hacks

Huang also spoke to the repeated compromises that DeFi protocols have suffered lately. Recently, DeFi protocol Balancer experienced an exploit that resulted in the loss of more than $100 million’ worth of funds.

Marcos Viriato, Cofounder & CEO of Parfin, emphasized the key role that this development played in the markets, stating that “From my perspective, the Balancer hack hit at a tough moment.”

“Ethereum was already down about 7–8%, and with liquidity still thin, even small sell pressure caused bigger moves across the market,” he continued. “A lot of people are still shaken from the Black Friday crash a few weeks ago, and confidence hasn’t fully returned.”

“This exploit just added to those concerns — it reminded everyone how fragile security can be in DeFi, and that uncertainty pushed some investors to pull back capital,” said Viriato.

Huang spoke to the impact these incidents are having on the markets, stating that “Confidence in DeFi remains fragile.”

“Repeated protocol breaches have exposed weak points across lending markets, which will likely accelerate the migration toward better-audited infrastructure,” he noted. “The next few weeks will show whether builders can restore trust or if capital will stay parked off-chain.”