Researchers bought 97 BTC in 2012 for blockchain research. Thirteen years later, they are preparing to sell the Bitcoin to fund quantum research projects.

Researchers bought 97 BTC in 2012 for blockchain research. Thirteen years later, they are preparing to sell the Bitcoin to fund quantum research projects.

A public research institute in Spain is preparing to sell a long-forgotten stash of Bitcoin, now worth more than $10 million, bought for just $10,000 in 2012 as part of a blockchain technology research project.

The Institute for Technology and Renewable Energy (ITER), part of the Tenerife Island Council, bought 97 Bitcoins more than a decade ago to research blockchain technology. According to a report from Spanish newspaper El Día, the council is now finalizing plans to liquidate the assets.

Juan José Martínez, Tenerife's innovation commissioner, said the council is working with a Spanish financial institution licensed by the Bank of Spain and the National Securities Commission (CNMV) to assist with the sale process.

Most banks in Europe still refuse to process Bitcoin transactions due to regulatory risks and price volatility, making it complicated to liquidate the institute's Bitcoin holdings.

Tenerife Council will reinvest the proceeds into quantum research

Martínez said he expected the transaction to be completed in the coming months, with the proceeds reinvested in ITER research programs, including quantum technology. He stressed that the 2012 Bitcoin purchase was not intended as an investment but as part of a pilot project to better understand blockchain infrastructure.

“It is one of many research projects that ITER has undertaken to explore and test new technological systems,” says Martínez.

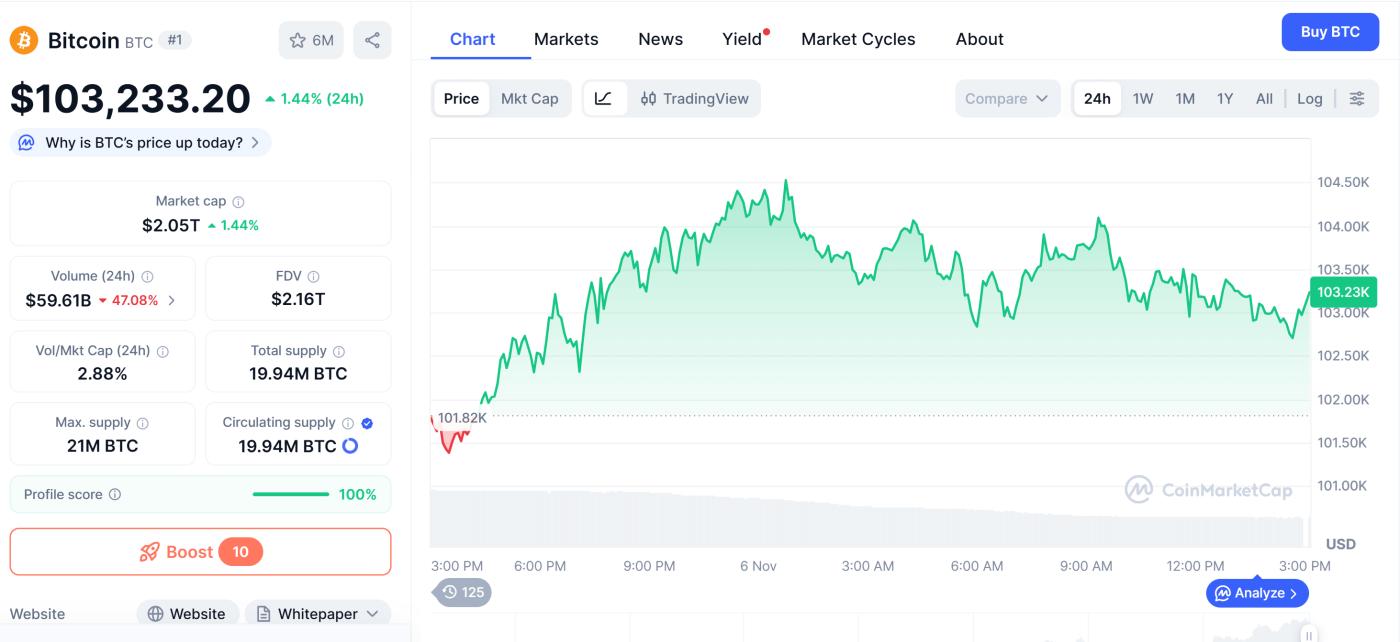

With Bitcoin currently trading around $103,200, ITER’s Bitcoin is worth more than $10 million. In early October, the asset was worth more than $12 million when Bitcoin hit an All-Time-High of around $126,198, according to data from CoinMarketCap.

Spanish Banking Giant BBVA Partners with Binance to Custody User Assets

In August, major Spanish bank BBVA partnered with Binance to become an independent custodian for its clients' assets. The deal allows Binance users to store assets backed by US Treasuries at BBVA, which the exchange uses as collateral for margin trading.

The deal comes after BBVA recommended its wealthy clients allocate between 3% and 7% of their portfolios to crypto and Bitcoin.