*This article is a compilation by Bitcoin Hyper and does not represent the views of the platform. It involves memecoins and related tokens, which may carry extremely high volatility and are not investment advice. See the disclaimer at the end of the article for details.

After two days of sharp fluctuations, the crypto market quickly rebounded, and this time, it wasn't Bitcoin that led the rally, but Ethereum. ETH rebounded strongly by 3.7% after falling below $3200, returning above $3418, significantly outperforming Bitcoin's 2.2%. This move has refocused market attention on the Ethereum ecosystem, particularly the renewed inflow of Layer 2 and DeFi funds, becoming a key driver of the short-term market reversal.

This rebound began with a technical correction following the panic selling. When Ethereum fell below $3200, short-term oversold signals appeared, triggering a rebound with a large number of limit buy orders and liquidation covering. On-chain data shows that the main inflow of funds was concentrated in the $3150 to $3250 range, indicating that long-term investors were buying on dips. Because ETH's decline was deeper than BTC's, its recovery was also stronger, leading to a stabilization of overall market sentiment.

Official sources stated that Ethereum's rebound was not merely a price correction, but also a restoration of investor confidence. The establishment of the Federal Reserve's interest rate cut cycle has driven institutional funds back into risk assets. Due to ETH's stronger correlation with DeFi, NFTs, and Layer 2 applications, it has become the preferred destination for this capital inflow. According to DeFiLlama data, the total value locked (TVL) on the Ethereum network has slightly increased in the past 48 hours, indicating a slight recovery in on-chain activity. This influx of funds has also simultaneously boosted the performance of secondary tokens such as SOL, TON, and BGB.

Stablecoin inflows and whale buying drive ETH price up.

Meanwhile, analysts say the increased inflow of stablecoins into exchanges is another key factor driving Ethereum's rebound. Deposits of USDT and USDC rose by about 8% in the past 48 hours, indicating a recovery in buying interest from both retail and institutional investors. Blockchain data also shows that some whale wallets are increasing their ETH holdings at lower prices, with a significant increase in transactions exceeding 10,000 ETH per transaction, indicating that large holders remain confident in the market outlook.

Ethereum's strength has also reshaped the market structure. Bitcoin's market dominance has fallen from 60% to 58.6%, indicating a redistribution of funds. Many analysts point out that ETH's leading rally not only reflects improved market sentiment but also represents a rising preference for utility crypto assets. Ethereum's current price structure is consolidating in the $3400-$3450 range; a break above $3500 could trigger a new round of upward movement.

Bitcoin Hyper pre-sale continues to heat up, becoming a hot topic in Layer 2 gaming.

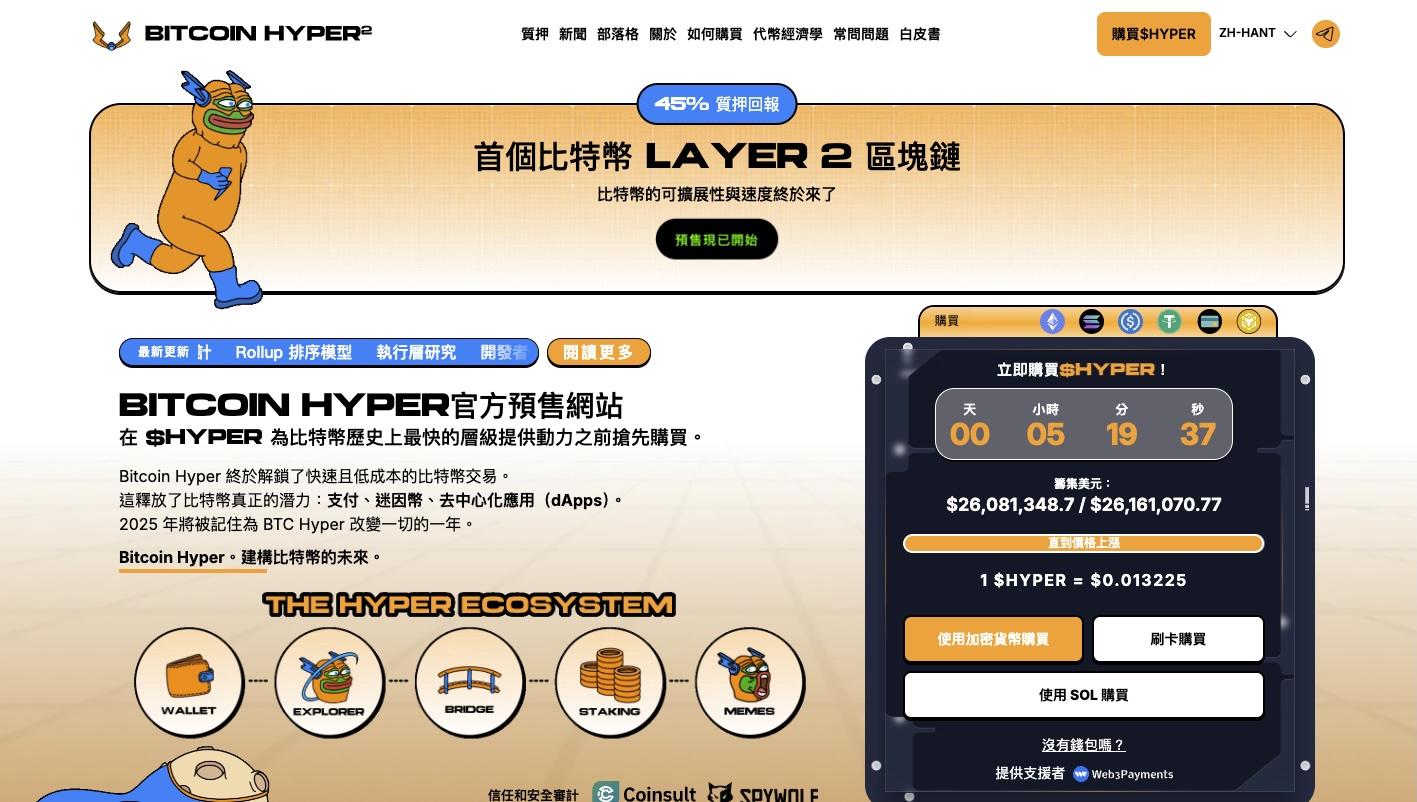

While Ethereum's strong performance has driven a market recovery, Bitcoin Hyper (HYPER) has become another focus of official promotion. This project, centered on the concept of Bitcoin Layer 2, claims to have attracted over $26 million in funding during its pre-sale, with a single whale purchase of $310,000 sparking considerable discussion. The official statement claims that HYPER is built on the Solana Virtual Machine (SVM), combining the security of BTC with the high performance of Solana, giving Bitcoin programmability and DeFi application potential for the first time.

According to official information, the HYPER token is currently priced at $0.013225 and uses an auto-incrementing mechanism, increasing every three days. As the core of the entire Layer 2 network, the token is responsible for transaction fees, staking rewards, and governance privileges. The official claim is that the annualized staking reward rate could reach as high as 45%, attracting a large number of early investors. This model, combining Layer 2 infrastructure with economic incentives, makes HYPER a key driver of a new cycle in the Bitcoin ecosystem.

Some analysts say that as Ethereum's price stabilizes and rebounds, investment interest in the entire Layer 2 blockchain sector is also rising. From Arbitrum to Optimism, and the emerging Bitcoin Hyper, funds are refocusing on "efficient and low-fee" blockchain infrastructure layer innovations. For investors, Ethereum's rise signifies a return to risk appetite, while pre-sales of Layer 2 projects offer opportunities for further expansion. Bitcoin Hyper, with its dual narrative of Bitcoin and Solana, has successfully attracted market funds, becoming the focus of attention after Ethereum.

For detailed information on purchasing Bitcoin Hyper from the official website, please visit here.

Conclusion: Ethereum regains dominance, and market sentiment turns positive.

This rebound, led by Ethereum, signifies a recovery in market sentiment and a rebalancing of funding structures. ETH's strength has not only stabilized confidence in mainstream cryptocurrencies but also reignited growth momentum in Layer 2 and DeFi. Against this backdrop, the pre-sale frenzy of Bitcoin Hyper has further amplified community expectations for the Layer 2 space. With Ethereum continuing to lead the gains and Bitcoin remaining stable, the overall crypto market may be poised for a new upward cycle driven by both capital and technology.

Disclaimer

Cryptocurrency investment carries high risks and significant price volatility, which may result in financial losses. This article is for informational purposes only and does not constitute investment advice. Please conduct your own research and make a careful decision.