Crypto markets dipped again on Friday, with Bitcoin briefly slipping under $100,000 and top altcoins retreating.

Bitcoin (BTC) is now flat on the day, trading near $101,700 after peaking above $110,000 earlier in the week.

Ethereum (ETH) is trading around $3,335, up 1.5% over the past 24 hours, but down 13% over the past week. Among other large-cap tokens, XRP, Solana’s SOL, and BNB are up by around 2% in the same timeframe.

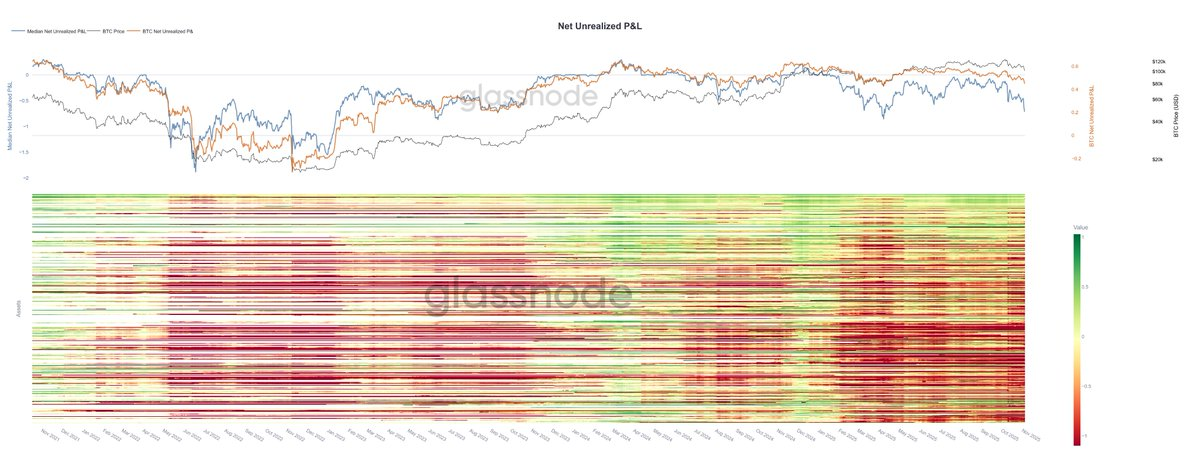

A Glassnode analyst under the alias 0x_anti noted in an X post today that altcoin net unrealized profit/loss (NUPL) is now in “deep capitulation territory,” adding that the market has reached a level “we haven't seen since the tariff war in April.”

The analyst noted that NUPL “clearly shows that we aren't quite in bear-market territory here overall” as the sentiment “seems to be though.”

Big Movers and Liquidations

Among the top-100 assets, Filecoin (FIL), NEAR and Zcash (ZEC) stand out as the best performers, up 101%, 43% and 32% on the day, respectively.

On the downside, LEO Token (LEO) and DASH lead losses, down 9% and 6%.

Data from Coinglass shows $712.1 million in leveraged positions liquidated in the past 24 hours, with longs accounting for $494.7 million and shorts $217.4 million. BTC and ETH liquidations were $9.5 million and $5.6 million, respectively, involving 242,347 traders overall.

ETFs and Macro Conditions

Spot Ethereum ETFs recorded $12.5 million in inflows Thursday, leaving total net assets at $21.75 billion. Spot Bitcoin ETFs saw $240 million in net inflows, bringing total net assets to $135.43 billion, according to data from SoSoValue.

On the macro side, U.S. Treasury yields barely moved on Friday as investors stayed cautious with the government shutdown still going on, CNBC reported. The 10-year Treasury yield went up less than 1 basis point to 4.102%, the 2-year note dropped just under 1 basis point to 3.562%, and the 30-year bond rose a bit more than 2 basis points to 4.708%.

Stock futures were down too, following a pullback in big tech stocks. Dow Jones futures fell 112 points, or 0.3%, while S&P 500 and Nasdaq 100 futures dropped 0.4% and 0.6%, leaving the major indexes on track for a losing week.