BNB has faced consistent selling pressure this month, with the cryptocurrency falling nearly 9% as it slipped below $1,000. The decline extends a broader market downtrend that has weighed on major altcoins.

However, historical indicators suggest that BNB’s recovery could be swift once accumulation begins at discounted levels.

BNB Investors Could Accumulate

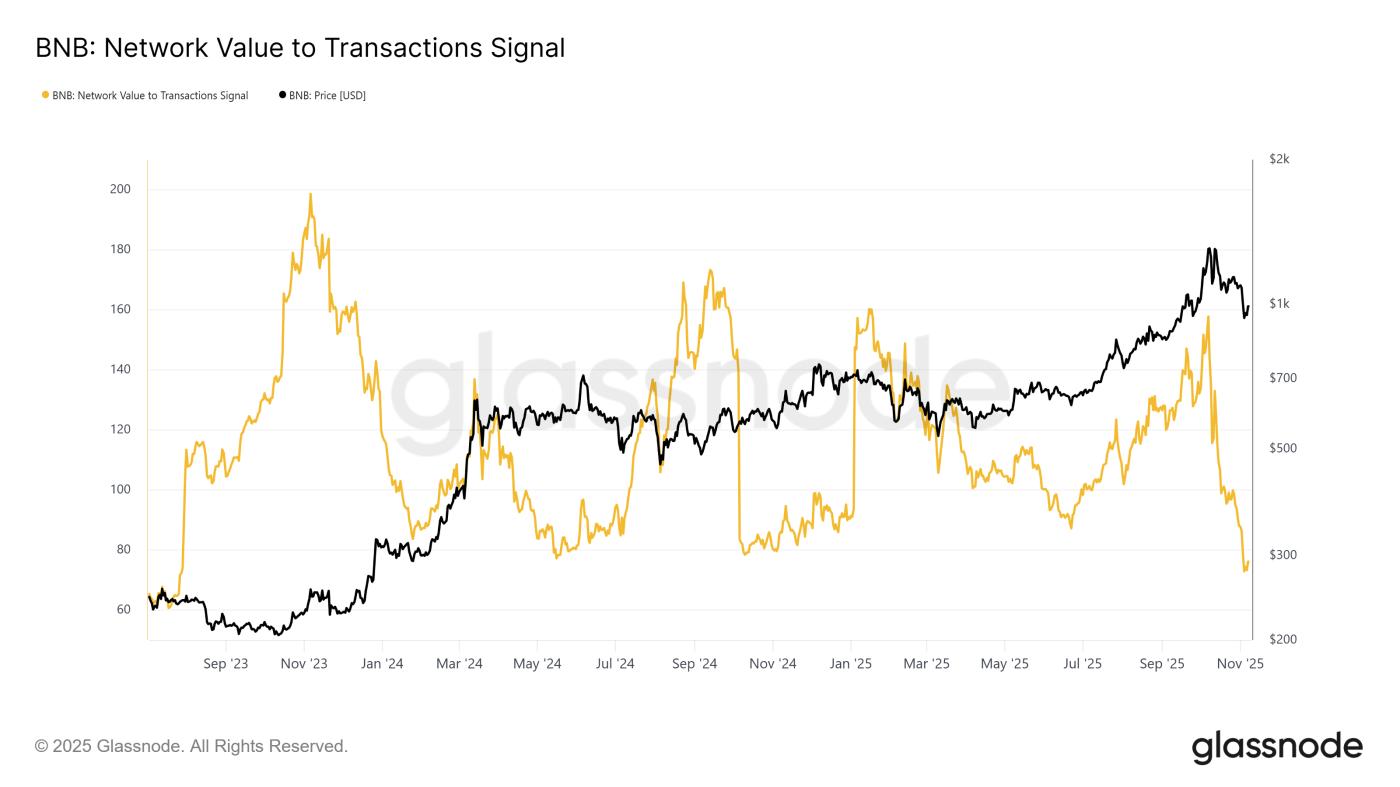

The NVT Signal, which measures a network’s valuation relative to transaction activity, is currently at a two-year and three-month low for BNB. This development typically signals that the asset may be undervalued, as on-chain transfer volume begins to outpace the growth in market capitalization.

Historically, such conditions have preceded sharp upward corrections.

This low NVT reading suggests that investors could begin viewing BNB as a bargain opportunity, marking the current price zone as a potential market bottom. If accumulation strengthens from these levels, buying pressure could stabilize the price.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BNB NVT Signal. Source: Glassnode

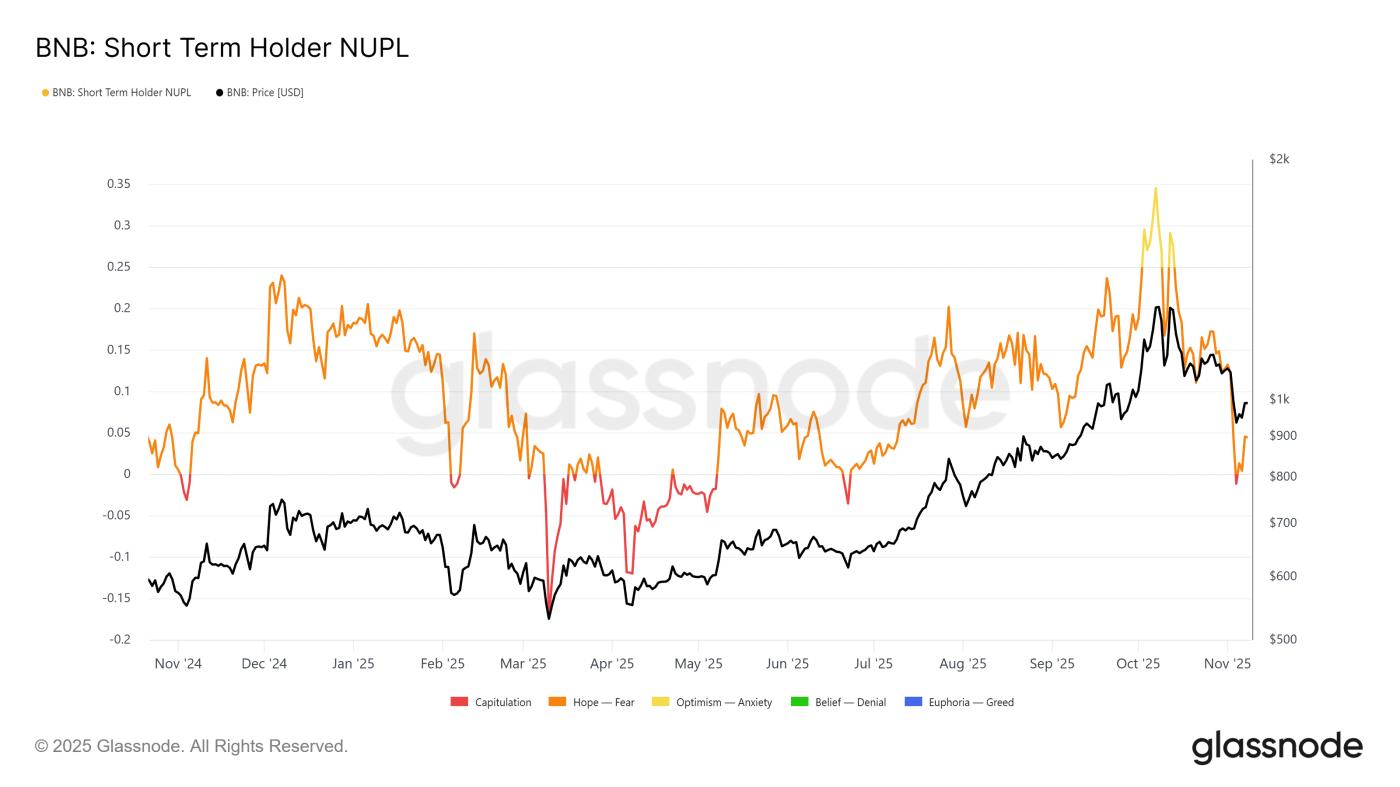

BNB NVT Signal. Source: GlassnodeThe short-term holder Net Unrealized Profit/Loss (STH NUPL) is currently dipping into the capitulation zone, another indicator hinting at an impending reversal.

Typically, short-term holders tend to sell early when profits emerge. However, during capitulation phases, they often accumulate at low valuations instead of selling at a loss.

Historically, extended dips of the STH NUPL indicator into capitulation have coincided with the end of major downtrends. For BNB, this pattern suggests that the ongoing decline could soon give way to a price rebound as renewed accumulation drives a shift in sentiment toward optimism and recovery.

BNB STH NUPL. Source: Glassnode

BNB STH NUPL. Source: GlassnodeBNB Price Is Facing a Downtrend

BNB’s price stands at $987, just under the $1,000 resistance level, after a 9% drop since early November. The month-long downtrend has tested investor confidence, but with strong on-chain signals, a rebound may be close.

If bullish momentum returns, BNB could breach the $1,000 mark and target $1,046, potentially breaking its downtrend. Sustained accumulation could then push the price higher toward $1,136.

BNB Price Analysis. Source: TradingView

BNB Price Analysis. Source: TradingViewHowever, if broader market weakness persists, BNB may revisit the $936 support. Losing this level would invalidate the bullish outlook and expose the token to a decline below $902.