#BTC

- Technical indicators show bullish momentum (MACD) but need breakout confirmation

- News sentiment is bifurcated: institutional optimism vs. miner/ETF pressures

- Price targets range from $142K (Power Law) to $170K (JP Morgan)

BTC Price Prediction

BTC Technical Analysis

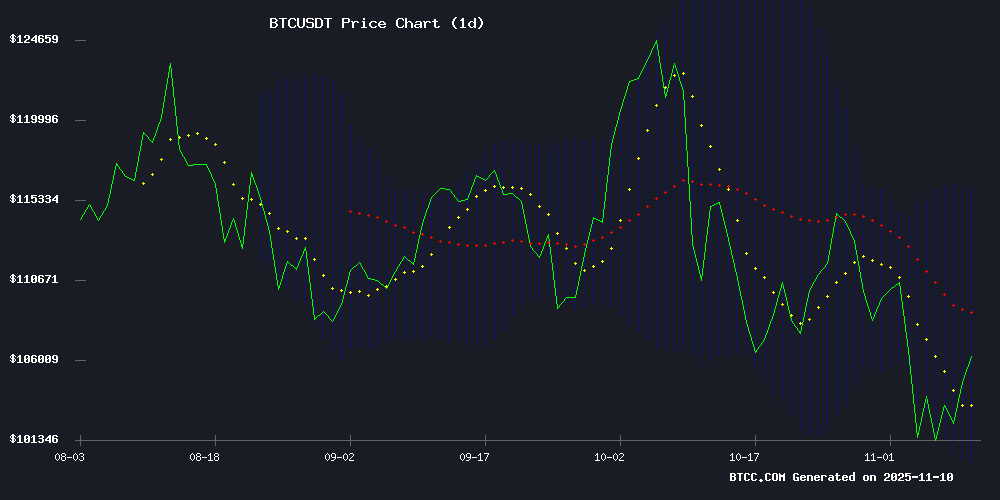

According to BTCC financial analyst Michael, BTC is currently trading at $106,144.25, slightly below its 20-day moving average of $108,014.20. The MACD indicator shows a bullish crossover with the MACD line at 3643.65 above the signal line at 2152.03, suggesting potential upward momentum. Bollinger Bands indicate volatility with the price NEAR the middle band, hinting at a possible breakout if it moves toward the upper band at $116,045.81.

BTC Market Sentiment Analysis

Michael from BTCC highlights mixed market signals. Negative pressures include ETF outflows ($1.28B weekly) and miner struggles, but bullish catalysts like JP Morgan's $170K prediction and Bitcoin's Power Law ($142K target) counterbalance them. Altcoin season potential adds complexity.

Factors Influencing BTC’s Price

Bitcoin Market in Restructuring Phase, Not Cycle Exhaustion: XWIN Research

Bitcoin's recent sluggish performance has sparked fears of a bull cycle end, but on-chain data suggests otherwise. XWIN Research Japan contends the market is merely resetting, with Leveraged positions being cleared out—a sign of restructuring rather than capitulation.

Open interest in Bitcoin futures has plummeted since late October, indicating short-term traders are exiting leveraged bets. Historically, cycle peaks see leveraged trading surge even at elevated prices. The absence of such euphoria now points to a recalibration, not a top.

'This isn’t exhaustion—it’s preparation,' the report implies, framing the downturn as groundwork for Bitcoin’s next major move. The analysis sidesteps panic, emphasizing structural health over price volatility.

Bitcoin Tests Key Support Amid ETF Outflows and Miner Pressures

Bitcoin hovers NEAR $102,001 after a 7.72% weekly drop, retesting the 50-week SMA at $102,980—a level that previously preceded all-time highs in 2023-2024. Traders watch for a weekly close above $103,200 to confirm bullish momentum, but descending trendline resistance and $2.3 billion in ETF outflows since peak levels weigh on sentiment.

The mining sector faces existential pressure as hash price plunges to $42/PH/s, nearing post-halving break-even costs. Major firms like Cipher Mining and IREN pivot to AI infrastructure deals totaling $15.2 billion with Amazon and Microsoft, while Bitdeer shifts to self-mining strategies.

Onchain activity reveals stark contrasts: trader James Wynn booked $85,380 profit on a 40x short, while Owen Gunden moved 600 BTC ($61.17M) to Kraken—potentially signaling divergent views on near-term direction.

Bitcoin ETFs See $1.28 Billion in Weekly Outflows as BTC Retests $100K

Bitcoin's volatile price action last week, including a retest of the $100,000 psychological level, coincided with significant capital flight from US spot ETFs. Institutional investors withdrew $1.28 billion net from these products, reflecting growing caution amid market uncertainty.

BlackRock's IBIT led outflows with $580.98 million withdrawn, though it maintains $82.28 billion in assets. Fidelity's FBTC saw $438.30 million exit but retains its position as the second-best performing ETF with $12 billion cumulative inflows. Ark Invest's ARKB and Grayscale's GBTC recorded smaller but notable outflows of $128.92 million and $64.33 million respectively.

Ex-Footballer Denies Crypto Theft Allegations Amid Legal Battle

Former rugby league player Merrin faces charges of stealing $91,000 in Bitcoin from ex-teammate Kade Ellis, according to New South Wales police. The alleged theft stems from a 2021 cryptocurrency investment arrangement where Merrin reportedly maintained control of the Bitcoin wallet's credentials.

Legal representatives for the athlete counter that Ellis received sevenfold returns on his initial investment, with documented transactions to support their claims. Forensic analysis of seized electronic devices may prove pivotal in the coming court proceedings.

The case highlights growing scrutiny around informal crypto arrangements between personal acquaintances. As digital asset adoption increases, such disputes test the boundaries between investment partnerships and alleged malfeasance in decentralized finance ecosystems.

Bitcoin's Power Law Suggests Imminent Surge to $142K Fair Value

Bitcoin's price trajectory appears primed for a significant upward move, according to power law models analyzed by writer Adam Livingston. The model positions BTC's fair value at $142,000, with historical patterns suggesting the asset is now 'hugging' this critical threshold—a rare occurrence that typically precedes explosive rallies.

The upper-band projection reaches $512,000 by December 2025, while the floor remains robust near $50,000. Market behavior since March 2024 mirrors past cycles where Bitcoin either surged immediately after reaching this valuation band or dipped briefly before stronger recoveries.

Recent volatility, including heavy liquidation events, hasn't derailed the asset's structural resilience. 'This isn't just technical analysis—it's mathematical inevitability,' remarked one trader, referencing the power law's decade-long predictive accuracy for BTC's price discovery.

Bitcoin Dominance Weakness Signals Potential Altcoin Season, Analyst Suggests

Bitcoin's market dominance is showing signs of erosion, with a 5.13% decline since May, now standing at 59.90%. Crypto analyst Matthew Hyland interprets this trend as a precursor to an impending altcoin season. "The BTC Dominance chart looks bearish and has looked bearish for many weeks," Hyland noted, suggesting the current relief rally may be a temporary rebound within a broader downtrend.

Hyland also raised concerns about potential market manipulation, speculating that Wall Street institutions could be behind Bitcoin's recent volatility. "Over the past month, I've maintained the view that much of this was essentially manipulation for Wall Street to position themselves," he stated in a recent analysis.

Despite these developments, altcoin season remains unconfirmed, with market indices still firmly in "Bitcoin Season" territory. The weakening dominance of BTC, however, suggests growing potential for altcoins to outperform in the near term.

Former Binance CEO CZ Denies Ties to Trump Amid Pardon Controversy

Changpeng Zhao, co-founder of Binance, expressed surprise at receiving a presidential pardon from Donald Trump, emphasizing he has no personal or business connections to the former U.S. president. The unexpected clemency, granted in October, has drawn scrutiny from Democratic lawmakers who allege potential impropriety.

Zhao clarified his sole interaction with the TRUMP family was a brief meeting with Eric Trump at a cryptocurrency conference in Abu Dhabi. He categorically denied any financial links between Binance and World Liberty Finance, a platform associated with Trump allies.

The pardon process remained opaque even to Zhao, who stated his legal team submitted the petition in April without receiving updates on its progress. The MOVE has become a flashpoint in ongoing debates about cryptocurrency's political influence.

Bitcoin Miners Face Survival Crisis as Hashprice Tumbles Below Critical Threshold

Bitcoin's mining sector is grappling with intensifying pressure as the hashprice—a key profitability metric—plunges toward levels that threaten operational viability. Current estimates place the hashprice at $42 per PH/s, a stark decline from July's $62+ levels. This erosion pushes marginal operators toward shutdown territory, with $40/PH/s widely viewed as the breakeven threshold for efficient miners.

Hardware manufacturers and hosting services face collateral damage. Machine orders have slowed precipitously, while Bitcoin-denominated revenues depreciated further during October's market downturn. Some firms like Bitdeer are pivoting to self-mining strategies to absorb excess inventory.

The industry's structural challenges compound these cyclical pressures. April's halving event slashed block rewards to 3.125 BTC—a far cry from 2009's 50 BTC payouts. Today's capital-intensive ASIC requirements have rendered CPU mining obsolete, forcing operators to explore alternative revenue streams including AI compute services.

Binance Founder CZ Breaks Silence on Trump Pardon in FOX News Interview

Changpeng Zhao, founder of Binance, made his first televised appearance since receiving a controversial presidential pardon from Donald Trump. In a FOX News Special Report interview, Zhao expressed surprise at the October 21 clemency decision, which vacated his four-month sentence for anti-money laundering violations.

The Binance executive vehemently denied speculation about political connections facilitating the pardon. "There was no deal and no discussion," Zhao stated when addressing rumors of backchannel negotiations with WLFI. His sole encounter with the Trump family amounted to a brief meeting with Eric Trump at a bitcoin conference in Abu Dhabi.

Market analysts interpret Trump's intervention as signaling a broader policy shift toward cryptocurrency regulation. The pardon has ignited debates about institutional influence in digital asset markets, though Zhao maintains no special access to political power centers.

JP Morgan Predicts Bitcoin Rally to $170K as Institutional Demand Surges

JP Morgan analysts project Bitcoin could reach $170,000 within 12 months, citing institutional adoption and ETF inflows as key drivers. The cryptocurrency, currently trading near $100,980, is increasingly viewed as digital Gold amid tightening traditional market liquidity.

Market attention is shifting toward altcoins as capital rotation gains momentum. Layer 1 networks, DeFi tokens, and cross-chain projects are attracting investor interest despite Bitcoin's strong fundamentals. Emerging platforms like Hyperliquid and Remittix are appearing on analyst watchlists as potential outperformers.

Bitcoin's recent 28% weekly ETF volume surge signals renewed institutional participation. The bank's forecast suggests corporate treasury adoption and digital asset fund growth could propel prices toward $150,000-$170,000 by mid-2026.

Spain’s Science Institute To Liquidate Decade-Old Bitcoin Holdings Worth $10M

The Institute of Technology and Renewable Energies (ITER) in Tenerife is preparing to sell 97 Bitcoin acquired in 2012 for €10,000—now valued at over $10 million. Originally purchased for blockchain research, the windfall will fund quantum technology and other scientific initiatives.

Liquidation faces regulatory hurdles, requiring compliance with Bank of Spain and CNMV rules. Proceeds will bypass retail exchanges, processed through a regulated financial institution. The move highlights institutional crypto adoption’s long-term payoff.

How High Will BTC Price Go?

Michael projects BTC could reach $142K-$170K based on institutional demand and Power Law models, but warns of short-term volatility. Key levels:

| Support | Resistance |

|---|---|

| $100K | $116K (Bollinger Upper) |