#SOL

- Technical Headwinds: Price below key moving averages with weakening momentum

- Fundamental Crosscurrents: ETF demand vs. FTX creditor selling pressure

- Price Target Reality: $200 requires 23% rally amid bearish structure

SOL Price Prediction

SOL Technical Analysis: Bearish Signals Dominate Short-Term Outlook

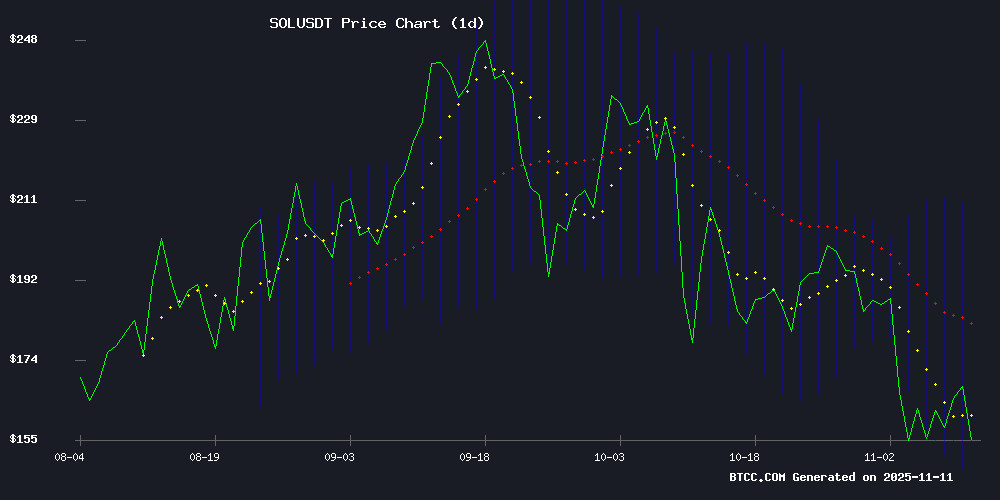

SOL is currently trading at $163.44, significantly below its 20-day moving average of $178.27, indicating bearish momentum. The MACD shows a bullish crossover (15.65 > 10.41) but the histogram is narrowing at 5.24, suggesting weakening upside momentum. Bollinger Bands show price testing the lower band at $146.67, which may act as support. 'The confluence of technical indicators points to continued volatility,' says BTCC analyst William. 'SOL needs to reclaim the $178 MA to shift sentiment.'

Mixed Fundamentals Create Crosscurrents for SOL Price Action

While solana ETFs continue seeing institutional demand, the network faces heavy selling pressure after breaking critical support. The FTX creditor distributions ($7.1B already paid) create ongoing sell-side pressure. 'These fundamental factors create a tug-of-war,' notes BTCC's William. 'ETF flows could provide a floor, but technicals suggest the $200 target looks ambitious near-term.'

Factors Influencing SOL's Price

Solana ETFs See Sustained Institutional Demand Despite Market Volatility

Spot Solana exchange-traded funds in the U.S. have notched ten consecutive days of net inflows, defying recent price weakness with $342.48 million accumulated since launch. Bitwise's BSOL led Monday's $6.78 million inflow, while Grayscale's GSOL contributed $854,480—marking the smallest daily gain yet but reinforcing a pattern of institutional conviction.

Analysts highlight the $70 million single-day inflow last Wednesday as particularly telling. 'This isn't just niche interest—it's institutional portfolios allocating to SOL as a high-beta complement to Bitcoin and Ethereum,' said Nick Ruck of LVRG Research. The trend contradicts early skepticism about Solana's regulatory and technical hurdles, with Bloomberg's Eric Balchunas calling the flows a mainstream adoption signal.

Solana Breaks Critical Support Amid Heavy Selling Pressure

Solana's price tumbled below a key technical threshold, dropping 3.1% to $164.30 as trading volume spiked 58% above average. The breakdown through $163.85 support triggered accelerated selling, with 66,399 transactions recorded during peak liquidation hours.

Technical indicators turned decisively bearish as SOL failed to hold psychological support at $165. Multiple rejection attempts at higher levels—including failed tests of $170.50 and $171.92—confirmed weakening buyer momentum. The altcoin's volatility reading of 4.9 reflected intense intraday swings spanning $8.06.

Market structure deteriorated further when a midday sell-off pushed volume to 1.47 million SOL, establishing clear downward momentum. Short-lived recovery attempts met immediate resistance, most notably when a bounce from $164.97 collapsed to $163.46 within hours.

FTX Creditors Receive $7.1B in Distributions, Next Payout Set for 2026

The FTX bankruptcy estate has distributed $7.1 billion to creditors across three rounds, marking significant progress since the exchange's collapse in November 2022. The first payout of $454 million occurred in February 2025, followed by $5 billion in May and $1.6 billion in September. Convenience Class creditors—those with claims under $50,000—have been fully repaid with interest.

Asset recoveries now total between $14.7 billion and $16.5 billion through liquidations and settlements. Payment providers including BitGo, Kraken, and Payoneer facilitate global distributions. The next disbursement is scheduled for January 2026, with eligibility determinations concluding by December 2025.

Will SOL Price Hit 200?

Based on current technicals and fundamentals, SOL faces significant resistance to reach $200 in the near term:

| Level | Value | Significance |

|---|---|---|

| Current Price | $163.44 | 23% below $200 target |

| 20-day MA | $178.27 | Key resistance level |

| Upper Bollinger | $209.86 | Would require extreme volatility |

BTCC's William observes: 'While institutional ETF demand provides support, SOL would need to overcome multiple technical hurdles and see a macro risk-on shift to test $200 before year-end.'

html