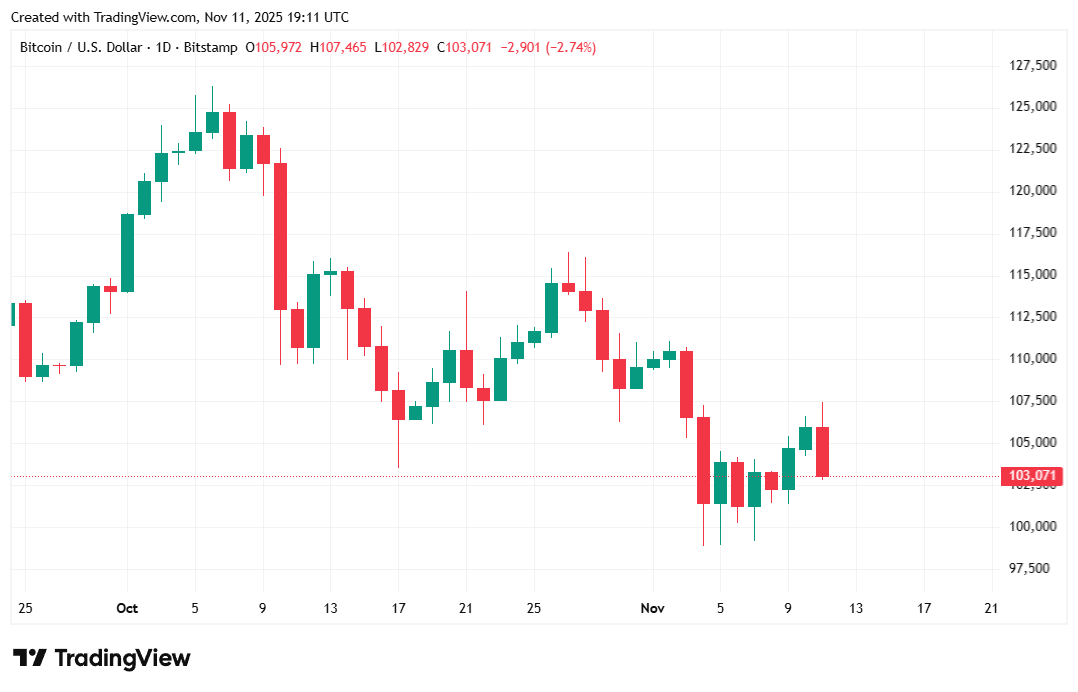

The leading cryptocurrency eased to $103K on Tuesday afternoon after climbing as high as $107K following a breakthrough in Congress to end the ongoing government closure.

Government Shutdown or AI Bubble? The Reason Bitcoin is Down

Japanese investment giant Softbank reported on Tuesday that it had offloaded its entire $5.83 billion stake in Nvidia, sending the chipmaker’s shares down nearly 3%. But Softbank’s Chief Financial Officer Yoshimitsu Goto, claims the move isn’t an indictment of overvalued AI companies, but rather, a strategic liquidation to transfer cash to OpenAI where Softbank will make a mammoth $22.5 billion investment. Nevertheless, tech stocks went lower and so did bitcoin, with the Nasdaq dipping 0.23% and the cryptocurrency shedding roughly 2.5%.

“We want to provide a lot of investment opportunities for investors, while we can still maintain financial strength,” Goto said, according to CNBC.

But there are multiple catalysts at play here. Monday saw bitcoin jump, after a Sunday evening breakthrough in Congress resulted in the successful passage of a funding bill that could finally end the longest federal government shutdown in U.S. history. The bill is now in the House where it will be voted on tomorrow afternoon.

The push-and-pull effect of competing catalysts appears to have made some traders noncommittal, with most skewing bearish. The shutdown has left the state of the U.S. economy up to speculation without the regular macroeconomic data provided by federal agencies, such as employment and inflation reports. Once the government re-opens, markets may be in for a pleasant or nasty surprise, or perhaps a bit of both, when critical data is finally processed and published. The uncertainty alone, could be the reason bitcoin slipped today.

“The shutdown of the federal government has delayed nearly all federal economic data releases for September and October,” said Goldman Sachs economists Elsie Peng and Ronnie Walker in a client note, according to CNBC. “While the shutdown appears to be nearing its end, it will take time for the statistical agencies to work through the backlog of releases.”

Overview of Market Metrics

Bitcoin was priced at $103,143.61 at the time of reporting, down 2.35% for the day, but up 1.78% over seven days, according to Coinmarketcap. The digital asset has been trading between $102,871.47 and $107,428.26 since yesterday.

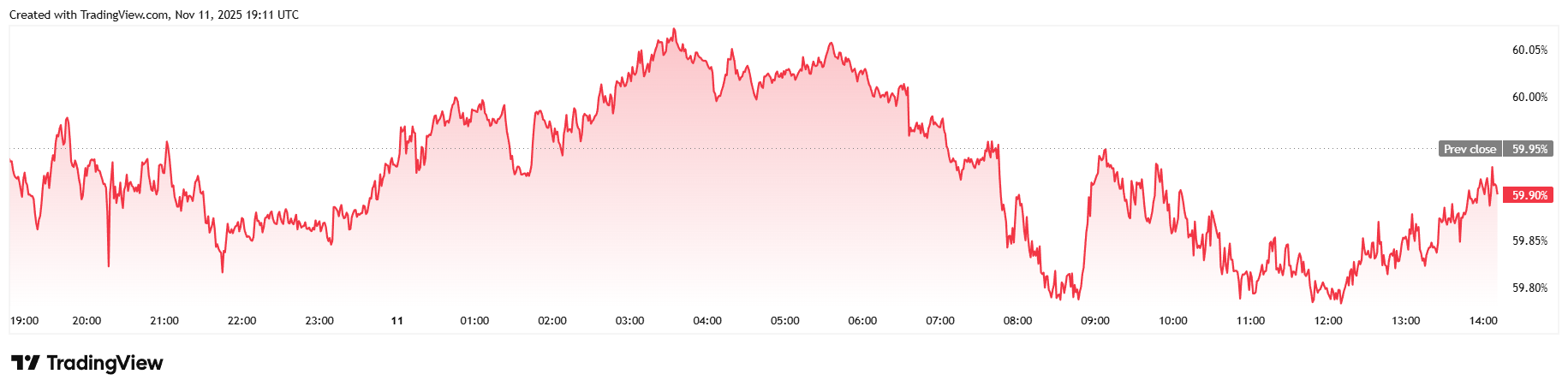

Twenty-four-hour trading volume dipped 4.32% to $71.01 billion and market capitalization fell to $2.05 trillion. Bitcoin dominance was also down, slipping 0.07% to 59.90%, falling below the 60% threshold it had recently reclaimed.

The total value of open bitcoin futures contracts was mostly flat at $68.53 billion, a 0.64% decrease, according to Coinglass. Liquidations were also lower over 24 hours at a grand total of $119.71 million. Long liquidations dominated the losses with $84.51 million wiped out, while shorts saw $35.20 million in liquidated margin.

FAQ ⚡

-

Why did bitcoin drop to $103K today?

Multiple reasons, but the sell-off following Softbank’s $5.83 billion Nvidia exit may have been a factor. -

Is the U.S. government shutdown affecting bitcoin?

The ongoing closure has delayed key economic data, creating uncertainty and dampening investor sentiment. -

What’s the latest on the shutdown deal?

Congress passed a funding bill in the Senate, and the House is set to vote on it tomorrow to potentially end the 41-day standoff. -

What are analysts watching next?

Traders expect volatility once the postponed U.S. inflation and employment data are finally released after the government reopens.