The delayed US CPI report — which was previously postponed due to the historic government shutdown — is scheduled for November 13, 2024, with market expectations high. Inflation is expected to hold near 2.6% in October and 3.3% in September, a lower reading could revive hopes for a rate cut, while a higher reading could delay it again. Ahead of the release, crypto whales are making selective purchases.

They appear to be shifting away from large risky bets towards Token with stable platforms and clear applications. Their accumulation patterns show a focus on DeFi related assets and lower-volatility projects. And the price structures show early signs of a trend reversal.

Chainlink (LINK)

Crypto whales are buying Chainlink again after weeks of selling. Over the past 24 hours, whales' holdings of LINK increased from 542.92 million LINK to 543.07 million LINK. That's a total of about 150,000 LINK, worth about $2.36 million at current prices.

LINK Whales: Santiment

LINK Whales: SantimentWant more information on Token like this? Sign up for Editor Harsh Notariya's daily Crypto newsletter here .

This sudden buying spree came ahead of the US CPI report, suggesting that whales expect low or stable inflation that could lift overall market sentiment. Their renewed interest suggests a belief that Chainlink ’s recent weakness may be nearing a Dip.

Technically, the LINK price has made a lower low between October 10, 2024, and November 4, 2024, while its Relative Strength Index (RSI) — which measures buying and selling power — has made a higher low. This rare bullish divergence often appears before a trend reversal, indicating accumulation hidden beneath the surface. For the current trend, LINK has fallen about 33% over the past three months, making the latest reversal theory more meaningful.

If this pattern plays out, the first key level to watch is $18.76, which has held back several rallies since late October. A break above this level could open up the next leg of the rally towards $23.80, and potentially as high as $27.92, confirming that whales got in at the right time.

LINK Price Analysis: TradingView

LINK Price Analysis: TradingViewHowever, if LINK price falls below $13.72, the structure will fail, and the price could revisit lower supports. Currently, the combination of whale accumulation, bullish divergence, and CPI-related optimism shows why crypto whales are buying Chainlink ahead of this important report.

Pendle (Pendle)

Crypto whales are also buying Pendle, steadily accumulating ahead of the CPI announcement. Unlike Chainlink ’s sudden surge in whale activity in the past 24 hours, Pendle ’s accumulation has been building quietly over the past week.

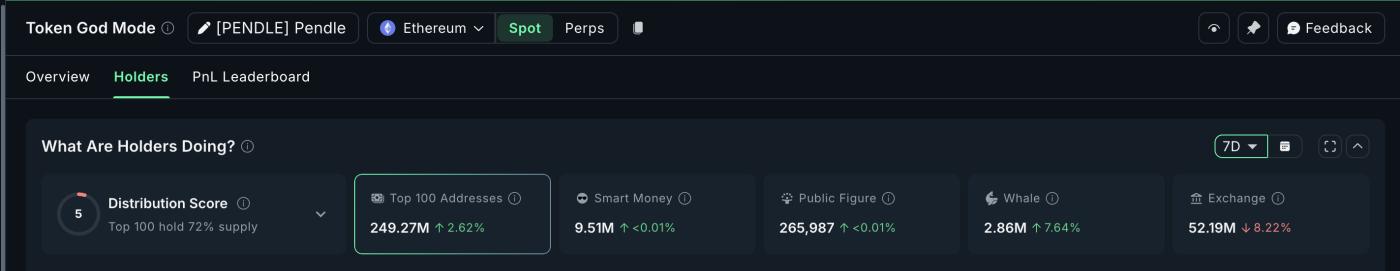

Whale wallets holding between 100,000 and 1 million Pendle increased their balances by 7.64%, reaching 2.86 million Token. At the same time, the top 100 addresses (mega whales) increased their holdings by 2.62%, now reaching 249.27 million Token — an additional 6.37 million Pendle, worth nearly $17.7 million.

Both whales and top holders have accumulated around 6.57 million Pendle over the past seven days, totaling nearly $18.3 million.

Pendle Whales: Nansen

Pendle Whales: NansenThis purchase occurred while the price had already risen slightly by 6.5% over the same period, suggesting that large holders were taking positions early, likely expecting a CPI-driven market rally. Despite the recent short-term rebound, Pendle is still down 47.9% over the past three months, making these levels an attractive place to accumulate.

Technically, the chart suggests why whales are getting involved. The Money Flow Index (MFI) indicator — which tracks money flowing into or out of an asset by comparing price and volume — just broke above a falling trendline that has been connecting lower highs since early November. The breakout suggests that inflow momentum is improving after weeks of decline, which is often seen in the early stages of recovery cycles.

If the price continues to rise, Pendle could test $3.37 first. A clear daily close above that level would open the way to $3.94. And if the macro sentiment continues to strengthen, $6.25 would be the long-term target.

Pendle Price Analysis: TradingView

Pendle Price Analysis: TradingViewHowever, if Pendle falls below $2.50, MFI's breakout could fail and short-term selling could resume, which would cause this DeFi Token to make a new low.

Cardano (ADA)

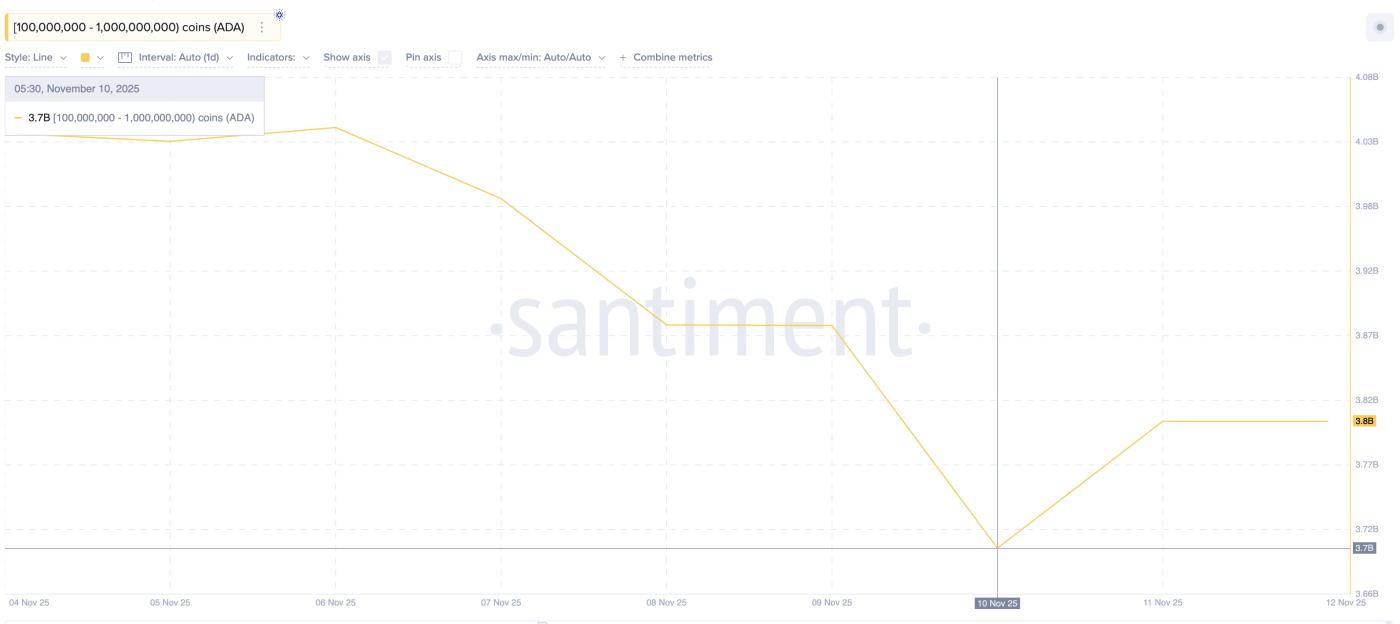

Crypto whales are buying Cardano again – but this time, the sentiment seems more cautious. Large holders of ADA between 100 million and 1 billion Token have increased their balances from 3.7 billion ADA to 3.8 billion ADA since November 10.

That's about 100 million ADA added in just two days, worth about $57 million at current prices.

ADA Whales Return to Buying: Santiment

ADA Whales Return to Buying: SantimentThis is the first significant accumulation wave in weeks and comes just ahead of the US CPI report, suggesting that whales may be targeting safer, less volatile assets while awaiting clarity on the macro front. ADA has barely moved over the past year – trading in a wide but slow range, making it the more “defensive” option among major altcoins.

The technical charts also support this move. ADA has fallen 41% in the past three months. However, from June 5 to November 4, the price made lower Dip while the momentum indicators made higher Dip . This is a classic bullish divergence pattern that often appears before a trend reversal.

Note that a similar divergence configuration appeared previously from June to mid-October. But previous rallies were capped below $0.69. This time, however, the lower Dip are clearer, which could create stronger upside momentum if the pattern plays out.

ADA ’s next resistance level is at $0.61, about 8% above current levels. A breakout above that would open the door to a move to $0.73, and a daily close above $0.73 could extend gains to $0.93 or higher.

ADA Price Analysis : TradingView

ADA Price Analysis : TradingViewHowever, if the price breaks below $0.49, the bullish configuration will fail, revealing a deeper correction.