Source: BitMEX Research

Original title: A Bit Of A Stretch

Compiled and edited by: BitpushNews

(Any views expressed here are the author's personal opinions and should not be used as the basis for investment decisions, nor should they be interpreted as recommendations or advice for participating in investment transactions.)

summary:

Let's take a look at Stretch ($STRC), a very new type of MSTR debt instrument designed to achieve price stability by adjusting the dividend yield monthly based on the market price of the debt.

Therefore, the product was marketed as a low-risk offering and compared to short-term U.S. Treasury bonds. This is yet another instance of Mr. Saylor maneuvering within the rules of the financial system to accumulate more Bitcoin.

Our analysis of the U.S. Securities and Exchange Commission (SEC) documents revealed that MSTR can abandon its goal of maintaining price stability at any time and reduce its dividend by up to 25 basis points per month, should it so choose.

This means that the dividend yield could drop to zero in just over three years. Therefore, we believe that the product terms are heavily biased towards MSTRs, and from an investment perspective, its risk is far higher than that of short-term government bonds .

Overview

In November 2024, we posted about MSTR, specifically the "We did Ponzi math" post:

https://x.com/BitMEXResearch/status/1859559585301909660

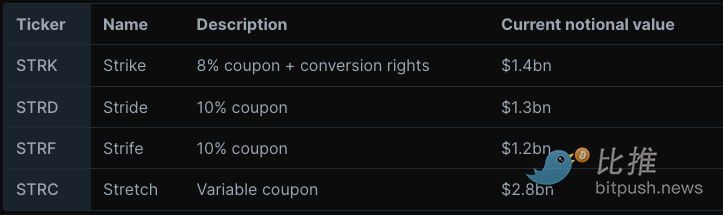

This is relatively simple, only looking at stocks. Besides stocks, MSTR offers a whole suite of financial products for investment. In particular, a relatively new wave of preferred perpetual securities:

In this article, we will focus on STRC, which we believe is the most interesting of the four products.

In particular, following our post on X in November 2024, STRC is the product that has caused us the most questions.

Questions such as:

What happens when the music stops and new funding for MSTR runs out?

How will MSTR cover STRC's dividend payments at that time?

Will MSTR be forced to sell Bitcoin?

Is STRC a Ponzi scheme?

In light of all these issues, we decided to write this brief explanation to outline our basic views on STRC.

What is STRC?

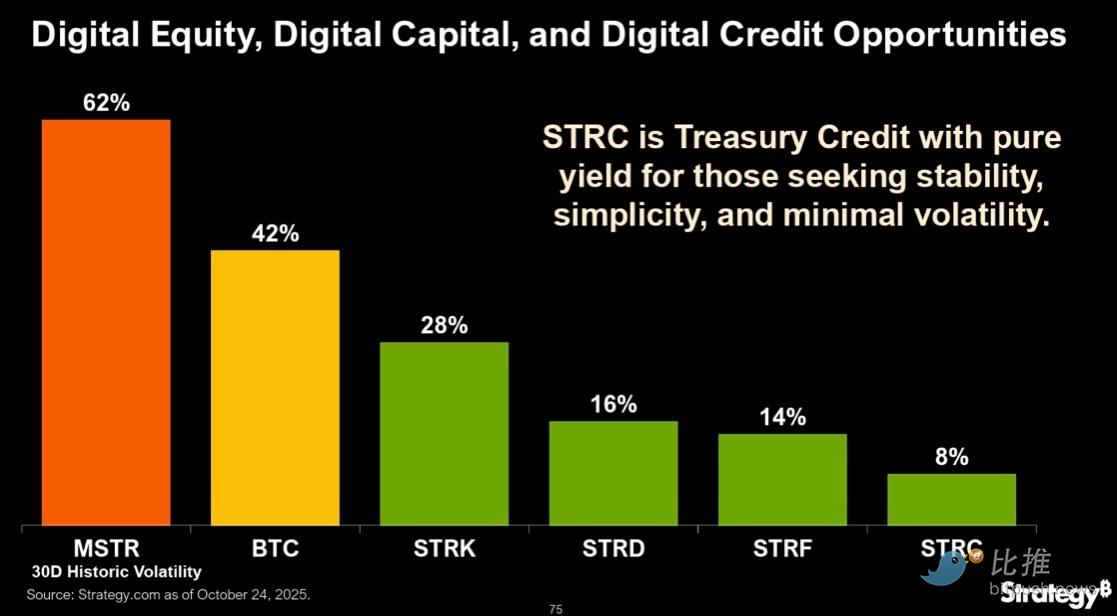

STRC is advertised as the lowest-risk component of the MSTR investment product suite. Its risk is so low that it is comparable to US Treasury bonds or stablecoins.

However, the yield is significantly higher than these low-risk alternatives. You can see an image below from a recent investor presentation by MSTR, where STRC is compared to "Treasury Credit".

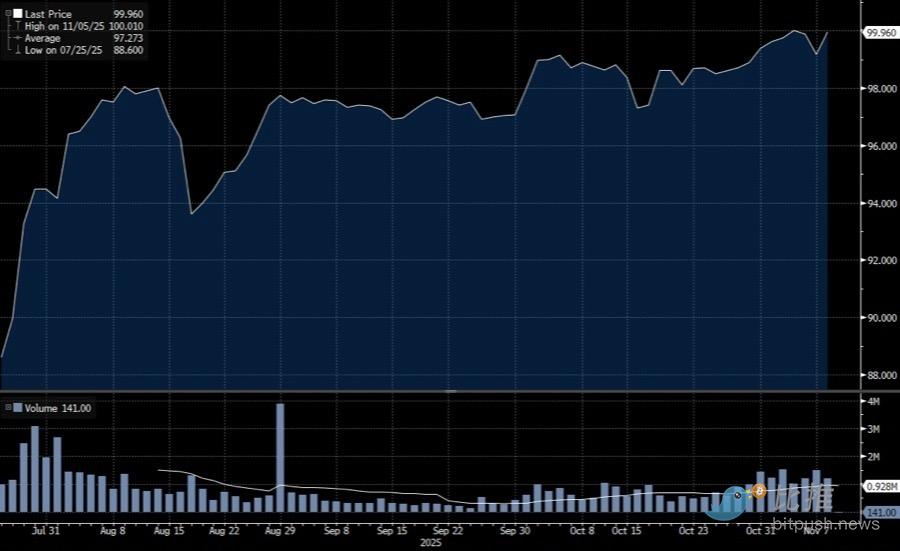

STRC tickets recently traded at face value as high as $100. This indicates some success and relatively stable prices.

How are interest rates determined?

STRC's goal appears to be to reach or approach $100 in its trading price. Dividends are typically paid monthly, and the company has the discretion to adjust them.

The idea is that if the price of STRC falls below $100, dividend payments can be increased, which should drive up the price of MSTR.

In another scenario, if the STRC trades above $100, the dividend amount can be reduced, which should theoretically push the price down to $100.

Therefore, this instrument should be very stable and consistently trade at or near $100. This makes STRC a cash-like instrument and an alternative investment to short-term Treasury bonds. A key difference from Treasury bonds is that the funds raised from issuing STRC are used to purchase Bitcoin. This is yet another hacking attempt on the financial system to buy more Bitcoin.

To the best of our knowledge, STRC is a novel product. There are no other similar debt instruments.

Debt instruments typically have a fixed coupon or a variable coupon, where the interest rate varies depending on other interest rates in the economy, such as the federal funds rate.

We are unaware of any other debt instrument whose interest rate would change in order to maintain the stability of the market price of the debt.

MSTR appears confident because their previous success in hacking the financial system (selling their own stock at a premium to buy Bitcoin) has led them to devise an even more audacious hacking method: issuing debt to buy Bitcoin, and thanks to some novel techniques, this debt appears to carry the same risks as short-term government bonds.

On the surface, this new debt issuance model immediately gives the impression that it may be unsustainable for a company.

If a company has a fixed coupon rate and is in trouble, its liabilities remain unchanged.

However, if a company has a variable coupon rate, and its changes are designed to maintain debt price stability, then if the company falls into distress and credit risk increases, it will need to increase coupon payments to maintain debt price stability. This means that as the company falls into distress, its debt will increase.

Therefore, a downward death spiral could occur, with the company's creditworthiness declining until bankruptcy. Thus, these novel instruments could increase corporate instability. In the case of MSTR, a drop in Bitcoin price could lead to a decrease in the value of STRC, which could increase the monthly payment liabilities of MSTR, thus causing a downward spiral.

What are the rules regarding interest rates?

Given the above mechanism, it is worth noting how the rules for monthly dividend payments are set, rather than simply the goal of STRC price stability. Particular attention should be paid to the rules regarding coupon rate reductions. The rules are described below, but may be difficult to understand due to legal language.

However, we will not be permitted to reduce the annual monthly regular dividend yield applicable to any regular dividend period:

(i) Exceeding the following amounts relative to the annual monthly regular dividend rate applicable to the previous regular dividend period: (1) the sum of 25 basis points; and (2) (x) the 'monthly SOFR annual rate' (as defined in this supplement to the prospectus) on the first business day of the previous regular dividend period exceeding (y) the portion exceeding the minimum of the monthly SOFR annual rate occurring on the business days from (inclusive) the first business day to (inclusive) the last business day of the previous regular dividend period (if any);

Or (ii) the annualized rate falls below the monthly SOFR annualized rate effective on the business day prior to our provision of the next regular dividend rate notice.

Source: https://www.sec.gov/Archives/edgar/data/1050446/000119312525165531/d852456d424b5.htm

Note: SOFR is the US market-based benchmark overnight interest rate. It was designed to replace LIBOR, which is more easily manipulated by certain banks.

Our understanding of the above is that MSTR has absolute autonomy to reduce the dividend yield by up to 25 basis points per month, regardless of what happens otherwise.

Regardless of what happens to the STRC price or the broader market, the dividend yield can decrease by 25 basis points per month. That equates to 300 basis points or 3 percentage points per year.

Therefore, based on the current 10% dividend yield, at the maximum permissible rate of decline, it would take three years and four months to bring interest rates to zero. In some cases, if market interest rates in the broader economy are also declining, companies can reduce the dividend yield much faster each month.

For example, if the overnight market rate falls by 100 basis points over a month (from the beginning of the month to its lowest point), then the STRC dividend yield could fall by 100 basis points + 25 basis points = 125 basis points in any given month. This seems fair if the benchmark rate falls, and the STRC should be able to adjust accordingly.

There are also some complicated rules regarding what happens if MSTR fails to pay its declared coupon. If this happens, the unpaid dividends continue to accrue.

Our understanding is that MSTR cannot pay "dividends of any class of dividend par stock" until the outstanding balance of this accrued dividend is paid, unless it also pays STRC dividends, and this proportion is no less than the same proportion of another class of stock that pays dividends.

In other words, the higher the accumulated unpaid dividends, the more difficult it is to pay any significant dividends for any other class of stocks.

Therefore, if MSTR begins to accumulate unpaid dividends on STRCs, it becomes more difficult to pay any other equity instruments. However, there is still no guarantee of any kind or risk of bankruptcy, and the company is not obligated to pay dividends to STRC holders at all if it chooses not to.

Is STRC a Ponzi scheme?

Now that we understand the mechanism of STRC, we can address the question of whether it shares characteristics with a Ponzi scheme. While it's not literally a Ponzi scheme because it's not based on lies or fraud, it's fair to compare something to a Ponzi scheme if it shares many similarities—for example, it delivers seemingly strong and consistent returns to investors, but the funding for these returns relies on a continuous influx of new capital into the system, causing it to collapse severely when the flow of funds stops.

From a cash flow perspective, STRC is costly, with an issuance of approximately $3 billion and an annual dividend payout of $300 million at a 10% interest rate. MSTR cannot afford this expense without raising new funds or selling Bitcoin, thus, in this sense, this instrument resembles a Ponzi scheme.

However, this does not resemble a Ponzi scheme at all when considering that dividend payments can gracefully and gradually decrease at the company’s absolute discretion, making them affordable.

Therefore, in general, we would say that STRC doesn't really resemble a Ponzi scheme. However, we don't believe that investing in STRC at $100 is "brilliant investing ." We believe that STRC carries significantly more risk than the risks associated with short-term U.S. Treasury bonds.

in conclusion

When this game ends and MSTR faces difficulties, it may not need to sell its Bitcoin. Instead, it could abandon its previous rhetoric about STRC's pursuit of stability and choose an easier path: simply reduce the STRC dividend yield by 25 basis points per month. At the current 10.5% interest rate, the dividend will drop to zero in about three and a half years. During this period, as the dividend yield decreases, the company's payment pressure will lessen. This is extremely beneficial for MSTR, making dividend payments sustainable and affordable.

Of course, this also means that the price of STRC could plummet by about 87%, falling to the present value of its dividend cash flow over the next three and a half years.

MSTR's scenario may differ from what many skeptics anticipate. In our view, its debt may not necessarily trigger a forced sell-off and a downward spiral in Bitcoin, much less lead to MSTR's own bankruptcy. It must be understood that MSTR's debt instruments are not traditional products; they are designed by the company itself and serve its own interests entirely. Saylor is no ordinary individual; he is a contemporary financial genius, always capable of devising financing schemes that are extremely advantageous to himself.

Regardless of changes in Bitcoin's price action or the capital environment, MSTR is likely to weather the storm; however, when the music stops, investors are more likely to suffer the losses. STRC perfectly embodies this logic.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush