As the price of Bitcoin fell to around $94,000, market sentiment fluctuated. Aside from Bitcoin itself, the company most affected was Strategy Inc. (formerly MicroStrategy), which was known as a "corporate Bitcoin ETF."

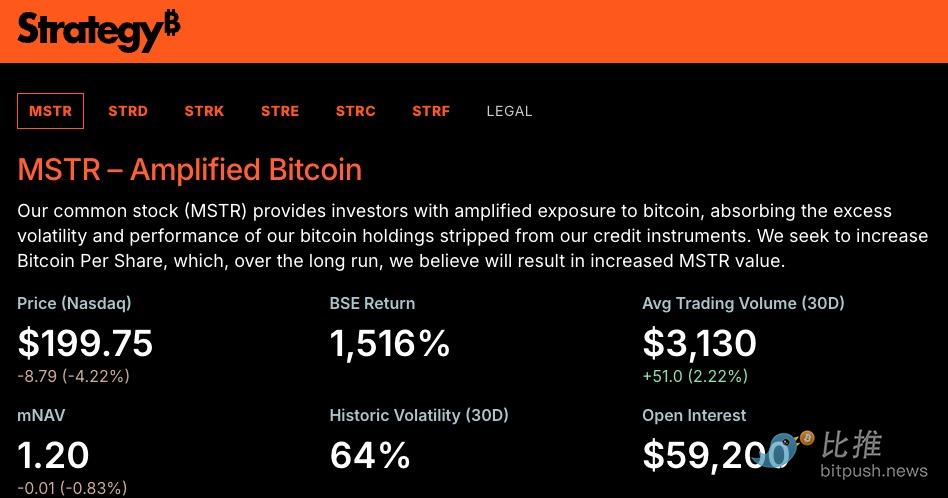

The company's stock price fell 4.2% on Friday, closing at $199.75, more than halved from its high six months ago. More noteworthy is the changing relationship between its market capitalization and the value of its Bitcoin holdings.

According to the latest disclosure, as of November 10, the company held 641,692 bitcoins, worth approximately $61 billion at current prices. However, Strategy's market capitalization has now fallen below $60 billion, not only far below its peak of $80 billion last November, but also significantly lower than the $70 billion it reached in July of this year.

This change seems to indicate that the market is re-evaluating the investment value of this "Bitcoin concept stock".

Investment bank Monness, Crespi, Hardt recently upgraded Strategy's stock rating from "sell" to "neutral," citing a narrowing premium relative to its Bitcoin holdings and reduced downside pressure. The research firm noted that Strategy's market capitalization premium relative to its Bitcoin holdings has significantly decreased.

Why did the premium "disappear"?

Strategy's valuation has long been higher than the value of its Bitcoin holdings, not because the company itself has a profit advantage, but because it once filled a structural gap in the financial market—in the era before Bitcoin ETFs were approved, it was a tradable asset for institutions to gain exposure to BTC.

This "alternative value" once commanded a significant premium, but with the rapid global adoption of ETFs, the basis for that premium is being eroded quickly.

ETFs offer more direct, transparent, and lower-cost exposure to Bitcoin. For most investors, “corporate-packaged Bitcoin” is becoming less attractive than “pure Bitcoin”, and the market is no longer willing to pay separately for “corporate-held Bitcoin”.

ByteTree's analysis clearly points out that the valuation premium that Strategy previously gained mainly came from the lack of ETFs. Now that this factor has disappeared, the valuation has naturally returned to a level that is closer to the asset itself.

Investors are also concerned about Strategy's continuously expanding capital structure.

Strategy's complex financial structure, rising financing costs, and continuously expanding capital structure are gradually becoming the main reasons for the contraction of premiums.

In recent years, the company has been raising funds to buy Bitcoin through convertible bonds, preferred shares, and ATM issuances, but these financing methods are facing pressure in the current market environment. On November 7, the company issued 7.75 million euro-denominated preferred shares with an annual interest rate of 10% , a financing cost significantly higher than in previous years.

With the prices of preferred stock, convertible bonds and other structured instruments falling, the company's future fundraising capabilities will be further constrained.

At the same time, cash flow pressure cannot be ignored. Bloomberg estimates that Strategy pays over $689 million annually to maintain its Bitcoin reserves (interest, operating costs, etc.). Given declining risk appetite and rising financing costs, this cash flow burden may increasingly fall on common shareholders.

This situation creates a typical negative feedback loop:

Valuation decline → Financing capacity decrease → Cash flow pressure increases → Market further lowers valuation.

This cycle is more easily amplified by the market during periods when the premium support is weaker.

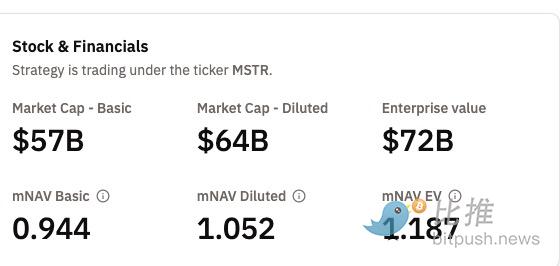

In a more radical view, investor Dr. Julian Hosp (@julianhosp) points out that, based on his use of the basic market cap, Strategy's basic mNAV has fallen to approximately 0.94 , meaning the market is valuing common shareholders below their corresponding Bitcoin value.

This data does not contradict the 1.2 times mNAV disclosed on the official website; the two figures are based on different metrics.

basic mNAV: Common stock market capitalization ÷ Bitcoin value , a measure of whether common stock still enjoys a premium;

diluted mNAV: Fully diluted market capitalization ÷ Bitcoin value , measures the risk tolerance of the entire capital structure.

Therefore, the decline in basic mNAV is essentially a repricing of the risk premium for common stockholders by the market.

While the series of projections made by Hosp based on this change are pessimistic, they all point to the same problem—when basic mNAV declines and financing conditions tighten, the financial engineering behind corporate balance sheets becomes more difficult to maintain.

However, BitMEX Research argues that, measured from an enterprise value (EV) perspective ( market capitalization MCap + debt ), even with a market capitalization approaching Bitcoin holdings, Strategy's overall capital structure (including convertible bonds and preferred stock) still results in an EV higher than BTC NAV. This means the company as a whole maintains a premium and has not reached a true "discount" zone.

It is worth noting that, regardless of whether the views are radical or not, all parties are pointing to the same trend:

The valuation structure that Strategy used to rely on sentiment and narrative is being dismantled, and the market is re-examining its risks in a way that is closer to traditional finance.

Not just Strategy, the entireDAT model has entered a new phase.

As a typical representative of the enterprise crypto asset model (DAT), Strategy's valuation fluctuations have always been regarded as an important indicator of the industry.

Recently, not only has Strategy experienced a deep correction, but the entire DAT sector has also shown significant divergence, indicating that the market is reassessing the value of this business model.

In terms of specific performance, DAT concept stocks have shown a polarized trend: Metaplanet and SharpLink have plummeted by nearly 80%-90% from their year-to-date highs, while Galaxy Digital has bucked the trend, maintaining a 73.4% year-to-date gain. This stark contrast reflects that the market is rigorously screening DAT companies, with multi-asset DAT companies holding high-risk tokens facing greater selling pressure.

CEX.IO Director Yaroslav Patsira commented, "When DAT stock trades below the value of its underlying crypto assets, it means the market is no longer paying for mere asset accumulation."

Fakhul Miah, Managing Director of Gomining Institutional, holds a similar view: "Investors will be more discerning in this cycle, prioritizing Bitcoin reserve companies that operate transparently and have well-structured operations."

Despite the challenges, DAT stocks, as high-beta assets in the crypto space, still possess the characteristic of being among the first to rebound in a bull market. However, the market's ultimate acceptance of the DAT model will depend on whether these companies can transcend a simple holding strategy and truly establish a sustainable and competitive business ecosystem and profitability. This not only represents an evolution in investment logic but also a crucial step for the DAT model to mature from concept.

Author: Seed.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush