Author | Jianwu Wu Blockchain Blockchain

summary

The JPEX incident is considered the biggest crypto collapse in Hong Kong's history. Starting in September 2023, when the Securities and Futures Commission (SFC) publicly warned against unlicensed operations and froze withdrawals, a wave of investor reports and police arrests ensued within days. Two years later, in November 2025, police formally prosecuted 16 people and issued arrest warrants for 3 ringleaders, bringing the total number of arrests to 80, with the amount involved exceeding HK$1.6 billion. The case revealed the systemic risks of unlicensed platforms and false advertising, and also propelled Hong Kong's virtual asset regulation into a new phase.

This article reviews the entire event, outlining its background, process, and impact, aiming to provide investors with a warning.

On September 17, 2023, JPEX suddenly froze withdrawals, prompting the Hong Kong Securities and Futures Commission (SFC) to issue a warning for operating without a license, triggering a wave of panic reports from investors. Just two days later, police arrested eight people in the first round, including KOL Joseph Lam (with over 150,000 Instagram followers). Lam is suspected of using false statements to lure people into investing in JPEX between July and September 2023, including claims that the platform had obtained licenses in multiple jurisdictions and that he possessed exclusive information about the platform, thus enticing investors to deposit funds.

On September 22, 2023, Joseph Lam held a press conference regarding his alleged involvement in the JPEX cryptocurrency fraud case. Photo credit: HKFP.

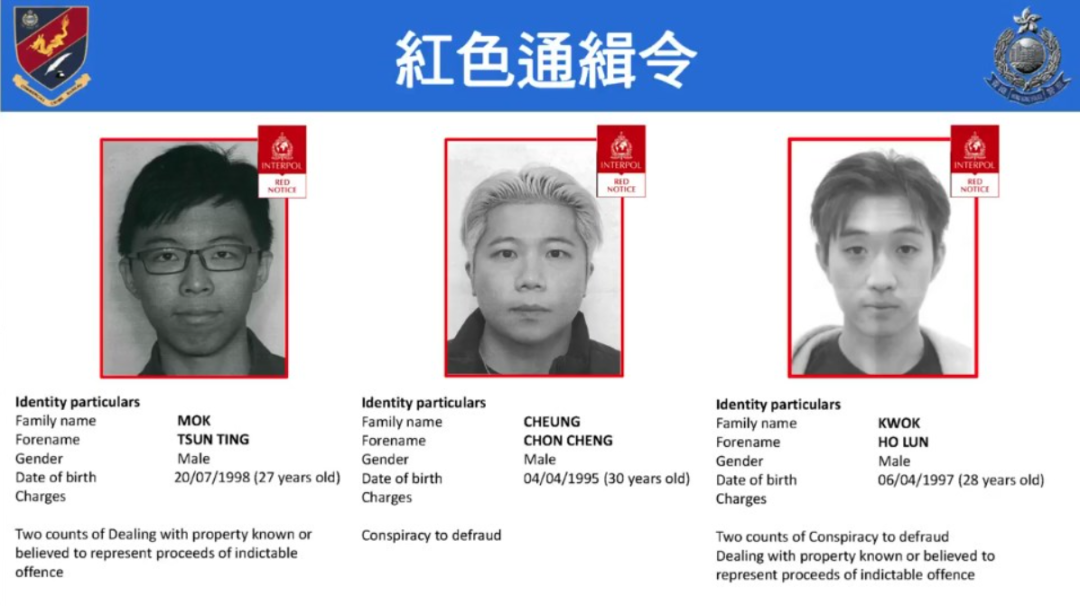

Two years later, on November 5, 2025, police formally charged 16 people, including Lam Tsz-chu and YouTuber Chan Wing-yee (with over 100,000 followers), with charges of conspiracy to defraud, money laundering, and obstruction of justice. Six of them were core members of JPEX, seven were OTC managers and KOLs, and three were nominee account holders. Interpol issued red notices for three fugitives (27-year-old Mok Chun-ting, 30-year-old Cheung Chun-shing, and 28-year-old Kwok Ho-lun), who were alleged to be the masterminds and had fled overseas. To date, the case has resulted in 80 arrests, over 2,700 victims, and losses exceeding HK$1.6 billion (approximately US$206 million). Police have frozen HK$228 million in assets, including cash, gold bars, luxury cars, and virtual assets. The incident exposed the chaotic promotion practices of unlicensed platforms and prompted regulatory authorities to strengthen controls on virtual assets.

The Rise and Illusion of JPEX: High Returns, Fake Licenses, and Overwhelming Advertising

Founded in 2020 and headquartered in Dubai, JPEX bills itself as a "global digital asset cryptocurrency trading platform." In Hong Kong, it promoted itself through extensive advertising (such as in subway stations, on buses, and on shopping mall facades), with some ads labeling it a "Japanese cryptocurrency exchange." The platform claimed to hold financial licenses from the US, Canada, Australia, and Dubai's VARA, but an investigation by the SFC revealed that these "licenses" were limited to foreign exchange and could not support virtual asset trading. The Japanese Financial Services Agency and VARA also clarified that JPEX was not authorized to operate.

JPEX's core appeal lay in its "Earn" product, promising high annual returns of 20% for BTC, 21% for ETH, and 19% for USDT, attracting a large number of investors. The platform promoted itself through over-the-counter (OTC) trading and social media KOLs, building an image of "low risk, high return." Early warnings from the SFC indicated that JPEX had been suspected of making false statements since July 2023, but promotional activities continued until the eve of its collapse.

Regulation and Crisis: Unlicensed Chaos Under Hong Kong's New System

In June 2023, the Hong Kong government introduced a licensing regime for Virtual Asset Trading Platforms (VATP), requiring all platforms to obtain approval from the Securities and Futures Commission (SFC) before providing services to retail investors. This regime aims to balance innovation and risk control, but JPEX did not apply for a license and continued to operate without one.

In July 2023, mainland users began reporting difficulties withdrawing funds. Complaints from mainland users regarding their inability to withdraw funds circulated on the popular Hong Kong social media platform LIHKG, alleging that the platform lured victims to Hong Kong to "handle their funds" before ambushing them. Police stated that a man surnamed Yu, holding a Chinese ID card, was invited to a Hong Kong OTC store for a "face-to-face resolution" after failing to withdraw funds. Upon arrival in Hong Kong, he was ambushed and assaulted by unidentified individuals near Cambridge Plaza at the intersection of San Wan Road and Cheuk Wan Street in Sheung Shui on July 18th, sustaining abrasions to his forehead and nose. Police subsequently issued arrest warrants for four individuals, including a Chinese man who was the head of an investment company; and three other Chinese men aged between 30 and 40, approximately 1.7 meters tall, wearing black shirts and black trousers; other details are unknown. These incidents spread rapidly, fueling rumors of a collapse. The promise of high returns and the initial signs of a liquidity crisis emerged. An internal investigation by the SFC revealed that JPEX was suspected of making false statements, but promotional activities continued.

Mr. Yu, a JPEX user, was beaten by several people (photo provided by the interviewee). Photo source: hk01.com

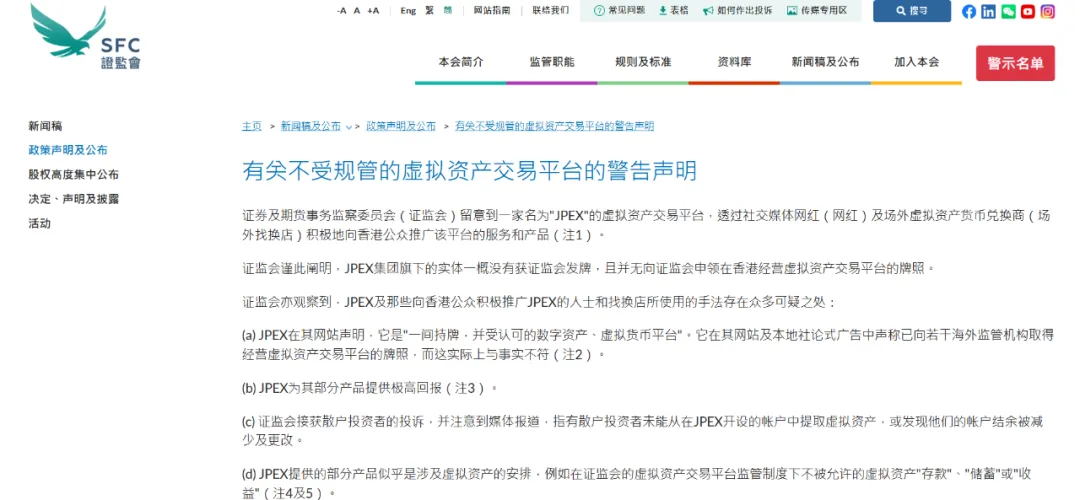

On September 13, 2023, the Hong Kong Securities and Futures Commission (SFC) issued a public warning statement against JPEX, titled "Warning Statement on Unregulated Virtual Asset Trading Platform." The statement directly accused JPEX of operating without a license, violating the VATP licensing regime that came into effect on June 1, and specifically named it for falsely claiming to hold financial licenses from the United States, Canada, Australia, and Dubai's VARA through social media influencers and KOLs (such as promotional posts on Instagram) and OTC stores. The SFC investigation revealed that these "licenses" were actually limited to foreign exchange services and could not support virtual asset trading. The statement emphasized that JPEX had been on the SFC's warning list since July 8, 2022, and its products, such as the Earn service promising high annual returns of 21% for ETH, 20% for BTC, and 19% for USDT, were suspected of being "deposit/yield" arrangements, constituting illegal fundraising, and numerous retail investors complained of being unable to withdraw funds or suffering losses. SFC has ordered all KOLs and OTC stores to immediately cease promoting JPEX and its related services and products.

Image source: Hong Kong Securities and Futures Commission (SFC)

Within hours of the statement's release, JPEX responded swiftly on its website and blog, stating that the SFC's actions, "the unfair suppression by the SFC, prompted us to consider withdrawing our license application in Hong Kong and adjusting our future policy accordingly. The SFC should also bear full responsibility for undermining the prospects for cryptocurrency development in Hong Kong." In a blog post, JPEX claimed that it had publicly announced its intention to seek a cryptocurrency trading license in Hong Kong as early as February 2023, considering Hong Kong a key market, but due to the SFC's statement "conflicting with Web3 policies," it was considering withdrawing its Hong Kong license application and adjusting its regional policies. This response further exacerbated investor panic, with complaints surging from several hundred before the statement to over 1,600. Many users flocked to OTC stores for help, making the platform's liquidity crisis public and marking the shift from a regulatory warning to the eve of collapse.

On September 17, 2023, JPEX issued an announcement on its official blog, declaring that its third-party market makers had "maliciously frozen" platform funds, exacerbating the liquidity crisis. The announcement accused Hong Kong regulators of "unfair treatment" and negative news of prompting market makers to demand more information, restrict liquidity, and significantly increase operating costs, leading to operational difficulties. JPEX emphasized that this was not a problem with the platform itself, but rather caused by external factors, and promised to restore liquidity and gradually adjust fees. The announcement also confirmed that the Earn service (products where users deposit assets to earn high returns, such as 20% annualized return on BTC) would be completely delisted on September 18, preventing users from placing new orders. This move marked the shift from a regulatory warning from the SFC to a public collapse, escalating user panic.

More notably, JPEX drastically increased its USDT withdrawal fee from 10 USDT to 999 USDT (with a maximum withdrawal limit of 1000 USDT), effectively limiting users to only 1 USDT. This move was seen as a "de facto freeze" of assets, sparking strong user dissatisfaction and heated discussions on social media, with many calling it a "disguised escape." JPEX explained the adjustment as a "response to business changes" but did not provide a timeline for resuming operations.

A screenshot from a JPEX user shows that USDT withdrawal fees have surged to 999 USDT (maximum withdrawal limit 1000 USDT).

Complete collapse and police intervention: KOLs arrested, funds frozen

On September 18, 2023, five days after the SFC issued a warning, the Hong Kong Police Commercial Crime Bureau (CCB) launched Operation Iron Gate, arresting the first batch of eight people, including Joseph Lam (an Oxford-educated lawyer turned insurance agent with 150,000 Instagram followers), investment YouTuber Chan Wing-yee (a former TVB artist turned investment blogger with over 100,000 followers), and OTC store owner Felix Chiu (owner of Coingaroo). Police raided 20 locations, seizing cash, computers, and documents. As of that day, 1,641 victims had reported the crimes, with losses estimated at approximately HK$1.2 billion. Police revealed that JPEX cultivated a "safe and easy-to-use" image through KOLs and OTC stores, with funds being transferred and laundered through multiple wallets. Police allege that Lin Zuo, between July and September, falsely claimed through Instagram posts, lectures, and live streams that JPEX was "safe and licensed" (including regulatory endorsements from multiple locations) and offered "exclusive information," enticing investors to deposit assets and resulting in losses. The arrest that day marked the escalation of the case into a criminal investigation. The SFC praised the police action and reiterated that KOLs must conduct due diligence on platform qualifications.

In October 2023, Hong Kong police arrested 28 people in their investigation of the JPEX case, including 28-year-old KOL Henry Choi Hiu-tung (founder of Hong Coin). Choi was accused of conspiracy to defraud, promoting JPEX's high-return Earn products through his social media pages "Hong Coin" and "TungClub," and collaborating with OTC stores to drive funds. As of October, over 2,530 victims had filed reports. The SFC (Securities and Funds Corporation) emphasized the loopholes in KOL promotion, pointing out that many KOLs, such as Choi, failed to conduct due diligence on the platform's qualifications, yet repeatedly claimed that JPEX was "safe and licensed," violating the SFC's disclosure requirements. This case has also affected Taiwan, sparking cross-border discussions. Taiwanese police have questioned several KOLs and are cooperating with the Hong Kong SFC to trace fund flows.

Latest Developments: First Formal Prosecution and Red Notice Issued in JPEX Case

On November 5, 2025, the Hong Kong Police Commercial Crime Bureau (CCB) formally charged 16 people, marking the first formal prosecution in the JPEX case in two years and signifying the commencement of criminal proceedings. The defendants include six core members of JPEX, seven OTC managers, and key opinion leaders (KOLs) such as Lam Tsz-chu and Chan Yee. Chief Superintendent Ernest Wong stated at a press conference that this was the first round of prosecutions in the JPEX case, with charges primarily involving conspiracy to defraud, money laundering, obstruction of justice, and inducing others to invest in virtual assets through fraudulent means or recklessly. The focus of the prosecution is on the defendants' use of false advertising and OTC networks to induce over 2,700 investors to deposit funds, as well as the platform's unlicensed operation and involvement in money laundering.

On the same day, Interpol issued red notices for three fugitives accused of being masterminds and core members who had fled overseas: 27-year-old Mok Tsun-ting, 30-year-old Cheung Chon-cheong, and 28-year-old Kwok Ho-lun. Police stated that the three were in charge of fund transfers and money laundering, and their assets have been frozen. The red notices request assistance from member countries worldwide in their arrest. To date, the JPEX case has resulted in 80 arrests, over 2,700 victims, and losses of HK$1.6 billion.

On November 6, 2025, 16 defendants (including Lam Tsz-chung and Chan Yee) appeared in the Eastern Magistrates' Courts. Fourteen of them were granted bail (ranging from HK$20,000 to HK$100,000, with Lam Tsz-chung and Chan Yee each receiving HK$300,000), and were required to surrender their travel documents and report regularly. This case is the largest fraud case in Hong Kong in recent years in terms of the number of victims and the amount of losses. HK$228 million in assets have been frozen, including cash, gold bars, luxury cars, and virtual assets.