The market these past two days has truly been a case of "what you fear most has come to pass."BTC has broken through key support levels, causing sentiment to plummet to a fear index of 10—the second time this has happened this year. The entire internet is screaming "bear," with some even saying the bull market is officially dead. But for me, while the trend has weakened, it has actually made things easier to trade.

With key support levels breached consecutively, the trend is unlikely to hold strong in the short term.

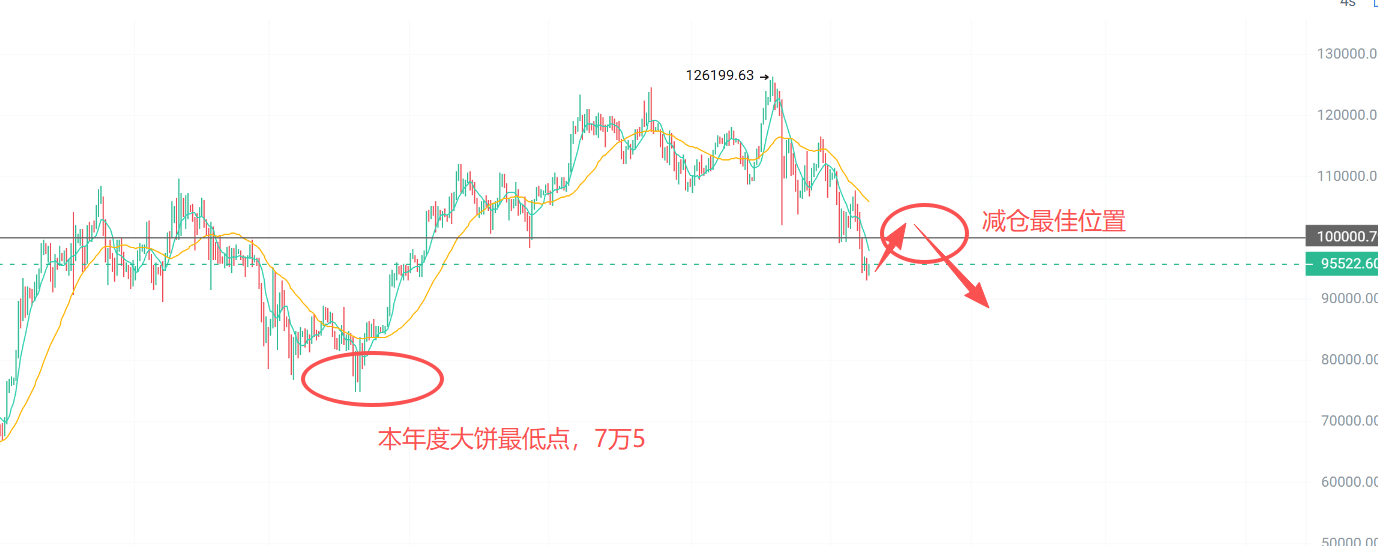

This bull market had never effectively broken through the 50-week and 60-week moving averages , but this time both were breached; the previous low of 98,200 was also breached with minimal effort. These were all "breakdowns with high volume," and if the price cannot recover in the short term, it constitutes a valid breakdown.

Last night, the 94,000 level held as a support level because it touched a triple support level: the weekly trendline, the lower boundary of the downtrend channel, and the 0.382 Fibonacci retracement. However, the problem is that the rebound was extremely weak, lacking a long lower shadow and significant volume; it was merely a follow-up move after the US stock market closed. If the bears push it down further, this level will be dangerous.

If the next two support levels are breached, the market will look even worse. After the weekend, I tend to believe that the short-term downtrend is not over, but there will be a decent rebound in the meantime.

98,000 will become a key resistance level in the short term—if it fails to break through, be wary of a second drop.

Neither policy nor technical factors support a continued bull market.

With a series of hawkish comments from Federal Reserve voting members, expectations for a December rate cut once fell below 50%. The market had previously priced in a "certain December rate cut," and this shift necessitates a correction to digest the change.

This wave of decline has seen almost no rebound, liquidity is poor, and sentiment is deteriorating... Caught in a three-pronged attack, a short-term reversal is extremely difficult.

The four-hour chart for Ethereum offers a glimmer of hope—a long lower shadow, a shrinking bearish candlestick body, and clear support below. However, the number of liquidations is high, but the amount involved is small, indicating that the bulls are running out of steam. The market is experiencing extreme panic, and the RSI is oversold, suggesting a potential rebound is imminent, but only if the price stabilizes around 3000 .

Want a decent market rally at the end of the year? It's unlikely, unless there's a very strong external stimulus.

The pullback over the past six months has been too severe, but since the trend has changed, don't fight the market head-on.

What's past cannot be changed; what we can do is minimize losses in the upcoming market and wait for opportunities to counterattack.

Since the trend has turned bearish, it's best to lower expectations and preserve strength.

My operational strategy is already very clear:

1) Spot trading: Reduce positions on rallies, avoid panic selling.

Don't sell when the fear index is around 10; wait for a decent rebound. My plan is to sell in batches between 106000 and 111000.

Reduce your holdings around these two price levels. For those in a hurry, around 100,000 is a good selling point.

2) Futures: Short short is more suitable in a bear market.

With the funds freed up from selling spot goods, I plan to open low-leverage (1x) short positions to gradually build a medium-term position in the bear market and avoid missing out on potential gains.

If it goes up, continue to add to your short positions; if it goes down, don't chase the price down.

The only thing that can save the market in the short term is the US stock market.

The crypto itself can't save it now; we need to watch the direction of the US stock market. However, ETH, BNB, and LTC do show clear signs of market support, and their structure isn't completely broken. The anonymity coin sector (such as $ZEC) has actually rebounded strongly, showing signs of a "spark," and we'll see if it can ignite a wildfire.

The market will never only fall without rising, especially now that contracts are dominant and short sellers are too rich—the major players can't possibly leave this liquidity untouched.

Short-term reference for major cryptocurrencies

$DOGE : 0.168–0.17 → Clear resistance level, short is possible. A strong pullback after the initial spike could be a buying opportunity.

Other mainstream cryptocurrencies such as #sol and #ETH will likely see another upward move after filling the gap above.

The key focus should be on next week's employment data, as that will be the real catalyst for the next development.

Panic is the norm, trends are signals. My current strategy is simple: reduce positions on rallies, short short at low leverage, protect capital, and survive.

The more difficult the market trend, the more stable it needs to be, and the less you should gamble. #CryptoMarket Correction #Trump Cancels Agricultural Tariffs

The opportunity will be gone in the blink of an eye, everyone gather quickly!

Don't let hesitation delay your chance to make money, and don't get burned by worthless cryptocurrencies. Join Sister Miao and let's ride this bull market together!

Contact me via WeChat: Mixm5688

If you can't add the WeChat account above, you can contact us via QQ to prevent losing contact: 3806326575