Aster is gaining strong market attention after a sharp 15% surge that pushed the token to a new monthly high. The altcoin is benefiting from renewed demand and growing confidence among large investors.

This rally follows rising accumulation from major holders who expect continued upside for ASTER in the near term.

Aster Holders Take The Lead

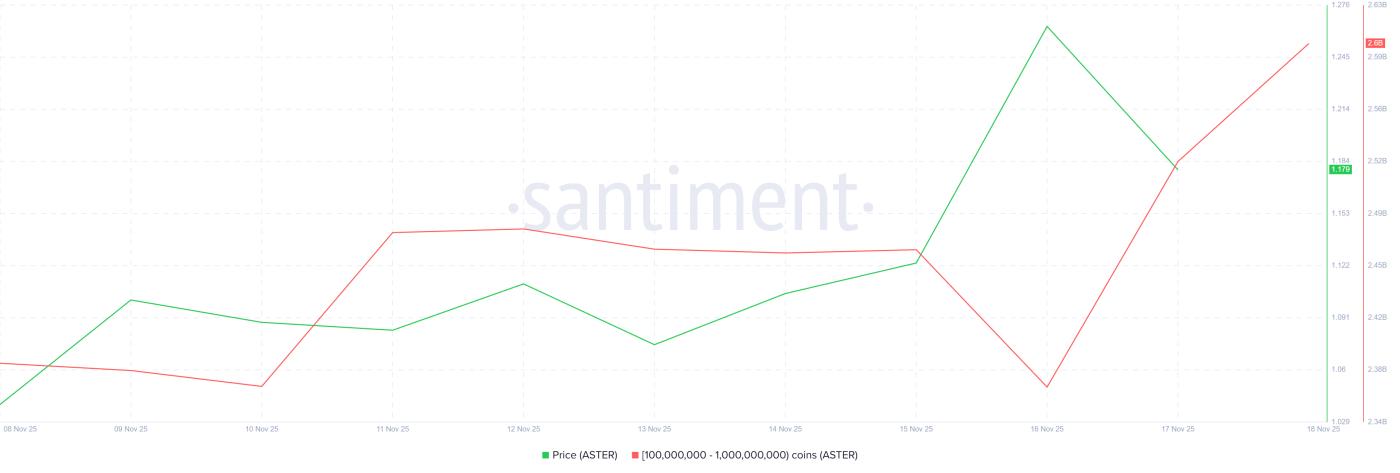

Whales have taken an aggressive position in ASTER, signaling a decisive shift in market sentiment. In the past two days, addresses holding between 100 million and 1 billion ASTER accumulated nearly 230 million tokens. This buying spree, valued at more than $310.5 million, highlights strong conviction from high-value investors.

The rapid accumulation supports the current price recovery and creates a favorable environment for further gains. Large holders often influence liquidity and short-term direction. Their renewed interest positions ASTER for potential growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Aster Whale Holding. Source: Santiment

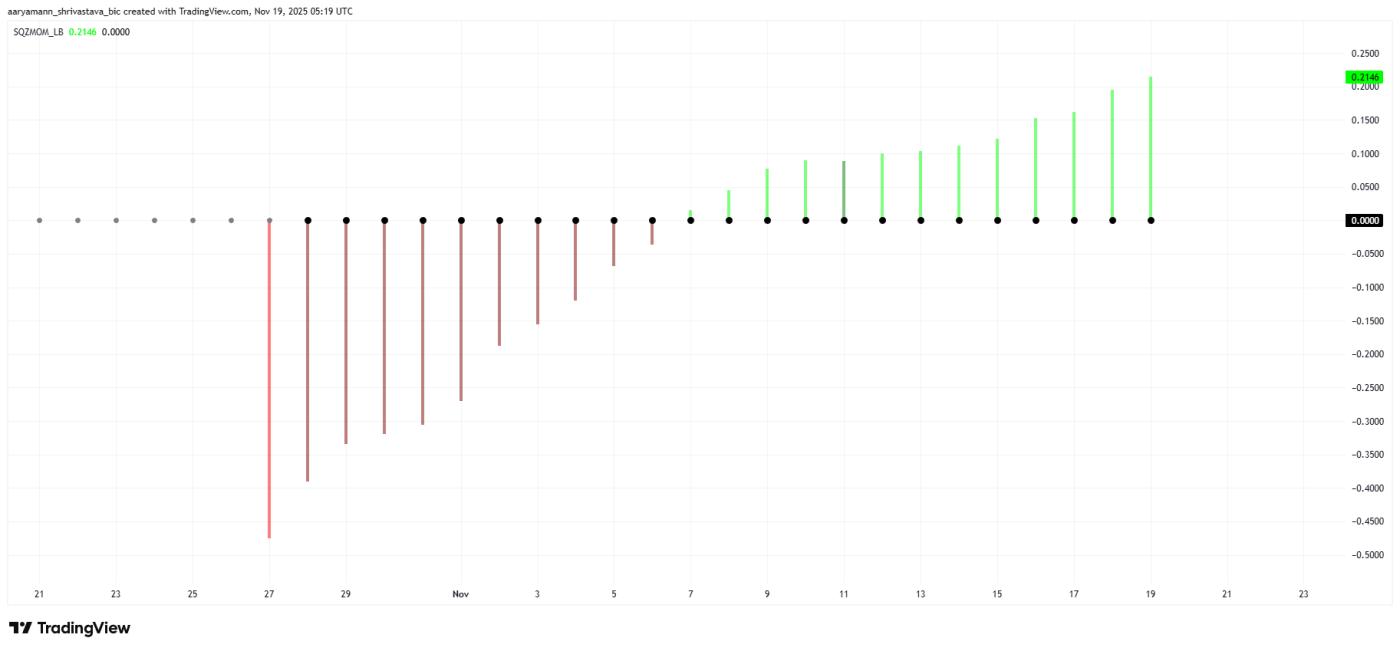

Aster Whale Holding. Source: SantimentMacro indicators also align with Aster’s bullish outlook. The squeeze momentum indicator shows a developing squeeze, suggesting compressed volatility and building pressure. This setup often precedes a significant move, giving traders a clear signal that momentum is shifting toward buyers.

If the squeeze releases in a bullish direction, ASTER could see a sharp rise in volatility accompanied by strong price expansion. This pattern has historically supported rapid upside moves across similar mid-cap assets.

ASTER Squeeze Momentum Indicator. Source: TradingView

ASTER Squeeze Momentum Indicator. Source: TradingViewASTER Price Takes A Hike

ASTER price is up 15% over the last 24 hours, sitting at $1.35 at the time of writing. The altcoin is just under the $1.39 resistance, marking a monthly high.

A successful move past $1.39 will depend on sustained investor support. Strong whale accumulation and bullish macro signals suggest the momentum is present. Clearing this barrier could propel ASTER toward $1.50, with potential for even higher targets if market conditions remain favorable.

ASTER Price Analysis. Source: TradingView

ASTER Price Analysis. Source: TradingViewHowever, failure to breach the resistance may expose ASTER to a pullback. A decline to $1.25 is possible if uncertainty increases, and a deeper slide to $1.15 remains a risk. Losing that support would invalidate the bullish outlook and could push ASTER toward $1.00 as sentiment weakens.