Editor's Note: The decentralized perpetual contract trading (Perp DEX) sector has undergone dramatic changes in the past year: from Hyperliquid's absolute dominance to the rise of Aster, Lighter, and EdgeX, the market landscape is being reshaped.

This article provides an in-depth analysis of the four major platforms from the perspectives of technical architecture, core indicators, risk events, and long-term feasibility, aiming to help readers see the "truth behind the data" rather than making judgments based solely on transaction volume rankings.

The following is the original text:

In 2025, the decentralized perpetual contract (perp DEX) market experienced explosive growth. In October 2025, the monthly trading volume of perpetual contract DEXs exceeded $1.2 trillion for the first time, quickly attracting high attention from retail traders, institutional investors, and venture capital funds.

Over the past year, Hyperliquid almost monopolized the market, peaking in May of this year to account for 71% of on-chain perpetual contract transactions. However, by November, its market share had plummeted to just 20%, with emerging competitors rapidly seizing territory.

- Lighter: 27.7%

- Aster: 19.3%

- EdgeX: 14.6%

In this rapidly evolving ecosystem, four leading players have already emerged and are engaged in fierce competition for industry dominance:

@HyperliquidX – The veteran king of on-chain perpetual contracts

@Aster_DEX — A "rocket" with massive trading volume and constant controversy.

@Lighter_xyz—The disruptor of zero-fee, native ZooKeeper.

@edgeX_exchange – A low-profile yet deeply aligned "dark horse" with institutional partners.

This in-depth investigation aims to dispel the fog and analyze the technical strength, core indicators, points of contention, and long-term feasibility of each platform.

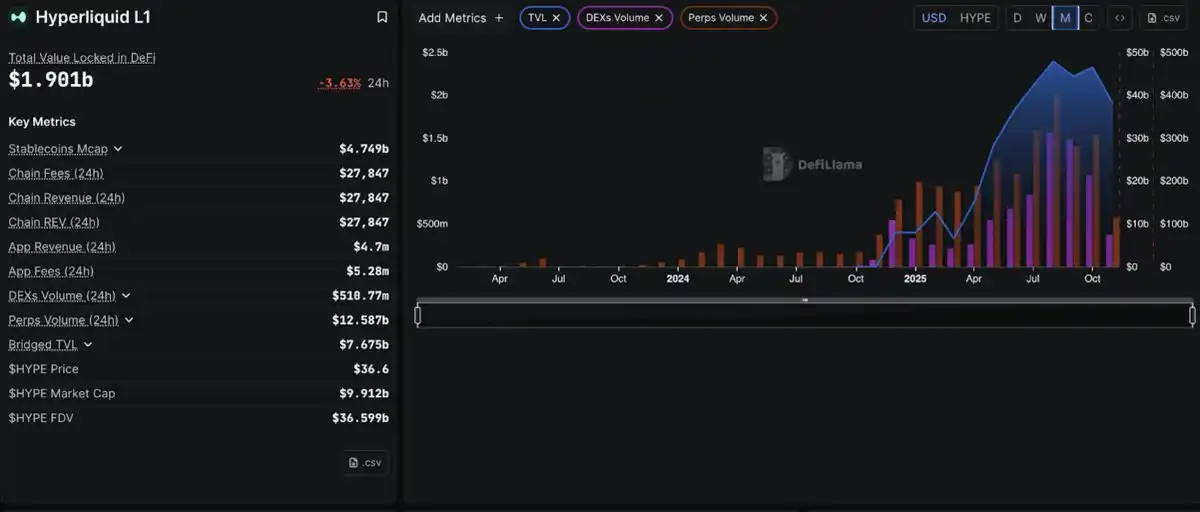

Part 1: Hyperliquid, the Undisputed King

Hyperliquid has established itself as the industry-leading decentralized perpetual contract trading platform, with a market share exceeding 71% at its peak. While competitors have made headlines with their explosive growth in trading volume, Hyperliquid remains a structural pillar of the entire perpetual contract DEX ecosystem.

Hyperliquid's advantage stems from a revolutionary architectural decision: building a custom Layer 1 blockchain specifically designed for derivatives trading. Its HyperBFT consensus mechanism achieves sub-second order confirmation and supports 200,000 transactions per second, rivaling or even surpassing centralized trading platforms in performance.

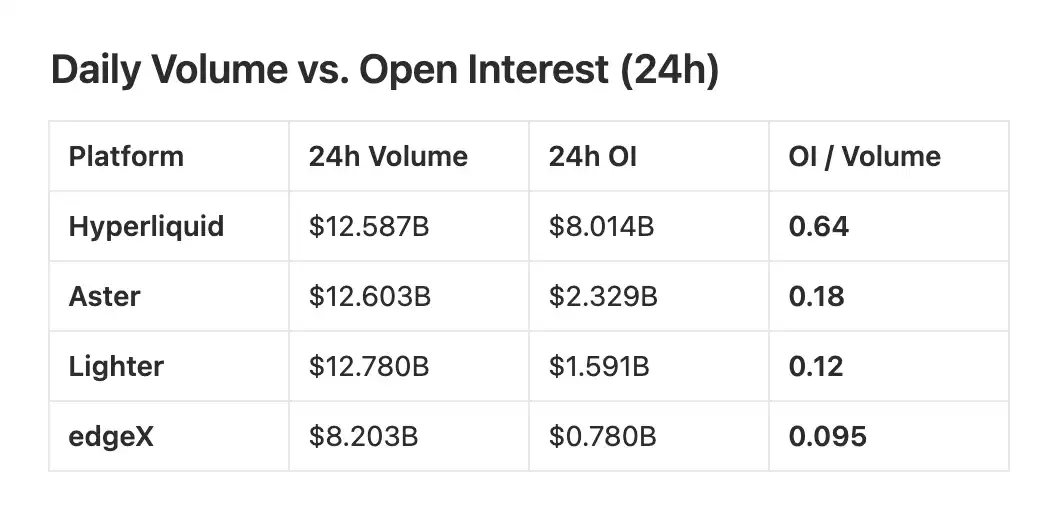

Competitors often attract attention with their astonishing 24-hour trading volume, but the real indicator of capital deployment is open interest (OI), which is the total value of all perpetual contracts still in operation.

Trading volume indicates market activity, while open interest indicates committed funds.

According to 21Shares data, in September 2025: Aster accounted for approximately 70% of total trading volume; Hyperliquid once fell to approximately 10%.

However, this advantage is only in terms of trading volume, which is the easiest indicator to manipulate through incentives, rebates, frequent trading by market makers, or even "volume brushing".

The latest 24-hour open interest data shows:

-Hyperliquid: $8.014B

-Aster: $2.329B

-Lighter: $1.591B

-edgeX: $780.41M

Total OI for the top four platforms: $12.714B

Hyperliquid's market share: approximately 63%

This means that Hyperliquid holds nearly two-thirds of the total open interest in the market, exceeding the combined open interest of Aster, Lighter, and edgeX.

Market share of open interest (24 hours)

-Hyperliquid: 63.0%

-Aster: 18.3%

-Lighter: 12.5%

-edgeX: 6.1%

This indicator reflects traders' willingness to hold funds overnight, rather than simply to boost incentives or trade frequently.

Hyperliquid: A high OI/trading volume ratio (approximately 0.64) indicates that a large volume of trading activity translates into sustained positions.

Aster & Lighter: Low ratios (approximately 0.18 and 0.12) indicate frequent trading but low cash retention, typical of incentive-driven behavior rather than stable liquidity.

Trading volume (24h): Indicates short-term activity.

Open interest (24h): Reflects the amount of risk capital remaining.

OI/Trading Volume Ratio (24h): Reveals Real Trading vs. Incentive-Driven Trading

Looking at all OI-related metrics, Hyperliquid is the structural leader: highest open interest; largest proportion of committed capital; strongest OI/trading volume ratio; and total OI exceeding the sum of the next three platforms.

Trading volume rankings may fluctuate, but open interest reveals the true market leader, and that leader is Hyperliquid.

In the liquidation event in October 2025, $19 billion in positions were liquidated, and Hyperliquid maintained zero downtime while handling massive trading peaks.

21Shares has submitted a product application for Hyperliquid (HYPE) to the U.S. Securities and Exchange Commission (SEC) and listed a regulated HYPE ETP on a Swiss stock exchange. These developments (including reports from platforms like CoinMarketCap) indicate increasing institutional access to HYPE. The HyperEVM ecosystem is also expanding, although publicly available data has not yet verified the exact figures of "180+ projects" or "$4.1 billion TVL".

Based on its current registration, trading platform listings, and ecosystem growth, Hyperliquid is demonstrating strong momentum and increasing institutional recognition, further solidifying its position as a leading DeFi derivatives platform.

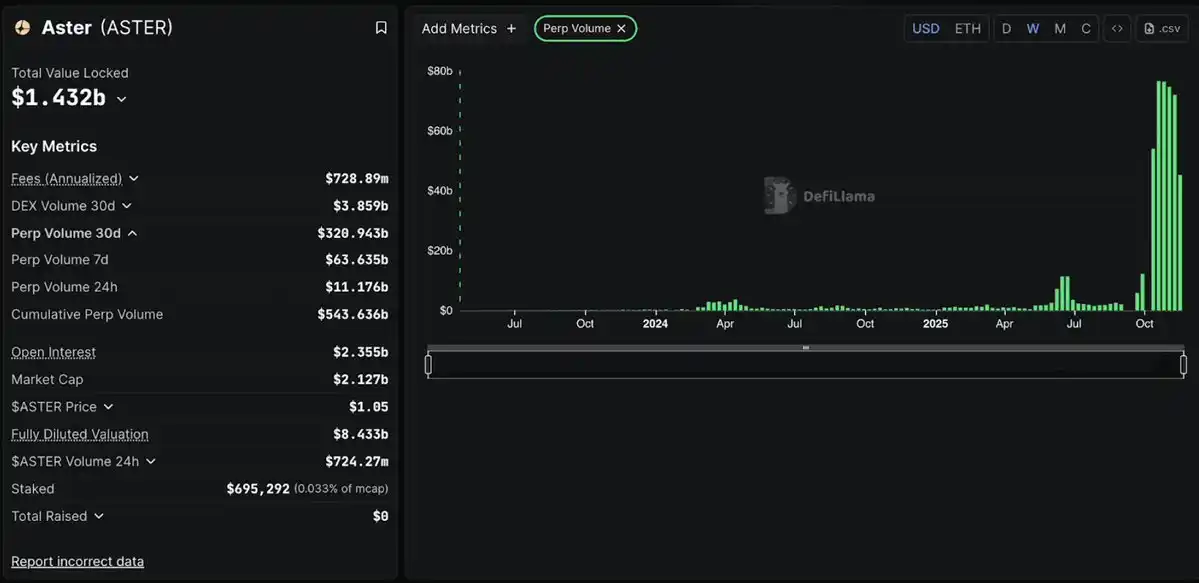

Part Two: Aster, Explosive Growth and Scandal

Aster is a multi-chain perpetual contract trading platform launched in early 2025 with a clear goal: to provide users with high-speed, high-leverage derivatives trading on networks such as BNB Chain, Arbitrum, Ethereum, and Solana, without the need for cross-chain asset transfers.

The project did not start from scratch, but originated from the merger of Asterus and APX Finance at the end of 2024, combining APX's mature perpetual contract engine with Asterus' liquidity technology.

Aster launched on September 17, 2025, at $0.08 and surged to $2.42 in just one week, a gain of 2800%. At its peak, daily trading volume exceeded $70 billion, and it once dominated the entire perpetual contract DEX market.

The fuel for this "rocket"? CZ. Binance founder CZ supported Aster through YZi Labs and personally tweeted his support, causing the token to surge. In its first 30 days, Aster's cumulative trading volume exceeded $320 billion, briefly capturing over 50% of the market share.

On October 5, 2025, DefiLlama, the most trusted data source in the crypto industry, removed Aster's data because its trading volume was almost identical to Binance's (1:1 correlation).

Real trading platforms exhibit natural fluctuations, while perfect correlation only implies one thing: data fraud.

The evidence includes:

- Trading volume patterns are fully synchronized with Binance (all trading pairs including XRP and ETH)

Aster refuses to provide transaction data, making it impossible to verify the authenticity of transactions.

-96% of ASTER tokens are concentrated in 6 wallets

- The volume/OI ratio is as high as 58+ (a healthy level should be below 3).

ASTER tokens immediately plummeted 10%, from $2.42 to approximately $1.05 currently.

CEO Leonard claims this correlation is merely hedging by "airdrop users" on Binance. But if true, why refuse to release data to prove it?

A few weeks later, Aster was relisted, but DefiLlama warned: "It's still a black box; we can't verify the data."

To be fair, Aster does have some technical highlights: 1001x leverage; hidden order book; multi-chain support (BNB, Ethereum, Solana); and interest-bearing collateral.

Furthermore, Aster is building the Aster Chain based on zero-knowledge proofs to achieve privacy protection. However, even the best technology cannot cover up false metrics.

The evidence is conclusive:

- Perfectly related to Binance = Wash trading

-Refusing transparency = concealing the facts

-96% token concentration = highly centralized

DefiLlama being removed from app stores = a collapse of credibility.

Aster capitalized on CZ's popularity and inflated trading volume to extract enormous value, but failed to build genuine infrastructure. It may survive due to Binance's support, but its reputation is permanently damaged.

For traders: High risk. You are betting on CZ's narrative, not real growth. Please set strict stop-loss orders.

For investors: Avoid this option; there are too many risk signals, and there are better options in the market (such as Hyperliquid).

Part Three: Lighter – Impressive Technology, Questionable Metrics

Lighter is different. Founded by a former Citadel engineer and backed by Peter Thiel, a16z, and Lightspeed (raising $68 million and valued at $1.5 billion), its core technology uses zero-knowledge proofs (ZK) to cryptographically verify every transaction.

As a Layer 2 (L2) blockchain, Lighter inherits Ethereum's security through an "escape pod" mechanism—even in the event of a platform failure, users can still retrieve their funds via smart contracts. Application chains, on the other hand, lack this security guarantee.

Lighter launched on October 2, 2025, and within weeks its TVL exceeded $1.1 billion, daily transaction volume reached $7-8 billion, and it had more than 56,000 users.

Lighter charges zero fees for both pending and take orders, completely revolutionizing the choices available to traders sensitive to transaction fees.

The strategy is simple: seize market share through an unsustainable economic model, build user loyalty, and then generate profits later.

Ten days after its mainnet launch, the crypto market experienced its largest liquidation event in history, with $19 billion in positions being liquidated.

Good news: The system remained operational during the 5-hour chaos, with LLP providing liquidity as competitors retreated.

Bad news: The database crashed after 5 hours, and the platform was down for 4 hours.

Even worse: LLP is losing money, while Hyperliquid's HLP and EdgeX's eLP are profitable.

Founder Vlad Novakovski explained: The database upgrade was originally scheduled for Sunday, but Friday's dramatic fluctuations prematurely crashed the old system.

The data strongly suggests score manipulation:

24-hour trading volume: $12.78 billion

- Open Interest (OI): $1.591 billion

-Transaction volume/OI ratio: 8.03

-Health level = Below 3, above 5 is suspicious, 8.03 is extremely abnormal.

contrast:

Hyperliquid: 1.57 (Natural)

EdgeX: 2.7 (Medium)

Aster: 5.4 (Worrying)

Lighter: 8.03 (Severe score manipulation)

For every $1 of capital a trader deploys, they generate $8 in trading volume—frequently flipping positions to inflate scores, rather than holding real positions.

30-day data verification: $294 billion in trading volume vs. $47 billion in cumulative OI = 6.25, still far above a reasonable level.

Lighter's points program is extremely aggressive. Points will be redeemable for LITER tokens on TGE (expected Q4 2025/Q1 2026). The OTC market is quoting points at $5-100+, with a potential airdrop value of tens of thousands of dollars, so the explosive trading volume is not hard to understand.

Key question: What will happen after TGE? Will users stay or will trading volume collapse?

Advantages:

Cutting-edge technology (ZK verified)

Zero transaction fees = a true competitive advantage. Inheriting Ethereum's security, top-tier team, and capital support.

Hidden concerns:

8.03 Transaction Volume/OI Ratio = Severe Score Manipulation

LLP suffered losses during stress testing.

The 4-hour outage raises questions about user retention after the airdrop, which remains unverified.

Key differences from Aster: No allegations of wash trading, no DefiLlama delisting. The high ratio reflects aggressive but temporary incentives, not systemic fraud.

Bottom-line assessment: Lighter possesses world-class technology, yet it's shrouded in questionable metrics. Can it convert users who manipulate scores into real users? Technology says "yes," history says "may not."

For users who want to rack up points: TGE offers a good chance.

For investors: Wait 2-3 months after TGE to observe whether the trading volume continues.

Probability assessment: 40% chance of becoming one of the top three platforms, 60% chance of becoming just another "score-farming farm," only with better underlying technology.

Part Four: EdgeX, Institutional Professional Players

EdgeX operates in a unique way. It was born in Amber Group's incubator (managing $5 billion in assets), and its team members come from Morgan Stanley, Barclays, Goldman Sachs, and Bybit. This is not "crypto-native" learning finance, but rather traditional finance (TradFi) experts bringing institutional-grade experience to DeFi.

Amber's market-making expertise directly empowers EdgeX: deep liquidity, tight spreads, and execution quality comparable to centralized trading platforms. Launched in September 2024, the platform has a clear goal: to achieve CEX-level performance without sacrificing self-custody.

Based on StarkEx (StarkWare's mature ZK engine), EdgeX can process 200,000 orders per second with a latency of less than 10 milliseconds, comparable to Binance.

EdgeX outperforms Hyperliquid in all aspects regarding transaction fees:

Billing fees: EdgeX 0.038% vs Hyperliquid 0.045%

Order placement fees: EdgeX 0.012% vs Hyperliquid 0.015%

For traders with a monthly trading volume of $10 million, this can save $7,000-$10,000 annually, and on retail orders (<$6 million), EdgeX offers better liquidity, tighter spreads, and lower slippage.

Unlike Lighter's zero-fee model or Aster's questionable data, EdgeX generates real, sustainable revenue:

TVL: $489.7 million

24-hour trading volume: $8.2 billion

Open Interest (OI): $780 million

30-day revenue: $41.72 million (147% increase compared to Q2)

Annualized revenue: $509 million (second only to Hyperliquid)

Trading volume/OI ratio: 10.51 (seems bad, but requires further analysis)

At first glance, 10.51 seems high, but the context is important: EdgeX initially used an aggressive points program to attract liquidity, and as the platform matured, this ratio has been steadily improving. More importantly, EdgeX has maintained healthy revenue during this period, proving that there are genuine traders, not just users who are simply farming points.

EdgeX performed exceptionally well during the market crash on October 11th ($19 billion liquidation):

Zero downtime (Lighter downtime was 4 hours)

eLP vault remains profitable (Lighter's LLP is losing money).

Liquidity providers offer an annualized return of 57% (the highest in the industry).

eLP (EdgeX Liquidity Pool) has demonstrated exceptional risk management capabilities during periods of extreme volatility, generating profits while its competitors have struggled.

Multi-chain flexibility: Supports Ethereum L1, Arbitrum, and BNB Chain; collateral supports USDT and USDC; cross-chain deposits and withdrawals are possible (Hyperliquid is limited to Arbitrum).

Best mobile experience: Official iOS and Android apps (not available for Hyperliquid), with a clean interface for easy position management anytime.

Asia Market Strategy: By providing localized support and participating in Korea Blockchain Week, we are actively expanding into the Asian market and seizing regions neglected by Western competitors.

Transparent Points Program: 60% Transaction Volume, 20% Referrals, 10% TVL/Vault, 10% Clearing/On-the-Job (OI)

It explicitly states: "We do not reward wash trading," and the metrics confirm this—the volume/OI ratio is improving, not deteriorating.

Market share: Only 5.5% of open interest in perpetual DEX contracts; growth would require more aggressive incentives (risk-based scoring) or major partnerships.

Lacking a "killer feature": The EdgeX performs steadily in all aspects, but lacks disruptive innovation. It is a "business class" option, professional but not amazing.

Unable to compete with Lighter on fees: Zero transaction fees make EdgeX's "lower than Hyperliquid" advantage less attractive.

TGE will arrive later: expected in Q4 2025, missing the first wave of airdrops.

EdgeX is the choice for professional users – stability over flashy features.

Advantages:

Amber Group's institutionally backed vault yielded a profit of $509 million in stress test revenue, with an APY as high as 57%.

Lower transaction fees than Hyperliquid

No fraudulent traffic scandals, clean metrics, multi-chain support, and optimal mobile experience.

Hidden concerns:

Small market share (5.5% OI)

The volume-to-inquiry ratio remains high (but is improving).

Lack of unique selling points and zero transaction fees create competitive pressure.

Suitable for:

Asian traders who need localization support

Institutional users value Amber liquidity.

Conservative traders prioritize risk management.

Mobile-first users

LP investors seeking stable returns

Bottom-line assessment: EdgeX is expected to capture 10-15% market share in the Asian market, among institutional and conservative traders. It will not threaten Hyperliquid's dominant position, but it doesn't need to—it is building a sustainable and profitable niche market.

Think of it as "Kraken among perpetual contract DEXs": not the biggest, not the most flashy, but stable, professional, and trusted by mature users who value execution quality.

For users who want to boost their scores: the chances are moderate, and the competition is not as fierce as on other platforms.

For investors: Suitable for small-position diversified investment, low risk, low return.

Comparative Analysis: Perp DEX Wars

Trading volume/open interest (OI) analysis

Industry standard: Health ratio ≤ 3

Hyperliquid: 1.57 ✅ Indicates a strong organic trading pattern.

Aster: 4.74 ⚠️ Slightly high, reflecting a large amount of incentive activities.

Lighter: 8.19 ⚠️ High ratio suggests points-driven trading

EdgeX: 10.51 ⚠️ The points program has a significant impact, but there has been some improvement.

Market share: Distribution of open interest

Total Market: Approximately $13 billion in open interest

Hyperliquid: 62% - Market Leader

Aster: 18% - A strong second tier

Lighter: 12% - Continued growth

EdgeX: 6% - Focus on niche markets

Platform Overview

Hyperliquid - Senior Leader

Holding a 62% market share, with stable indicators

Annualized return of $2.9 billion, active buyback program

Community ownership model, reliable performance

Advantages: Market dominance, sustainable economic model

Rating: A+

Aster - High growth, high questions

Strong integration of the BNB ecosystem, endorsed by CZ

In October 2025, it faced data challenges from DefiLlama.

Multi-chain strategy promotes adoption

Advantages: Ecosystem support, broad retail user coverage

Key concern: The need to monitor data transparency.

Rating: C+

Lighter - Tech Pioneer

Zero-fee model, advanced ZK verification

Top investors (Thiel, a16z, Lightspeed)

Performance data is limited in the early stages of TGE (Q1 2026).

Advantages: Technological innovation, Ethereum L2 security

Key concerns: Business model sustainability, user retention after airdrop.

Rating: Not Completed (Awaiting TGE Performance)

EdgeX - Institutional Oriented

Backed by Amber Group, professional-grade execution.

Annualized income of $509 million, stable performance of the vault.

Asian market strategy, mobile-first

Advantages: Institutional reputation, steady growth

Key concerns: Small market share, competitive positioning

Rating: B

Investment considerations

Trading platform selection:

Hyperliquid: Deepest liquidity, proven reliability

Lighter: Zero transaction fees, suitable for high-frequency traders.

EdgeX: Lower transaction fees than Hyperliquid, excellent mobile experience.

Aster: Multi-chain flexibility, BNB ecosystem integration

Token investment timeline:

HYPE: Now available, $37.19

ASTER: Trading price $1.05, further developments need to be monitored.

LITER: TGE 2026 Q1, Evaluate Post-Launch Metrics

EGX: TGE 2025 Q4, observe initial performance

Key conclusions

Market maturity: The Perp DEX sector shows significant differences, with Hyperliquid establishing its dominance through sustainability metrics and community collaboration.

Growth strategy: Each platform targets a different user group – Hyperliquid (professional), Aster (retail/Asia), Lighter (technology), EdgeX (institutions).

Key metrics to watch: The volume/OI ratio and revenue generation are better indicators of performance than volume alone.

Future Outlook: Lighter and EdgeX’s post-TGE performance will determine their long-term competitiveness; Aster’s future depends on its ability to address transparency issues and maintain ecosystem support.